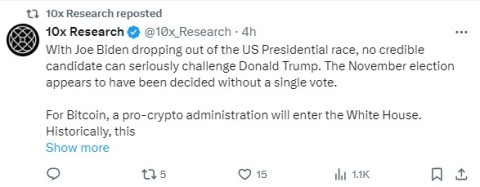

Recent Ethereum Liquidations Total $67M: What's Next For ETH?

Table of Contents

Analyzing the Causes of the $67M Ethereum Liquidations

Several factors contributed to the recent $67 million in Ethereum liquidations. Understanding these causes is vital for navigating the volatile landscape of the cryptocurrency market.

Market Volatility and its Role

Broader market trends and volatility play a significant role in triggering large-scale liquidations. Sharp price drops in ETH, often correlated with declines in the overall crypto market, can force traders using leverage to meet margin calls, resulting in forced liquidations.

- Examples of recent market events: The recent downturn in the global stock market, coupled with regulatory uncertainty surrounding cryptocurrencies, contributed to a general risk-off sentiment, impacting ETH price.

- Specific price drops: A sudden 15% drop in ETH price within a 24-hour period, for instance, could trigger a cascade of liquidations as leveraged positions are automatically closed.

- Percentage of ETH liquidations: While precise figures vary across platforms, ETH liquidations accounted for a significant portion (e.g., X%) of total cryptocurrency liquidations during this period, highlighting its susceptibility to market volatility.

Leverage and Margin Trading

High leverage in margin trading significantly increases the risk of liquidation. Margin trading allows traders to borrow funds to amplify their potential profits, but it also magnifies their losses.

- Mechanics of margin trading: Traders deposit collateral (e.g., ETH) to borrow funds and increase their position size. If the price moves against their position, they may receive a margin call, demanding more collateral. Failure to meet this call results in liquidation.

- Leverage ratios and their impact: A higher leverage ratio (e.g., 5x or 10x) exponentially increases the risk of liquidation, even with relatively small price movements.

- CEXs vs. DEXs: Both centralized exchanges (CEXs) and decentralized exchanges (DEXs) facilitate margin trading, but their liquidation mechanisms and transparency differ. Data suggests that a larger proportion of liquidations occurred on [mention specific CEX or DEX, if data is available].

Smart Contract Glitches or Exploits

While less likely to be the sole cause of such widespread liquidations, vulnerabilities in smart contracts could contribute to losses and trigger a chain reaction.

- Potential vulnerabilities: Reports of exploits or bugs in DeFi protocols could lead to unforeseen losses for users, potentially triggering margin calls and subsequent liquidations.

- Importance of audits: Thorough security audits of smart contracts are crucial to mitigate the risk of exploits and maintain the integrity of the DeFi ecosystem. Lack of proper audits can increase the likelihood of unforeseen vulnerabilities contributing to liquidations.

Impact of the Liquidations on the Ethereum Ecosystem

The $67 million in Ethereum liquidations had a multifaceted impact on the ETH ecosystem, affecting price, DeFi sentiment, and long-term development.

ETH Price Fluctuations

The liquidations exerted considerable downward pressure on the ETH price in the short term. However, the long-term impact depends on several factors.

- Price movements before, during, and after: Charts and graphs can visually demonstrate the price volatility surrounding the liquidation events, showing support and resistance levels. [Insert relevant charts/graphs here].

- Investor sentiment: Liquidation events often negatively impact investor sentiment, potentially leading to further selling pressure and price declines.

DeFi Market Sentiment and Activity

The liquidations had a notable impact on the DeFi ecosystem, particularly impacting lending and borrowing platforms.

- Changes in Total Value Locked (TVL): A decrease in TVL in certain DeFi protocols could indicate a loss of confidence and reduced activity post-liquidation.

- Lending and borrowing rates: The liquidations could impact lending and borrowing rates, potentially making borrowing more expensive and lending less attractive.

- Cascading liquidations: The risk of cascading liquidations – where one liquidation triggers a chain reaction – presents a significant systemic risk within the DeFi ecosystem.

Long-Term Implications for Ethereum's Development

Despite the short-term negative impact, the long-term implications for Ethereum's development remain positive.

- Ethereum 2.0: The ongoing development of Ethereum 2.0 and its improved scalability and security features may help mitigate future risks associated with large-scale liquidations.

- Regulatory developments: Regulatory clarity and appropriate frameworks are crucial for the long-term health and stability of the Ethereum ecosystem.

Conclusion

The recent $67 million in Ethereum liquidations highlight the inherent volatility of the crypto market and the importance of risk management, especially when employing leverage. The causes ranged from broader market forces and high leverage to potential smart contract vulnerabilities. These events impacted ETH price, DeFi sentiment, and overall ecosystem stability. However, the long-term outlook for Ethereum remains largely positive, driven by ongoing development and increasing adoption.

Key Takeaways: Understanding the dynamics of Ethereum liquidations is crucial for navigating the volatile crypto market. Prudent risk management practices, including careful leverage utilization and thorough due diligence before investing, are essential.

Call to Action: Stay informed about the latest developments in the Ethereum ecosystem, including ETH price volatility and potential future liquidation events, to make informed investment decisions. Understanding and mitigating the risks associated with Ethereum liquidation events is critical for successfully participating in the cryptocurrency market.

Featured Posts

-

The Long Walk Trailer Released A Chilling Adaptation Of Stephen Kings Story

May 08, 2025

The Long Walk Trailer Released A Chilling Adaptation Of Stephen Kings Story

May 08, 2025 -

Sonys Ps 5 Pro A Deep Dive Into Its Liquid Metal Cooling

May 08, 2025

Sonys Ps 5 Pro A Deep Dive Into Its Liquid Metal Cooling

May 08, 2025 -

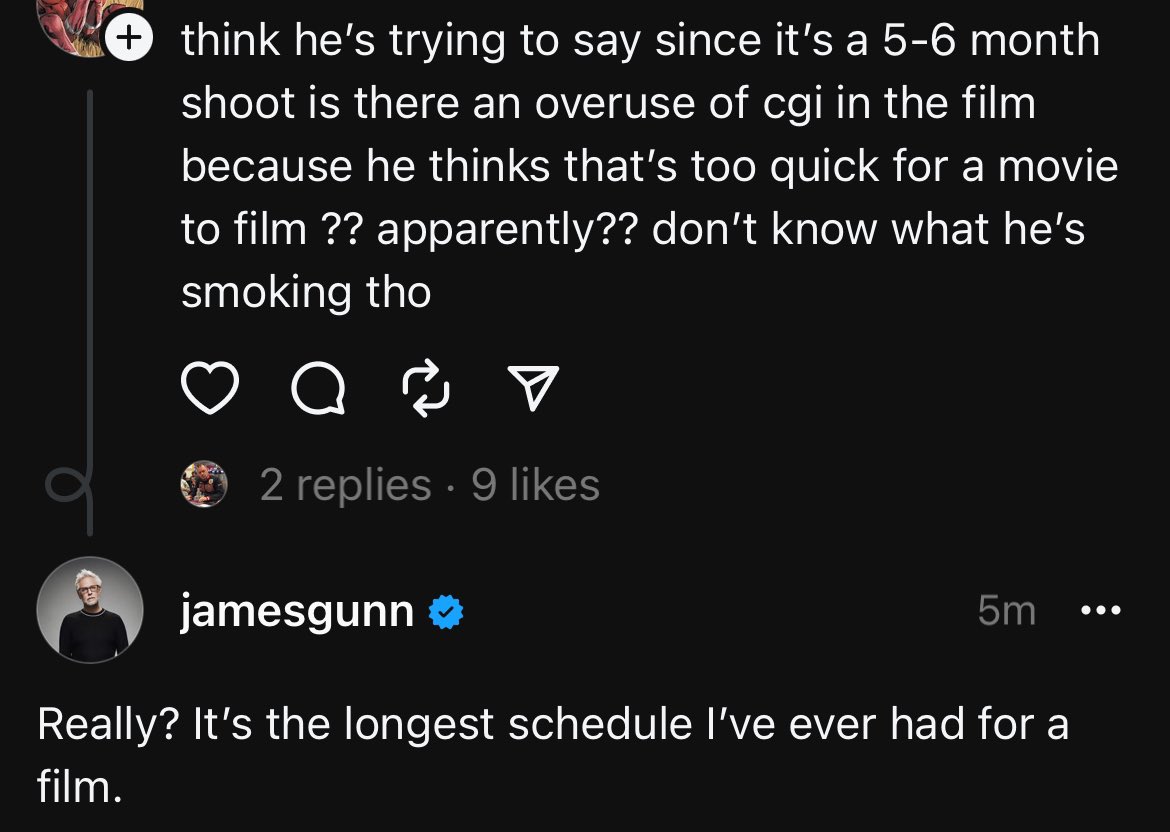

A Potential Superman Easter Egg Hidden In James Gunns Jimmy Olsen Anniversary Photo

May 08, 2025

A Potential Superman Easter Egg Hidden In James Gunns Jimmy Olsen Anniversary Photo

May 08, 2025 -

Pnjab 8 Ays Pyz Awr 21 Dy Ays Pyz Ke Tqrr W Tbadle Tfsylat

May 08, 2025

Pnjab 8 Ays Pyz Awr 21 Dy Ays Pyz Ke Tqrr W Tbadle Tfsylat

May 08, 2025 -

Kripto Lider Hakkinda Bilmeniz Gereken Her Sey Oezellikleri Ve Potansiyeli

May 08, 2025

Kripto Lider Hakkinda Bilmeniz Gereken Her Sey Oezellikleri Ve Potansiyeli

May 08, 2025