Recordati: Tariff Volatility And M&A Opportunities In Italy

Table of Contents

The Impact of Tariff Volatility on Recordati's Operations in Italy

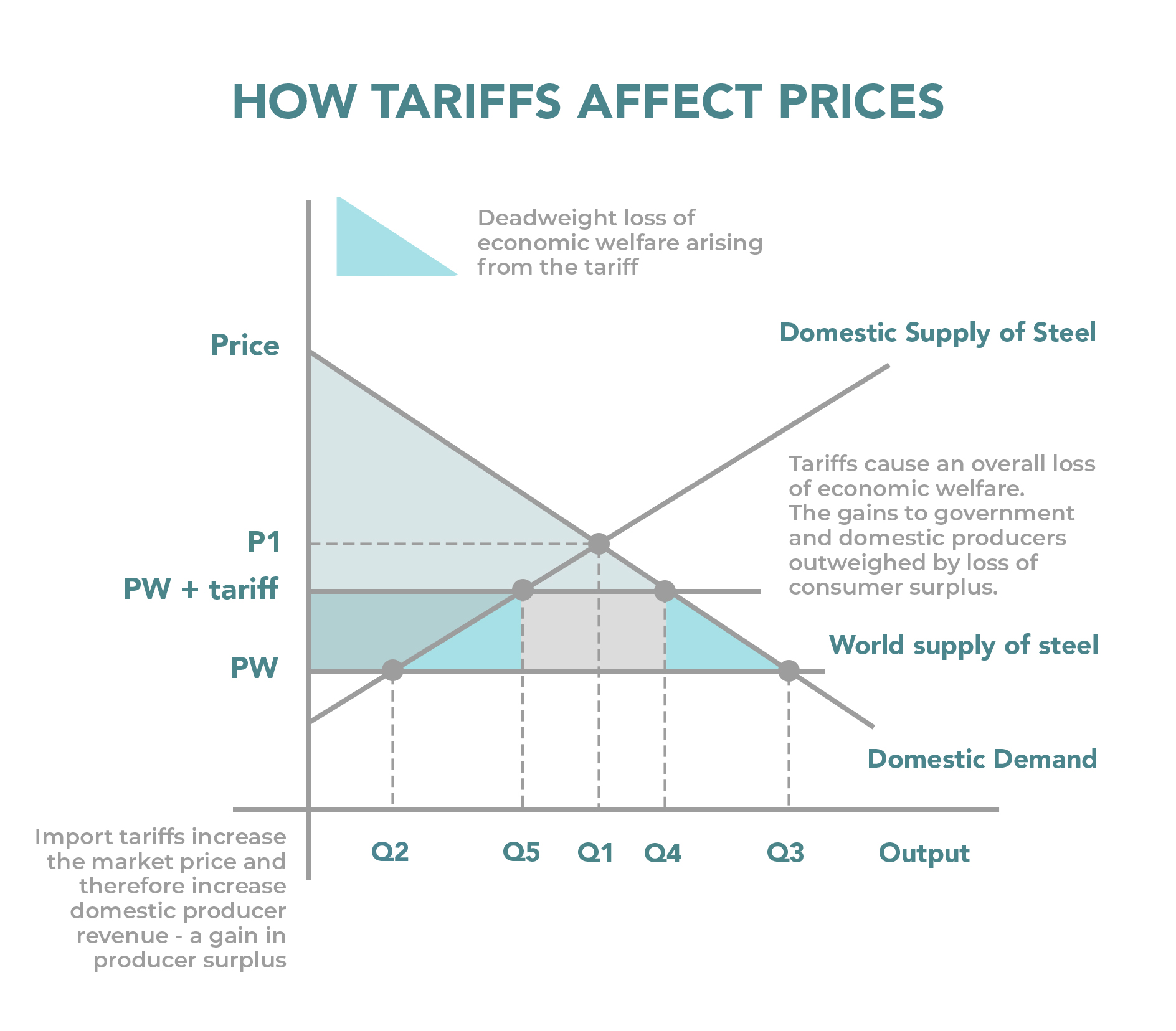

Tariff volatility significantly impacts the Italian pharmaceutical industry, creating uncertainty and requiring nimble responses from companies like Recordati. Several types of tariffs affect the sector, including import duties on raw materials and finished goods, as well as value-added taxes (VAT) and other regulatory levies. These fluctuations directly influence Recordati's operational costs and profitability.

Fluctuating tariffs force Recordati to constantly adjust its pricing strategies. Increased input costs due to import tariffs, for instance, necessitate careful evaluation of pricing to maintain margins without pricing themselves out of the market. The price sensitivity of Italian consumers adds another layer of complexity. Recordati must strike a delicate balance between maintaining profitability and remaining competitive, particularly against the growing pressure from generic drug manufacturers.

To mitigate the impact of tariff changes, Recordati likely employs several strategies:

- Increased input costs due to import tariffs: Sourcing raw materials from multiple suppliers to diversify and mitigate supply chain risks.

- Price sensitivity of Italian consumers: Implementing targeted marketing campaigns and promotional offers to manage price elasticity.

- Competitive pressures from generics: Focusing on specialized therapeutic areas with less generic competition and investing in R&D for innovative drugs.

- Recordati's pricing strategies to mitigate tariff impacts: Implementing sophisticated pricing models that incorporate tariff projections and sensitivity analyses.

Recordati's M&A Strategy in the Italian Market

Recordati's growth trajectory has, in part, been fueled by strategic mergers and acquisitions within the Italian market. Historically, Recordati has demonstrated a preference for acquiring smaller, specialized pharmaceutical companies, bolstering its product portfolio and market share.

The potential benefits of M&A for Recordati are substantial:

- Market share expansion: Acquiring competitors strengthens their presence in specific therapeutic areas.

- Access to new technologies: Acquiring innovative companies can introduce new products and manufacturing capabilities.

- Synergies: Combining operations with acquired entities can lead to cost efficiencies and improved operational effectiveness.

Identifying potential targets for future acquisitions requires careful consideration of market dynamics and regulatory hurdles. While specific companies are not named here due to confidentiality and market sensitivity, potential targets might include smaller, innovative firms specializing in niche therapeutic areas that complement Recordati's existing portfolio. The current Italian M&A landscape is characterized by both consolidation and increased competition, presenting both opportunities and challenges for Recordati.

Challenges include:

- Acquisition of smaller Italian pharmaceutical companies: Negotiating favorable acquisition terms.

- Strategic partnerships to expand market reach: Balancing collaborative efforts with independent operations.

- Consolidation within the Italian pharmaceutical sector: Competing with larger international pharmaceutical companies.

- Challenges related to regulatory approvals and antitrust concerns: Navigating complex regulatory processes and approvals.

Analyzing Recordati's Competitive Advantages and Future Outlook in Italy

Recordati enjoys several competitive advantages in the Italian pharmaceutical market:

- Strong brand recognition in Italy: A long history of operation and a solid reputation.

- Specialized therapeutic areas: Focusing on niche areas reduces direct competition.

- Efficient manufacturing and distribution networks: Ensuring timely delivery of products to consumers.

- Potential for further growth through organic expansion and M&A: A balanced strategy for sustainable growth.

However, Recordati also faces challenges such as intensified competition from international pharmaceutical companies, the ever-evolving regulatory environment, and pricing pressures from generic drugs. Its long-term prospects depend on its ability to adapt to these changes and continue to innovate. The company's future success in the Italian market hinges on its ability to navigate tariff volatility effectively while pursuing strategic acquisitions that support its long-term growth goals.

Recordati's Future in Italy: A Balancing Act of Tariff Management and Strategic Acquisitions

In conclusion, Recordati's success in the Italian pharmaceutical market depends on its capacity to manage the challenges posed by tariff volatility while simultaneously pursuing strategic growth opportunities through M&A activities. The company's ability to balance these seemingly opposing forces will determine its long-term prospects. A well-defined strategy, encompassing both cost-effective tariff mitigation and selective acquisitions, is crucial for sustainable success.

To further understand Recordati's strategic positioning and the broader Italian pharmaceutical landscape, we encourage you to delve deeper into relevant research. Consider exploring resources on "Recordati stock analysis," "Italian pharmaceutical market trends," "M&A in the Italian pharma industry," and "managing tariff volatility in the pharma sector." This will allow for a comprehensive understanding of Recordati's future within the Italian pharmaceutical market and the broader implications of tariff volatility and M&A activity.

Featured Posts

-

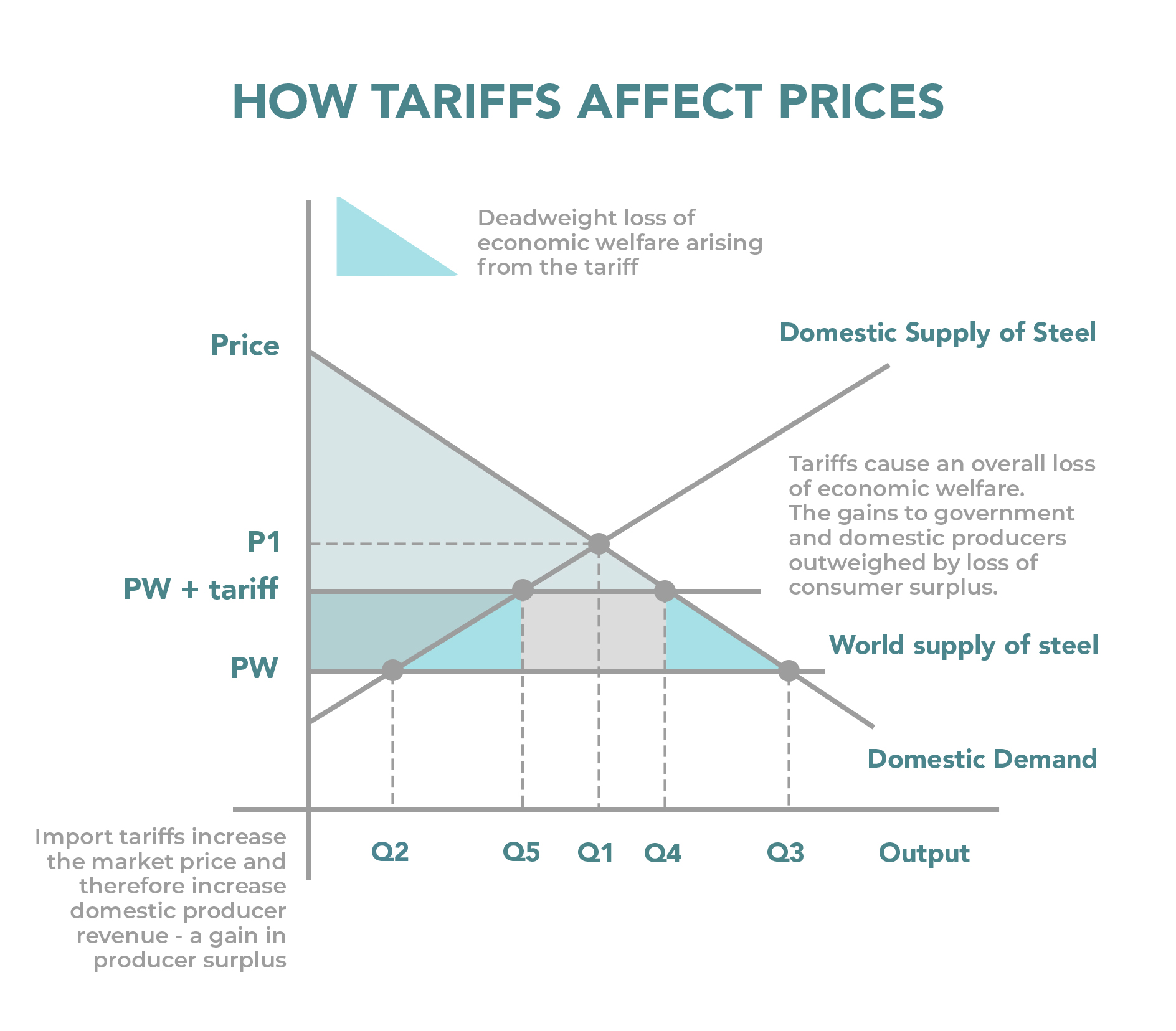

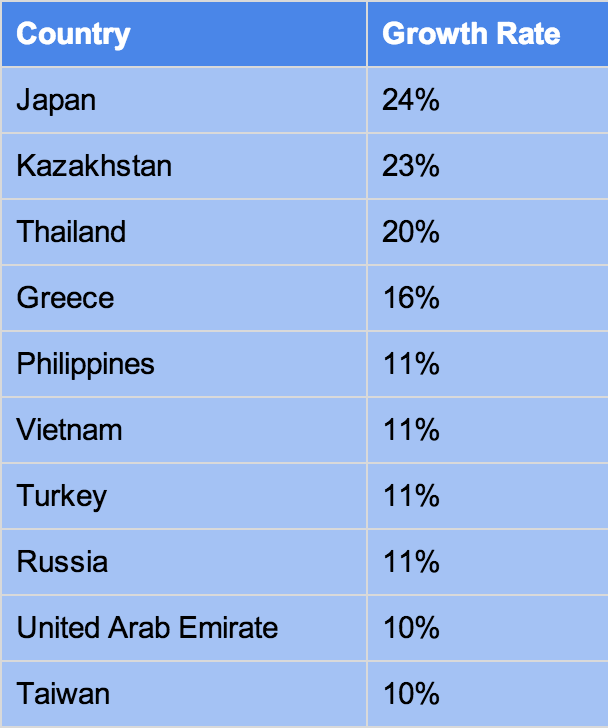

Identifying The Countrys Fastest Growing Business Locations

May 01, 2025

Identifying The Countrys Fastest Growing Business Locations

May 01, 2025 -

Meer Dan Een Jaar Wachten Op Tbs Een Onacceptabele Situatie

May 01, 2025

Meer Dan Een Jaar Wachten Op Tbs Een Onacceptabele Situatie

May 01, 2025 -

Market Uncertainty Secure Your S And P 500 Investments With Smart Strategies

May 01, 2025

Market Uncertainty Secure Your S And P 500 Investments With Smart Strategies

May 01, 2025 -

The Diverging Paths Of Altman And Nadella Implications For The Future Of Ai

May 01, 2025

The Diverging Paths Of Altman And Nadella Implications For The Future Of Ai

May 01, 2025 -

Discover The Best New Southern Cruises For 2025

May 01, 2025

Discover The Best New Southern Cruises For 2025

May 01, 2025

Latest Posts

-

Giai Bong Da Sinh Vien Tran Dau Soi Noi Mo Man Vong Chung Ket

May 01, 2025

Giai Bong Da Sinh Vien Tran Dau Soi Noi Mo Man Vong Chung Ket

May 01, 2025 -

Quan Quan Giai Bong Da Thanh Nien Thanh Pho Hue Lan Thu Vii Thong Tin Chi Tiet

May 01, 2025

Quan Quan Giai Bong Da Thanh Nien Thanh Pho Hue Lan Thu Vii Thong Tin Chi Tiet

May 01, 2025 -

Chung Ket Giai Bong Da Sinh Vien Tran Mo Man Day Soi Dong

May 01, 2025

Chung Ket Giai Bong Da Sinh Vien Tran Mo Man Day Soi Dong

May 01, 2025 -

Fallecimiento De Joven Figura De Afa Conmocion En El Futbol Argentino

May 01, 2025

Fallecimiento De Joven Figura De Afa Conmocion En El Futbol Argentino

May 01, 2025 -

Giai Bong Da Thanh Nien Thanh Pho Hue Lan Thu Vii Doi Nao Dang Quang

May 01, 2025

Giai Bong Da Thanh Nien Thanh Pho Hue Lan Thu Vii Doi Nao Dang Quang

May 01, 2025