Ripple XRP Price: SBI Holdings' XRP Shareholder Reward And Market Implications

Table of Contents

SBI Holdings' XRP Reward Program: A Detailed Look

H3: Understanding the Mechanics of the Reward Program:

SBI Holdings, a major Japanese financial services company and a significant investor in Ripple, has implemented a shareholder reward program distributing XRP to its eligible shareholders. This isn't simply a dividend in the traditional sense; it's a strategic move designed to boost XRP adoption and potentially influence its market price. The program details, while not fully public in all aspects, indicate that eligible shareholders receive a certain amount of XRP based on their shareholding. Reports suggest the reward is tied to the number of shares held and potentially varies depending on the holding period. Furthermore, some reports suggest that alongside XRP, shareholders might also receive other benefits, such as discounts on SBI Holdings' financial services. Eligibility criteria likely include holding SBI shares for a minimum period and meeting other specific requirements set by the company. Precise figures regarding the amount of XRP distributed per share are not consistently reported across all sources but indicate a significant distribution impacting the overall XRP supply in circulation.

H3: Impact on XRP Demand and Price:

The SBI Holdings reward program is expected to significantly impact XRP demand and, consequently, its price. The direct distribution of XRP to shareholders creates immediate buying pressure as recipients may choose to sell their newly acquired tokens on cryptocurrency exchanges. This could lead to short-term price spikes, particularly immediately following distribution periods. However, the long-term impact is arguably more significant. By increasing the number of XRP holders, SBI Holdings' actions enhance XRP's market perception and foster wider adoption.

- Increased buying pressure on exchanges: The sudden influx of XRP into the market could create significant buying pressure, pushing the Ripple XRP price upwards.

- Potential for price spikes immediately following distributions: We can anticipate short-term volatility linked to the timing of these distributions.

- Enhanced market perception of XRP: The action by a major financial institution like SBI Holdings lends credibility and boosts confidence in XRP.

Market Sentiment and Ripple XRP Price Volatility

H3: Analyzing Current Market Conditions:

The cryptocurrency market is inherently volatile, influenced by a multitude of factors including regulatory changes, macroeconomic conditions, and overall investor sentiment. Currently, we see [insert current market trends: e.g., a bearish market, increased interest in specific altcoins, etc.]. This context significantly influences how the market will react to the SBI Holdings initiative. Recent news, such as [mention any relevant news, e.g., announcements from other major players, new regulations], can further impact XRP's price.

H3: The Influence of Regulatory Uncertainty:

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) casts a long shadow over XRP's price. The SEC's classification of XRP as an unregistered security significantly impacts investor confidence and trading volumes. A favorable ruling for Ripple could lead to a substantial increase in XRP's price due to restored confidence and potentially increased institutional investment. Conversely, a negative outcome could result in further price drops. Regulatory clarity is paramount for price stability and long-term growth.

- Positive legal developments could boost XRP price: A favorable court ruling or settlement could significantly increase investor confidence.

- Negative news could trigger price drops: Conversely, unfavorable developments in the lawsuit would likely depress the Ripple XRP price.

- Importance of regulatory clarity for investor confidence: Clear regulatory frameworks are essential to attract institutional investment and stabilize XRP's price.

Long-Term Prospects for Ripple XRP and SBI Holdings' Strategy

H3: SBI Holdings' Strategic Vision for XRP:

SBI Holdings' decision to reward shareholders with XRP is not merely a financial maneuver; it's a strategic investment in the long-term success of Ripple and the broader adoption of XRP. This strategy likely aims to strengthen XRP's position in the Japanese market and potentially expand its use cases within SBI Holdings' extensive network. Future partnerships and collaborations stemming from this initiative could further boost XRP's utility and price.

H3: Future Price Predictions (with caveats):

Predicting the long-term Ripple XRP price is inherently speculative. While the SBI Holdings initiative and potential positive outcomes in the Ripple-SEC lawsuit are positive catalysts, the cryptocurrency market remains susceptible to unforeseen events. Factors like wider adoption, technological advancements, and overall market sentiment will all play significant roles.

- Potential growth driven by increasing adoption: Wider usage of XRP for payments and other applications could drive price appreciation.

- Risks associated with regulatory hurdles and market volatility: The ongoing legal battle and inherent volatility of crypto markets pose significant risks.

- Long-term price potential dependent on various factors: A multitude of factors will determine XRP's future price, making precise predictions impossible.

Conclusion

SBI Holdings' decision to reward shareholders with XRP has significant implications for the Ripple XRP price and the broader cryptocurrency market. While the short-term price fluctuations are difficult to predict with certainty, the increased demand and potentially improved market sentiment could lead to positive long-term growth. However, regulatory uncertainty remains a key factor influencing XRP's price volatility. Keep a close eye on developments in the Ripple-SEC lawsuit and the overall crypto market trends to make informed decisions about your Ripple XRP investments. Stay updated on the latest news and analysis surrounding the Ripple XRP price to navigate this evolving landscape effectively.

Featured Posts

-

Daily Lotto Winning Numbers For Thursday April 17 2025

May 02, 2025

Daily Lotto Winning Numbers For Thursday April 17 2025

May 02, 2025 -

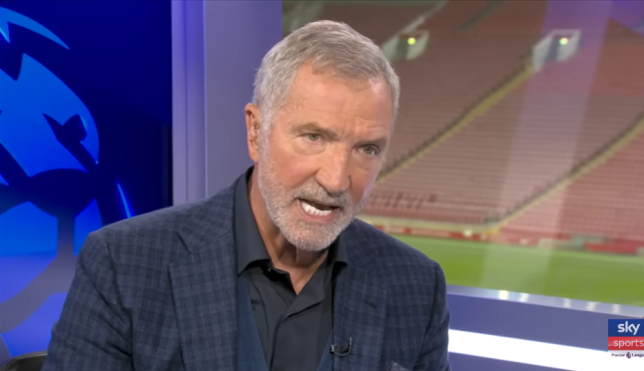

Souness Premier League Favourites A Surprising Choice

May 02, 2025

Souness Premier League Favourites A Surprising Choice

May 02, 2025 -

Explore The Latest Play Station Plus Extra And Premium Game Additions

May 02, 2025

Explore The Latest Play Station Plus Extra And Premium Game Additions

May 02, 2025 -

Arc Raider Tech Test 2 Console Release And Sign Up Details

May 02, 2025

Arc Raider Tech Test 2 Console Release And Sign Up Details

May 02, 2025 -

Slah Fy Khtr Jw 24 Ywjh Thdhyra Shdyd Allhjt

May 02, 2025

Slah Fy Khtr Jw 24 Ywjh Thdhyra Shdyd Allhjt

May 02, 2025

Latest Posts

-

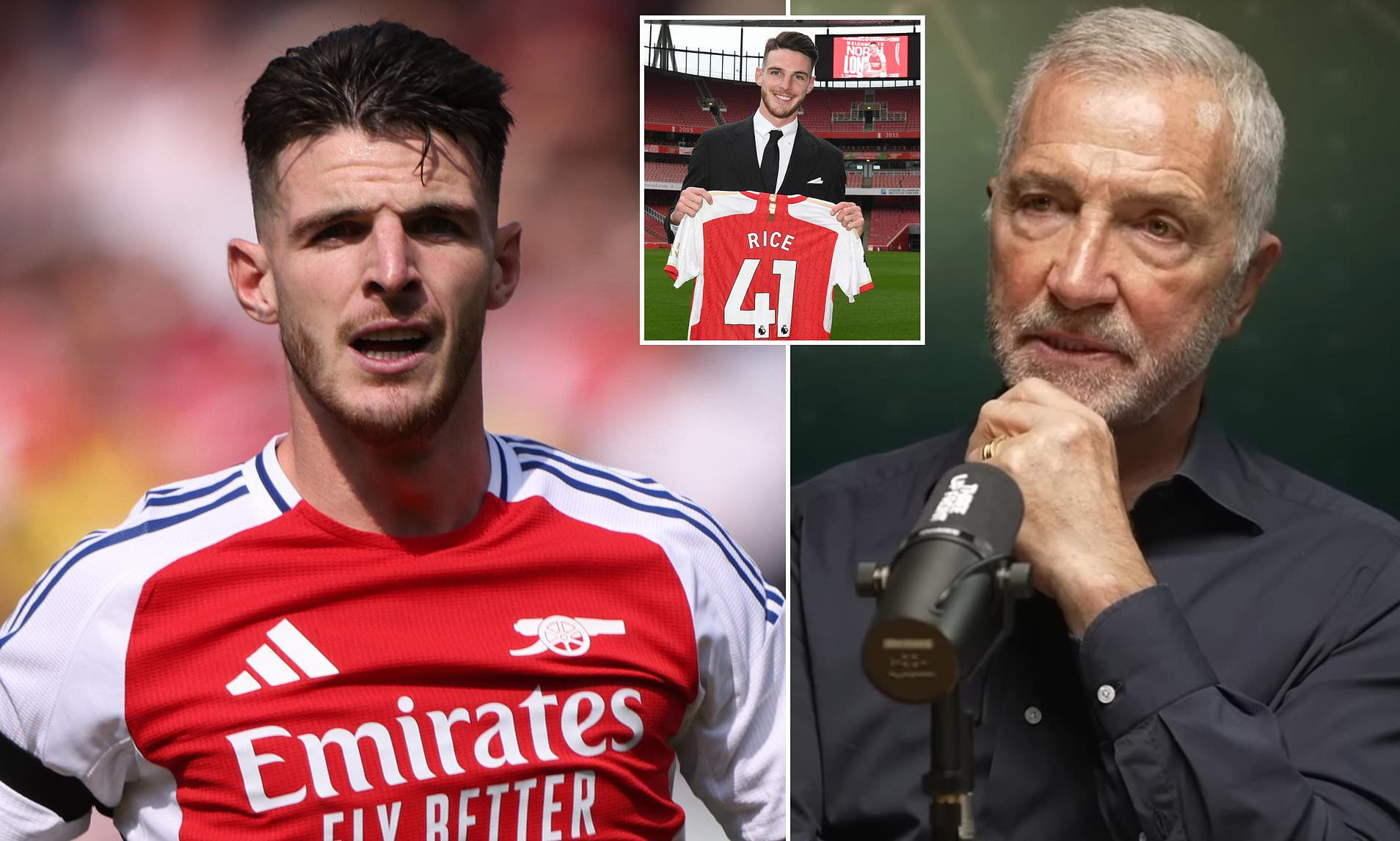

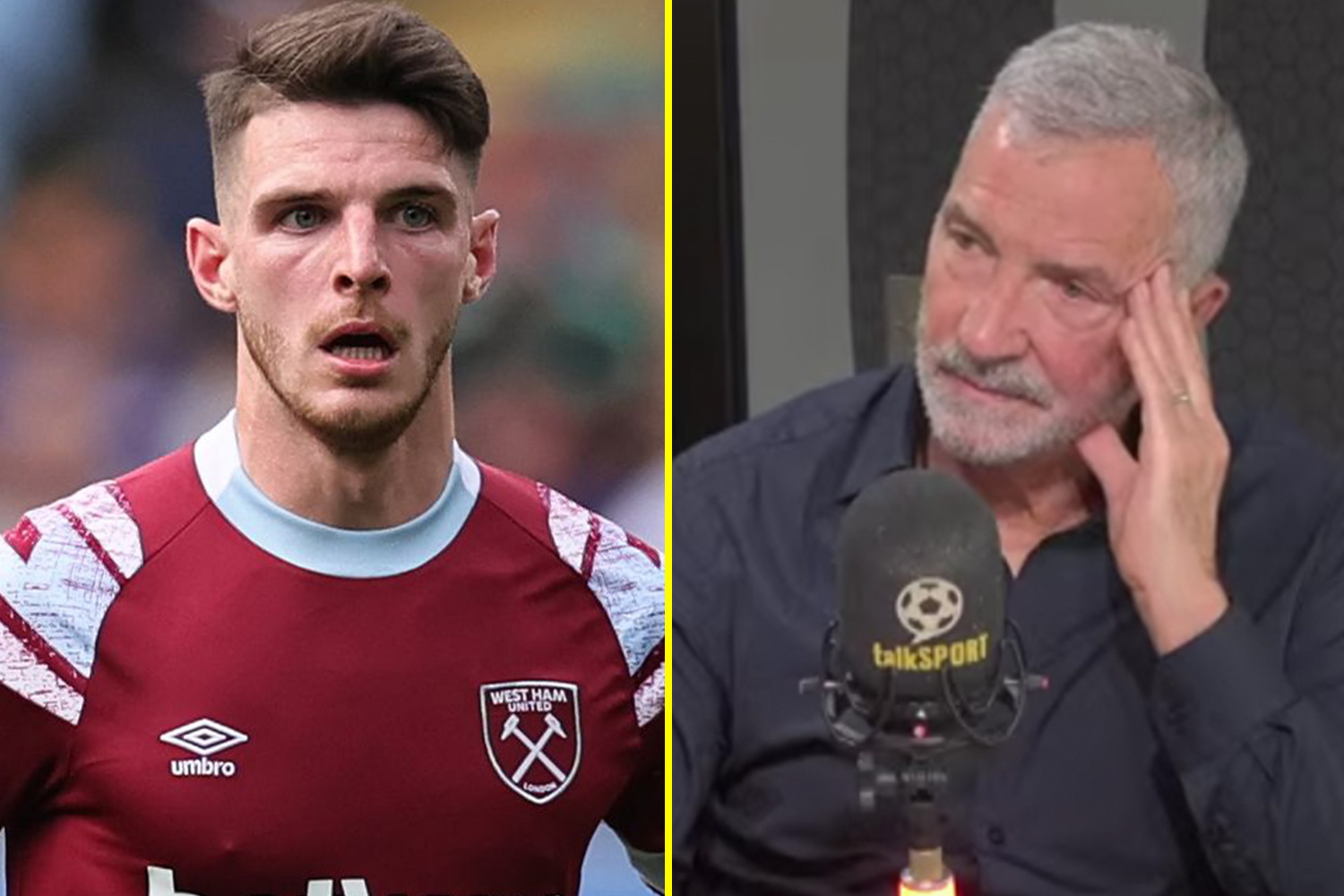

Graeme Souness Critiques Declan Rices Final Third Performance

May 03, 2025

Graeme Souness Critiques Declan Rices Final Third Performance

May 03, 2025 -

Arsenals Rice Souness Assessment And Path To Elite Status

May 03, 2025

Arsenals Rice Souness Assessment And Path To Elite Status

May 03, 2025 -

Souness On Rice Arsenal Star Needs To Elevate His Final Third Play

May 03, 2025

Souness On Rice Arsenal Star Needs To Elevate His Final Third Play

May 03, 2025 -

Epl Souness Verdict On Havertzs Arsenal Transfer And Future

May 03, 2025

Epl Souness Verdict On Havertzs Arsenal Transfer And Future

May 03, 2025 -

Graeme Souness Declan Rice Needs Final Third Improvement For World Class Status

May 03, 2025

Graeme Souness Declan Rice Needs Final Third Improvement For World Class Status

May 03, 2025