Ripple (XRP) 15,000% Surge: Millionaire Maker Or Market Fluctuation?

Table of Contents

Analyzing the 15,000% XRP Price Surge: What Fueled the Rocket?

The astronomical rise in XRP price wasn't a spontaneous event; several factors contributed to this dramatic increase. Understanding these factors is crucial for assessing the future of XRP and its potential as an investment.

Ripple's Technology and Use Cases:

Ripple's technology centers around RippleNet, a global payment network, and the XRP Ledger, a distributed ledger technology (DLT) that facilitates fast and efficient cross-border transactions. Its purpose is to streamline international payments, offering a solution that is faster, cheaper, and more transparent than traditional banking systems.

- Successful RippleNet Partnerships: Ripple has partnered with numerous financial institutions globally, including major banks and money transfer operators. These partnerships represent significant adoption of Ripple's technology.

- Cost-Effectiveness and Speed: RippleNet significantly reduces transaction costs and processing times, making it an attractive alternative to traditional SWIFT payments.

- Transparency and Security: The XRP Ledger provides a transparent and secure platform for tracking and verifying transactions.

Market Speculation and Hype:

The media's portrayal of XRP, coupled with social media buzz and speculative trading, significantly fueled the price increase. Positive news coverage and endorsements from influential figures in the crypto community can create a self-fulfilling prophecy, driving demand and pushing the price upwards.

- Pump-and-Dump Schemes: It's important to acknowledge the potential for manipulative market activities, including pump-and-dump schemes, which can artificially inflate prices before a sudden crash.

- Social Media Influence: Social media platforms like Twitter and Telegram play a significant role in shaping investor sentiment and driving price fluctuations. Understanding the influence of crypto influencers is crucial.

Regulatory Uncertainty and its Impact:

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) has significantly impacted XRP's price volatility. Uncertainty surrounding regulatory clarity affects investor confidence and can lead to dramatic price swings.

- Positive Regulatory Developments: Positive news or rulings regarding the SEC lawsuit could lead to a surge in investor confidence and increased XRP price.

- Negative Regulatory Outcomes: Conversely, negative news or rulings could trigger a significant price drop.

- Long-Term Regulatory Landscape: The long-term impact of regulatory clarity or uncertainty on XRP's value is a crucial factor to consider for long-term investors.

The Reality Check: Is XRP a Millionaire Maker or a High-Risk Investment?

While the Ripple (XRP) 15,000% surge is tempting, it's crucial to understand the inherent risks.

Understanding Volatility and Risk:

The cryptocurrency market is notoriously volatile. While XRP's price has experienced significant growth, it's equally susceptible to dramatic drops. Past cryptocurrency crashes serve as a stark reminder of the potential for substantial losses.

- High-Risk, High-Reward: Investing in XRP, or any cryptocurrency, involves a significant level of risk. The potential for high gains must be weighed against the possibility of substantial losses.

- Price Fluctuations: Be prepared for significant price fluctuations, driven by market sentiment, regulatory news, and technological developments.

Diversification and Responsible Investing:

Never invest more than you can afford to lose. Diversification is key to mitigating risk. Don't put all your eggs in one basket.

- Research and Due Diligence: Thoroughly research any cryptocurrency before investing. Understand the technology, the market, and the risks involved.

- Risk Tolerance: Consider your personal risk tolerance and financial goals before making any investment decisions.

Long-Term Potential vs. Short-Term Gains:

While the allure of short-term gains is tempting, a long-term investment strategy often yields better results.

- Long-Term Vision: Focus on the long-term potential of XRP based on factors such as adoption rates, technological advancements, and regulatory clarity.

- Avoiding Speculation: Avoid chasing quick profits driven by speculation and hype.

Conclusion:

The Ripple (XRP) 15,000% surge highlights the potential for significant returns in the cryptocurrency market, but also underscores the inherent volatility and risk. While the technology behind Ripple and its potential use cases are promising, the regulatory landscape and market speculation remain significant factors influencing XRP price. Remember, responsible investing in any cryptocurrency, including XRP, requires careful research and understanding of the inherent volatility. Don't let the allure of quick riches overshadow the importance of a well-informed investment strategy. Conduct thorough research before investing in XRP or any cryptocurrency. Make informed decisions based on a comprehensive understanding of the technology, market risks, and your own financial goals.

Featured Posts

-

Enexis Wachtlijst Van Meer Dan 1000 Limburgse Ondernemers

May 01, 2025

Enexis Wachtlijst Van Meer Dan 1000 Limburgse Ondernemers

May 01, 2025 -

Shh Rg Zyr Khnjr Ayksprys Ardw Ka Jayzh Awr Tjzyaty Rpwrt

May 01, 2025

Shh Rg Zyr Khnjr Ayksprys Ardw Ka Jayzh Awr Tjzyaty Rpwrt

May 01, 2025 -

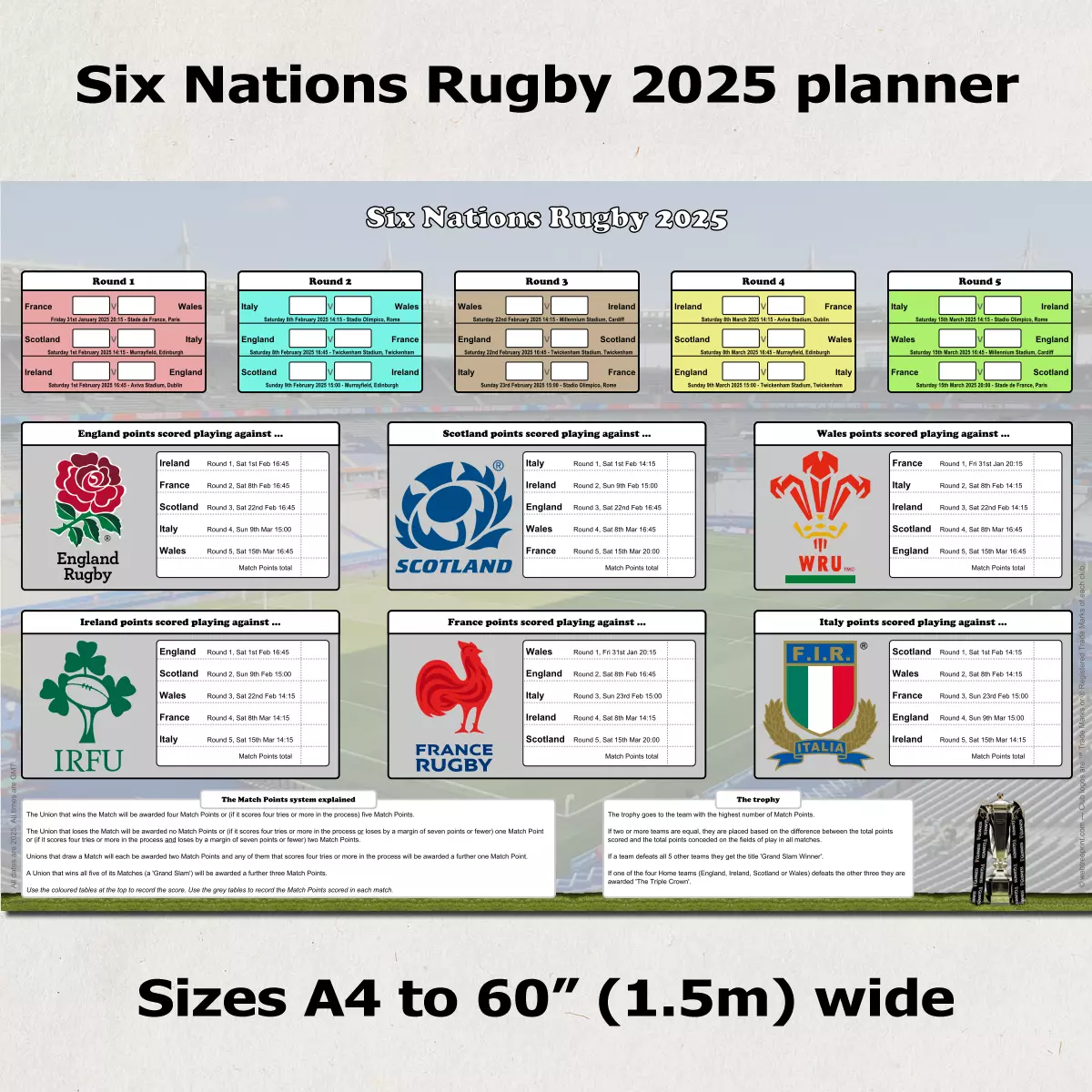

Frances Rugby Future Six Nations 2025 And Beyond

May 01, 2025

Frances Rugby Future Six Nations 2025 And Beyond

May 01, 2025 -

Enexis En Kampen In Juridisch Conflict Aansluiting Stroomnet In Kort Geding

May 01, 2025

Enexis En Kampen In Juridisch Conflict Aansluiting Stroomnet In Kort Geding

May 01, 2025 -

Cincinnati Defeats Lady Raiders In Home Game 59 56

May 01, 2025

Cincinnati Defeats Lady Raiders In Home Game 59 56

May 01, 2025

Latest Posts

-

Dallas Star Dies The End Of An Era For 80s Soap Operas

May 01, 2025

Dallas Star Dies The End Of An Era For 80s Soap Operas

May 01, 2025 -

The Death Of A Dallas And 80s Soap Star

May 01, 2025

The Death Of A Dallas And 80s Soap Star

May 01, 2025 -

A Dallas Legend And 80s Soap Star Is Dead

May 01, 2025

A Dallas Legend And 80s Soap Star Is Dead

May 01, 2025 -

Tv Icon From Dallas And 80s Soaps Passes Away

May 01, 2025

Tv Icon From Dallas And 80s Soaps Passes Away

May 01, 2025 -

Dallas And 80s Soap Opera The Passing Of A Beloved Star

May 01, 2025

Dallas And 80s Soap Opera The Passing Of A Beloved Star

May 01, 2025