Recent Drop In Gas Prices: Economic Factors And National Average

Table of Contents

Global Oil Supply and Demand Dynamics

The recent drop in gas prices is significantly linked to the interplay between global oil supply and demand.

Increased Oil Production

OPEC+ oil production has played a major role. Several countries, including Saudi Arabia and Russia, have increased their crude oil supply, leading to a surge in the global oil market's overall availability.

- Increased Saudi Arabian Production: Saudi Arabia, a key player in OPEC+, has boosted its oil production significantly, contributing substantially to the increased global supply.

- Geopolitical Factors: Geopolitical stability (or at least the absence of major disruptions) in key oil-producing regions has allowed for smoother and more consistent production.

- New Oil Discoveries: While not a major factor in this particular price drop, the potential for new oil discoveries always influences the long-term outlook for global oil supply.

Reduced Global Demand

Simultaneously, reduced global oil demand has further contributed to the decline in gas prices. This decrease stems from several converging factors.

- Economic Slowdowns: Concerns about global economic slowdowns, including potential recessions in major economies, have dampened industrial activity and consumer spending, resulting in lower demand for fuel.

- Fuel Efficiency Improvements: The increasing prevalence of fuel-efficient vehicles and advancements in fuel technology have reduced overall fuel consumption.

- Changes in Consumer Behavior: Factors like working from home, reduced travel, and a shift towards public transportation have contributed to lower gasoline demand.

Economic Factors Influencing Gas Prices

Beyond global supply and demand, several key economic indicators have influenced the recent drop in gas prices.

Inflation and Interest Rates

Inflation and interest rate hikes significantly affect consumer spending habits.

- Reduced Disposable Income: High inflation erodes consumers' purchasing power, leaving less disposable income for non-essential expenses like gasoline.

- Interest Rate Hikes and Reduced Spending: Increased interest rates make borrowing more expensive, discouraging large purchases and potentially impacting driving habits.

The US Dollar's Strength

The strength of the US dollar plays a crucial role in global oil markets because oil is primarily traded in US dollars.

- Impact on Oil Prices: A strong US dollar makes oil more expensive for buyers using other currencies, potentially leading to reduced demand and lower oil prices.

- Currency Exchange Rates: Fluctuations in currency exchange rates constantly influence the global oil market, impacting the final price at the pump.

National Average Gas Price Trends and Regional Variations

Tracking the national average gas price reveals a clear downward trend.

Tracking the National Average

Data from reliable sources like AAA and the EIA show a consistent decrease in the national average gas price over the past few months. (Include a chart or graph here if possible showing the price decrease over a specific period).

- Monthly and Yearly Comparisons: Comparing current prices to the previous month and the same period last year highlights the magnitude of the recent drop.

- AAA Gas Price Report: Regularly consulting the AAA gas price report provides up-to-date information on national and regional trends.

- EIA Fuel Data: The Energy Information Administration (EIA) provides comprehensive data and analysis on fuel prices and energy markets.

Regional Differences in Gas Prices

Despite the national average decline, gas prices vary significantly across different states and regions.

- State Taxes: State taxes on gasoline significantly impact the final price at the pump.

- Local Market Conditions: Local competition among gas stations and distribution costs can also create price variations.

- Regional Demand: Differences in population density and transportation habits can also contribute to regional variations in gas prices.

Conclusion

The recent drop in gas prices is a result of a multifaceted interplay of increased global oil production, reduced demand due to economic slowdowns and changes in consumer behavior, and influential economic factors like inflation and the strength of the US dollar. While this decrease offers short-term relief for consumers, predicting the long-term sustainability of these lower prices remains challenging. The volatile nature of the global oil market makes any prediction uncertain. Stay updated on the latest trends in the recent drop in gas prices by checking reliable resources like AAA and the EIA regularly. Understanding these fluctuations can help you make informed decisions about your fuel consumption and budget planning.

Featured Posts

-

Solve Wordle 1366 Hints And Answer For March 16th

May 22, 2025

Solve Wordle 1366 Hints And Answer For March 16th

May 22, 2025 -

Lindsi Grem Ta Inshi Senatori Tisk Na Trampa Schodo Konfiskatsiyi Rosiyskikh Aktiviv

May 22, 2025

Lindsi Grem Ta Inshi Senatori Tisk Na Trampa Schodo Konfiskatsiyi Rosiyskikh Aktiviv

May 22, 2025 -

The Health Benefits Of Cassis Blackcurrant A Nutritional Perspective

May 22, 2025

The Health Benefits Of Cassis Blackcurrant A Nutritional Perspective

May 22, 2025 -

Occasionverkoop Abn Amro Neemt Flink Toe Analyse Van De Groei

May 22, 2025

Occasionverkoop Abn Amro Neemt Flink Toe Analyse Van De Groei

May 22, 2025 -

Steelers Draft Strategy Kiper Weighs In On Aaron Rodgers Potential Impact

May 22, 2025

Steelers Draft Strategy Kiper Weighs In On Aaron Rodgers Potential Impact

May 22, 2025

Latest Posts

-

Cobra Kai A Study In Continuity And Its Relationship To The Karate Kid Films

May 23, 2025

Cobra Kai A Study In Continuity And Its Relationship To The Karate Kid Films

May 23, 2025 -

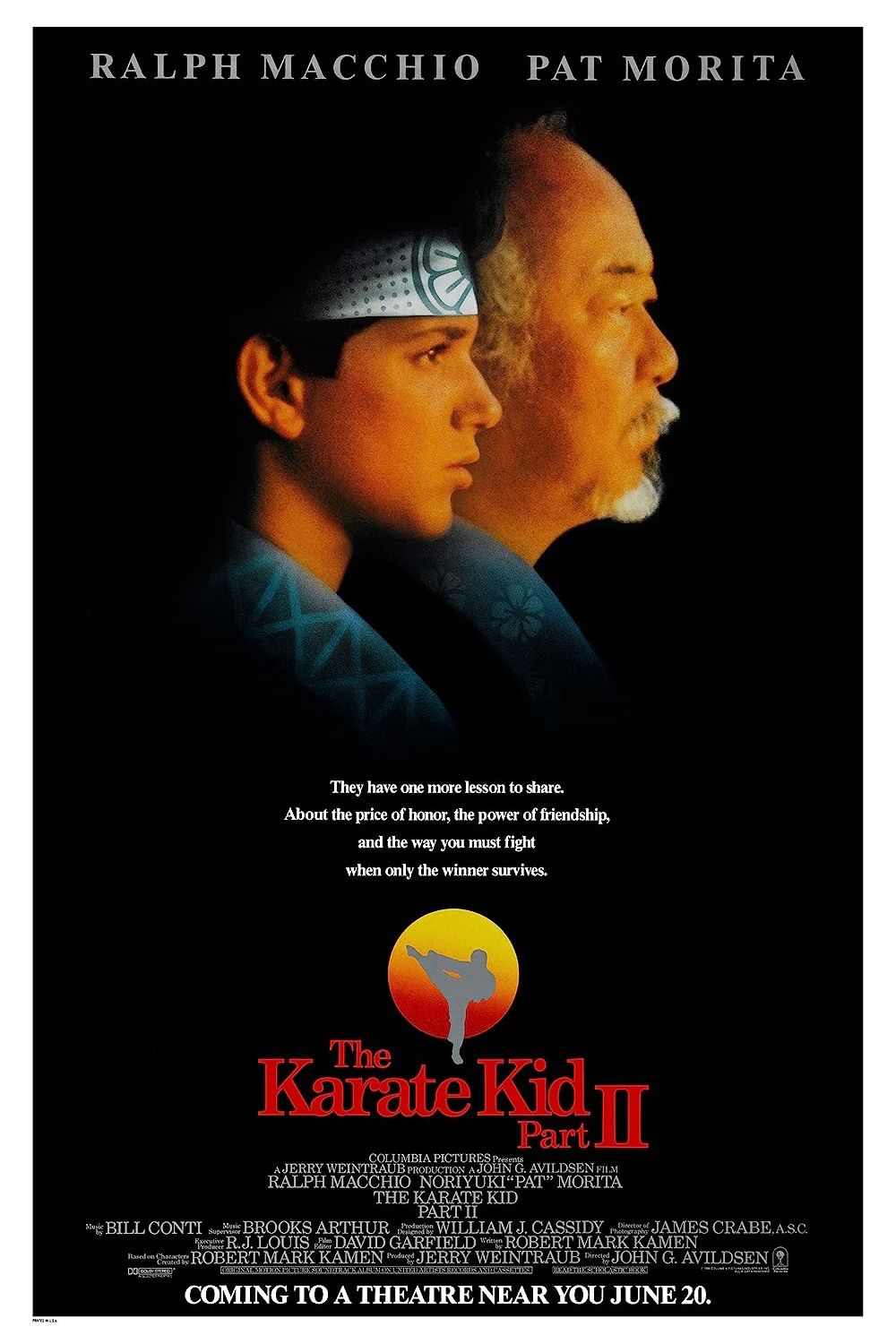

The Karate Kid Part Ii A Comparative Analysis Of The Film Series

May 23, 2025

The Karate Kid Part Ii A Comparative Analysis Of The Film Series

May 23, 2025 -

Connecting The Dots Cobra Kais Continuity And Its Impact On The Karate Kid Universe

May 23, 2025

Connecting The Dots Cobra Kais Continuity And Its Impact On The Karate Kid Universe

May 23, 2025 -

Review Of The Karate Kid Part Ii Thirty Years Later

May 23, 2025

Review Of The Karate Kid Part Ii Thirty Years Later

May 23, 2025 -

Analyzing Cobra Kai Maintaining Continuity Across Multiple Karate Kid Generations

May 23, 2025

Analyzing Cobra Kai Maintaining Continuity Across Multiple Karate Kid Generations

May 23, 2025