Republican Tax Plan: Key Features Of Trump's Economic Agenda

Table of Contents

Corporate Tax Cuts: A Cornerstone of the Plan

The most dramatic change introduced by the Republican Tax Plan was the slashing of the corporate tax rate. This reduction aimed to incentivize business investment, boost domestic competitiveness, and ultimately, create jobs.

- Reduction from 35% to 21%: This represented the most significant decrease in the corporate tax rate in decades, making the U.S. more attractive to foreign investment and potentially encouraging companies to repatriate overseas profits.

- Impact on corporate profitability and investment strategies: Many corporations saw a substantial increase in after-tax profits. However, the extent to which this translated into increased investment and job creation remains a subject of ongoing economic research and analysis of the Republican tax plan. Some companies used the extra capital for stock buybacks rather than expansion.

- Debate surrounding the effectiveness of this reduction: While proponents argued that the lower rate spurred economic activity, critics pointed to a lack of robust evidence directly linking the tax cut to significant job growth or increased capital expenditures. The effectiveness of the Republican tax plan on this front continues to be debated.

- International implications and competitiveness: The lower corporate tax rate aimed to enhance the U.S.'s global competitiveness, attracting foreign investment and encouraging multinational corporations to base more operations within the country. However, other countries responded with their own tax reforms, limiting the overall impact of the U.S. changes.

Additional Details: The Republican Tax Plan also included provisions for the repatriation of overseas profits, with a one-time reduced tax rate on the return of previously untaxed foreign earnings. While this led to a surge in repatriated funds, concerns remained about the lack of sufficient measures to prevent corporate tax avoidance through loopholes and aggressive tax planning. Further research into the effects of the Republican tax plan on corporate behavior is needed.

Individual Tax Rate Reductions: Impact on Households

The Republican Tax Plan didn't just target corporations; it also lowered individual income tax rates across various brackets. These reductions were designed to provide tax relief to families and individuals, boosting consumer spending and stimulating economic activity.

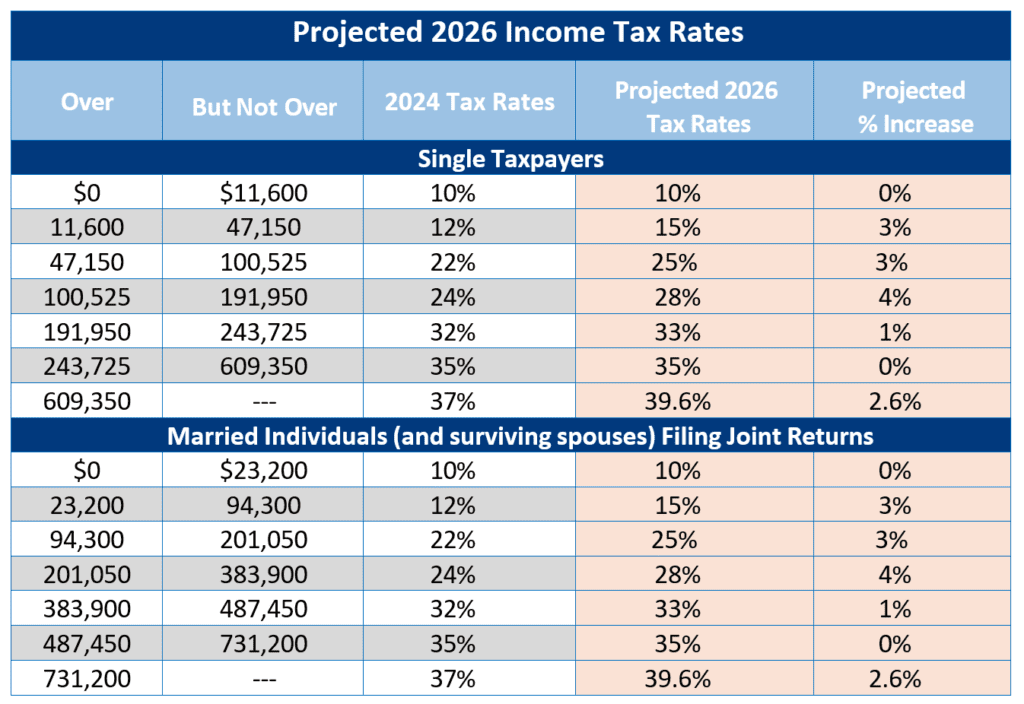

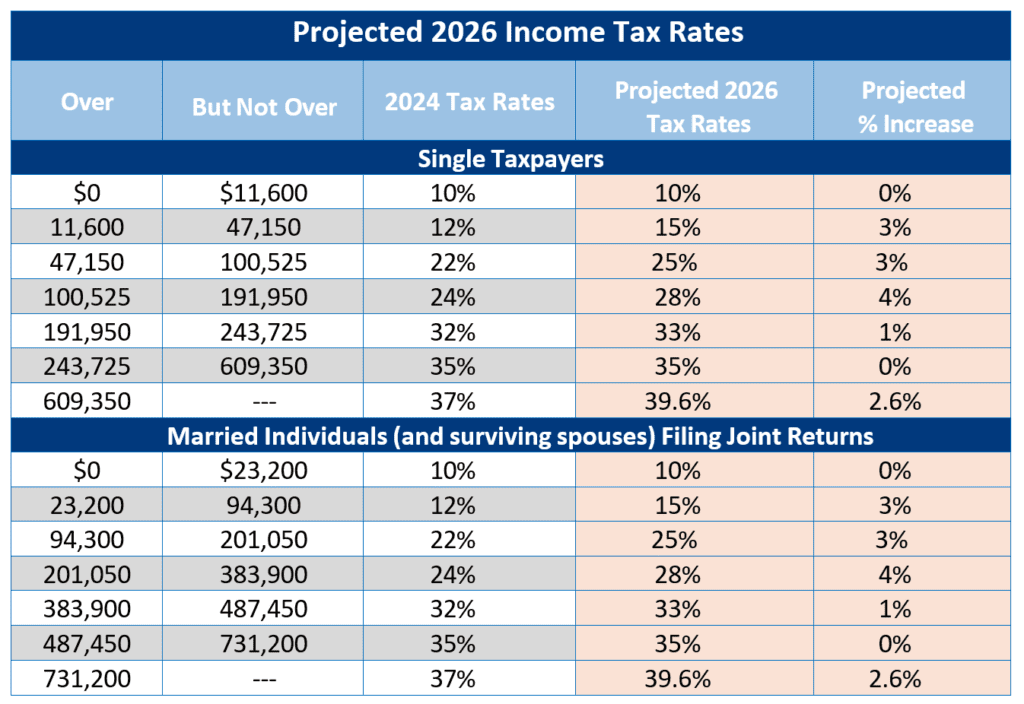

- Specific changes to each tax bracket: The plan reduced the number of individual income tax brackets, and it lowered the rates within each bracket. For example, the top individual income tax rate was reduced. (Specific numerical changes should be included here, referencing official government sources).

- Impact on different income levels and household budgets: While all taxpayers saw some reduction, the benefits were not evenly distributed. Higher-income individuals and families generally received a larger percentage reduction in their taxes than lower-income individuals. Analyses of the Republican tax plan's impact on household budgets show a varied impact, depending on income, family size, and other factors.

- Changes to standard deduction and personal exemptions: The standard deduction was significantly increased, while personal exemptions were eliminated. This change simplified the tax code for some, but it also had the effect of making certain deductions less beneficial.

- Analysis of the distributional effects (who benefited most/least): Numerous studies have analyzed the distributional effects of the Republican Tax Plan, showing that the largest tax cuts went to high-income earners. Lower- and middle-income households received smaller tax cuts, and some saw their tax burden increase due to the phase-out of certain deductions.

Additional Details: The long-term fiscal implications of the individual income tax cuts, particularly their impact on the national debt, remain a point of significant contention. Many provisions of the Republican Tax Plan, including several individual tax cuts, were temporary, leading to discussions about their renewal or extension. These sunset clauses significantly impact the long-term economic and budgetary analyses of this Republican tax plan.

Pass-Through Business Tax Changes: Impact on Small Businesses

The Republican Tax Plan also introduced changes to the taxation of pass-through businesses – entities like sole proprietorships, partnerships, and S corporations, where profits and losses are passed directly to the owners' personal income tax returns.

- Deduction for qualified business income (QBI): The plan created a new deduction for qualified business income (QBI), allowing eligible business owners to deduct up to 20% of their QBI. This aimed to provide tax relief for small business owners and the self-employed.

- Impact on small business owners and self-employed individuals: The QBI deduction had a significant impact, potentially reducing the tax burden for many small business owners. However, the complexity of the calculation and the limitations on the deduction caused confusion and challenges for many.

- Limitations and complexities of the QBI deduction: The QBI deduction came with several limitations and complexities, including income limitations and limitations based on the type of business. These complexities made it difficult for some small business owners to accurately calculate their deduction.

- Comparison with previous tax treatments of pass-through entities: Prior to the Republican Tax Plan, pass-through entities faced higher tax rates and less favorable treatment compared to corporations. The changes in the Republican Tax Plan sought to address these disparities and help level the playing field for these important components of the U.S. economy.

Additional Details: The calculation of the QBI deduction proved to be a significant challenge for many small business owners and tax professionals. The potential for abuse and manipulation of the deduction also raised concerns. Clearer guidelines and simplified calculations were needed to fully realize the potential benefits of this section of the Republican tax plan.

Estate Tax Changes: Impact on Wealth Transfer

The Republican Tax Plan also modified the estate tax, the tax on the transfer of assets upon death. These changes were aimed at benefiting high-net-worth individuals and families.

- Increase in the estate tax exemption: The estate tax exemption was significantly increased, meaning that a larger amount of assets could be passed on to heirs without incurring estate tax.

- Impact on high-net-worth individuals and families: The increase in the exemption largely benefited high-net-worth individuals and families, reducing the estate tax burden on the transfer of substantial wealth. This aspect of the Republican Tax Plan became a major point of debate on issues of wealth equality.

- Debate surrounding the fairness and effectiveness of the estate tax: The estate tax has long been a subject of debate, with proponents arguing it is necessary to curb wealth inequality and opponents arguing it is unfair and economically damaging. The changes in the Republican Tax Plan intensified this debate.

- Long-term implications for wealth inequality: Critics argue that the changes to the estate tax will exacerbate wealth inequality, allowing substantial wealth to remain concentrated within a small segment of the population. This aspect of the Republican Tax Plan's legacy continues to be debated by economists and policy experts.

Additional Details: The arguments for and against the estate tax are complex and multifaceted. Proponents emphasize its role in promoting economic mobility by preventing the concentration of wealth across generations. Opponents point to its potential negative impact on investment, entrepreneurship, and family-owned businesses, arguing that it unfairly punishes success and discourages wealth creation.

Conclusion

The Republican Tax Plan, with its comprehensive cuts to corporate and individual income taxes, significantly altered the U.S. tax system. While proponents claimed it fostered economic growth and job creation, critics highlighted the increased national debt and the uneven distribution of its benefits. Understanding the key features—corporate tax rate reductions, individual tax bracket adjustments, pass-through business tax changes, and estate tax modifications—is crucial for a thorough assessment of its long-term impact. To further your understanding of this pivotal legislation and its continuing consequences, research additional analyses of the Republican Tax Plan and its effects on various sectors of the economy. Further exploration of the Republican Tax Plan's effects will provide a more nuanced and complete understanding of its complexities and consequences.

Featured Posts

-

Earthquakes New Season Begins Mls Match Preview

May 15, 2025

Earthquakes New Season Begins Mls Match Preview

May 15, 2025 -

Analyzing The Los Angeles Dodgers Offseason Performance

May 15, 2025

Analyzing The Los Angeles Dodgers Offseason Performance

May 15, 2025 -

Trumps Sleepy Joe Attacks Analyzing Bidens Presidential Record

May 15, 2025

Trumps Sleepy Joe Attacks Analyzing Bidens Presidential Record

May 15, 2025 -

The Latest On Anthony Edwards Baby Mama Dispute A Twitter Breakdown

May 15, 2025

The Latest On Anthony Edwards Baby Mama Dispute A Twitter Breakdown

May 15, 2025 -

Florida Welcomes Foot Lockers New Global Headquarters

May 15, 2025

Florida Welcomes Foot Lockers New Global Headquarters

May 15, 2025