Recession-Proofing Your Portfolio: Is Uber Stock A Safe Bet?

Table of Contents

Uber's Business Model and Recession Resilience

H3: Analyzing Uber's Diverse Revenue Streams:

Uber's business model isn't solely reliant on ride-sharing. This diversification is a key factor in assessing its potential for weathering economic storms. Uber's multiple revenue streams offer a degree of protection against a downturn impacting just one area.

- Ride-sharing: While vulnerable to reduced consumer spending during a recession, this remains a core component of Uber's revenue.

- Uber Eats: Food delivery services often see increased demand during economic hardship, as people opt for more affordable meal options.

- Uber Freight: The logistics and freight sector can be relatively resilient, as businesses still need to transport goods even during economic slowdowns.

- Other Services: Uber continues to expand into new areas, such as micromobility (scooters and bikes) and other delivery services, further diversifying its revenue base.

While precise percentage contributions fluctuate, the multi-pronged approach provides a buffer. For instance, during previous economic slowdowns (data needed here, referencing specific periods and sources), Uber Eats demonstrated surprising growth, partially offsetting declines in ride-sharing revenue. This diversification is a crucial element of considering Uber as a component of a recession-proof stocks portfolio.

H3: The Essential Nature of Uber's Services:

A core argument for Uber's recession resilience lies in the essential nature of its services. Even during tough economic times, people still need transportation and food delivery.

- Affordable Transportation: Uber can provide a relatively cheaper alternative to car ownership, particularly appealing during periods of economic uncertainty.

- Food Delivery Convenience: With limited budgets, people may cut back on eating out, increasing reliance on home food delivery services like Uber Eats.

However, it's crucial to acknowledge counterarguments. During severe economic crises, even essential services might experience reduced demand as people drastically cut back on discretionary spending. Reduced ridership and lower order volumes for Uber Eats are potential downsides to consider.

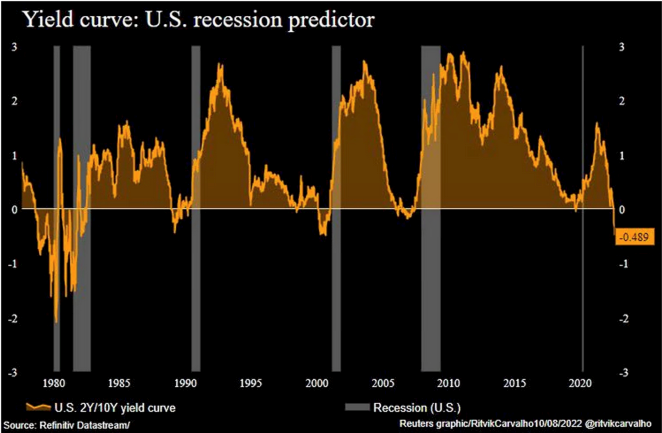

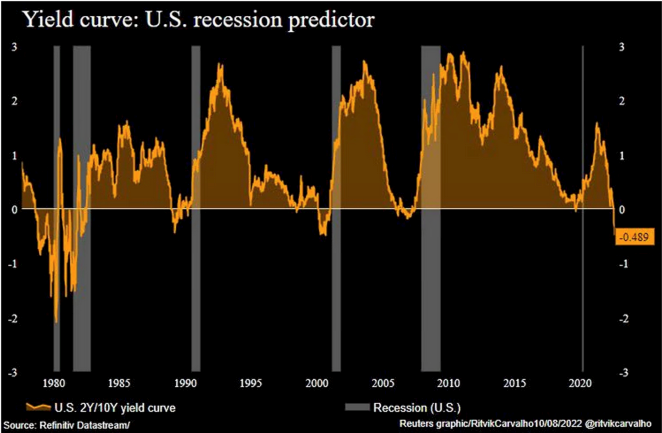

Assessing Uber's Stock Performance During Past Recessions

H3: Historical Performance Analysis:

Analyzing Uber's stock performance during previous economic downturns is vital. Unfortunately, Uber's IPO was relatively recent, limiting the historical data available for analysis during full-blown recessions. (Insert chart/graph here visualizing stock performance since IPO, highlighting periods of economic uncertainty).

- Stock Price Fluctuation: Examining the stock price volatility during periods of market uncertainty can provide insight into its responsiveness to economic shifts.

- Revenue Growth: Observing revenue growth (or contraction) during such periods is crucial for understanding the company's adaptability.

- Earnings per Share (EPS): Monitoring EPS reveals the profitability of the business, a vital indicator of financial health during economic stress.

(Include specific data points and contextualize them, relating them to broader market trends. Mention any significant events that influenced Uber's stock price during these periods).

H3: Comparing Uber to Traditional Recession-Proof Sectors:

How does Uber compare to traditionally recession-resistant sectors like consumer staples and healthcare? (Insert comparative chart/graph here illustrating the performance of Uber against these sectors during periods of economic downturn).

- Consumer Staples: These businesses typically see relatively stable demand, even during recessions, as consumers still need essential goods.

- Healthcare: The healthcare sector is often seen as a safe haven, with consistent demand for services regardless of the economic climate.

Uber's performance may not match the stability of these sectors but its diversified revenue streams and essential service offerings could offer a degree of protection compared to more cyclical industries. This comparative analysis is vital for placing Uber's potential within the context of broader investment strategy.

Risks and Considerations: Is Uber Truly Recession-Proof?

H3: Vulnerability to Economic Shifts:

While Uber exhibits certain characteristics of a recession-resistant business, it's not immune to economic downturns.

- Decreased Consumer Spending: A significant economic slowdown could lead to a substantial drop in ride-sharing and food delivery demand.

- Increased Competition: Economic hardship can intensify competition as companies fight for a shrinking market share.

- Regulatory Changes: Government regulations could significantly impact Uber's operations and profitability.

Uber employs various strategies to mitigate these risks. These include cost-cutting measures, exploring new markets, and leveraging its technological advantages to improve efficiency.

H3: Debt and Financial Health:

Understanding Uber's financial health is paramount. Analyzing its debt levels and financial ratios provides a clearer picture of its resilience.

- Debt-to-Equity Ratio: This ratio indicates the proportion of debt financing compared to equity, giving an idea of the company's financial leverage.

- Profitability Margins: Analyzing profit margins helps assess Uber's ability to generate profits, even during challenging economic times.

- Cash Flow: Strong cash flow is vital for navigating economic downturns, ensuring the company can meet its financial obligations.

(Include specific data points here for Uber's key financial ratios, obtained from reputable financial sources). A high debt load could make Uber more vulnerable during an economic crisis.

Conclusion: Is Uber Stock Right for Your Recession-Proof Portfolio?

Uber's potential as a recession-proof investment is complex. While its diversified revenue streams and the essential nature of some of its services offer some degree of protection, it's not entirely immune to economic downturns. The company's historical performance, financial health, and competitive landscape all need careful consideration. The benefits of diversification within a well-structured portfolio cannot be overstated.

This analysis highlights both the potential upsides and inherent risks. Remember, there's no such thing as a completely "recession-proof" investment. Before incorporating Uber stock into your recession-proofing your portfolio strategy, thorough due diligence is essential. Consider consulting with a qualified financial advisor to assess how Uber fits into your broader investment strategy and risk tolerance. Diversification remains the cornerstone of any sound recession-proof investment strategy. Don't rely solely on a single stock; build a resilient portfolio that withstands economic fluctuations.

Featured Posts

-

Unlocking Private Credit Career Opportunities 5 Key Steps

May 19, 2025

Unlocking Private Credit Career Opportunities 5 Key Steps

May 19, 2025 -

Maastricht Airport Significante Daling Passagiersaantallen In 2025

May 19, 2025

Maastricht Airport Significante Daling Passagiersaantallen In 2025

May 19, 2025 -

Complete Ufc Vegas 106 Fight Card Betting Odds And Predictions For Burns Vs Morales

May 19, 2025

Complete Ufc Vegas 106 Fight Card Betting Odds And Predictions For Burns Vs Morales

May 19, 2025 -

Samoy Eysevios Erxesthe Stin Ekklisia Akoloythontas Ton Xristo

May 19, 2025

Samoy Eysevios Erxesthe Stin Ekklisia Akoloythontas Ton Xristo

May 19, 2025 -

Securing Your Place In The Sun Navigating The International Property Market

May 19, 2025

Securing Your Place In The Sun Navigating The International Property Market

May 19, 2025