Ripple (XRP) Price Forecast: The Road To $3.40

Table of Contents

Analyzing the Current Market Landscape for XRP

Understanding the current state of the XRP market is crucial for any price forecast. We need to consider investor sentiment, technological advancements, and the rate of adoption.

Market Sentiment and Investor Confidence

Investor sentiment towards XRP remains complex, heavily influenced by the ongoing SEC lawsuit. While some investors remain cautious, others see the potential for significant gains if the legal battle resolves favorably. Recent price movements show a degree of volatility, reflecting this uncertainty. Trading volume provides insights into market activity and overall interest. For example, a spike in trading volume alongside a price increase could indicate bullish sentiment. Analyzing charts and graphs showing historical price movements and trading volume is essential for any comprehensive XRP market analysis.

- Recent Price Movements: Examine weekly and monthly charts to identify trends.

- Trading Volume Analysis: High volume often accompanies significant price changes.

- News Sentiment: Track news articles and social media sentiment to gauge overall opinion.

Technological Advancements and Ripple's Roadmap

Ripple continues to invest in research and development, improving its technology and expanding its capabilities. Partnerships and collaborations with financial institutions are key to driving XRP adoption. The ongoing development of RippleNet, its payment network, is a crucial factor in the XRP price forecast. The success of these initiatives will significantly influence XRP's value. The Ripple vs. SEC lawsuit also plays a major role here. Positive developments could greatly boost investor confidence and unlock XRP’s potential.

- RippleNet Expansion: Increased adoption by financial institutions strengthens the network effect.

- Technological Upgrades: Improvements to speed and efficiency enhance the attractiveness of XRP.

- SEC Lawsuit Progression: A positive resolution could unlock substantial price appreciation for XRP technology.

Adoption Rate and Real-World Use Cases

The growing adoption of XRP in cross-border payments is a significant driver for its price. Real-world applications, such as faster and cheaper international money transfers, demonstrate the practicality of XRP. Increased adoption by businesses and financial institutions directly correlates with increased demand, impacting the XRP price. This increasing XRP adoption is a testament to its potential in revolutionizing the global payments landscape.

- Cross-Border Payment Solutions: RippleNet’s success in facilitating faster and cheaper transactions.

- Financial Institution Partnerships: Examples of banks and payment providers using Ripple's technology.

- New Use Cases: Exploration of XRP in other sectors beyond payments, potentially boosting demand.

Factors that Could Drive XRP to $3.40

Several factors could contribute to XRP reaching the $3.40 price point. These include positive legal developments, increased institutional adoption, and growing demand.

Positive Legal Developments

The outcome of the SEC lawsuit is arguably the most significant factor influencing XRP's price. A favorable ruling would likely trigger a substantial price surge, as it would remove a major source of uncertainty and unlock significant investor confidence. Different scenarios, ranging from a complete dismissal of the lawsuit to a partial settlement, will significantly impact XRP's trajectory. Analyzing these scenarios is crucial for any accurate XRP SEC lawsuit analysis.

- Complete Dismissal: This would likely lead to a sharp and sustained price increase.

- Partial Settlement: A less favorable outcome, but still positive, potentially leading to a moderate price increase.

- Negative Ruling: This would likely cause a significant short-term price drop, but not necessarily a permanent one.

Increased Institutional Adoption

Larger financial institutions adopting XRP for cross-border payments could significantly boost demand. Institutional investment generally brings stability and legitimacy to a cryptocurrency, leading to increased price appreciation. The more widely XRP is adopted by reputable institutions, the greater the likelihood of sustained price growth. Examples of institutions already using Ripple's technology provide a strong indicator of future adoption trends.

- Increased Trading Volume from Institutions: This signals greater confidence and legitimacy in XRP.

- Integration into Existing Financial Systems: Seamless integration increases the utility and value of XRP.

- Positive Press Coverage: Institutional adoption tends to generate positive media attention.

Growing Demand and Scarcity

The interplay of supply and demand fundamentally drives price in any market, including cryptocurrencies. Increased demand for XRP, driven by factors like institutional adoption and real-world use cases, will naturally push the price higher. The relative scarcity of XRP, compared to other cryptocurrencies, could also contribute to price appreciation. Analyzing XRP supply and demand dynamics is key to accurately forecasting its price.

- Demand Drivers: Identify major sources of demand, such as cross-border transactions and institutional investment.

- Supply Constraints: Evaluate the fixed supply of XRP and how it impacts potential price appreciation.

- Market Cap Analysis: Assess XRP's market capitalization relative to its potential and other cryptocurrencies.

Potential Challenges and Risks

While the potential for XRP to reach $3.40 is significant, it's essential to acknowledge the challenges and risks.

Regulatory Uncertainty

The cryptocurrency market remains subject to regulatory uncertainty. Changes in regulations, either favorable or unfavorable, can significantly impact XRP's price. Understanding the potential impact of future regulations and navigating regulatory hurdles are crucial for investors. This regulatory uncertainty around XRP necessitates a cautious approach to investment.

- Varying Regulatory Landscapes: Different jurisdictions have different regulatory approaches to cryptocurrencies.

- Potential for Increased Regulation: Governments might introduce stricter rules impacting cryptocurrency trading and usage.

- Uncertainty Surrounding SEC Lawsuit Outcome: The outcome of the SEC lawsuit remains a major unknown factor.

Market Volatility

The cryptocurrency market is inherently volatile. External factors, such as macroeconomic conditions or major news events, can cause significant price swings. Understanding and managing the risks associated with XRP volatility is paramount for investors. The inherent XRP volatility underscores the importance of careful risk management.

- Macroeconomic Factors: Events such as economic downturns can negatively impact cryptocurrency prices.

- Market Sentiment Shifts: Sudden shifts in investor sentiment can lead to dramatic price fluctuations.

- Black Swan Events: Unforeseen events can significantly impact market conditions.

Competition from Other Cryptocurrencies

XRP faces competition from other cryptocurrencies with similar functionalities. The competitive landscape continuously evolves, requiring constant evaluation of XRP's position within the broader market. Analyzing the strengths and weaknesses of XRP relative to its competitors is crucial for a realistic price forecast. The intensity of XRP competitors in the market should be carefully assessed.

- Technological Advancements by Competitors: Competing projects constantly innovate, pushing the boundaries of technology.

- Market Share Competition: XRP needs to maintain its market share against its rivals.

- New Entrants: New cryptocurrencies constantly enter the market, creating further competition.

Conclusion: The Path to $3.40 and Beyond for XRP

The potential for XRP to reach $3.40 hinges on several factors: a favorable resolution to the SEC lawsuit, increased institutional adoption, growing demand, and navigating regulatory uncertainty and market volatility effectively. While the road to $3.40 is not without its challenges, a cautious yet optimistic outlook remains valid. A comprehensive understanding of the market dynamics, coupled with careful risk management, is essential for any investor considering XRP.

Explore the potential of XRP. Learn more about the Ripple (XRP) price forecast. Is a $3.40 XRP price realistic? Find out more and stay updated on the latest XRP news and developments.

Featured Posts

-

Current Lotto Results Lotto Lotto Plus 1 And Lotto Plus 2 Draws

May 08, 2025

Current Lotto Results Lotto Lotto Plus 1 And Lotto Plus 2 Draws

May 08, 2025 -

Chicago United Center Fans New 5 Uber Shuttle Service Available

May 08, 2025

Chicago United Center Fans New 5 Uber Shuttle Service Available

May 08, 2025 -

Saglik Bakanligi Personel Alimi 2024 Basvuru Tarihleri Ve Detaylar

May 08, 2025

Saglik Bakanligi Personel Alimi 2024 Basvuru Tarihleri Ve Detaylar

May 08, 2025 -

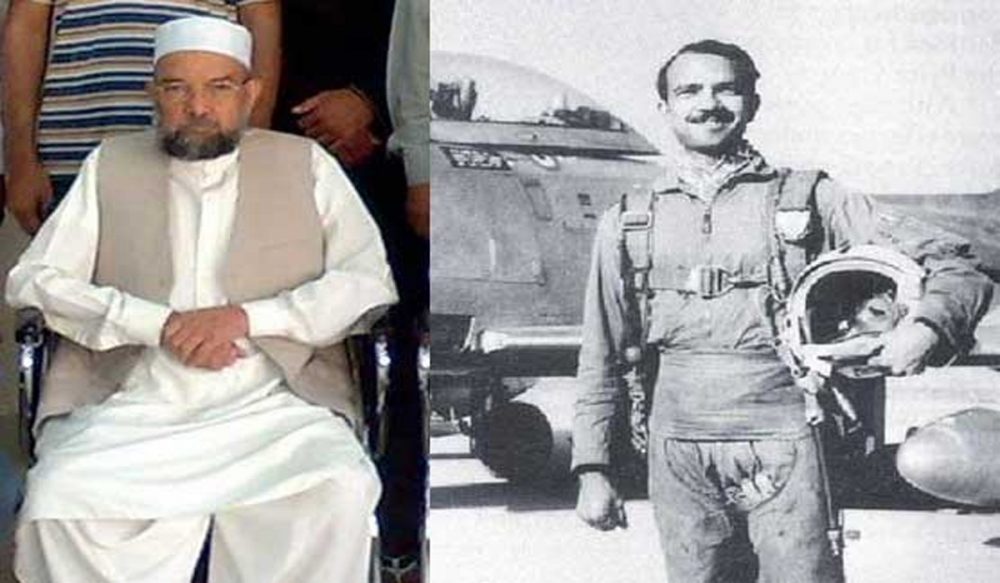

Qwmy Hyrw Aym Aym Ealm Ky 12 Wyn Brsy Ky Tqrybat Ka Aghaz

May 08, 2025

Qwmy Hyrw Aym Aym Ealm Ky 12 Wyn Brsy Ky Tqrybat Ka Aghaz

May 08, 2025 -

Secret Papal Conclave Dossier Reveals Candidate Profiles

May 08, 2025

Secret Papal Conclave Dossier Reveals Candidate Profiles

May 08, 2025