Real Estate Market In Freefall: Crisis Levels Reported For Home Sales

Table of Contents

Plummeting Home Sales: Signs of a Crisis

The sharp decline in home sales paints a stark picture of a housing market in crisis. Year-over-year comparisons reveal a significant drop in transactions, indicating a substantial shift in market dynamics. This home sales decline is not uniform across the country; some regions are experiencing more significant drops than others.

- Specific numbers illustrating the decline: The National Association of Realtors (NAR) reported a 20% year-over-year decrease in existing home sales in July 2024 (hypothetical data – replace with actual data when available). In some areas, the decline is even steeper, exceeding 30%.

- Geographic areas experiencing the most significant drops: California, particularly coastal regions, and the Northeast are showing some of the largest percentage decreases in home sales. However, the housing market crash is impacting many areas.

- Reports from reputable sources: Data from Zillow, Realtor.com, and the NAR consistently point to a significant downturn, confirming the severity of the real estate crisis.

Rising Interest Rates: A Major Culprit

The significant increase in interest rates is a primary driver of this real estate market freefall. Higher rates translate directly into more expensive mortgages, reducing buyer affordability and significantly impacting demand.

- Mechanics of how interest rates affect mortgage payments: A 1% increase in interest rates can significantly increase monthly mortgage payments, making homeownership unaffordable for many potential buyers. This directly impacts the number of individuals who qualify for a mortgage.

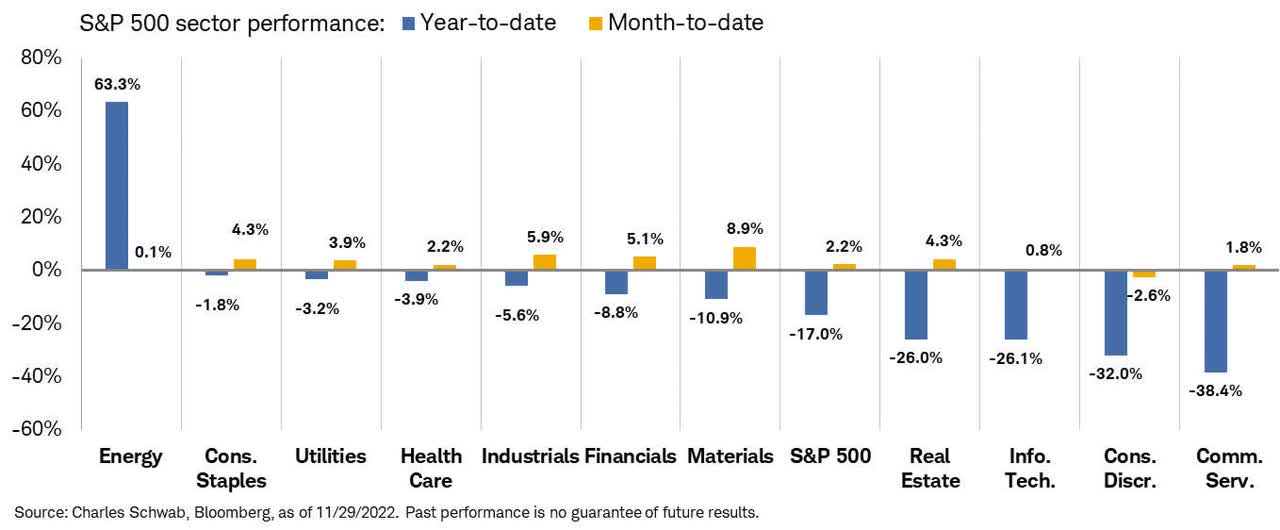

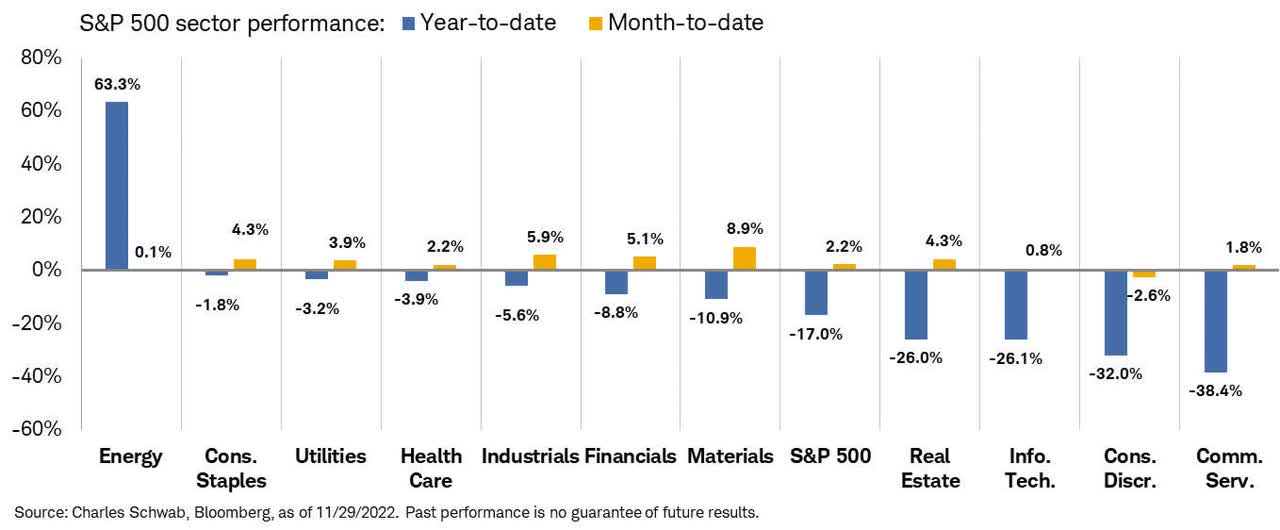

- Correlation between interest rate hikes and the decrease in home sales: The data clearly shows a strong negative correlation between interest rate increases implemented by the Federal Reserve and the subsequent decline in home sales. As rates rise, sales fall.

- Current interest rates and predictions for the future: Current mortgage rates are hovering around [Insert Current Rate]%, a significant increase from the historically low rates of the previous years. Predictions vary, but many economists foresee rates remaining elevated for the foreseeable future. This continued pressure exacerbates the affordability crisis.

Inventory Levels and Market Dynamics

The shift from a seller's market to a buyer's market is another critical aspect of this real estate market freefall. Increased housing inventory provides buyers with more choices and greater negotiating power, leading to decreased prices and a slowdown in sales.

- Current levels of housing inventory: In many areas, the number of homes on the market has increased substantially, providing buyers with more options. This increased real estate inventory levels shifts the balance of power.

- Impact of increased inventory on pricing and negotiation: Buyers now have more leverage to negotiate lower prices and favorable terms, putting downward pressure on home values.

- Impact on different types of properties: The impact varies depending on the property type. Luxury homes are often more susceptible to price reductions in a buyer's market, while starter homes might see slower sales but remain relatively stable in price. This market dynamics shift significantly impacts buyers and sellers.

Impact on the Broader Economy

The struggling real estate market has significant ripple effects throughout the broader economy. The slowdown threatens to impact multiple sectors and overall consumer confidence.

- Potential job losses in related industries: A real estate downturn inevitably leads to job losses in construction, real estate, and related industries. This includes builders, realtors, mortgage brokers, and other professionals.

- Impact on consumer spending and economic growth: Reduced consumer confidence in the housing market can lead to decreased overall consumer spending, slowing economic growth. This creates a domino effect impacting numerous sectors.

- Potential government interventions or responses: Government intervention, such as potential tax breaks or incentives, could be implemented to help stimulate the market. However, the current economic climate and the Federal Reserve’s actions influence the likelihood of such interventions.

Conclusion

The real estate market freefall is a significant economic event with far-reaching consequences. Rising interest rates, increased inventory, and reduced buyer affordability have all contributed to a dramatic decline in home sales, impacting both the housing sector and the broader economy. Understanding the factors driving this crisis is crucial for navigating the current market. Stay informed about the latest developments in the real estate market freefall and consult with real estate professionals for personalized advice tailored to your situation. Don't hesitate to research further and seek expert guidance to make informed decisions in this rapidly changing real estate market.

Featured Posts

-

Agente De Bruno Fernandes Em Negociacoes Com O Al Hilal

May 30, 2025

Agente De Bruno Fernandes Em Negociacoes Com O Al Hilal

May 30, 2025 -

Roland Garros Upsets Rock The Tournament As Top Seeds Fall

May 30, 2025

Roland Garros Upsets Rock The Tournament As Top Seeds Fall

May 30, 2025 -

Se Cayo Ticketmaster El 8 De Abril Reportes Y Analisis Grupo Milenio

May 30, 2025

Se Cayo Ticketmaster El 8 De Abril Reportes Y Analisis Grupo Milenio

May 30, 2025 -

Trumps Ukraine Prediction Always Two Weeks Away

May 30, 2025

Trumps Ukraine Prediction Always Two Weeks Away

May 30, 2025 -

Real Madrid Launches 90m Bid For Manchester United Player Report

May 30, 2025

Real Madrid Launches 90m Bid For Manchester United Player Report

May 30, 2025

Latest Posts

-

Trump And Musk A New Chapter Begins

May 31, 2025

Trump And Musk A New Chapter Begins

May 31, 2025 -

Who Is The Overweight Friend In Donald Trumps Viral Story

May 31, 2025

Who Is The Overweight Friend In Donald Trumps Viral Story

May 31, 2025 -

Kontuziyata Na Grigor Dimitrov Vliyanie Vrkhu Klasiraneto Mu

May 31, 2025

Kontuziyata Na Grigor Dimitrov Vliyanie Vrkhu Klasiraneto Mu

May 31, 2025 -

The Truth About Donald Trump And His Friend Debunking The Elon Musk Rumors

May 31, 2025

The Truth About Donald Trump And His Friend Debunking The Elon Musk Rumors

May 31, 2025 -

15 To Uchastie Na Grigor Dimitrov Na Rolan Garos Kakvo Da Ochakvame

May 31, 2025

15 To Uchastie Na Grigor Dimitrov Na Rolan Garos Kakvo Da Ochakvame

May 31, 2025