Review Of The Trump Tax Cut Legislation Proposed By House Republicans

Table of Contents

Individual Income Tax Changes

The proposed House Republican tax plan includes several changes to individual income tax rates, aiming to provide tax relief for individuals. These changes potentially affect various aspects of individual taxation:

-

Proposed Changes to Tax Brackets: The plan suggests adjustments to the existing tax brackets, potentially lowering rates for specific income levels. While precise details vary depending on the specific proposal, many versions aim to reduce the highest tax brackets, leading to decreased tax burdens for high-income earners. However, the impact on lower and middle-income groups remains a subject of debate.

-

Standard Deduction Adjustments: Modifications to the standard deduction are also anticipated. Some proposals suggest increasing the standard deduction, potentially benefiting taxpayers who don't itemize their deductions. This change would simplify tax filing for many individuals. However, the extent of the increase and its impact on different income groups needs further scrutiny.

-

Child Tax Credit Modifications: The child tax credit, a crucial component of tax relief for families, is also likely to be impacted. Proposals range from maintaining the current credit to expanding or modifying its eligibility criteria and potential maximum amounts. These variations in the child tax credit significantly impact families with children.

Potential Impacts: While proponents argue that these changes will lead to increased disposable income, stimulating economic growth, critics express concerns about the potential exacerbation of income inequality, with high-income earners benefiting disproportionately from lower tax rates. Further analysis of the specific numbers and their distribution across income groups is needed to fully understand the impact. Keywords used: individual income tax, tax brackets, standard deduction, child tax credit, tax cuts for individuals.

Corporate Tax Rate Reductions

A core element of the proposed legislation centers on further corporate tax rate reductions. The plan generally suggests lowering the current corporate tax rate, aiming to boost business investment and job creation.

-

Lowering the Corporate Tax Rate: The precise percentage reduction varies across different versions of the proposed plan but generally aims for a lower rate compared to the current level. This reduction is intended to enhance corporate profitability.

-

Impact on Investment and Job Creation: Proponents argue that lower corporate tax rates will encourage businesses to invest more in expansion, research and development, and ultimately, create more jobs. This is a key argument for justifying these tax cuts.

-

Potential Drawbacks: Critics raise concerns about the potential negative impacts of reduced corporate taxes. These include a decrease in government revenue, potentially leading to cuts in crucial public services, and the risk of increased corporate power and influence. The potential for corporations to use these savings for purposes other than job creation or investment (such as stock buybacks) also remains a concern. Keywords used: corporate tax rate, corporate tax reform, business tax cuts, investment incentives, economic growth.

Impact on National Debt and Deficit

The proposed Trump tax cuts have significant implications for the national debt and deficit. Analyzing these projections is crucial for a holistic understanding of the plan's impact.

-

Projected Impact: Accurate projections of the plan's effect on the national debt and deficit depend greatly on the specific details of the proposed legislation and economic forecasts. However, most independent analyses suggest that significant tax cuts will lead to an increase in the deficit and add to the national debt over time.

-

Long-Term Fiscal Implications: The long-term implications of increased debt are considerable. They can lead to higher interest payments, reduced government spending on other programs, and potential risks to long-term economic stability.

-

Arguments For and Against: Proponents often argue that the economic stimulus from tax cuts will lead to increased economic growth, eventually offsetting the increased debt. Critics counter that this "trickle-down" effect is unreliable and that the increased debt will outweigh any economic benefits. Keywords used: national debt, federal deficit, fiscal policy, government spending, budget impact.

Criticisms and Controversies Surrounding the Legislation

The proposed House Republican tax plan has faced significant criticism from various quarters. These criticisms highlight concerns about the plan's fairness, effectiveness, and potential unintended consequences.

-

Fairness Concerns: Critics argue that the proposed cuts disproportionately benefit wealthy individuals and corporations at the expense of lower and middle-income taxpayers, exacerbating income inequality.

-

Effectiveness Debate: Arguments exist around the overall effectiveness of these tax cuts in stimulating economic growth. Some critics argue that past similar tax cuts haven't resulted in the promised economic benefits.

-

Unintended Consequences: Concerns exist regarding potential unintended consequences, such as increased inflation or reduced government spending on critical social programs. Keywords used: tax reform debate, economic inequality, tax loopholes, tax fairness, political implications.

Comparison to the 2017 Tax Cuts and Jobs Act

Comparing the proposed legislation to the 2017 Tax Cuts and Jobs Act highlights both similarities and key differences.

-

Similarities: Both proposals share similar goals, such as lowering individual and corporate tax rates, and aim to stimulate economic growth.

-

Differences: The specifics of the tax cuts, the extent of proposed reductions, and the targeting of tax relief differ significantly, reflecting the evolving political landscape and economic conditions. Analyzing these differences provides crucial context for understanding the potential impact of the new proposal. Keywords used: 2017 Tax Cuts and Jobs Act, tax reform comparison, policy continuity, policy change.

Conclusion: Understanding the Implications of the House Republican Trump Tax Cut Proposals

This review of the House Republicans' proposed Trump tax cut legislation reveals a complex picture with both potential benefits and significant drawbacks. While proponents highlight potential economic growth and increased disposable income, critics express concerns about the widening income gap, increased national debt, and potential negative consequences for social programs. The long-term impacts of these proposed changes remain uncertain, dependent on numerous factors including economic growth and the actual implementation of the plan. To fully grasp the implications of these proposals, explore the details further and conduct your own research on the Trump tax cut legislation. Stay informed about ongoing tax policy debates and engage in thoughtful discussions about tax reform and its potential impact on our economy and society.

Featured Posts

-

Predvybornaya Programma Edinoy Rossii Predlozheniya Ot Deputatov

May 13, 2025

Predvybornaya Programma Edinoy Rossii Predlozheniya Ot Deputatov

May 13, 2025 -

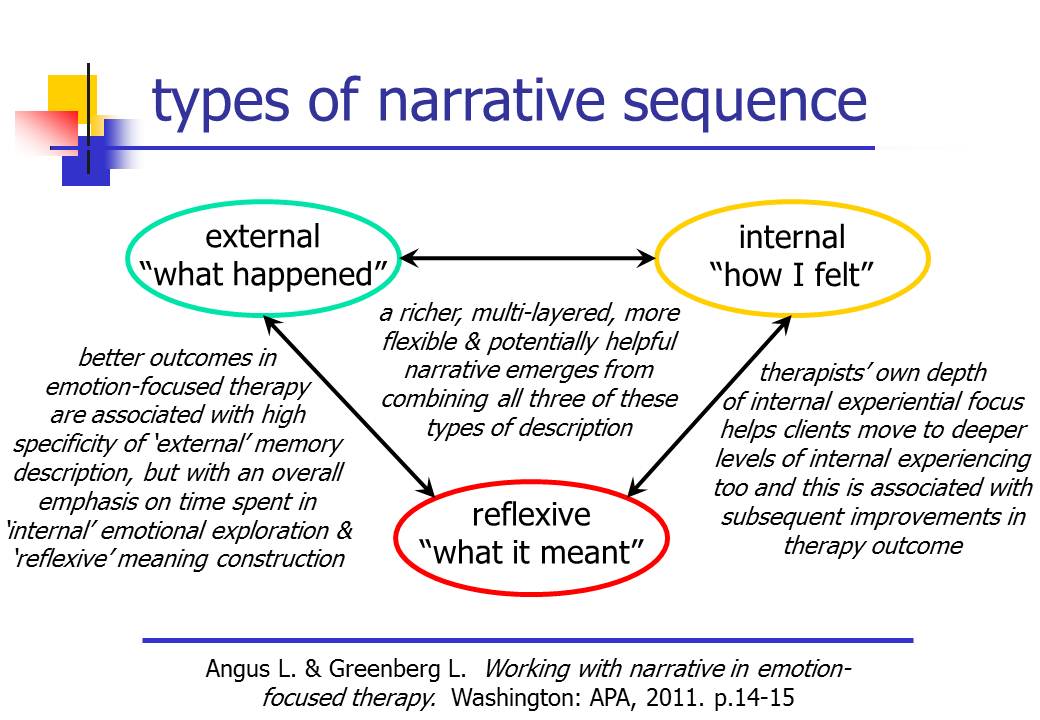

Analyzing The Da Vinci Code Literary Techniques And Narrative Structure

May 13, 2025

Analyzing The Da Vinci Code Literary Techniques And Narrative Structure

May 13, 2025 -

Portola Valley Preserve Search 79 Year Old Woman Still Missing

May 13, 2025

Portola Valley Preserve Search 79 Year Old Woman Still Missing

May 13, 2025 -

The Growing Legal Web Around Asap Rocky Involving 50 Cent Tory Lanez And More

May 13, 2025

The Growing Legal Web Around Asap Rocky Involving 50 Cent Tory Lanez And More

May 13, 2025 -

Cassidy Hutchinsons Memoir Key Witness To January 6th Details Plans For Fall Release

May 13, 2025

Cassidy Hutchinsons Memoir Key Witness To January 6th Details Plans For Fall Release

May 13, 2025