Refinancing Federal Student Loans: Comparing Private And Federal Options

Table of Contents

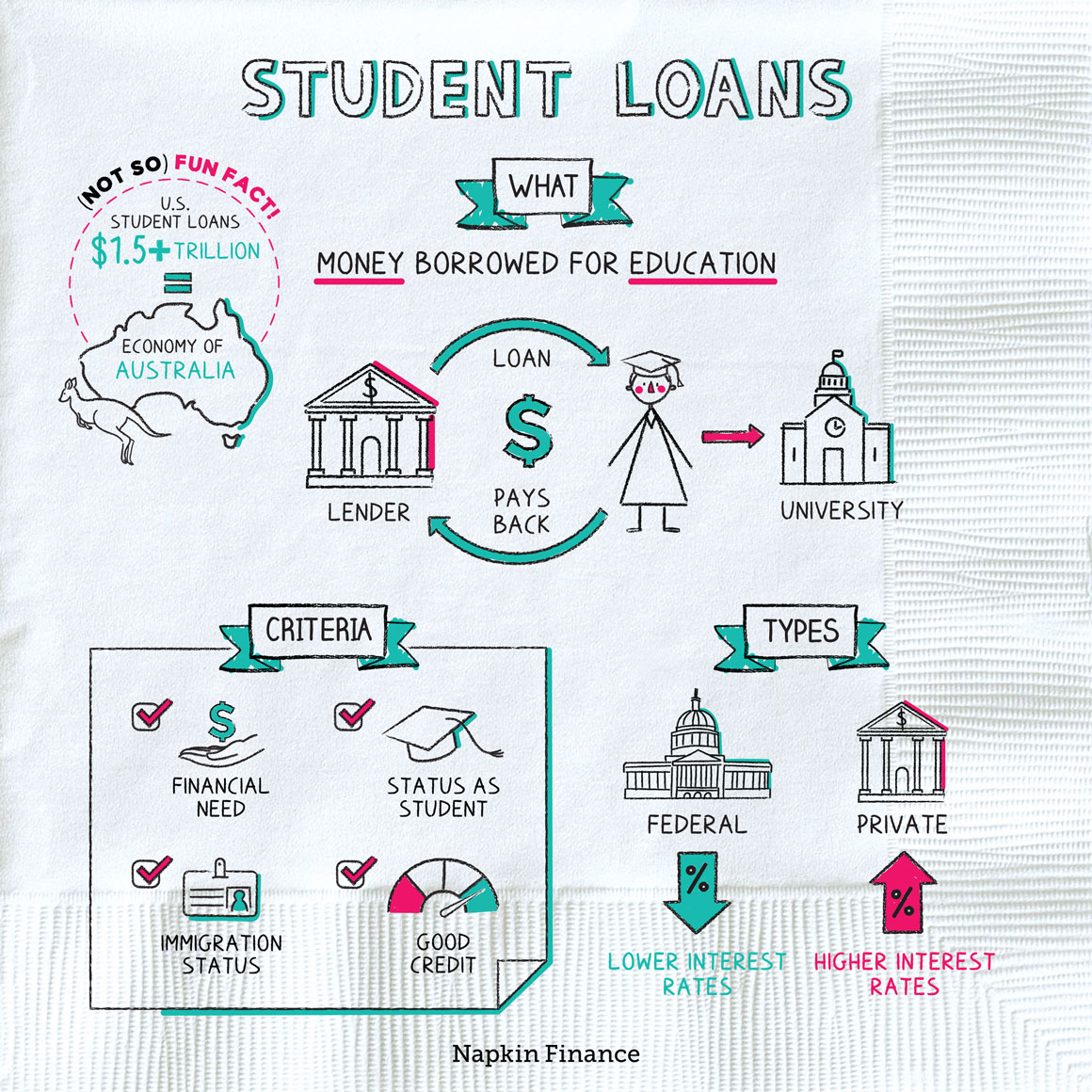

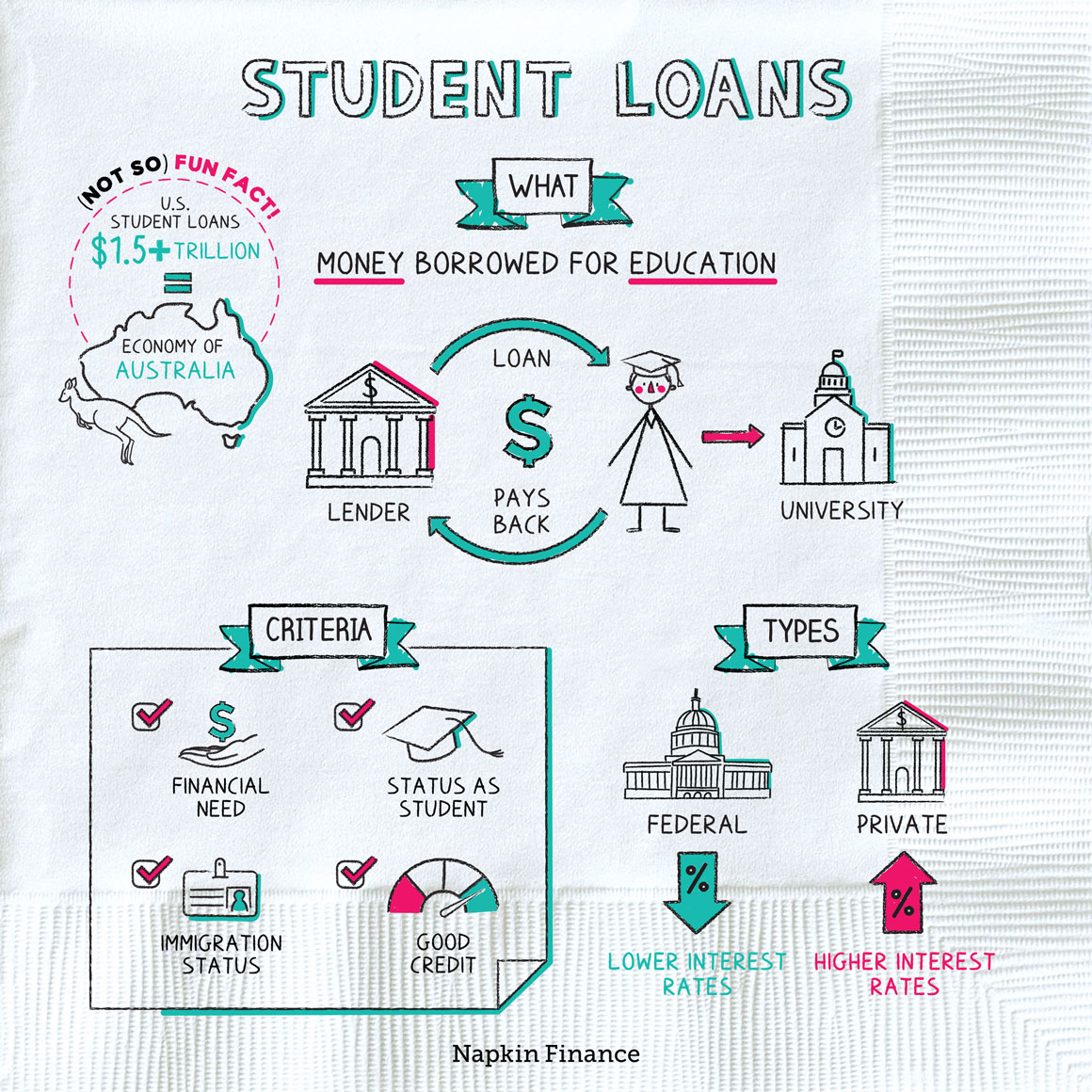

Understanding Federal Student Loan Refinancing

What is Federal Student Loan Refinancing?

The term "federal student loan refinancing" can be a bit misleading. There isn't a true federal program that allows you to refinance your existing federal student loans into a new federal loan with a potentially lower interest rate. However, you can consolidate your federal student loans through the federal government. This process combines multiple federal student loans into a single loan with a new repayment plan. It's crucial to understand the difference between refinancing and consolidation. Refinancing generally implies getting a new loan from a private lender at a potentially lower interest rate, while consolidation involves combining existing federal loans under a single federal loan. Keywords: Federal student loan refinancing, federal student loan consolidation.

Pros and Cons of Federal Consolidation

Pros:

- Simplified Repayment: Manage one monthly payment instead of multiple, making budgeting easier.

- Potential for Income-Driven Repayment Plans: Depending on your income, you might qualify for income-driven repayment (IDR) plans, lowering your monthly payments based on your income and family size.

Cons:

- May Not Lower Interest Rates Significantly: Your new interest rate will likely be a weighted average of your existing loan interest rates; it may not result in substantial savings.

- No Reduction in Loan Principal: Consolidation doesn't reduce the total amount you owe; it simply simplifies the repayment process. Keywords: Federal student loan consolidation, income-driven repayment.

Exploring Private Student Loan Refinancing

How Private Refinancing Works

Private student loan refinancing involves taking out a new loan from a private lender to pay off your existing federal student loans. Private lenders assess your creditworthiness, considering your credit score, debt-to-income ratio, and income. If approved, you'll receive a new loan with potentially better terms. Keywords: Private student loan refinancing, private lender.

Advantages of Private Refinancing

Pros:

- Potential for Lower Interest Rates: Depending on your credit score, you may qualify for significantly lower interest rates than your current federal loans.

- Shorter Repayment Terms: A shorter repayment term can lead to faster debt payoff, but remember that this means higher monthly payments.

- Fixed or Variable Interest Rates: Choose a fixed interest rate for predictable monthly payments or a variable rate, which might be lower initially but could fluctuate.

Specific benefits vary by lender. Compare offers carefully.

Keywords: Lower interest rates, shorter repayment terms, fixed interest rate, variable interest rate.

Disadvantages of Private Refinancing

Cons:

- Loss of Federal Student Loan Benefits: Once you refinance with a private lender, you lose access to federal student loan benefits such as income-driven repayment plans, deferment, and forbearance options. This is a significant drawback to consider.

- Higher Risk if You Default: Defaulting on a private student loan can severely damage your credit score and potentially lead to wage garnishment or lawsuits.

Carefully evaluate your financial stability before refinancing.

Keywords: Income-driven repayment, deferment, forbearance.

Comparing Federal and Private Refinancing Options: A Side-by-Side Analysis

| Feature | Federal Consolidation | Private Refinancing |

|---|---|---|

| Interest Rates | Weighted average of existing rates | Potentially lower, depending on credit |

| Fees | Typically minimal | Varies by lender |

| Eligibility | All federal student loan borrowers | Requires good credit, stable income |

| Repayment Terms | Flexible options available | Customizable, potentially shorter terms |

| Benefits | Simplified repayment, IDR plans | Potential for lower interest rates |

| Drawbacks | May not lower rates significantly | Loss of federal benefits, higher risk |

Keywords: Interest rates, fees, eligibility requirements, repayment terms.

Factors to Consider Before Refinancing

Your Credit Score and Debt-to-Income Ratio

A high credit score and a low debt-to-income ratio significantly improve your chances of securing favorable refinancing terms, including lower interest rates. Check your credit report and work on improving your score before applying. Keywords: Credit score, debt-to-income ratio.

Your Current Interest Rates

Refinancing only makes sense if you can secure a significantly lower interest rate. Use a refinance calculator to compare your current rates with potential new rates from different lenders. Only refinance if the savings justify the loss of federal benefits. Keywords: Interest rates, refinance calculator.

Long-Term Financial Goals

Consider your overall financial picture. Does refinancing align with your long-term financial goals, such as buying a home or investing? Make sure refinancing won't negatively impact your ability to achieve those goals. Keywords: Financial goals, long-term financial planning.

Conclusion

Refinancing federal student loans can offer significant benefits, such as lower monthly payments and faster repayment, but choosing between private and federal options requires careful consideration. While federal consolidation simplifies payments, private refinancing may offer lower interest rates. Weigh the pros and cons of each option based on your individual financial situation, creditworthiness, and long-term goals. Before making a decision, thoroughly research different lenders and compare their offerings. Don't hesitate to seek professional financial advice to determine if refinancing federal student loans is the right choice for you.

Featured Posts

-

United States Crypto Casino Comparison Jack Bit Vs The Competition

May 17, 2025

United States Crypto Casino Comparison Jack Bit Vs The Competition

May 17, 2025 -

Angel Reese On Potential Wnba Player Strike Over Pay

May 17, 2025

Angel Reese On Potential Wnba Player Strike Over Pay

May 17, 2025 -

Tam Krwz Ke Jwte Pr Pawn Rkhne Waly Khatwn Mdah Awr Adakar Ka Rdeml

May 17, 2025

Tam Krwz Ke Jwte Pr Pawn Rkhne Waly Khatwn Mdah Awr Adakar Ka Rdeml

May 17, 2025 -

Giants Vs Mariners Updated Injury List For April 4 6 Games

May 17, 2025

Giants Vs Mariners Updated Injury List For April 4 6 Games

May 17, 2025 -

The Enduring Legacy Of Tony Bennett A Look At His Life And Career

May 17, 2025

The Enduring Legacy Of Tony Bennett A Look At His Life And Career

May 17, 2025

Latest Posts

-

Srbija Na Evrobasketu Pripremna Utakmica U Bajernovoj Dvorani I Najnovije Vesti

May 17, 2025

Srbija Na Evrobasketu Pripremna Utakmica U Bajernovoj Dvorani I Najnovije Vesti

May 17, 2025 -

Novak Djokovic In 186 Milyon Dolarlik Geliri Detaylar Ve Analiz

May 17, 2025

Novak Djokovic In 186 Milyon Dolarlik Geliri Detaylar Ve Analiz

May 17, 2025 -

Generalka Srbije Pred Evrobasket Detaljan Pregled Utakmice U Bajernovoj Dvorani

May 17, 2025

Generalka Srbije Pred Evrobasket Detaljan Pregled Utakmice U Bajernovoj Dvorani

May 17, 2025 -

Fortnites Controversial Music Update Players Express Their Discontent

May 17, 2025

Fortnites Controversial Music Update Players Express Their Discontent

May 17, 2025 -

Fortnite Unreleased Skins And Their Potential Return

May 17, 2025

Fortnite Unreleased Skins And Their Potential Return

May 17, 2025