Resorts World Las Vegas Hit With $10.5M Money Laundering Fine

Table of Contents

Details of the Money Laundering Violations

The Resorts World Las Vegas money laundering fine stems from several AML violations identified by the Nevada Gaming Control Board (NGCB). These breaches primarily involved insufficient reporting of suspicious transactions and inadequate due diligence on certain customers. The NGCB investigation, spanning several months, uncovered a pattern of irregularities in financial transactions.

-

Nature of Violations: The violations centered on failures to file timely and accurate Suspicious Activity Reports (SARs). Insufficient customer due diligence, including a lack of thorough background checks on high-roller clients, further contributed to the findings. Internal control failures allowed these issues to persist.

-

Timeframe: The violations occurred over a period of approximately 18 months, beginning in early 2021.

-

Suspicious Transactions: While the exact number remains undisclosed, the NGCB report cited numerous transactions exceeding reporting thresholds that were not flagged or properly reported. These involved both cash and electronic transfers.

-

NGCB Role: The NGCB conducted a thorough investigation, reviewing thousands of financial records and interviewing numerous Resorts World Las Vegas employees. Their findings led to the significant $10.5 million fine.

-

Internal Control Failures: The investigation revealed weaknesses in Resorts World Las Vegas’s internal AML compliance program, including inadequate staff training and insufficient oversight of transaction monitoring systems.

The $10.5 Million Fine: Implications for Resorts World Las Vegas

The $10.5 million money laundering fine carries significant implications for Resorts World Las Vegas. Beyond the substantial financial penalty, the incident has caused significant reputational damage.

-

Financial Impact: The $10.5 million fine represents a considerable dent in the company's profitability and will likely impact shareholder returns. This significant casino penalty will necessitate reallocation of resources.

-

Reputational Damage: The scandal has undoubtedly tarnished the Resorts World Las Vegas brand, potentially affecting customer confidence and future business. This negative publicity could impact tourism and overall revenue streams.

-

Stock Price & Investor Confidence: While the immediate stock market reaction was muted, the long-term consequences on investor confidence remain uncertain. The incident could lead to decreased investor interest and reduced stock valuation.

-

Other Repercussions: Further regulatory scrutiny and potential additional penalties from other regulatory bodies are also possibilities. This case might trigger more intensive audits from financial institutions.

The Wider Implications for the Gaming Industry and AML Compliance

The Resorts World Las Vegas case serves as a stark warning to the entire gaming industry about the importance of stringent AML compliance. It emphasizes the need for proactive and comprehensive measures to prevent money laundering.

-

Importance of Robust AML Programs: This case highlights the necessity for casinos to invest in robust and up-to-date AML compliance programs that meet or exceed regulatory requirements. Ignoring this critical aspect leaves casinos vulnerable to significant financial penalties and reputational harm.

-

Potential Regulatory Changes: The incident could lead to tighter regulations and stricter enforcement of AML compliance across the gaming sector. This might involve increased oversight and more frequent audits.

-

Effectiveness of Current Regulations: The case raises questions about the effectiveness of current AML regulations in preventing money laundering. Are they sufficient, or do they require revisions to better address the evolving tactics of money launderers?

-

Implications for Other Casinos: Other casinos in Nevada and beyond are likely to review their own AML compliance programs in light of the Resorts World Las Vegas case, ensuring they meet the highest standards.

Best Practices for AML Compliance in Casinos

Casinos must adopt proactive strategies to prevent money laundering effectively. Implementing best practices is crucial to avoid hefty fines and reputational damage.

-

Due Diligence & Customer Identification: Thorough due diligence procedures are paramount, including rigorous identity verification of all customers, especially high-rollers. This includes using advanced KYC (Know Your Customer) methods.

-

Transaction Monitoring: Casinos need sophisticated transaction monitoring systems capable of identifying suspicious patterns and flagging potentially illicit activities in real-time. The use of AML software is essential.

-

Employee Training: Regular, comprehensive training for all casino employees on AML regulations, procedures, and suspicious activity reporting is vital. This should include regular refresher courses.

-

Risk Assessment & Internal Audits: Regular risk assessments and internal audits are essential to identify vulnerabilities and ensure compliance measures are effective. Independent audits should be considered for enhanced transparency and accountability.

Conclusion

The $10.5 million money laundering fine levied against Resorts World Las Vegas is a stark reminder of the serious consequences of failing to uphold anti-money laundering regulations within the gaming industry. This case underscores the crucial need for robust compliance programs and highlights the ongoing challenge of preventing financial crime within the casino sector. Understanding and implementing effective anti-money laundering measures is paramount for all gaming operators. Learn more about best practices to avoid similar financial penalties and reputational damage by researching and adopting stringent AML compliance protocols. Ignoring AML compliance is simply too risky for any casino.

Featured Posts

-

Complete Spring Breakout 2025 Rosters Early Insights And Analysis

May 18, 2025

Complete Spring Breakout 2025 Rosters Early Insights And Analysis

May 18, 2025 -

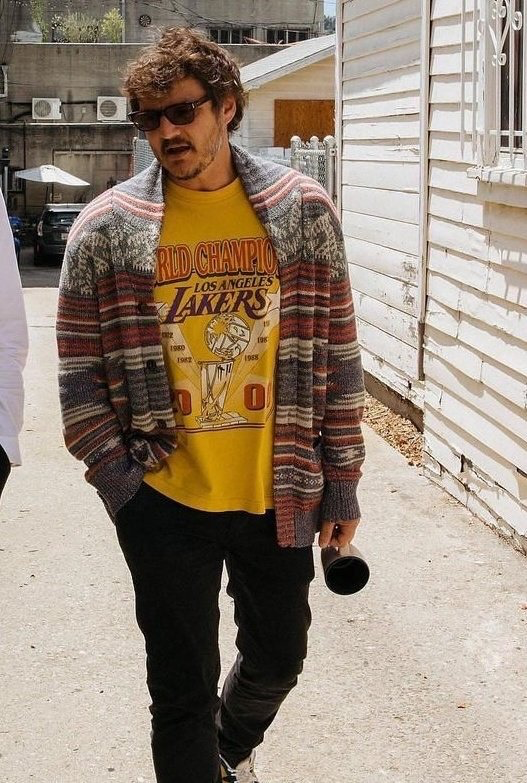

Pedro Pascals 2025 His Rise Begins Next Week

May 18, 2025

Pedro Pascals 2025 His Rise Begins Next Week

May 18, 2025 -

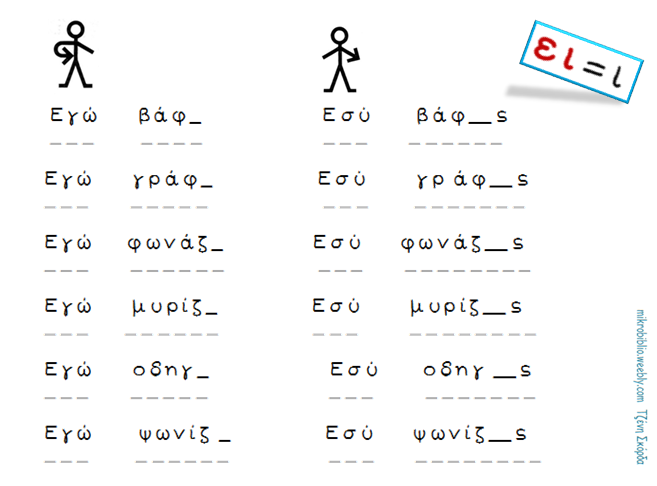

Eyropaiki Naytilia Gigantiaia Megethi Kai Arithmoi

May 18, 2025

Eyropaiki Naytilia Gigantiaia Megethi Kai Arithmoi

May 18, 2025 -

Kasselakis Prooptikes Gia Ti Naytilia Kai Tin Nisiotiki Ellada

May 18, 2025

Kasselakis Prooptikes Gia Ti Naytilia Kai Tin Nisiotiki Ellada

May 18, 2025 -

Golden Triangle Ventures Lavish Entertainment And Viptio Partner To Launch Next Gen Omnichannel Media Infrastructure At Destino Ranch

May 18, 2025

Golden Triangle Ventures Lavish Entertainment And Viptio Partner To Launch Next Gen Omnichannel Media Infrastructure At Destino Ranch

May 18, 2025

Latest Posts

-

New Uber Shuttle Option 5 Rides From United Center After Events

May 19, 2025

New Uber Shuttle Option 5 Rides From United Center After Events

May 19, 2025 -

5 Uber Shuttle Service Launches For United Center Events

May 19, 2025

5 Uber Shuttle Service Launches For United Center Events

May 19, 2025 -

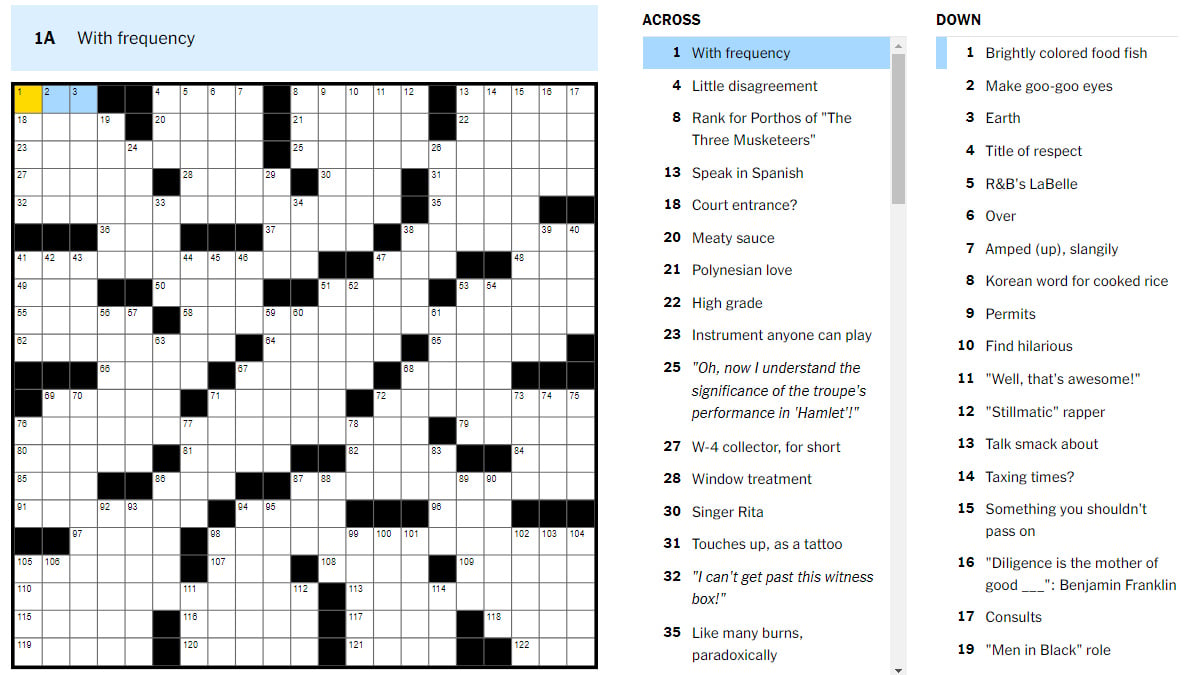

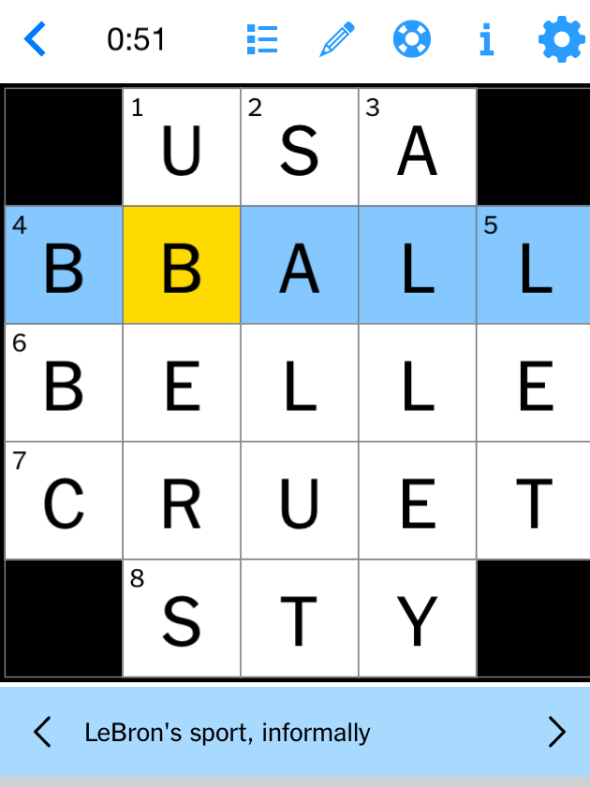

Easy Solutions Nyt Mini Crossword Hints For April 18 2025

May 19, 2025

Easy Solutions Nyt Mini Crossword Hints For April 18 2025

May 19, 2025 -

Nyt Mini Crossword Solutions March 24 2025

May 19, 2025

Nyt Mini Crossword Solutions March 24 2025

May 19, 2025 -

Todays Nyt Mini Crossword March 24 2025 Complete Solutions

May 19, 2025

Todays Nyt Mini Crossword March 24 2025 Complete Solutions

May 19, 2025