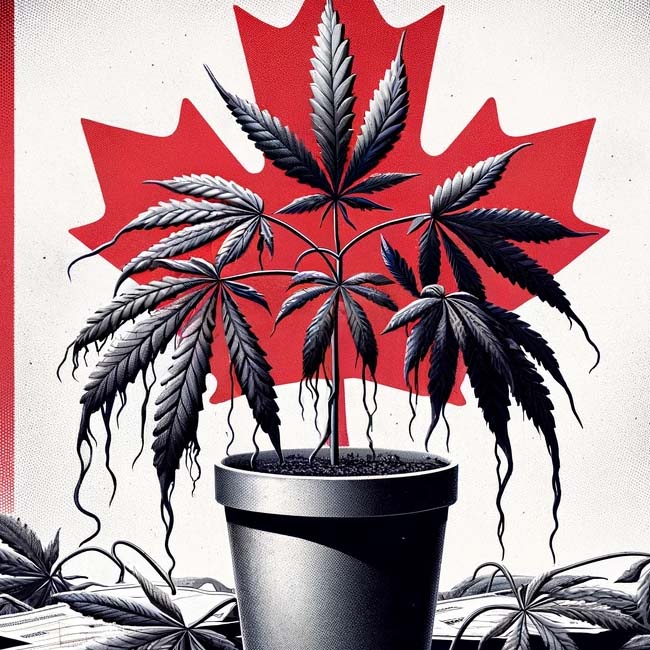

Rebalancing Canadian Ownership: Reducing U.S. Dominance

Table of Contents

The Current State of U.S. Investment in Canada

The substantial presence of U.S. companies in Canada raises questions about the country's economic independence. Understanding the extent of this influence is crucial for developing effective strategies to rebalance Canadian ownership.

Key Sectors Dominated by U.S. Companies

U.S. companies hold significant sway in several key sectors of the Canadian economy, impacting jobs, innovation, and overall economic growth.

- Energy: Major U.S. oil and gas companies have extensive operations in Alberta and other provinces, controlling significant portions of resource extraction and processing. This dominance can influence energy policy and pricing, limiting Canada's ability to independently chart its energy future.

- Technology: The tech sector sees considerable U.S. investment, particularly in software, data analytics, and artificial intelligence. This translates to significant market share and influence on innovation and technological advancements within Canada.

- Finance: U.S. financial institutions hold a substantial presence in Canadian banking and investment, impacting capital flows and lending practices. This concentration can create vulnerabilities in the Canadian financial system.

The consequences of this concentrated U.S. presence are multifaceted:

- Job creation skewed towards U.S. interests: While some jobs are created, the overall impact on Canadian job creation and the quality of those jobs might not always align with Canadian economic goals.

- Limited Canadian innovation: Dominance by established U.S. firms can stifle the growth and development of Canadian companies and innovative ideas.

- Vulnerability to U.S. economic cycles: The Canadian economy becomes more susceptible to fluctuations in the U.S. economy, creating instability.

Impact on Canadian Economic Sovereignty

The high level of U.S. investment significantly impacts Canada's ability to independently shape its economic policies.

- Limited policy flexibility: Canada's ability to implement policies that prioritize Canadian interests might be constrained by the need to maintain positive relationships with large U.S. investors.

- Vulnerability to external pressures: The dependence on U.S. investment creates potential vulnerabilities to political and economic pressures emanating from the United States.

- Reduced control over strategic sectors: U.S. dominance in key sectors reduces Canada's control over essential resources and industries, limiting its ability to strategically direct its economic development.

Strategies for Rebalancing Canadian Ownership

Rebalancing Canadian ownership requires a multi-pronged approach focusing on promoting domestic investment, strengthening regulations, and empowering Canadian institutions.

Promoting Canadian Investment and Entrepreneurship

Several measures can encourage domestic investment and foster the growth of Canadian businesses.

- Tax incentives for Canadian investors: Offering tax breaks and other incentives can make investing in Canadian businesses more attractive for domestic investors.

- Funding for Canadian startups: Increased government funding and venture capital initiatives can support the growth of innovative Canadian startups.

- Support for SMEs: Targeted programs designed to support small and medium-sized enterprises (SMEs) can boost their competitiveness and help them compete with larger foreign entities.

- Entrepreneurial skills education: Investing in education and training programs that foster entrepreneurial skills will build a stronger base of Canadian entrepreneurs.

Strengthening Regulations on Foreign Investment

Adjustments to foreign investment regulations are necessary to ensure a more balanced approach.

- Increased scrutiny of acquisitions: Implementing stricter review processes for acquisitions of Canadian companies in strategic sectors is vital.

- Foreign ownership limits: Establishing clearer limits on foreign ownership in sensitive sectors can safeguard Canadian interests.

- Enhanced transparency requirements: Increasing transparency requirements for foreign investors will promote accountability and prevent clandestine acquisitions.

Encouraging Canadian Pension Fund Investments in Domestic Companies

Canadian pension funds play a crucial role in supporting domestic businesses.

- Incentivizing domestic investments: Policies incentivizing pension funds to prioritize investments in Canadian companies would channel more capital into the Canadian economy.

- Reducing reliance on foreign assets: Strategies to reduce the reliance of pension funds on foreign assets will lessen vulnerability to global economic uncertainties.

- Long-term economic growth: Increased investment in Canadian businesses by pension funds supports long-term economic growth and job creation.

The Importance of Maintaining Positive U.S.-Canada Relations

Rebalancing Canadian ownership does not necessitate isolationism; it is about strategic management.

Balancing Economic Sovereignty with International Cooperation

Maintaining a strong bilateral relationship with the U.S. remains crucial, even as Canada works to strengthen its economic sovereignty.

- Benefits of trade and collaboration: Continued collaboration with the U.S. through trade agreements and other partnerships is essential for economic growth.

- Navigating regulatory challenges: Open communication and collaboration with the U.S. are critical in navigating potential challenges arising from increased regulations on foreign investment.

Conclusion

Rebalancing Canadian ownership and reducing U.S. dominance is not about rejecting foreign investment, but about managing it strategically to safeguard Canada's economic future. By implementing the strategies outlined above—promoting Canadian investment, strengthening regulations, and encouraging domestic pension fund investments—Canada can foster a more balanced and resilient economy. This requires a long-term commitment from government, businesses, and individuals to prioritize Canadian ownership and strengthen Canadian economic sovereignty. Let's work together to reclaim control and build a stronger, more independent Canadian economy through responsible strategies for rebalancing Canadian ownership and fostering greater Canadian control over key sectors.

Featured Posts

-

Pakistans Rise In Global Crypto Pccs 50 Day Strategy

May 29, 2025

Pakistans Rise In Global Crypto Pccs 50 Day Strategy

May 29, 2025 -

Donde Ver El Real Zaragoza Eibar Online Guia Completa La Liga Hyper Motion

May 29, 2025

Donde Ver El Real Zaragoza Eibar Online Guia Completa La Liga Hyper Motion

May 29, 2025 -

Rally Ban Dominates French Elections As Le Pen Claims Political Persecution

May 29, 2025

Rally Ban Dominates French Elections As Le Pen Claims Political Persecution

May 29, 2025 -

Kunst Und Vintagemarkt Belebt Koeln Bickendorf Coty Gelaende Im Neuen Glanz

May 29, 2025

Kunst Und Vintagemarkt Belebt Koeln Bickendorf Coty Gelaende Im Neuen Glanz

May 29, 2025 -

Hollywoods Double Strike What It Means For Film And Television

May 29, 2025

Hollywoods Double Strike What It Means For Film And Television

May 29, 2025