Recent Developments Affecting CoreWeave Stock Price

Table of Contents

CoreWeave, a prominent player in the rapidly growing cloud computing market, has experienced notable stock price volatility recently. This article delves into the major developments shaping CoreWeave's share value, offering insights for investors and those interested in the company's trajectory. We will examine key factors contributing to these fluctuations, providing a comprehensive overview of the current market landscape for CoreWeave. Understanding these influences is crucial for navigating the complexities of this dynamic tech stock.

CoreWeave's Recent Financial Performance and Earnings Reports

Revenue Growth and Profitability

CoreWeave's recent earnings reports reveal a complex picture of its financial health. Analyzing revenue growth and profitability is crucial to understanding the fluctuations in its stock price. While precise figures require accessing official financial statements, we can examine general trends. For example, comparing year-over-year revenue growth will illustrate the company's expansion rate.

- Revenue Growth: Has CoreWeave experienced consistent revenue growth, or have there been periods of deceleration? A strong, sustained increase typically signals positive investor sentiment.

- Profitability Margins: Analyzing profit margins (gross profit margin, operating margin, net profit margin) provides insights into CoreWeave's efficiency and cost management. Improving margins often lead to a higher stock valuation.

- Comparison to Previous Quarters/Years: Analyzing trends over time provides a clearer picture than looking at single data points. Are the recent numbers in line with historical performance, or is there a significant deviation?

- Analyst Expectations: Comparing CoreWeave's actual financial results to analysts' expectations reveals whether the company has met or exceeded market predictions. Significant discrepancies can significantly impact the stock price.

Key Financial Metrics and Investor Sentiment

Beyond revenue and profit, several key financial metrics influence investor sentiment toward CoreWeave.

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): EBITDA provides a measure of a company's operating performance, excluding the impact of financing and accounting decisions. A strong EBITDA indicates robust operational efficiency.

- Cash Flow: Positive cash flow demonstrates CoreWeave's ability to generate cash from its operations, a vital indicator of financial health and sustainability.

- Debt Levels: High debt levels can increase financial risk and potentially deter investors. Analyzing CoreWeave's debt-to-equity ratio offers insights into its financial leverage.

- Analyst Ratings and Stock Price Movements: Tracking analyst ratings and observing stock price reactions to earnings reports and news announcements helps gauge overall investor confidence.

Strategic Partnerships and Business Developments

New Partnerships and Collaborations

Strategic partnerships can significantly impact CoreWeave's stock price. New alliances can expand its market reach, enhance its technological capabilities, and boost revenue streams.

- Specific Partners: Identifying the key partners and the nature of their collaborations is essential. Partnerships with major technology companies or industry leaders often signal positive growth prospects.

- Impact on Revenue and Market Position: Analyzing the potential revenue increase and market share gains resulting from these partnerships is critical. Synergistic collaborations can unlock substantial value for CoreWeave.

Product Launches and Innovation

Innovation is crucial for success in the dynamic cloud computing market. New product launches and technological advancements can drive revenue growth and attract investors.

- Market Impact of New Products: Evaluating the potential market demand and competitive advantage offered by CoreWeave's new offerings is vital. Disruptive technologies can significantly boost its stock price.

- Analyst and Investor Perception: How are these new products or technologies perceived by industry analysts and investors? Positive reviews and market enthusiasm can translate into increased stock value.

Macroeconomic Factors and Industry Trends

Impact of the Overall Tech Market

The broader technology market significantly influences CoreWeave's stock price. Overall market sentiment, investor confidence, and economic conditions all play a role.

- Cloud Computing Sector Performance: The overall performance of the cloud computing sector is a key indicator. Positive industry trends generally benefit CoreWeave.

- Interest Rate Hikes and Macroeconomic Factors: Interest rate hikes and other macroeconomic factors like inflation and recessionary fears can negatively impact investor appetite for technology stocks, including CoreWeave.

Competitive Landscape and Market Share

Analyzing CoreWeave's competitive landscape and market share is essential. Intense competition can pressure profit margins and hinder growth.

- Competitive Threats: Identifying key competitors and analyzing their strengths and weaknesses helps understand the challenges facing CoreWeave.

- Market Share Changes: Tracking CoreWeave's market share over time indicates its success in gaining and maintaining its position within the industry.

Conclusion

CoreWeave's recent stock price fluctuations are a result of the interplay between its financial performance, strategic partnerships, product innovation, and broader macroeconomic factors. Strong revenue growth, healthy profit margins, strategic collaborations, and successful product launches contribute to positive investor sentiment and stock price appreciation. Conversely, economic downturns, increased competition, and disappointing financial results can negatively impact the stock. Understanding these factors is crucial for investors looking to assess the future trajectory of CoreWeave's stock price.

Call to Action: Stay informed on the latest developments affecting CoreWeave stock price by regularly checking reputable financial news sources and conducting your own thorough research. Understanding these factors is crucial for making well-informed investment decisions regarding CoreWeave and other similar cloud computing stocks. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Real Madrid In Ancelotti Sonrasi Plani Yeni Teknik Direktoer Kim Olacak

May 22, 2025

Real Madrid In Ancelotti Sonrasi Plani Yeni Teknik Direktoer Kim Olacak

May 22, 2025 -

Discover Provence A Hiking Itinerary From Mountains To Mediterranean

May 22, 2025

Discover Provence A Hiking Itinerary From Mountains To Mediterranean

May 22, 2025 -

Outrun Movie Michael Bay Directs Sydney Sweeney Cast

May 22, 2025

Outrun Movie Michael Bay Directs Sydney Sweeney Cast

May 22, 2025 -

Lucy Connolly Appeal Fails In Racial Hatred Case

May 22, 2025

Lucy Connolly Appeal Fails In Racial Hatred Case

May 22, 2025 -

Gas Buddy Reports Decline In Average Gasoline Prices Across Virginia

May 22, 2025

Gas Buddy Reports Decline In Average Gasoline Prices Across Virginia

May 22, 2025

Latest Posts

-

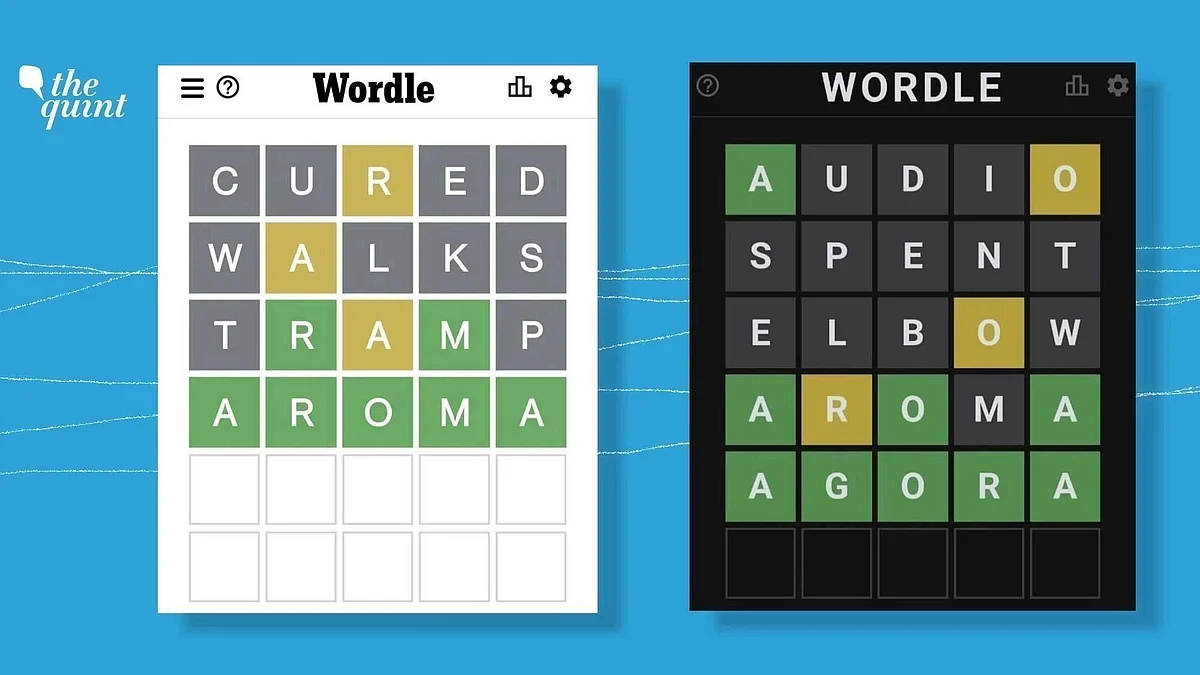

Wordle 1358 Hints And Solution For March 8th

May 22, 2025

Wordle 1358 Hints And Solution For March 8th

May 22, 2025 -

Nyt Wordle March 26 Solution And Analysis

May 22, 2025

Nyt Wordle March 26 Solution And Analysis

May 22, 2025 -

Wordle Help Solving Todays March 26 Nyt Wordle Puzzle

May 22, 2025

Wordle Help Solving Todays March 26 Nyt Wordle Puzzle

May 22, 2025 -

Tough Wordle Today March 26 Nyt Wordle Answer Revealed

May 22, 2025

Tough Wordle Today March 26 Nyt Wordle Answer Revealed

May 22, 2025 -

Nyt Wordle Solution For March 26 Tips And Hints

May 22, 2025

Nyt Wordle Solution For March 26 Tips And Hints

May 22, 2025