Resilient Investments Power China Life's Profit Growth

Table of Contents

Diversified Investment Portfolio: A Cornerstone of Resilience

China Life's success is built upon a foundation of robust portfolio management and a commitment to diversification. Their investment strategy prioritizes mitigating risk through a carefully balanced allocation across various asset classes. This approach ensures that potential losses in one sector are offset by gains in others, leading to more consistent returns.

-

Strategic Asset Allocation: China Life doesn't rely on a single investment type. Instead, they strategically allocate assets across several categories, creating a resilient portfolio capable of weathering market fluctuations. This diversification is key to their long-term growth.

-

Fixed Income Securities: A significant portion of China Life's portfolio is dedicated to lower-risk, fixed-income securities like government bonds and high-quality corporate bonds. This provides a stable base for returns and reduces overall portfolio volatility. This conservative approach ensures a steady stream of income, even during periods of market uncertainty.

-

Equities for Growth: While maintaining a cautious approach, China Life strategically invests in equities, carefully selecting companies with strong fundamentals and long-term growth potential. This element contributes to higher overall returns, balancing the stability of fixed-income investments. The selection process emphasizes thorough due diligence and a long-term perspective.

-

Alternative Investments: China Life further enhances portfolio resilience by exploring alternative investments. These can include infrastructure projects, real estate developments, and private equity, adding another layer of diversification and potentially higher returns. This forward-thinking approach allows them to capitalize on unique opportunities in diverse sectors.

For example, China Life's investments in high-speed rail infrastructure projects have yielded significant returns while contributing to China's national development. Similarly, their strategic real estate acquisitions in major cities have proven to be highly profitable. While the exact percentages allocated to each asset class aren't publicly available for competitive reasons, the impact of this diversified approach on their profit growth is undeniable.

Strategic Focus on Long-Term Growth Investments

China Life doesn't focus solely on short-term gains. Their investment strategy prioritizes long-term sustainable growth, aligning investments with China's economic development and global trends. This long-term vision allows them to weather short-term market volatility and capitalize on sustained growth opportunities.

-

Infrastructure Investments: A cornerstone of their long-term strategy is investment in infrastructure projects. These investments not only offer attractive financial returns but also contribute to the country's economic development and social progress, aligning with responsible investing principles.

-

Real Estate Investments: Strategic acquisitions in the real estate sector, primarily in high-growth urban areas, demonstrate another facet of their long-term strategy. Careful selection of properties with strong rental potential and appreciation prospects contributes substantially to the company's long-term profit growth. This demonstrates a proactive approach to capitalizing on growth opportunities in a key sector.

-

Value Investing: China Life employs a value investing approach, focusing on identifying undervalued assets with strong potential for future appreciation. This patient, long-term approach allows them to purchase assets at attractive prices and reap the benefits of their future growth.

For instance, China Life's investment in renewable energy infrastructure has delivered substantial returns while also contributing to environmental sustainability. Their long-term focus has allowed them to capture significant gains from projects that initially may have appeared less attractive to investors focused solely on short-term results. This strategic patience is a key factor in their sustained profitability.

Robust Risk Management Framework Ensuring Stability

China Life's success isn't solely dependent on strategic investment choices; it's also bolstered by a robust risk management framework. This comprehensive system ensures the stability and long-term viability of their investment portfolio.

-

Due Diligence: Before committing to any investment, rigorous due diligence is performed to assess potential risks and ensure alignment with the company's risk appetite. This proactive approach significantly reduces exposure to unexpected losses.

-

Regulatory Compliance: Strict adherence to all relevant regulatory standards and best practices minimizes potential legal and financial risks, further enhancing investor confidence and long-term stability.

-

Dynamic Portfolio Adjustments: Regular portfolio reviews and adjustments based on market conditions allow for a dynamic response to changing economic landscapes. This agile approach ensures the portfolio remains well-positioned to adapt to new opportunities and challenges.

The risk management framework employed by China Life is a multi-layered system involving internal audits, external reviews, and ongoing monitoring of market trends. This proactive approach has proven invaluable in mitigating potential losses and maintaining the long-term stability of the company's investments. For example, their proactive risk management helped minimize losses during the 2008 global financial crisis.

Conclusion

China Life's remarkable profit growth is a direct result of a strategic combination of diversified investment strategies, a focus on resilient, long-term growth investments, and a robust risk management framework. Their success underscores the importance of a well-defined investment strategy that carefully balances risk and return for sustainable financial performance. Their approach to resilient investments provides a compelling model for other insurance companies and investors seeking long-term success.

Call to Action: Learn how resilient investments can power your financial growth. Explore investment strategies for long-term success by [link to relevant resource, e.g., China Life's investor relations page or a financial planning website]. Understand the importance of resilient investments in building a secure financial future.

Featured Posts

-

Tramp I Zelenskiy Mozhliva Zustrich Na Pokhoroni Papi

Apr 30, 2025

Tramp I Zelenskiy Mozhliva Zustrich Na Pokhoroni Papi

Apr 30, 2025 -

Apples Data Privacy Practices Scrutinized E162 Million Fine In France

Apr 30, 2025

Apples Data Privacy Practices Scrutinized E162 Million Fine In France

Apr 30, 2025 -

Rekordnye Ptitsy Vorombe Ikh Zhizn I Prichiny Ischeznoveniya

Apr 30, 2025

Rekordnye Ptitsy Vorombe Ikh Zhizn I Prichiny Ischeznoveniya

Apr 30, 2025 -

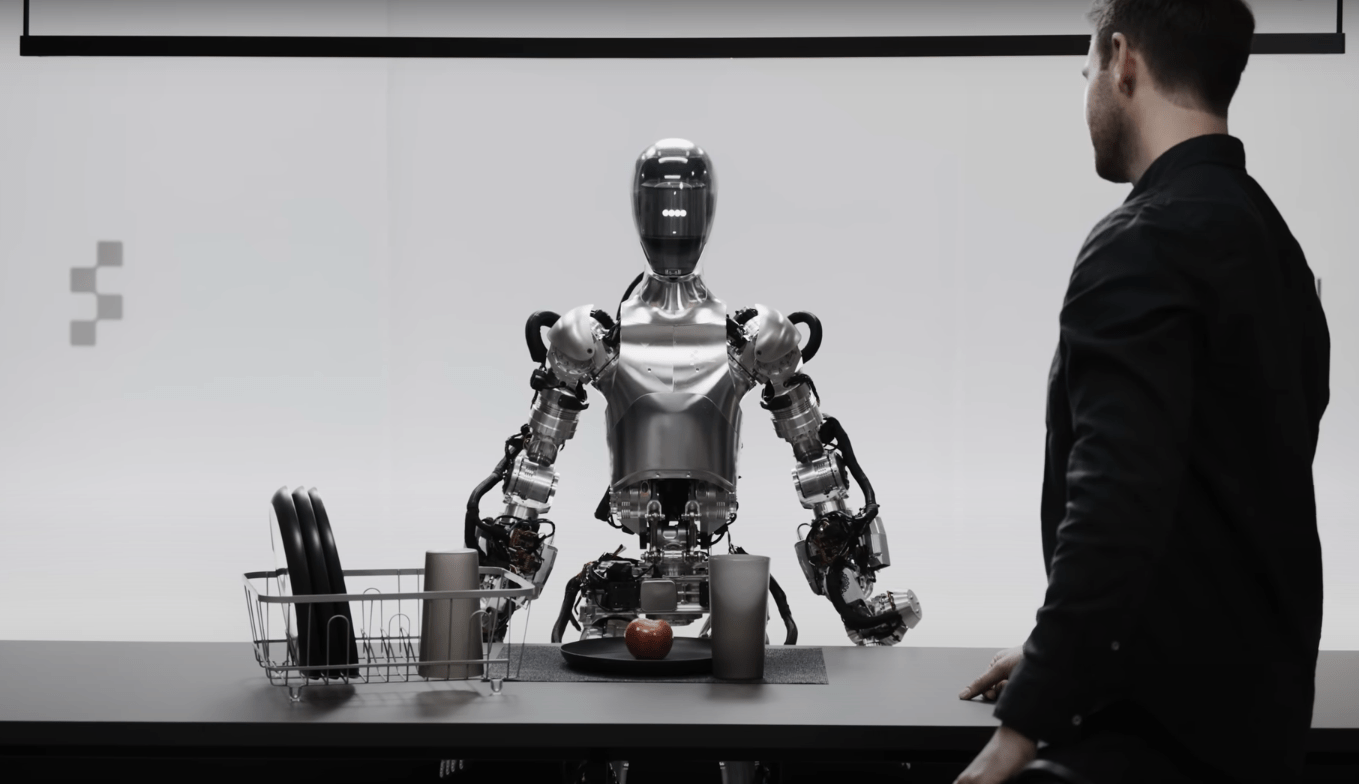

Ups Exploring Humanoid Robots With Figure Ai Partnership

Apr 30, 2025

Ups Exploring Humanoid Robots With Figure Ai Partnership

Apr 30, 2025 -

Schneider Electrics Trade Show Strategy Maximizing Marketing Impact

Apr 30, 2025

Schneider Electrics Trade Show Strategy Maximizing Marketing Impact

Apr 30, 2025