Rethinking The 10-Year Mortgage: A Canadian Perspective

Table of Contents

Advantages of a 10-Year Mortgage in Canada

A 10-year mortgage offers several potential benefits for Canadian homeowners, but it's crucial to weigh them against the risks.

Lower Interest Rates (Potentially)

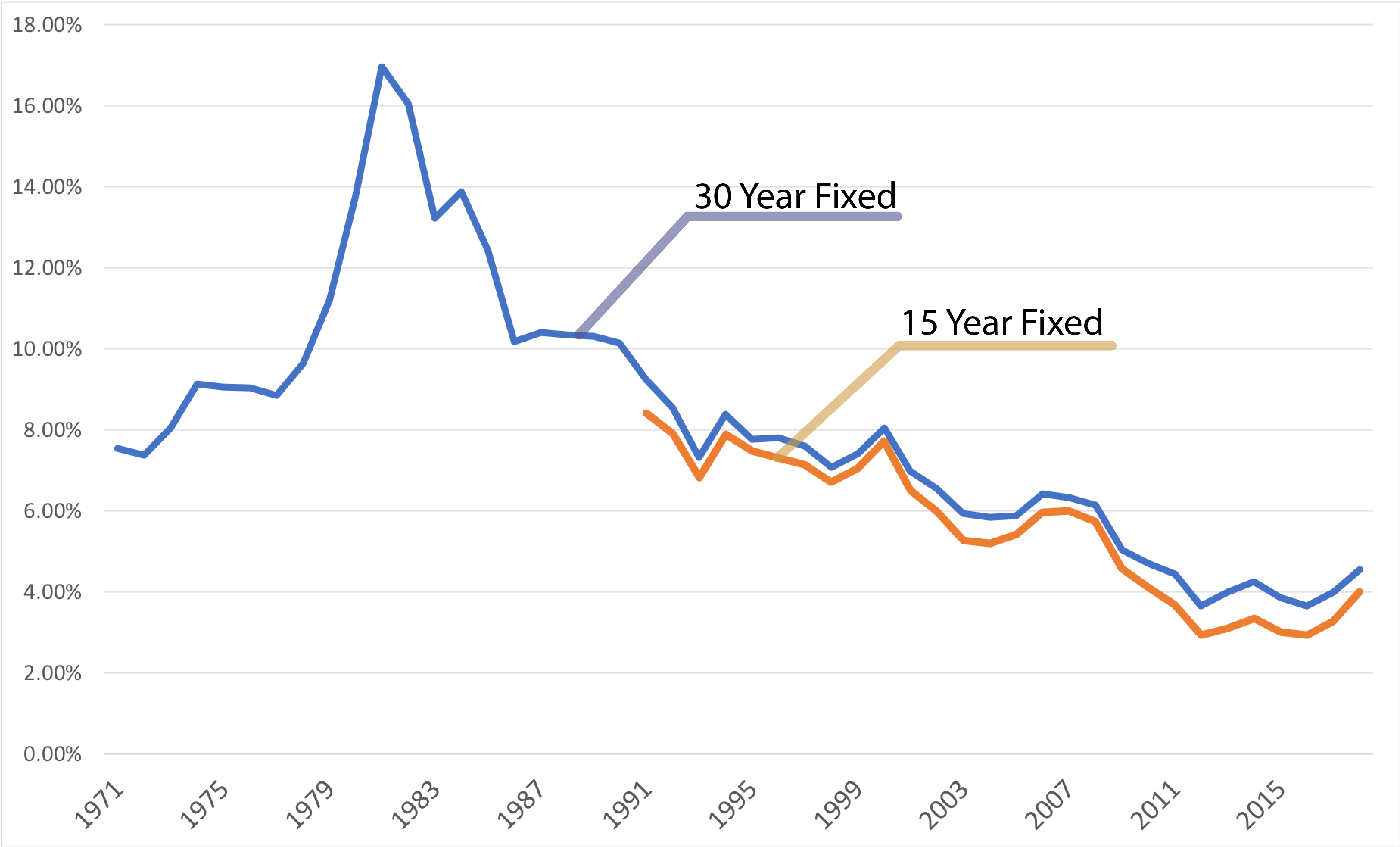

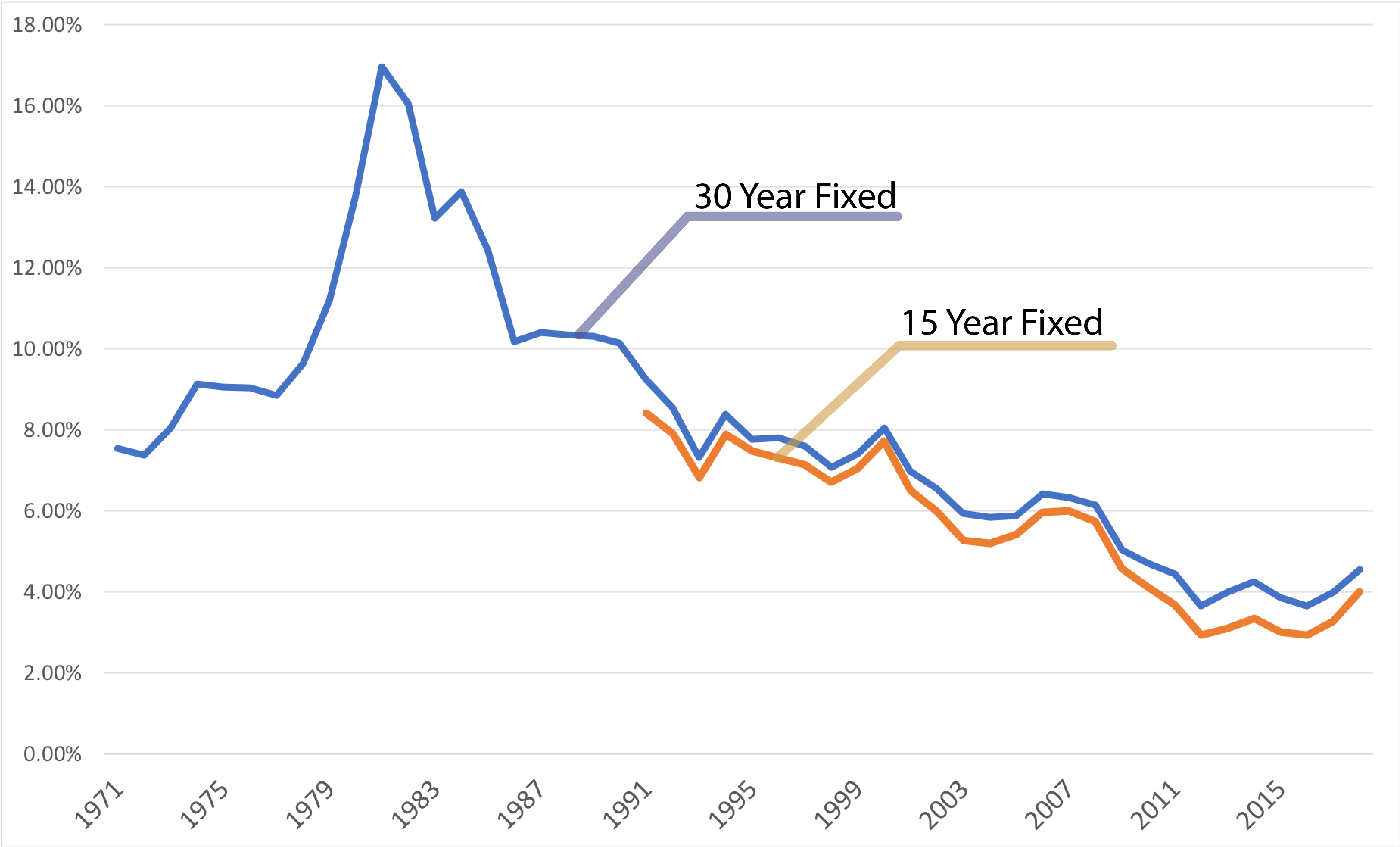

One of the primary draws of a 10-year mortgage is the possibility of securing a lower interest rate compared to shorter-term options like a 5-year mortgage. Lenders sometimes offer slightly lower rates for longer terms to compensate for the increased risk they take. However, this isn't guaranteed. Future interest rate fluctuations are unpredictable.

- Potential Rate Savings: While you might save on interest over the life of the loan, this depends entirely on the rate environment throughout the 10-year period.

- Comparison Shopping is Crucial: Always compare rates from multiple lenders before committing to a 10-year mortgage in Canada. Shop around and don't settle for the first offer.

- Rate Lock-in Risk: Locking into a rate for a decade carries considerable risk. If interest rates fall significantly during your term, you'll miss out on potential savings.

Predictable Monthly Payments

The stability of fixed monthly payments over 10 years offers significant advantages for budgeting and financial planning. This predictability reduces financial stress and allows for better control over your finances.

- Peace of Mind: Knowing exactly how much you'll pay each month for a decade provides a sense of security.

- Improved Budgeting: Consistent mortgage payments simplify budgeting, allowing for better allocation of funds towards other financial goals like savings or investments.

- Reduced Financial Stress: The predictability significantly reduces the anxiety associated with fluctuating mortgage payments. (Note: This only applies to fixed-rate mortgages; variable-rate mortgages will have fluctuating payments.)

Faster Equity Buildup

A larger portion of your early monthly payments on a 10-year mortgage goes towards principal repayment. This results in faster equity growth compared to a shorter-term mortgage.

- Accelerated Equity: The accelerated equity growth can be significant, particularly in the initial years of the mortgage.

- Financial Benefits: Building equity faster can provide financial benefits down the line, such as increased borrowing power or the ability to refinance at more favorable terms.

- Example: A simple illustration: A $500,000 mortgage with a 25-year amortization would see significantly less principal paid in the first few years compared to a 10-year amortization, leading to a faster build-up of equity in the latter scenario.

Disadvantages of a 10-Year Mortgage in Canada

Despite the potential advantages, several significant drawbacks need careful consideration before opting for a 10-year mortgage in Canada.

Interest Rate Risk

The biggest risk associated with a 10-year mortgage is locking into a high interest rate. If rates decline during your term, you’ll be paying more than you might have if you’d chosen a shorter-term mortgage and refinanced later.

- Opportunity Cost: The potential savings lost by missing out on lower interest rates represents a significant opportunity cost.

- Refinancing Challenges: Refinancing a 10-year mortgage before the term ends often involves significant penalties and complexities.

- Market Volatility: The Canadian mortgage market can be volatile; unexpected changes in interest rates can drastically impact your monthly payments and overall mortgage cost.

Financial Flexibility

A 10-year mortgage significantly reduces your financial flexibility. Life is unpredictable, and unforeseen circumstances can make meeting your obligations challenging.

- Job Loss: A job loss or unexpected income reduction can make meeting your mortgage payments difficult.

- Unexpected Expenses: Unexpected medical bills, home repairs, or other significant expenses can strain your finances.

- Family Changes: Significant life changes, such as having children or experiencing a separation, can impact your financial capacity.

- Prepayment Penalties: Breaking a 10-year mortgage early typically involves substantial penalties.

Prepayment Penalties

Prepayment penalties on a 10-year mortgage can be substantial, potentially negating any interest rate savings achieved. These penalties vary by lender and the type of mortgage.

- Penalty Structures: Understand the specific prepayment penalty structure of your mortgage before signing.

- Impact on Decision: The potential for high prepayment penalties should be a major factor in your decision-making process.

Alternatives to a 10-Year Mortgage in Canada

While a 10-year mortgage might seem appealing, several alternatives offer greater flexibility and potentially lower risks.

5-Year Mortgages

The 5-year mortgage remains a popular choice in Canada, offering a balance between stability and flexibility. You have the opportunity to refinance every five years, taking advantage of potentially lower interest rates.

Variable Rate Mortgages

Variable-rate mortgages offer lower initial rates than fixed-rate options. However, your payments fluctuate with changes in the benchmark interest rate, introducing risk and uncertainty.

Other Mortgage Terms

Several other mortgage terms are available in Canada, such as 7-year mortgages, that might be more suitable depending on your financial circumstances and risk tolerance.

Conclusion

Choosing a 10-year mortgage in Canada requires careful consideration of your individual financial situation, risk tolerance, and long-term financial goals. While the potential for lower interest rates and faster equity buildup is attractive, the lack of flexibility and the risk of locking into a high interest rate for a decade are significant drawbacks. Before committing to a 10-year mortgage, or any long-term mortgage commitment, carefully weigh the advantages and disadvantages. Consult with a mortgage broker to explore different mortgage options and compare rates to find the best fit for your needs. Understanding the nuances of a 10-year mortgage Canada is crucial for making an informed decision about your long-term financial well-being.

Featured Posts

-

Florida Panthers Dramatic Comeback Falls Short Against Avalanches Offensive Powerhouse

May 04, 2025

Florida Panthers Dramatic Comeback Falls Short Against Avalanches Offensive Powerhouse

May 04, 2025 -

Another Simple Favor Director Clarifies Behind The Scenes Drama

May 04, 2025

Another Simple Favor Director Clarifies Behind The Scenes Drama

May 04, 2025 -

Lizzo And Szas Unreleased Rock Band Project

May 04, 2025

Lizzo And Szas Unreleased Rock Band Project

May 04, 2025 -

Wind Energy And Rail A Comprehensive Look At Wind Powered Train Technology

May 04, 2025

Wind Energy And Rail A Comprehensive Look At Wind Powered Train Technology

May 04, 2025 -

Kivinin Kabugu Yenir Mi Oence Bunlari Bilmelisiniz

May 04, 2025

Kivinin Kabugu Yenir Mi Oence Bunlari Bilmelisiniz

May 04, 2025

Latest Posts

-

Ufc 314 Fight Card Volkanovski Headlines In Perth

May 04, 2025

Ufc 314 Fight Card Volkanovski Headlines In Perth

May 04, 2025 -

The Poirier Retirement Debate Insights From Paddy Pimblett

May 04, 2025

The Poirier Retirement Debate Insights From Paddy Pimblett

May 04, 2025 -

Ufc 314 Volkanovski Vs Lopes Full Event Preview And Predictions

May 04, 2025

Ufc 314 Volkanovski Vs Lopes Full Event Preview And Predictions

May 04, 2025 -

Paddy Pimblett And Dustin Poirier Retirement And The Future Of Ufc

May 04, 2025

Paddy Pimblett And Dustin Poirier Retirement And The Future Of Ufc

May 04, 2025 -

Ufc 314 Complete Fight Card Date And Where To Watch

May 04, 2025

Ufc 314 Complete Fight Card Date And Where To Watch

May 04, 2025