Ripple And SEC Near Settlement: XRP's Commodity Status In Question

Table of Contents

The SEC's Case Against Ripple

The SEC's core argument centers on the assertion that Ripple conducted an unregistered securities offering of XRP. They claim this violated federal securities laws, specifically citing the Howey Test. The Howey Test, a landmark legal precedent, determines whether an investment contract qualifies as a security. It assesses whether an investment involves an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others.

- Unregistered securities offering: The SEC alleges Ripple sold XRP without registering it as a security, depriving investors of crucial information and protections.

- Violation of federal securities laws: The SEC argues Ripple's actions constitute a clear breach of federal securities laws, potentially exposing the company and its executives to significant penalties.

- Focus on the Howey Test and its application to XRP: The SEC's case hinges on applying the Howey Test to XRP, arguing that Ripple's actions and the expectations of XRP purchasers meet the criteria for a security.

- Impact on investors: The SEC contends that investors were misled about XRP's true nature and the risks associated with its purchase, leading to potential financial harm.

Ripple's Defense and Arguments

Ripple vehemently denies the SEC's accusations, arguing that XRP is a decentralized digital asset, fundamentally different from securities. Their defense strategy focuses on distinguishing XRP from other cryptocurrencies deemed securities.

- XRP as a decentralized digital asset: Ripple emphasizes XRP's decentralized nature, highlighting its open-source code and lack of centralized control by Ripple Labs.

- Distinction between XRP and other cryptocurrencies deemed securities: Ripple argues that XRP’s functionality and market operation differ significantly from the cryptocurrencies the SEC has previously classified as securities.

- Emphasis on XRP's utility and market functionality: Ripple points to XRP's use in cross-border payments and its established market presence as evidence of its utility and non-security nature.

- Arguments against the application of the Howey Test: Ripple contests the SEC's application of the Howey Test, arguing that the test's criteria don't accurately reflect XRP's decentralized functionality and market dynamics. [Link to Ripple's official legal filings would go here].

Potential Settlement Implications for XRP

A settlement could significantly alter the XRP landscape. Several potential outcomes exist, each carrying profound consequences.

- Potential for XRP to be classified as a commodity or security: The settlement might explicitly define XRP’s legal status, potentially classifying it as either a commodity (like gold) or a security (like a stock).

- Impact on XRP exchanges and trading volumes: The classification will dramatically influence the listing of XRP on exchanges and potentially affect trading volumes. A "security" classification could lead to delisting from many exchanges.

- Consequences for Ripple Labs and its future operations: Depending on the settlement terms, Ripple Labs could face substantial fines, operational restrictions, or other penalties.

- Ripple's potential fine or other penalties: The settlement may involve a significant financial penalty for Ripple, potentially impacting its future growth and development.

- The precedent set for other cryptocurrencies: The outcome will set a crucial precedent for how regulators approach other cryptocurrencies, impacting the entire industry's regulatory landscape.

Impact on the broader Cryptocurrency Market

The Ripple-SEC case has a far-reaching impact beyond just XRP. Uncertainty surrounding the XRP commodity status is causing ripples throughout the cryptocurrency market.

- Uncertainty and volatility in the crypto market: The ongoing legal battle has created uncertainty, leading to volatility in cryptocurrency prices.

- Increased regulatory scrutiny of other digital assets: The SEC's actions have increased regulatory scrutiny of other digital assets, forcing other projects to review their compliance measures.

- Potential for similar legal challenges against other crypto projects: The case may encourage regulatory bodies worldwide to launch similar legal actions against other crypto projects.

- Influence on future regulatory frameworks for cryptocurrencies: The outcome will significantly influence the development of future regulatory frameworks for cryptocurrencies, shaping the industry's future.

The Future of XRP and Regulatory Clarity

The future of XRP is inextricably linked to the outcome of the Ripple-SEC case and the broader need for clearer regulatory guidelines in the crypto space.

- The importance of regulatory certainty for investor confidence: Regulatory clarity is essential to restore investor confidence and attract further investment into the cryptocurrency market.

- Calls for more comprehensive crypto legislation: The case underscores the need for comprehensive legislation that provides clear guidelines for cryptocurrencies.

- Potential for self-regulation within the cryptocurrency industry: The industry itself might need to explore self-regulatory mechanisms to address compliance issues.

- Long-term prospects for XRP depending on the settlement outcome: The long-term success of XRP hinges heavily on the resolution of the legal battle and its impact on its classification and market access.

Conclusion

The SEC vs. Ripple case, and the question of XRP's commodity status, has far-reaching implications for the cryptocurrency market. The potential settlement carries significant consequences for XRP, Ripple Labs, and the entire crypto industry. The classification of XRP as either a security or a commodity will set a crucial precedent, influencing future regulatory frameworks and investor confidence. Understanding the nuances of this case is vital for navigating the evolving cryptocurrency landscape.

Call to Action: Stay updated on the latest developments regarding the XRP commodity status and the Ripple-SEC case. Follow our blog for future analyses and insights into the evolving cryptocurrency regulatory landscape.

Featured Posts

-

Aansluiting Stroomnet Geweigerd Kampen Neemt Enexis Voor De Rechter

May 02, 2025

Aansluiting Stroomnet Geweigerd Kampen Neemt Enexis Voor De Rechter

May 02, 2025 -

Which Console Reigns Supreme In The Us Ps 5 Vs Xbox Series X S Sales Data

May 02, 2025

Which Console Reigns Supreme In The Us Ps 5 Vs Xbox Series X S Sales Data

May 02, 2025 -

Oklahoma Severe Weather Timeline Strong Winds Forecast

May 02, 2025

Oklahoma Severe Weather Timeline Strong Winds Forecast

May 02, 2025 -

Ely Rda Syd Ka Byan Kshmyrywn Ke Lye Ansaf Awr Khte Ka Amn

May 02, 2025

Ely Rda Syd Ka Byan Kshmyrywn Ke Lye Ansaf Awr Khte Ka Amn

May 02, 2025 -

Splices Cay Fest Documentary An In Depth Look

May 02, 2025

Splices Cay Fest Documentary An In Depth Look

May 02, 2025

Latest Posts

-

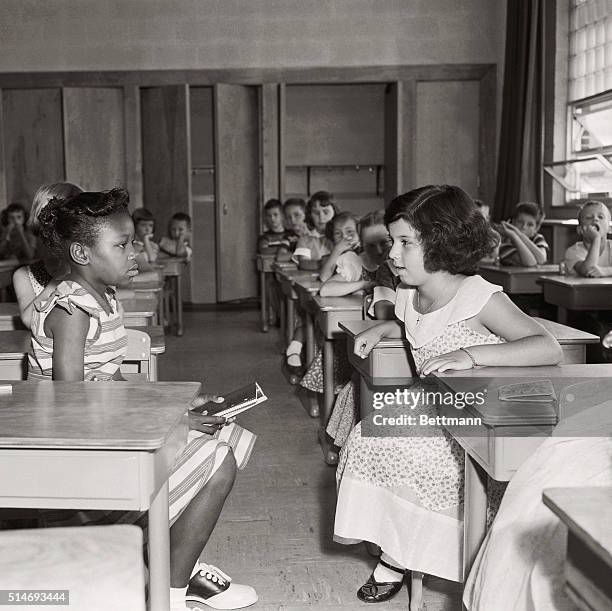

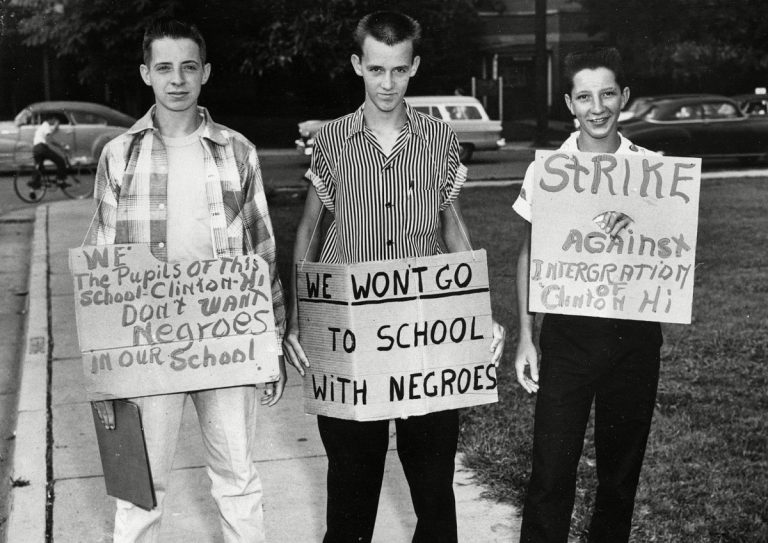

The Fallout From The Justice Departments School Desegregation Order Decision

May 02, 2025

The Fallout From The Justice Departments School Desegregation Order Decision

May 02, 2025 -

School Desegregation Order Terminated Potential For Further Changes

May 02, 2025

School Desegregation Order Terminated Potential For Further Changes

May 02, 2025 -

The Fallout From The Justice Departments School Desegregation Order Termination

May 02, 2025

The Fallout From The Justice Departments School Desegregation Order Termination

May 02, 2025 -

School Desegregation Orders End A Legal And Social Analysis

May 02, 2025

School Desegregation Orders End A Legal And Social Analysis

May 02, 2025 -

End Of School Desegregation Order Implications For Other Districts

May 02, 2025

End Of School Desegregation Order Implications For Other Districts

May 02, 2025