Retirement Investing: Evaluating The Risks Of Emerging Investment Ideas

Table of Contents

Understanding the Appeal of Emerging Investment Ideas

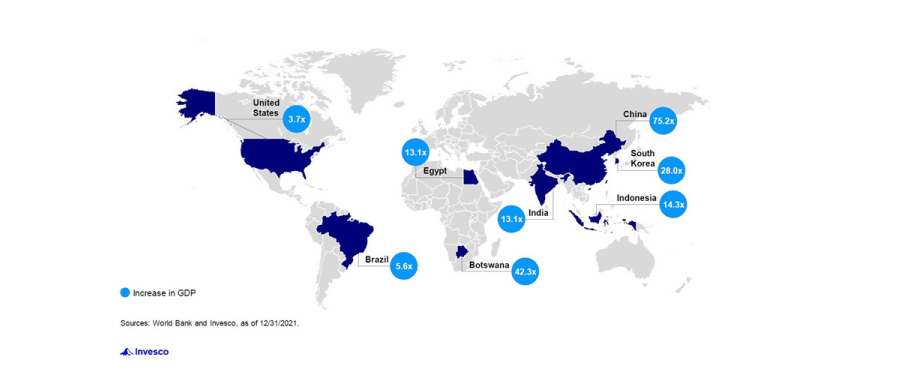

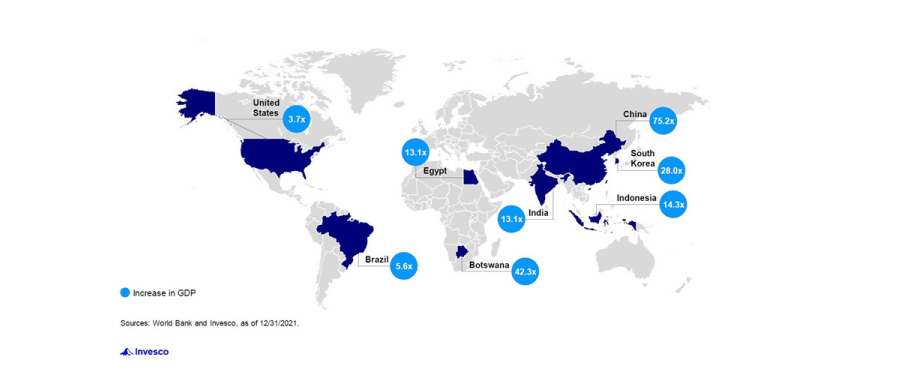

Emerging markets, alternative investments, and innovative financial products often hold significant allure for retirement investors. Their appeal stems from two primary factors: the potential for higher returns and the diversification benefits they offer.

Higher Potential Returns

Emerging markets, by their nature, represent economies with high growth potential. This translates into the possibility of significantly higher returns compared to more established markets. Similarly, alternative investments such as cryptocurrency or impact investing can offer unique growth opportunities not found in traditional asset classes.

- Illustrative example: The Vietnamese stock market experienced substantial growth in the past decade, outperforming many developed markets. However, this is not representative of all emerging markets.

- Potential for outsized returns: While risky, investments like venture capital or angel investing in early-stage companies can yield exceptionally high returns if successful.

- Cautionary note: Past performance is not indicative of future results. Emerging markets and alternative investments are inherently volatile and subject to significant fluctuations.

Diversification Benefits

Diversifying your retirement portfolio beyond traditional stocks and bonds is crucial for risk management. Emerging markets and alternative investments can play a vital role in this strategy.

- Hedge against downturns: Emerging markets often exhibit low correlation with developed markets, meaning their performance may not always mirror the ups and downs of established economies. This can act as a hedge during market corrections.

- Examples of alternative investments for diversification: Real estate investment trusts (REITs), commodities, and private equity can offer diversification benefits.

- Understanding correlation and diversification: It's crucial to understand the correlation between different asset classes to build a well-diversified portfolio that minimizes overall risk. Simply adding emerging market investments without understanding their correlation with your existing holdings might not improve diversification effectively.

Assessing the Risks of Emerging Investment Ideas

While the potential rewards are enticing, it's vital to acknowledge the inherent risks associated with emerging investment ideas for retirement planning.

Volatility and Market Fluctuations

Emerging markets are known for their volatility. Geopolitical instability, economic uncertainty, and currency fluctuations can lead to significant price swings.

- Examples of historical volatility: The Russian stock market experienced dramatic fluctuations following the 2022 geopolitical events, illustrating the impact of external factors.

- Geopolitical risks: Political instability, social unrest, and unexpected regulatory changes in emerging economies can dramatically impact investment values.

- Currency risk: Fluctuations in exchange rates can significantly affect the returns of investments denominated in foreign currencies.

Lack of Liquidity

Many emerging investments, particularly alternative investments, suffer from a lack of liquidity. This means they may be difficult to buy or sell quickly, potentially limiting your access to funds when needed.

- Examples of illiquid investments: Private equity, certain real estate investments, and some cryptocurrency investments can be difficult to liquidate quickly.

- Challenges of valuing illiquid assets: Determining the fair market value of an illiquid asset can be challenging, making it difficult to accurately assess your portfolio's worth.

- Liquidity needs in retirement: Consider your liquidity needs in retirement. You may need easy access to funds for unexpected expenses or healthcare costs.

Regulatory Uncertainty and Fraud Risk

Emerging markets may lack the robust regulatory frameworks found in developed economies. This increases the risk of fraud, scams, and regulatory uncertainty.

- Examples of regulatory risks: Lack of transparency and weak enforcement of investor protection laws in some emerging markets can expose investors to higher risks.

- Importance of due diligence: Conduct thorough due diligence on any investment opportunity before committing your funds. This includes verifying the legitimacy of the investment and the track record of the investment manager.

- Identifying reputable investment opportunities: Stick to well-known and reputable investment firms with a proven track record when investing in emerging markets.

Strategies for Mitigating Risks in Retirement Investing

While the risks associated with emerging investments are significant, they can be mitigated through careful planning and proactive risk management strategies.

Diversification

Diversification remains the cornerstone of risk mitigation. Spread your investments across various asset classes, geographies, and sectors to reduce exposure to any single risk factor.

- Examples of a diversified portfolio: Include a mix of traditional assets (stocks, bonds), emerging market investments, alternative investments, and real estate.

- Consulting a financial advisor: A financial advisor can help you create a personalized portfolio that aligns with your risk tolerance and retirement goals.

Due Diligence

Conduct thorough due diligence on any emerging investment opportunity before committing your funds. This involves researching the investment's history, management team, and regulatory compliance.

- Due diligence checklist: Review financial statements, analyze risk factors, and assess the investment's potential for growth and liquidity.

- Resources for verification: Utilize reputable financial news sources, independent research firms, and regulatory databases to verify the legitimacy of investments.

Risk Tolerance Assessment

Understand your own risk tolerance before making any investment decisions. Only invest in assets that align with your comfort level and financial goals.

- Different risk tolerance profiles: Your risk tolerance depends on factors like your age, financial situation, and retirement timeline.

- Considering your time horizon: Younger investors with a longer time horizon can generally tolerate more risk than those closer to retirement.

Conclusion

Emerging investment ideas present both exciting opportunities and substantial risks. Successful retirement investing requires a careful assessment of your risk tolerance, thorough due diligence, and a well-diversified investment strategy. By understanding the potential pitfalls and employing appropriate risk mitigation techniques, you can potentially enhance your retirement portfolio while managing the inherent uncertainties. Remember, consulting a qualified financial advisor is crucial before making any significant investment decisions in the world of retirement investing, especially with emerging investment ideas. Don't hesitate to seek professional guidance to optimize your retirement investing strategy and navigate the complexities of emerging market opportunities successfully.

Featured Posts

-

Mob Land Premiere Cassie Ventura And Alex Fines Stunning Red Carpet Moment

May 18, 2025

Mob Land Premiere Cassie Ventura And Alex Fines Stunning Red Carpet Moment

May 18, 2025 -

Scho Stalo Prichinoyu Rozrivu Mizh Kanye Vestom Ta Byankoyu Tsenzori

May 18, 2025

Scho Stalo Prichinoyu Rozrivu Mizh Kanye Vestom Ta Byankoyu Tsenzori

May 18, 2025 -

The Life And Death Of An Fsu Employee A Familys Complex History

May 18, 2025

The Life And Death Of An Fsu Employee A Familys Complex History

May 18, 2025 -

Fsu Shooting Details Emerge About Victim With Cia Linked Father

May 18, 2025

Fsu Shooting Details Emerge About Victim With Cia Linked Father

May 18, 2025 -

2 2011

May 18, 2025

2 2011

May 18, 2025

Latest Posts

-

Fsu Shooting Victims Connection To Cuban Exile And Cia

May 18, 2025

Fsu Shooting Victims Connection To Cuban Exile And Cia

May 18, 2025 -

Florida State University Shooting Family Background Of A Victim

May 18, 2025

Florida State University Shooting Family Background Of A Victim

May 18, 2025 -

Gilbert Burns Losses To Chimaev Della Maddalena And Muhammad Arent His Biggest Regret

May 18, 2025

Gilbert Burns Losses To Chimaev Della Maddalena And Muhammad Arent His Biggest Regret

May 18, 2025 -

Michael Morales Winning Streak Continues Another Bonus At Ufc Vegas 106

May 18, 2025

Michael Morales Winning Streak Continues Another Bonus At Ufc Vegas 106

May 18, 2025 -

The One Thing That Upset Gilbert Burns More Than His Defeats

May 18, 2025

The One Thing That Upset Gilbert Burns More Than His Defeats

May 18, 2025