Recent Chinese Stock Market Increase: A Result Of US Discussions And Key Economic Data

Table of Contents

The Impact of US-China Discussions on Market Sentiment

The fluctuating relationship between the US and China significantly impacts global markets, and the recent Chinese stock market increase is no exception. Improved relations and easing trade tensions have played a crucial role in boosting investor confidence.

Easing Trade Tensions

Recent positive developments in US-China trade negotiations have contributed significantly to the improved market sentiment. The reduction in trade tensions reduces uncertainty for businesses operating in both countries, encouraging investment and stimulating economic activity.

- Phase One Trade Deal: The signing of the Phase One trade deal in early 2020 marked a significant de-escalation in the trade war, leading to a noticeable increase in Chinese stock market indices.

- Reduced Tariffs: Subsequent announcements regarding tariff reductions further boosted investor confidence, signaling a potential move towards more stable and predictable trade relations.

- Increased Communication: Improved communication channels between the two governments, facilitating dialogue and conflict resolution, have also contributed to a more positive market outlook. For example, the increase in high-level meetings and discussions has demonstrably reduced volatility.

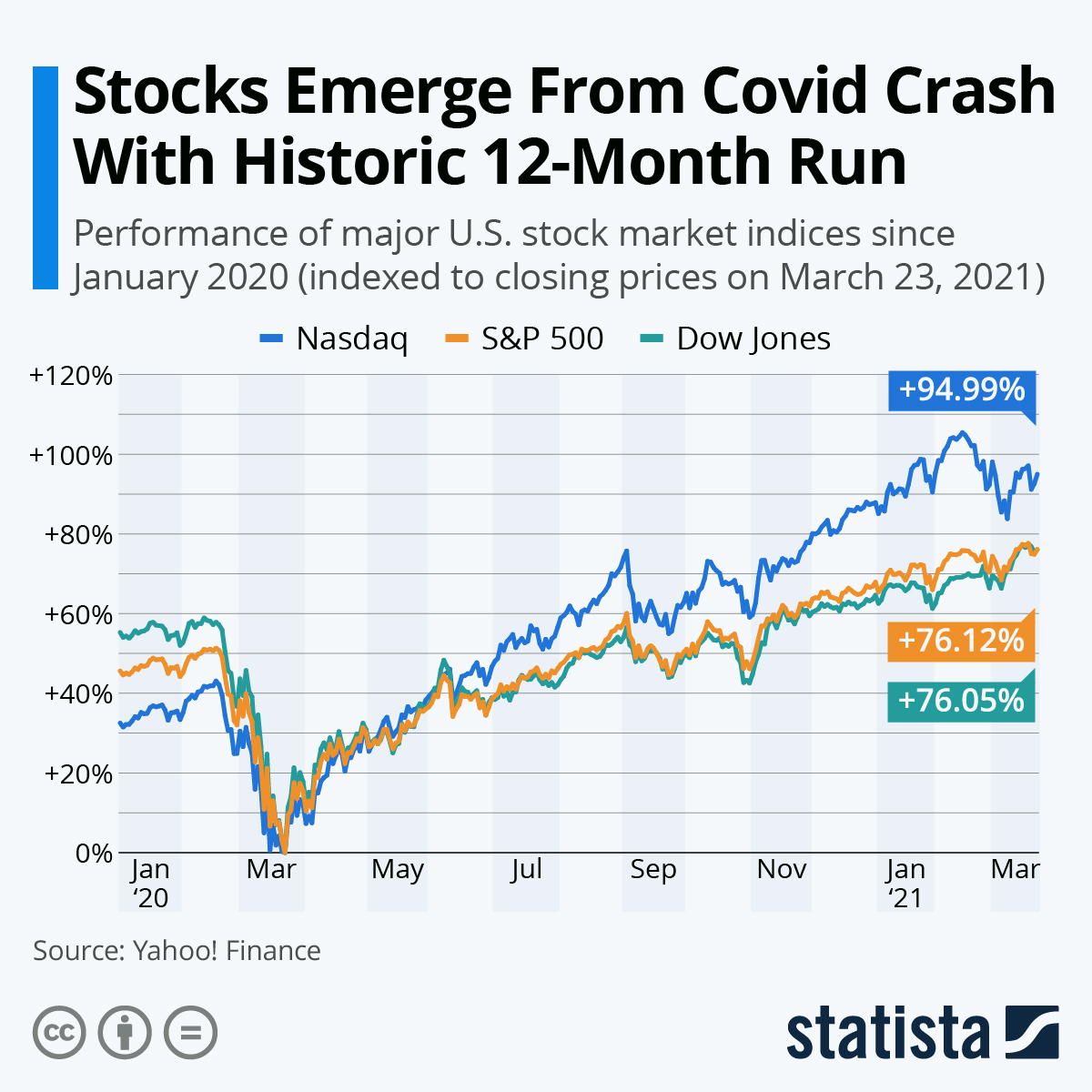

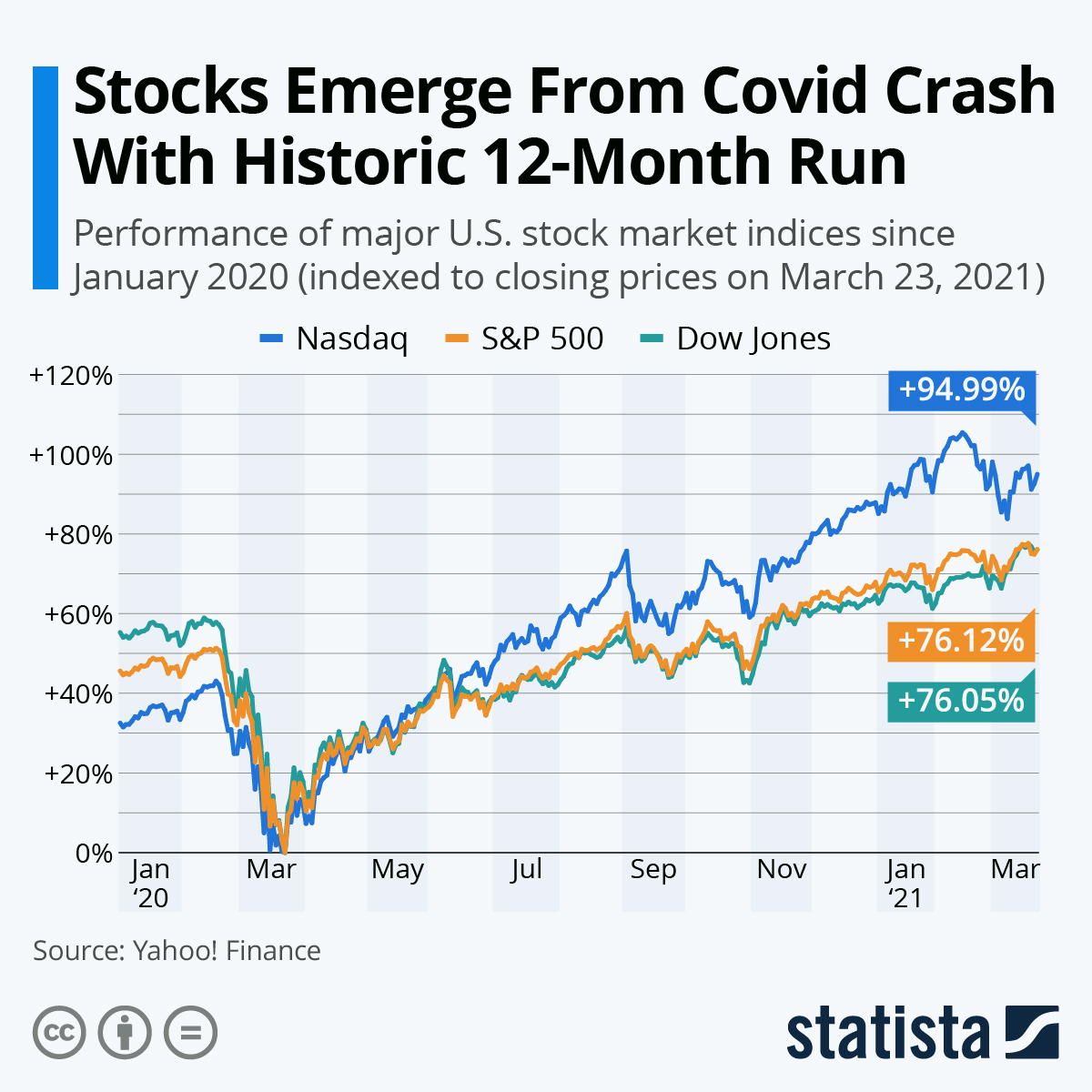

Data shows a clear correlation between positive announcements regarding US-China trade and increases in key Chinese stock market indices like the Shanghai Composite Index and the Shenzhen Component Index. Analysis reveals a significant uptick following major breakthroughs in negotiations.

Improved Diplomatic Relations

Beyond trade, improvements in overall diplomatic relations between the US and China have further fueled the recent Chinese stock market increase. Reduced geopolitical uncertainty fosters a more favorable environment for foreign investment.

- High-Level Diplomatic Visits: Increased high-level diplomatic visits and exchanges between the two countries signal a willingness to cooperate on global issues.

- Joint Statements on Cooperation: Joint statements focusing on areas of mutual interest, such as climate change or global health, demonstrate a commitment to collaboration, reducing the perception of risk for investors.

- Reduced Rhetorical Hostility: A noticeable decrease in aggressive rhetoric from both sides has created a more stable and predictable geopolitical landscape, contributing to investor confidence.

The potential future implications of improved US-China relations are significant. Continued cooperation could lead to sustained foreign investment and further growth in the Chinese stock market.

Key Economic Data Fueling the Market Rise

Beyond geopolitical factors, positive economic data releases from China have played a vital role in driving the recent stock market increase. Stronger-than-expected economic indicators suggest a healthy and resilient economy, encouraging investment.

Positive GDP Growth

Recent GDP growth figures have exceeded expectations, signaling a robust economic recovery. This positive trend has significantly boosted investor confidence.

- Stronger-than-expected Q[Insert Quarter] Growth: China's GDP growth in [Insert Quarter] surpassed analysts' forecasts, indicating a strong rebound from previous economic challenges.

- Industrial Production Increase: Increased industrial production demonstrates robust activity in the manufacturing sector, a key driver of economic growth.

- Rising Retail Sales: Strong growth in retail sales signifies increased consumer spending and confidence in the economy.

Compared to previous quarters or years, the current economic growth figures paint a picture of significant improvement, reinforcing the positive market sentiment.

Strong Consumer Spending

Robust consumer spending is a crucial indicator of a healthy economy and a key driver of the recent market rise. Increased consumer activity reflects confidence in the future and stimulates further economic growth.

- Increased Retail Sales in Key Sectors: Significant increases in retail sales across various sectors, including automobiles and electronics, show strong consumer demand.

- Growing Tourism: A resurgence in domestic and international tourism further indicates a healthy economy and increased consumer spending.

- Rising Disposable Incomes: Increases in disposable incomes contribute to greater purchasing power, fueling consumer spending.

Government Policies and Initiatives

The Chinese government has implemented several policies and initiatives aimed at stimulating economic growth, which has further bolstered investor confidence and contributed to the recent market increase.

- Infrastructure Spending: Significant investment in infrastructure projects creates jobs and stimulates economic activity.

- Tax Cuts and Incentives: Targeted tax cuts and incentives for businesses encourage investment and expansion.

- Support for High-Tech Industries: Government support for the development of high-tech industries fosters innovation and economic growth.

The potential long-term impact of these policies is substantial. Continued government support for economic growth could lead to sustained market performance.

Conclusion

In conclusion, the recent Chinese stock market increase is a result of a confluence of factors, primarily driven by improved US-China discussions and positive economic data releases. Easing trade tensions, strengthened diplomatic relations, robust GDP growth, strong consumer spending, and supportive government policies have all contributed to increased investor confidence and market optimism. While potential risks and challenges remain, the current trend suggests a positive outlook for the Chinese stock market in the near term. To better understand future fluctuations in the recent Chinese stock market increase, stay informed about developments in US-China relations and key Chinese economic indicators. Consult reputable financial news sources and market analysis tools for continued updates and in-depth information.

Featured Posts

-

Hydrogen Vs Battery Buses A European Transit Comparison

May 07, 2025

Hydrogen Vs Battery Buses A European Transit Comparison

May 07, 2025 -

Ks Sliwinski Tajemnice Konklawe I Wybor Papieza

May 07, 2025

Ks Sliwinski Tajemnice Konklawe I Wybor Papieza

May 07, 2025 -

Ayesha Howard Awarded Custody After Paternity Dispute With Anthony Edwards

May 07, 2025

Ayesha Howard Awarded Custody After Paternity Dispute With Anthony Edwards

May 07, 2025 -

Ed Sheeran Reveals Special Bond With Rihanna

May 07, 2025

Ed Sheeran Reveals Special Bond With Rihanna

May 07, 2025 -

E Bay And Section 230 Legal Implications Of Selling Banned Chemicals

May 07, 2025

E Bay And Section 230 Legal Implications Of Selling Banned Chemicals

May 07, 2025

Latest Posts

-

Celtics Vs Cavaliers A Prediction For Game Game Number

May 07, 2025

Celtics Vs Cavaliers A Prediction For Game Game Number

May 07, 2025 -

Safeguarding Your Brand A Trademark Guide For March Madness

May 07, 2025

Safeguarding Your Brand A Trademark Guide For March Madness

May 07, 2025 -

Mitchells Dominance Cleveland Cavaliers Triumph Over Brooklyn Nets

May 07, 2025

Mitchells Dominance Cleveland Cavaliers Triumph Over Brooklyn Nets

May 07, 2025 -

Cavaliers Defeat Grizzlies Extend Win Streak To Franchise Record 16 Games With Mobleys Help

May 07, 2025

Cavaliers Defeat Grizzlies Extend Win Streak To Franchise Record 16 Games With Mobleys Help

May 07, 2025 -

Can The Celtics Defeat The Cavaliers At Home Prediction And Preview

May 07, 2025

Can The Celtics Defeat The Cavaliers At Home Prediction And Preview

May 07, 2025