Recent Rise In Bitcoin Mining: What's Driving The Growth?

Table of Contents

Increased Bitcoin Price and Mining Profitability

The most direct driver of Bitcoin mining growth is the simple economics of supply and demand. A higher Bitcoin price directly translates to higher mining profitability. When the price of Bitcoin increases, miners earn more Bitcoin for each block they successfully mine, making the endeavor significantly more lucrative. This increased revenue incentivizes more individuals and organizations to enter the Bitcoin mining space, leading to a rise in overall mining activity.

- Illustrative Charts: Charts depicting the strong correlation between Bitcoin's price and the hashrate (a measure of total Bitcoin network computing power) clearly illustrate this relationship. A rising Bitcoin price usually precedes a surge in hashrate, as miners respond to increased profitability.

- Transaction Fees: It's not just the Bitcoin block reward that contributes to miner revenue; transaction fees play a crucial role as well. Higher network congestion leads to higher fees, further boosting the overall profitability of mining.

- Mining Pools: The risk involved in solo Bitcoin mining is substantial. Mining pools alleviate this risk by pooling resources and distributing the rewards among participants proportionally, making Bitcoin mining accessible to smaller players and contributing to the overall hashrate.

Advancements in Bitcoin Mining Hardware

Technological advancements in Bitcoin mining hardware are another crucial factor fueling the recent growth. The development of increasingly sophisticated Application-Specific Integrated Circuits (ASICs) has revolutionized the efficiency and power of Bitcoin mining. These specialized chips are designed solely for Bitcoin mining, dramatically outperforming general-purpose hardware like GPUs.

- Efficiency Gains: Modern ASIC miners boast significantly higher hash rates and lower energy consumption per unit of computational power compared to their predecessors. This increased efficiency directly lowers the cost per Bitcoin mined, making mining more profitable even at lower Bitcoin prices.

- Mining Farms and Economies of Scale: Large-scale mining operations, often housed in specialized data centers known as mining farms, benefit from economies of scale. These farms can acquire hardware at lower costs and leverage bulk electricity contracts, further enhancing their profitability and contributing significantly to the overall hashrate.

- Environmental Impact: While Bitcoin mining consumes considerable energy, the development of more energy-efficient mining hardware is mitigating some of the environmental concerns. The improved energy efficiency per Bitcoin mined helps lessen the industry's overall carbon footprint.

The Role of Institutional Investors and Large-Scale Mining Operations

The entrance of institutional investors and the rise of large-scale mining operations have profoundly impacted the Bitcoin mining landscape. These significant players bring substantial capital, allowing them to invest in massive amounts of mining hardware and infrastructure. This results in a substantial increase in the total hashrate, driving up overall mining activity.

- Publicly Traded Mining Companies: The emergence of publicly traded Bitcoin mining companies has provided a new avenue for institutional investment, further fueling growth in the sector. Their performance directly reflects the market's perception of Bitcoin mining profitability.

- Venture Capital Funding: Venture capital firms are increasingly investing in large-scale mining projects, recognizing the potential for substantial returns in this growing market. This injection of capital allows for expansion and technological innovation within the industry.

- Decentralization Concerns: While the involvement of institutional investors boosts hashrate, it also raises concerns about the decentralization of Bitcoin mining. The dominance of a few large players could potentially pose a threat to the network's security and resilience.

Regulatory Landscape and its Influence on Bitcoin Mining

Government regulations, or the lack thereof, significantly influence where Bitcoin mining operations are established. Regions with favorable regulatory environments attract miners, leading to concentrated growth in those areas.

- Bitcoin-Friendly Jurisdictions: Countries with clear regulatory frameworks that support cryptocurrency mining, or those with lax regulations, tend to attract a significant portion of the mining activity. This concentration of mining power in certain regions has a substantial impact on the global hashrate.

- Future Regulatory Impacts: The evolving regulatory landscape poses both opportunities and risks for the Bitcoin mining industry. Future regulations could either stifle or encourage growth depending on their nature and implementation.

- Decentralization and Regulation: The impact of differing regulatory approaches across various jurisdictions significantly influences the decentralization of Bitcoin mining. Strict regulations in some areas might drive miners to more permissive environments, potentially affecting the network's security and distribution.

The Impact of the Bitcoin Halving

The Bitcoin halving, a periodic event that reduces the Bitcoin block reward paid to miners, has a significant impact on mining profitability. While it initially decreases rewards, it often leads to increased Bitcoin price over the long term, offsetting some of the impact on profitability. This cyclical event creates volatility and reshapes the dynamics of the Bitcoin mining landscape.

Conclusion

The recent rise in Bitcoin mining is a multifaceted phenomenon driven by a complex interplay of factors. Increased Bitcoin price and profitability, advancements in mining hardware, the significant investment from institutional players, and the influence of regulatory environments all contribute to this growth surge. Understanding these intertwined elements is crucial for navigating the dynamic world of Bitcoin mining. Stay informed about the dynamic world of Bitcoin mining and its future growth. Follow [Your Website/Blog] for continued updates on the latest trends in Bitcoin mining and cryptocurrency. Learn more about [Link to related article on your website about Bitcoin mining or cryptocurrency].

Featured Posts

-

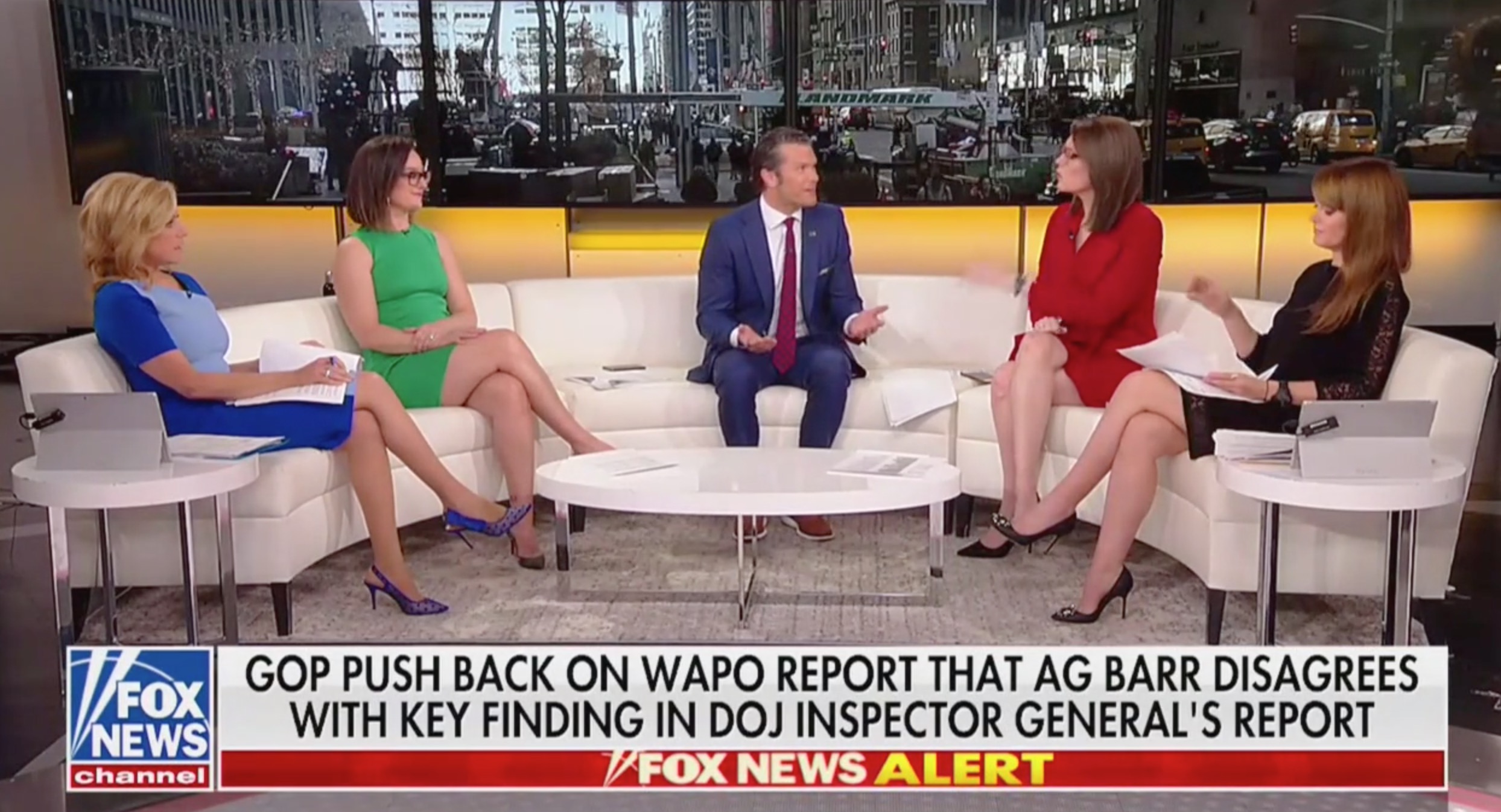

Debate Tarlov Challenges Pirros Pro Trade War Position On Canada

May 09, 2025

Debate Tarlov Challenges Pirros Pro Trade War Position On Canada

May 09, 2025 -

Bert Kreischer Netflix Stand Up And His Wifes Take On The Material

May 09, 2025

Bert Kreischer Netflix Stand Up And His Wifes Take On The Material

May 09, 2025 -

Harry Styles Reaction To A Critically Bad Snl Impression

May 09, 2025

Harry Styles Reaction To A Critically Bad Snl Impression

May 09, 2025 -

Otkaz Makrona Starmera Mertsa I Tuska Ot Poezdki V Kiev 9 Maya Prichiny I Posledstviya

May 09, 2025

Otkaz Makrona Starmera Mertsa I Tuska Ot Poezdki V Kiev 9 Maya Prichiny I Posledstviya

May 09, 2025 -

Iditarod Rookies 7 Sled Dog Teams Chasing Nome

May 09, 2025

Iditarod Rookies 7 Sled Dog Teams Chasing Nome

May 09, 2025