Republican Tax Overhaul In Jeopardy Amidst Conservative Pushback

Table of Contents

Conservative Concerns Fueling the Opposition

The Republican tax overhaul isn't just facing opposition from Democrats; a significant faction within the Republican party itself is voicing strong concerns. This internal resistance is proving to be a major obstacle to the bill's passage.

Spending Cuts Concerns

A core element of the conservative pushback centers on concerns about spending. Many conservatives argue that the proposed tax cuts are fiscally irresponsible without corresponding reductions in government spending. They fear a substantial increase in the national debt.

- Concerns about entitlement programs: Conservative groups are demanding significant reforms to Social Security and Medicare, arguing that these programs are unsustainable in their current form.

- Demands for significant reductions in non-defense discretionary spending: Pressure is mounting to slash funding for various government agencies and programs to offset the cost of the tax cuts.

- Pressure to offset tax cuts with spending reductions: Conservatives are pushing for a balanced approach, insisting that any tax cuts must be accompanied by equivalent spending cuts to prevent an expansion of the national debt.

The Heritage Foundation, for example, has published several reports outlining proposals for significant spending reductions, arguing that these are necessary to maintain fiscal responsibility. Senators such as [Insert Senator's Name], known for their fiscally conservative stance, have publicly voiced similar concerns, demanding stricter spending controls before they will support the tax overhaul. The financial implications of their demands are significant, potentially impacting crucial government services and programs.

Tax Code Simplification Concerns

Beyond spending concerns, some conservatives are also expressing dissatisfaction with the lack of sufficient simplification within the proposed tax code. They argue that the overhaul doesn't go far enough in reforming the tax system, leaving loopholes and complexities intact.

- Complaints about loopholes remaining: Critics point to specific provisions in the bill that they believe will allow for continued tax avoidance by corporations and wealthy individuals.

- Concerns about unintended consequences: There are worries that certain aspects of the proposed tax overhaul might have unforeseen negative economic consequences.

- Desire for a more fundamentally reformed tax system: Some conservatives advocate for a more radical restructuring of the tax code, moving towards a simpler, flatter tax system.

Conservative commentators and think tanks have pointed out specific sections of the bill that they deem problematic, arguing that they fall short of achieving true tax simplification. The Club for Growth, a powerful conservative lobbying group, has publicly criticized the bill for not addressing these concerns adequately, highlighting its impact on their decision-making regarding support for the bill.

The Impact of Divided Republican Ranks

The deep rift within the Republican party is the biggest hurdle the tax overhaul faces. Even with unlikely Democratic support, achieving passage requires near-unanimous Republican backing, a situation that currently appears unattainable.

Internal Party Divisions

The Republican party is far from monolithic. Different factions – libertarian, fiscal conservative, and social conservative – have conflicting priorities, making it challenging for party leadership to forge a unified front.

- Different factions within the party and their varying priorities: The varying priorities of these factions make consensus-building a herculean task.

- Challenges in party leadership in achieving unity: The current Republican leadership faces an uphill battle in uniting these disparate factions behind the tax overhaul.

- Potential for defections on key votes: Several Republican representatives and senators have expressed reservations, raising the possibility of defections during crucial votes.

[Insert Representative's Name] and [Insert Senator's Name] are prime examples of Republicans expressing reservations about the current plan. Their public statements and potential votes against the bill highlight the fragility of the Republican party's unity on this issue. The potential for defections significantly impacts the bill's chances of passing.

Negotiation Challenges

Negotiations are proving exceedingly difficult, further jeopardizing the tax overhaul’s success. Finding common ground between various Republican factions is proving nearly impossible.

- Difficulties in finding common ground between conservative and moderate Republicans: Bridging the ideological gap between these factions is a major challenge.

- The influence of lobbying groups and special interests: Powerful lobbying groups are exerting considerable influence on the negotiations, potentially hindering efforts to reach a consensus.

- The pressure of upcoming deadlines and elections: The approaching deadlines for legislative action and the upcoming elections are adding immense pressure, potentially leading to rushed and poorly thought-out decisions.

The ongoing negotiations are a testament to the significant challenges in achieving a compromise. The likelihood of reaching a consensus remains uncertain, further emphasizing the precarious state of the Republican tax overhaul.

Potential Economic Consequences of Failure

The failure to pass the Republican tax overhaul would have significant repercussions for the US economy and the Republican party itself.

Uncertainty and Market Volatility

A failure to pass the tax overhaul would inject significant uncertainty into the markets, potentially leading to substantial volatility.

- Potential investor reaction to failed legislation: Investors might react negatively, potentially leading to market downturns.

- The impact on consumer confidence: Uncertainty about future tax policies could negatively impact consumer spending, slowing economic growth.

- The effect on economic growth forecasts: Economic forecasters predict a slowdown in economic growth should the bill fail to pass.

Many economists have expressed concerns about the negative consequences of the bill's potential failure. These concerns range from a decline in investor confidence to decreased consumer spending, both contributing to a potential economic downturn. The ripple effects could be far-reaching and deeply impact various sectors of the economy.

Political Ramifications

Beyond the economic impact, the failure of this key legislative agenda could severely damage the Republican party's standing.

- Negative impact on voter trust and support for the party: Failure to deliver on a key campaign promise could erode voter trust and support for the Republican party.

- Potential for loss of seats in Congress: The failure of the tax overhaul could contribute to Republican losses in the upcoming midterm elections.

- Consequences for the party's reputation: Failure could damage the party's image as effective legislators and capable managers of the economy.

The political fallout from a failed tax overhaul could be substantial, potentially impacting the upcoming midterm elections and even the 2024 presidential election. Analysts predict significant consequences for the party's standing among voters, particularly those who were counting on the tax cuts.

Conclusion

The Republican tax overhaul is facing a critical juncture, caught in the crossfire of internal party divisions and significant conservative pushback. The consequences of failure are substantial, both economically and politically. The coming weeks will be crucial in determining whether a compromise can be reached or if this ambitious plan will collapse, leading to potentially widespread negative repercussions. Stay informed about the ongoing developments surrounding the Republican tax overhaul, its potential alternatives, and its impact on the US economy and the political landscape. Understanding the intricacies of this legislative battle is essential for informed civic participation.

Featured Posts

-

The Us Armys Right To Repair Initiative Implications And Benefits

May 18, 2025

The Us Armys Right To Repair Initiative Implications And Benefits

May 18, 2025 -

Damiano Davids Next Summer Stream It Now

May 18, 2025

Damiano Davids Next Summer Stream It Now

May 18, 2025 -

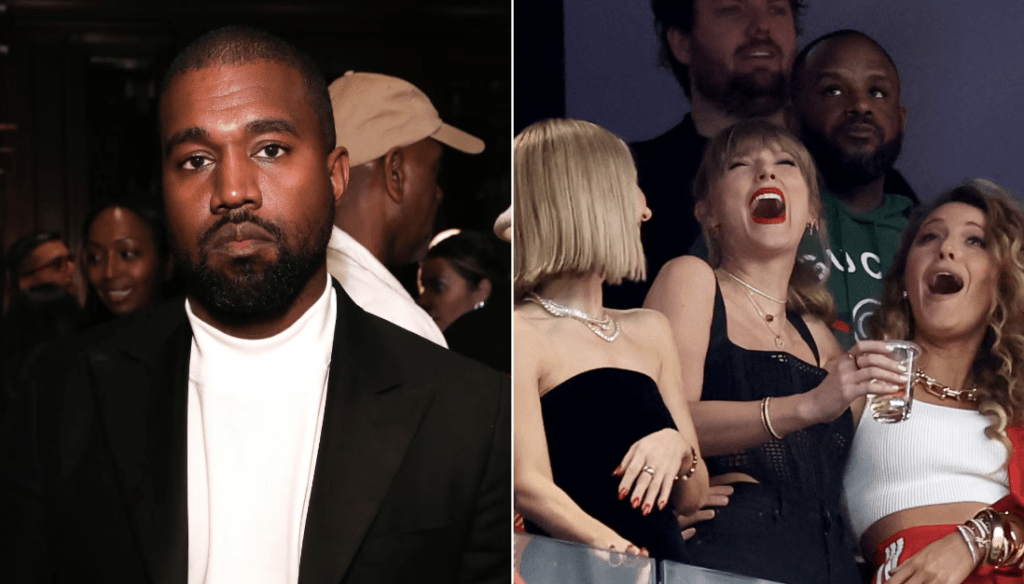

The Kanye West Taylor Swift Rift Impact On Super Bowl Performance

May 18, 2025

The Kanye West Taylor Swift Rift Impact On Super Bowl Performance

May 18, 2025 -

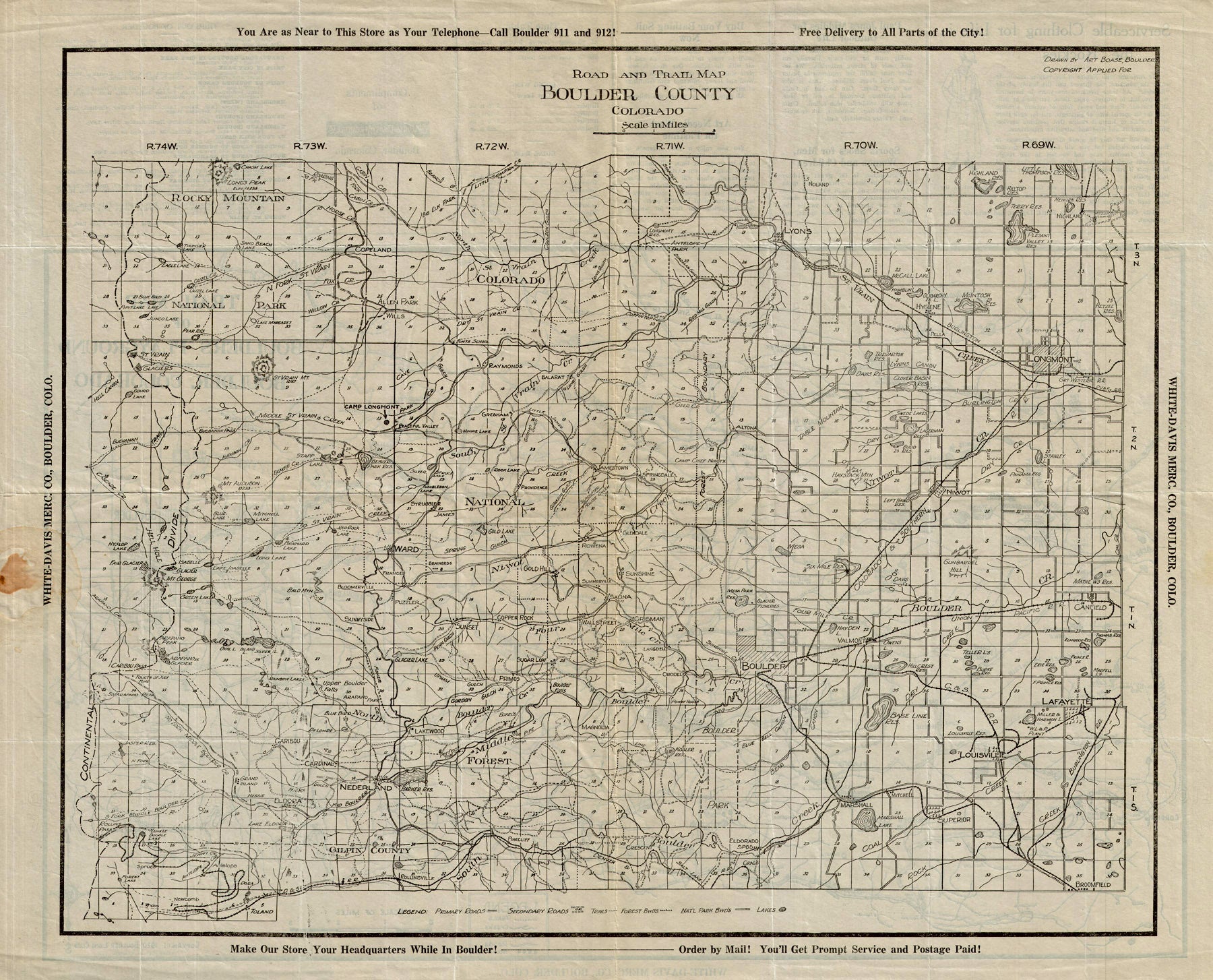

Switzerland Trail A Mining History In Boulder County Colorado

May 18, 2025

Switzerland Trail A Mining History In Boulder County Colorado

May 18, 2025 -

Uncensored Snl Audience Members Caught Swearing On Air

May 18, 2025

Uncensored Snl Audience Members Caught Swearing On Air

May 18, 2025

Latest Posts

-

9 Nyc Bridges At Risk After Baltimore Bridge Collapse Urgent Safety Concerns

May 18, 2025

9 Nyc Bridges At Risk After Baltimore Bridge Collapse Urgent Safety Concerns

May 18, 2025 -

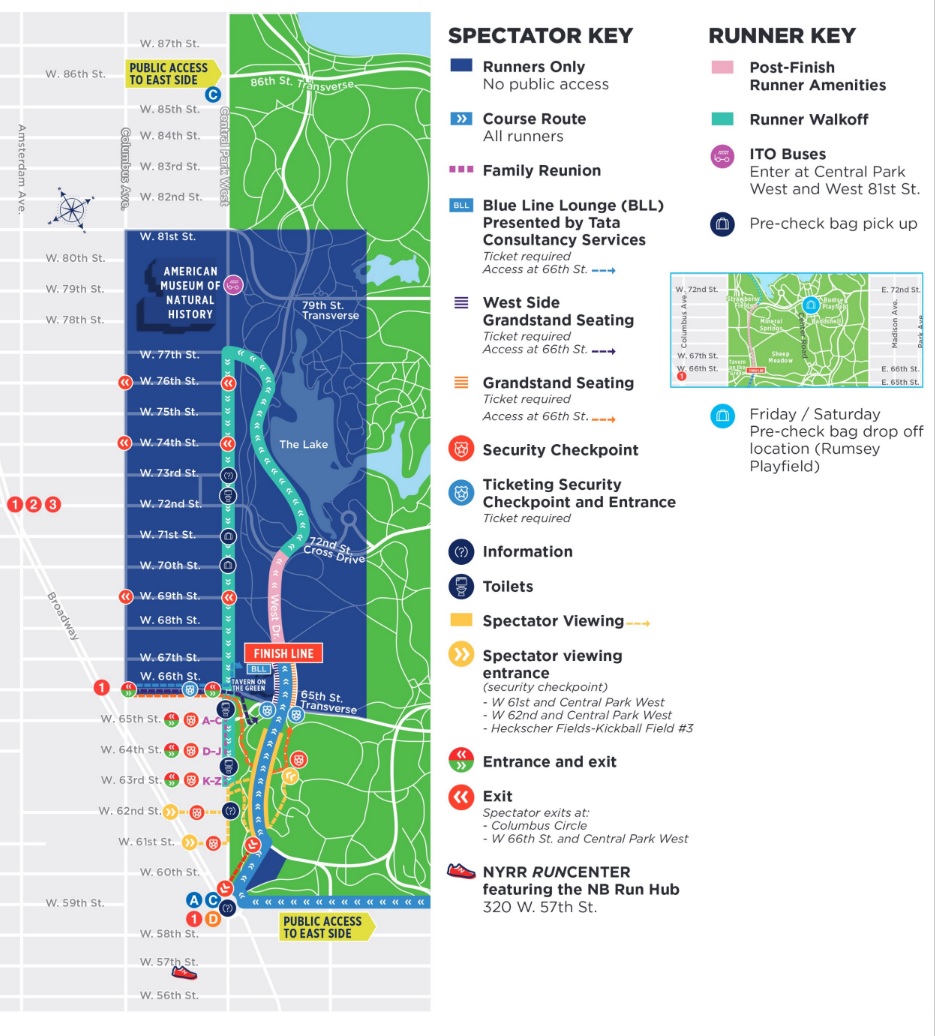

Nyc Half Marathon Tens Of Thousands Expected To Run Across Brooklyn Bridge

May 18, 2025

Nyc Half Marathon Tens Of Thousands Expected To Run Across Brooklyn Bridge

May 18, 2025 -

Analysis Of The Brooklyn Bridge Stability Maintenance And Long Term Prospects

May 18, 2025

Analysis Of The Brooklyn Bridge Stability Maintenance And Long Term Prospects

May 18, 2025 -

Cops Investigate Homicide In Brooklyn Bridge Park

May 18, 2025

Cops Investigate Homicide In Brooklyn Bridge Park

May 18, 2025 -

Brooklyn Bridge Assessment Strengths And Areas For Future Enhancement

May 18, 2025

Brooklyn Bridge Assessment Strengths And Areas For Future Enhancement

May 18, 2025