Recordati And The Impact Of Tariff Fluctuations On M&A Activity In Italy

Table of Contents

Recordati's M&A Strategy in Italy

Recordati has a history of strategic acquisitions in Italy, consistently aiming to expand its portfolio and market presence. Their focus areas typically include specific therapeutic areas with high growth potential and opportunities for geographic expansion within the Italian market. They prioritize companies with strong product pipelines, established market positions, and synergies with existing Recordati operations.

-

Examples of past acquisitions: While specific details of all acquisitions may not be publicly available due to commercial sensitivity, analyzing publicly released information reveals a pattern of targeted acquisitions enhancing their specialty pharmaceutical offerings. The success of these acquisitions varies, dependent on successful integration and market response. Challenges may include the integration of different corporate cultures and the optimization of combined operational processes.

-

Recordati's acquisition criteria: Recordati likely assesses potential acquisitions based on factors such as profitability, market share, regulatory approvals, intellectual property, and potential for synergistic growth. A strong management team and operational efficiency are also key considerations.

-

Assessment of M&A strategy effectiveness: Recordati's M&A strategy, while not publicly quantified in terms of overall success rates, has demonstrably expanded their market share and product offerings. Continuous monitoring and adaptation to market conditions are crucial for ongoing success.

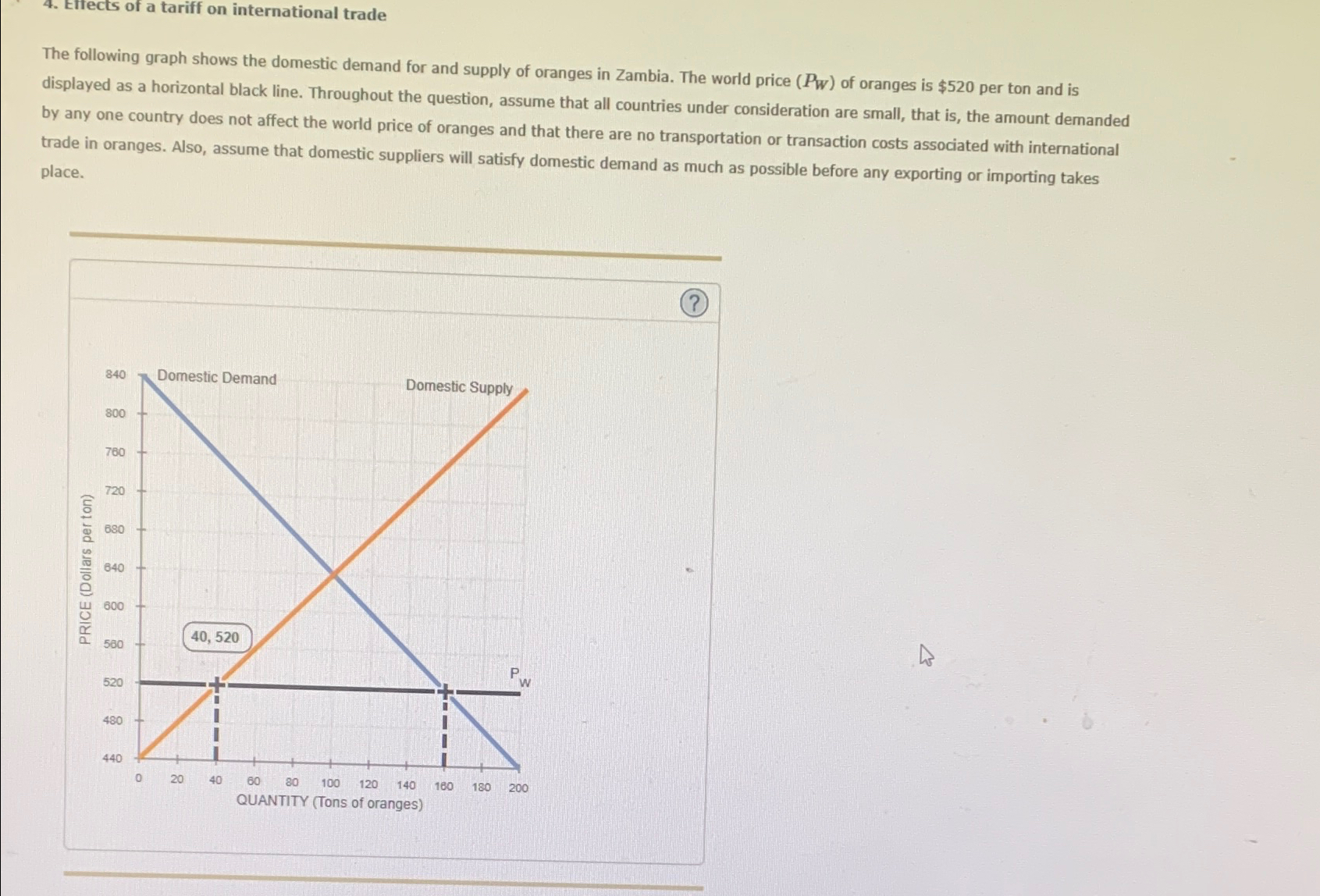

The Impact of Tariff Fluctuations on the Italian Pharmaceutical Market

Tariff changes significantly affect pharmaceutical pricing and profitability in Italy. The price of imported raw materials and finished goods directly influences production costs and ultimately, the price of medicines to consumers. EU regulations and international trade agreements also play a significant role, creating a complex regulatory environment.

-

Examples of specific tariffs impacting the pharmaceutical industry: Changes in import tariffs on active pharmaceutical ingredients (APIs) or specialized equipment can lead to increased production costs. Export tariffs on finished pharmaceuticals can reduce competitiveness in international markets.

-

Impact on import/export costs for Recordati: Fluctuating tariffs directly impact Recordati's costs for importing raw materials and exporting finished products, affecting both profitability and pricing strategies.

-

Price sensitivity and M&A decisions: In a price-sensitive market like Italy, tariff changes influence the attractiveness of potential acquisition targets. A sudden increase in tariffs might significantly alter the valuation and profitability projections of a potential acquisition.

How Tariff Uncertainty Affects Recordati's M&A Decisions

Unpredictable tariff changes create substantial risk and uncertainty for Recordati's M&A decisions. This uncertainty complicates financial forecasting and deal valuations, making it challenging to accurately assess the long-term return on investment (ROI) of potential acquisitions.

-

Challenges in forecasting future profits and ROI: The volatile nature of tariffs makes it difficult to predict future profitability, impacting investment decisions. Accurate financial modeling becomes exceedingly complex, requiring sophisticated forecasting techniques.

-

Strategies to mitigate tariff risks: Recordati might employ strategies such as hedging (financial instruments to mitigate currency or tariff risks), diversifying sourcing of raw materials, and incorporating tariff uncertainty into deal valuations.

-

Due diligence and tariff-related risks: Thorough due diligence processes are crucial to assess tariff-related risks during M&A processes. This includes analyzing potential exposure to tariff changes, identifying mitigation strategies, and incorporating these risks into the overall deal valuation.

Case Study: (Optional - Replace with a relevant Recordati acquisition if available and publicly accessible data exists)

(This section would contain a detailed analysis of a specific Recordati acquisition, showing how tariff fluctuations influenced the decision-making process and the eventual outcome. Data would need to be sourced from public Recordati disclosures or reliable financial news outlets.)

Conclusion

Tariff fluctuations significantly impact Recordati's M&A activity in Italy, creating both challenges and opportunities. The unpredictable nature of tariffs introduces considerable uncertainty into investment decisions and strategic planning. Effective risk management strategies are crucial for Recordati and other companies operating in the Italian pharmaceutical market. Successfully navigating this volatile environment requires sophisticated financial modeling, proactive risk mitigation strategies, and a deep understanding of the interplay between EU regulations, international trade agreements, and Italian-specific market dynamics.

Call to Action: For further insights into the impact of tariff fluctuations on Recordati and the Italian pharmaceutical M&A landscape, continue your research using keywords like "Recordati M&A analysis," "Italian pharmaceutical market tariffs," and "Recordati strategic acquisitions." Understanding these factors is crucial for anyone involved in or interested in the Italian pharmaceutical industry.

Featured Posts

-

Ripple Xrp News Sbi Holdings Xrp Shareholder Reward Program Details

May 01, 2025

Ripple Xrp News Sbi Holdings Xrp Shareholder Reward Program Details

May 01, 2025 -

The Truth About Michael Sheens Million Pound Philanthropy

May 01, 2025

The Truth About Michael Sheens Million Pound Philanthropy

May 01, 2025 -

Dallas Stars Death At 100 Shocks Fans

May 01, 2025

Dallas Stars Death At 100 Shocks Fans

May 01, 2025 -

Xrp News Sec Classification Commodity Or Security

May 01, 2025

Xrp News Sec Classification Commodity Or Security

May 01, 2025 -

Slim Opladen Met Enexis In Noord Nederland Buiten De Piekuren

May 01, 2025

Slim Opladen Met Enexis In Noord Nederland Buiten De Piekuren

May 01, 2025

Latest Posts

-

Nguy Co Mat Trang Khi Gop Von Vao Cong Ty Co Tien Su Lua Dao

May 01, 2025

Nguy Co Mat Trang Khi Gop Von Vao Cong Ty Co Tien Su Lua Dao

May 01, 2025 -

Best Cruise Lines In The Usa For 2024

May 01, 2025

Best Cruise Lines In The Usa For 2024

May 01, 2025 -

Dau Tu Gop Von Vao Cong Ty Tung Bi Nghi Van Lua Dao Can Luu Y Gi

May 01, 2025

Dau Tu Gop Von Vao Cong Ty Tung Bi Nghi Van Lua Dao Can Luu Y Gi

May 01, 2025 -

Cty Tam Hop Chien Thang Thuyet Phuc Goi Thau Cap Nuoc Gia Dinh Truoc 6 Doi Thu Khac

May 01, 2025

Cty Tam Hop Chien Thang Thuyet Phuc Goi Thau Cap Nuoc Gia Dinh Truoc 6 Doi Thu Khac

May 01, 2025 -

Tam Hop Xuat Sac Gianh Chien Thang Goi Thau Cap Nuoc Gia Dinh Truoc 6 Doi Thu

May 01, 2025

Tam Hop Xuat Sac Gianh Chien Thang Goi Thau Cap Nuoc Gia Dinh Truoc 6 Doi Thu

May 01, 2025