Ripple And SEC Near Settlement: Potential Commodity Classification For XRP

Table of Contents

The SEC's Case Against Ripple and its Arguments

The SEC's lawsuit against Ripple alleges that XRP is an unregistered security, violating federal securities laws. The core of the SEC's argument rests on their interpretation of the Howey Test, a benchmark used to determine whether an investment contract qualifies as a security. The SEC argues that XRP's sale and distribution involved an investment of money in a common enterprise with a reasonable expectation of profits derived from Ripple's efforts.

- SEC's focus on the Howey Test: The SEC contends that XRP investors expected profits based on Ripple's development and market activities.

- Allegations of unregistered sales of XRP: The SEC claims Ripple engaged in unregistered sales of XRP, bypassing crucial regulatory processes.

- Arguments regarding investor expectations and profit from Ripple's efforts: Central to the SEC's case is the assertion that investors purchased XRP with the expectation of profiting from Ripple's business activities, not solely from its use as a currency. This implies a direct relationship between the success of Ripple and the value of XRP, a key element of the Howey Test.

Ripple's Defense and Arguments for Commodity Classification

Ripple vehemently denies the SEC's accusations, arguing that XRP is a decentralized digital asset and should be classified as a commodity, similar to gold or Bitcoin. Their defense strategy hinges on highlighting XRP's functionality as a medium of exchange and its decentralized nature.

- Emphasis on XRP's decentralized nature and functionality: Ripple emphasizes that XRP operates on a decentralized blockchain, independent of Ripple's control, unlike many centralized tokens.

- Arguments about XRP's use as a medium of exchange and store of value: Ripple highlights the use of XRP in cross-border payments, emphasizing its utility beyond mere investment. This counters the SEC's argument focusing solely on investment expectations.

- Comparison to other cryptocurrencies classified as commodities: Ripple's defense likely points to other cryptocurrencies, such as Bitcoin, that are widely considered commodities and are not subject to the same securities regulations as XRP.

Potential Outcomes of a Settlement and Commodity Classification for XRP

A settlement favorable to Ripple, resulting in XRP being classified as a commodity, would have significant repercussions. This could lead to increased regulatory clarity, potentially boosting XRP's price and trading volume.

- Increased regulatory clarity for XRP: A commodity classification would provide much-needed regulatory certainty for XRP, potentially attracting more institutional investors.

- Potential impact on other cryptocurrencies: The outcome could significantly impact how other cryptocurrencies are regulated, setting a precedent for future legal battles.

- Changes in the market capitalization and trading volumes: A positive ruling could substantially increase XRP's market capitalization and trading volume, attracting significant investment.

- Implications for investors and exchanges: Investors could see substantial returns, while exchanges would benefit from increased trading activity. However, the opposite is true if the ruling is unfavorable to Ripple.

Alternative Scenarios and Uncertainties

While a settlement favorable to Ripple is a possibility, other scenarios remain. The SEC could prevail, leading to stricter regulation of XRP and potentially other cryptocurrencies. The legal battle could also be prolonged, introducing significant uncertainty.

- Potential for a prolonged legal battle: Appeals and further litigation could delay a final decision for years, creating uncertainty for investors and the market.

- Uncertainties surrounding future regulatory actions: The outcome, regardless of who wins, could prompt further regulatory scrutiny of the cryptocurrency market as a whole.

- The potential for different interpretations of the ruling: Even a seemingly clear decision could have multiple interpretations, leading to further legal challenges and ambiguity.

Conclusion: The Future of XRP and the Importance of Commodity Classification

The Ripple-SEC case has profound implications for the future of XRP and the cryptocurrency industry as a whole. A commodity classification for XRP would bring much-needed regulatory clarity, potentially stimulating growth and investment. However, the uncertainties remain substantial. The outcome will shape the regulatory landscape and influence future developments in the cryptocurrency market. Stay informed about the Ripple and SEC case and its implications for the future of XRP and the broader cryptocurrency landscape. Understanding the potential outcomes of this landmark legal battle is crucial for anyone involved in or considering investment in the XRP market and the future of cryptocurrency classification.

Featured Posts

-

Death Of Priscilla Pointer Tributes Pour In For Dallas And Carrie Star

May 01, 2025

Death Of Priscilla Pointer Tributes Pour In For Dallas And Carrie Star

May 01, 2025 -

Englands Last Minute Try Secures Six Nations Win Against France

May 01, 2025

Englands Last Minute Try Secures Six Nations Win Against France

May 01, 2025 -

Unlocking The Potential How Middle Managers Contribute To A Thriving Organization

May 01, 2025

Unlocking The Potential How Middle Managers Contribute To A Thriving Organization

May 01, 2025 -

Spot Stock Up Spotify Reports 12 Subscriber Growth

May 01, 2025

Spot Stock Up Spotify Reports 12 Subscriber Growth

May 01, 2025 -

Nrc Biedt Gratis Nyt Toegang Waarom Nu

May 01, 2025

Nrc Biedt Gratis Nyt Toegang Waarom Nu

May 01, 2025

Latest Posts

-

Black Sea Oil Spill Leads To Closure Of Dozens Of Miles Of Beaches In Russia

May 01, 2025

Black Sea Oil Spill Leads To Closure Of Dozens Of Miles Of Beaches In Russia

May 01, 2025 -

Environmental Emergency Oil Spill Closes Extensive Black Sea Beach Area

May 01, 2025

Environmental Emergency Oil Spill Closes Extensive Black Sea Beach Area

May 01, 2025 -

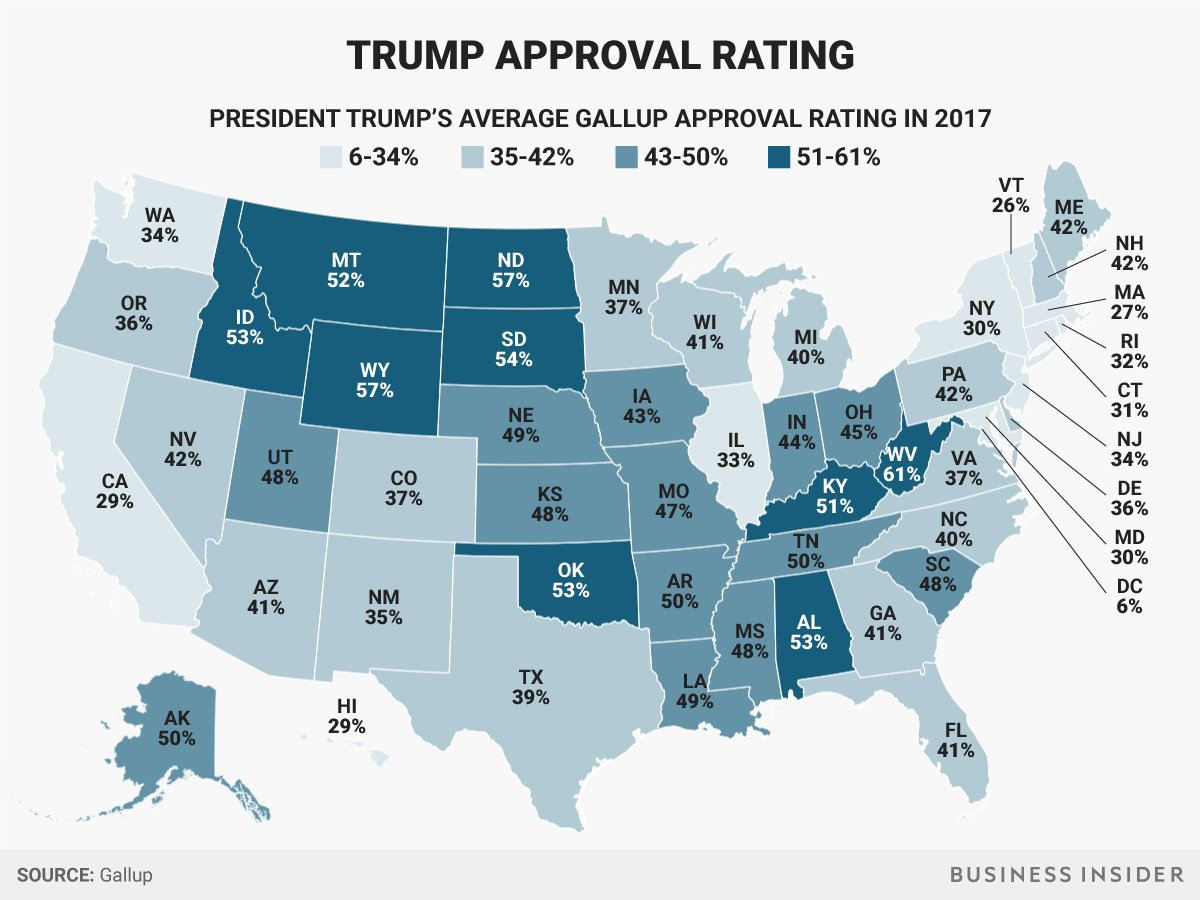

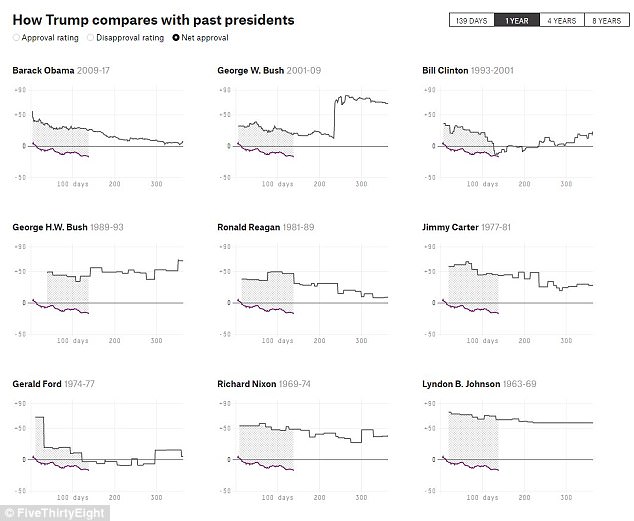

President Trumps Approval Rating At 39 Factors Contributing To The Decline

May 01, 2025

President Trumps Approval Rating At 39 Factors Contributing To The Decline

May 01, 2025 -

Slow Start Trumps 39 Approval Rating At The 100 Day Mark

May 01, 2025

Slow Start Trumps 39 Approval Rating At The 100 Day Mark

May 01, 2025 -

Major Oil Spill Forces Closure Of 62 Miles Of Russian Black Sea Beaches

May 01, 2025

Major Oil Spill Forces Closure Of 62 Miles Of Russian Black Sea Beaches

May 01, 2025