Retirement Planning: A Critical Look At New Investment Strategies

Table of Contents

Understanding the Evolving Retirement Landscape

The retirement landscape is changing rapidly, and understanding these changes is crucial for effective retirement planning. Factors such as increased life expectancy, inflation, and market volatility significantly impact how we approach retirement savings and investments. These evolving realities demand a shift from traditional, often static, investment approaches to more dynamic and adaptable strategies.

- Increased Life Expectancy: We are living longer than ever before, meaning our retirement funds need to last longer. This necessitates a longer-term financial plan and a greater focus on generating sustainable retirement income.

- Inflation Risk: Inflation erodes the purchasing power of savings over time. A retirement fund that seems substantial today may not provide the same standard of living in 20 or 30 years. Therefore, it's vital to incorporate inflation-hedging strategies into your retirement investments.

- Market Volatility: The stock market is inherently volatile. Traditional retirement strategies heavily reliant on stocks can be significantly impacted by market downturns. A robust retirement plan needs to account for and mitigate these risks.

- The Need for Diversified Income Streams: Relying on a single source of retirement income, such as a pension or Social Security, is risky. Diversifying income streams through various investment vehicles is crucial for financial resilience.

Exploring Innovative Retirement Investment Strategies

Traditional retirement strategies are no longer sufficient. Fortunately, numerous innovative investment options offer potential for greater returns and risk mitigation. It's crucial to understand the benefits and risks of each before incorporating them into your retirement portfolio.

- Target-date funds (TDFs): TDFs automatically adjust their asset allocation based on your target retirement date, becoming more conservative as you approach retirement. They offer a convenient, hands-off approach to investment management, suitable for individuals with lower risk tolerance. However, they may not be perfectly tailored to individual needs and circumstances.

- Annuities: Annuities provide a guaranteed income stream for a specified period, offering security against market fluctuations. Various annuity types exist, including immediate annuities (providing immediate income) and deferred annuities (providing income at a later date). While annuities provide security, they often come with fees and may limit access to your principal.

- Real Estate Investment Trusts (REITs): REITs offer diversification through exposure to the real estate market. They can provide a steady stream of income through dividends and potential for capital appreciation. However, REITs are subject to market risk and can be affected by economic downturns in the real estate sector.

- Inflation-Protected Securities (TIPS): TIPS are government bonds whose principal adjusts with inflation, helping to protect your savings from erosion. They offer a relatively low-risk investment option with a stable return linked to the inflation rate.

- ESG Investing (Environmental, Social, and Governance): ESG investing focuses on companies with strong environmental, social, and governance practices. While it's not solely about financial returns, research suggests that many ESG funds deliver comparable, or even better, returns than traditional funds, providing a more ethical and sustainable investment approach. However, ESG investing is a relatively new and evolving field with some ongoing debates about its standardization and efficacy.

Building a Diversified Retirement Portfolio

Diversification is paramount in retirement planning. Spreading your investments across various asset classes – stocks, bonds, real estate, etc. – reduces risk and enhances the potential for long-term growth. Your asset allocation strategy should align with your risk tolerance and retirement goals.

- Importance of a Diversified Portfolio: A diversified portfolio minimizes the impact of poor performance in any single asset class.

- Assessing Individual Risk Tolerance: Understanding your risk tolerance—your comfort level with potential investment losses—is crucial in determining the appropriate asset allocation for your retirement portfolio.

- Regular Portfolio Rebalancing: Periodically rebalancing your portfolio to maintain your desired asset allocation is essential to prevent overexposure to any single asset class.

- Seeking Professional Financial Advice: Working with a qualified financial advisor can provide invaluable guidance on building and managing a diversified retirement portfolio tailored to your specific needs and circumstances.

The Role of Financial Advisors in Retirement Planning

Navigating the complexities of retirement planning can be daunting. A financial advisor provides expert guidance, helping you develop a comprehensive plan that aligns with your goals, risk tolerance, and financial situation. They offer personalized investment strategies, risk management, and ongoing support throughout your retirement journey. A financial advisor's expertise is invaluable in ensuring your retirement plan remains robust and adaptable to changing market conditions.

Conclusion

Securing a comfortable retirement requires a proactive and adaptable approach. The traditional methods are no longer sufficient in the face of evolving economic realities. By understanding the changing retirement landscape, exploring innovative investment strategies, and building a well-diversified retirement portfolio, you can significantly improve your chances of achieving financial security in your later years. Remember, seeking professional financial advice is highly recommended. Start planning your retirement today! Explore new investment options and consult with a financial advisor to create a personalized retirement plan. Take control of your financial future with effective retirement planning.

Featured Posts

-

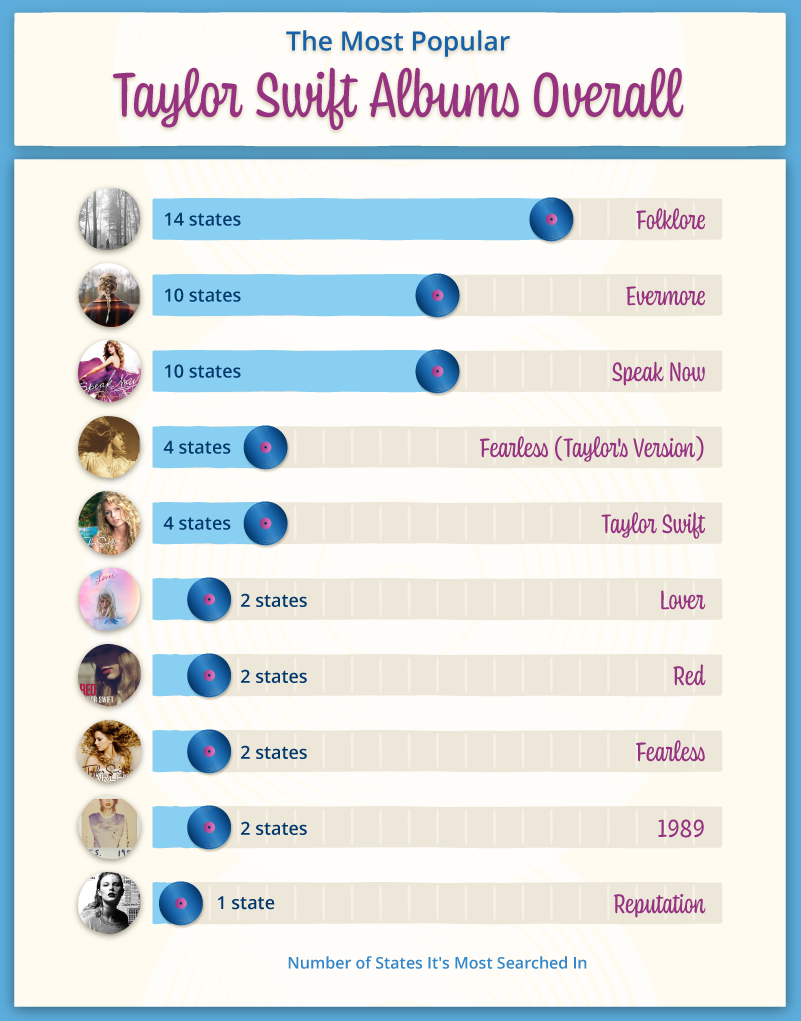

Ranking Taylor Swifts Taylors Version Albums A Comprehensive Guide

May 18, 2025

Ranking Taylor Swifts Taylors Version Albums A Comprehensive Guide

May 18, 2025 -

Michelle Williams And The Mystery Of Marcello Hernandezs Clasp In Dying For Sex

May 18, 2025

Michelle Williams And The Mystery Of Marcello Hernandezs Clasp In Dying For Sex

May 18, 2025 -

Julia Foxs Risque Outfit Kanye Wests Ex Imitating Bianca Censori

May 18, 2025

Julia Foxs Risque Outfit Kanye Wests Ex Imitating Bianca Censori

May 18, 2025 -

Two Month Delay Doesnt Stop True Crime Series From Topping Netflix Charts

May 18, 2025

Two Month Delay Doesnt Stop True Crime Series From Topping Netflix Charts

May 18, 2025 -

13 Year Prison Sentence For Australian Fighting With Ukrainian Forces In Russia

May 18, 2025

13 Year Prison Sentence For Australian Fighting With Ukrainian Forces In Russia

May 18, 2025

Latest Posts

-

The Stephen Miller Nsa Nomination Implications And Analysis

May 18, 2025

The Stephen Miller Nsa Nomination Implications And Analysis

May 18, 2025 -

Stephen Miller And The Nsa Understanding The Potential Appointment

May 18, 2025

Stephen Miller And The Nsa Understanding The Potential Appointment

May 18, 2025 -

Stephen Millers Potential Appointment As National Security Advisor

May 18, 2025

Stephen Millers Potential Appointment As National Security Advisor

May 18, 2025 -

Jersey Mikes Subs Galesburg Location Details Revealed

May 18, 2025

Jersey Mikes Subs Galesburg Location Details Revealed

May 18, 2025 -

Could Stephen Miller Become The Next Nsa Director Under Trump

May 18, 2025

Could Stephen Miller Become The Next Nsa Director Under Trump

May 18, 2025