RBC's Q[Quarter] Earnings Fall Short: Impact Of Potential Loan Losses

![RBC's Q[Quarter] Earnings Fall Short: Impact Of Potential Loan Losses RBC's Q[Quarter] Earnings Fall Short: Impact Of Potential Loan Losses](https://genussprofessional.de/image/rbcs-q-quarter-earnings-fall-short-impact-of-potential-loan-losses.jpeg)

Table of Contents

RBC Q3 Earnings: A Detailed Breakdown

Key Financial Metrics

RBC's Q3 2024 earnings painted a concerning picture. The bank reported a net income of [Insert Actual Net Income Figure], significantly lower than the [Insert Analyst Prediction Figure] predicted by analysts and a [Insert Percentage]% decrease compared to Q2 2024's net income of [Insert Q2 Net Income]. Earnings per share (EPS) also fell short of expectations, registering at [Insert EPS Figure] compared to the anticipated [Insert Analyst Prediction Figure]. Return on equity (ROE), a key measure of profitability, dropped to [Insert ROE Figure]%, indicating a decline in the bank's efficiency in generating profits from shareholder investments. Revenue, while still substantial at [Insert Revenue Figure], also showed a [Insert Percentage]% decrease year-over-year.

- Net Income: [Insert Actual Net Income Figure] (vs. Analyst Prediction: [Insert Analyst Prediction Figure])

- EPS: [Insert EPS Figure] (vs. Analyst Prediction: [Insert Analyst Prediction Figure])

- ROE: [Insert ROE Figure]% (vs. Previous Quarter: [Insert Previous Quarter ROE])

- Revenue: [Insert Revenue Figure] (YoY Change: [Insert Percentage]%)

Impact on Stock Price

The market reacted negatively to RBC's Q3 earnings announcement. The bank's stock price experienced a [Insert Percentage]% drop immediately following the release, falling from [Insert Stock Price Before Announcement] to [Insert Stock Price After Announcement]. Trading volume also spiked significantly, indicating heightened investor activity and concern. Several analysts downgraded their ratings for RBC stock, reflecting a pessimistic outlook on the bank's short-term prospects.

- Stock Price (Pre-Announcement): [Insert Stock Price Before Announcement]

- Stock Price (Post-Announcement): [Insert Stock Price After Announcement]

- Percentage Change: [Insert Percentage]%

- Trading Volume: [Insert Trading Volume Data - e.g., Significantly Increased]

The Rise in Potential Loan Losses: Identifying the Causes

Economic Headwinds

The significant increase in RBC's provision for credit losses is directly linked to several macroeconomic headwinds. Soaring inflation, aggressive interest rate hikes by the central bank, and growing recessionary fears are creating a challenging environment for borrowers. This is particularly impacting sectors like real estate, where higher mortgage rates are increasing the risk of defaults. Consumer loans are also showing signs of increased stress as consumers grapple with rising costs of living. Commercial loans, especially those to smaller businesses, are vulnerable due to reduced consumer spending.

- Inflation Rate: [Insert Current Inflation Rate]

- Interest Rate: [Insert Current Interest Rate]

- GDP Growth Forecast: [Insert GDP Growth Forecast]

- Vulnerable Sectors: Real Estate, Consumer Goods, Small Businesses

RBC's Provision for Credit Losses

RBC significantly increased its provision for credit losses in Q3 to [Insert Provision Amount], reflecting the bank's anticipation of a rise in loan defaults. This provision, a non-cash expense, represents the bank's estimate of potential losses from loans that might not be repaid. Compared to the [Insert Previous Quarter Provision Amount] provision in Q2, this represents a substantial increase of [Insert Percentage]%, directly impacting the bank's reported net income. This proactive measure underscores the bank's concern about the deteriorating economic climate and its potential impact on loan repayment rates.

- Q3 Provision for Credit Losses: [Insert Provision Amount]

- Q2 Provision for Credit Losses: [Insert Previous Quarter Provision Amount]

- Percentage Increase: [Insert Percentage]%

- Impact on Net Income: [Explain the direct impact on net income]

Looking Ahead: Implications for RBC and the Banking Sector

Future Outlook and Guidance

RBC's management expressed caution regarding the outlook for the coming quarters, acknowledging the persistent economic uncertainties and the potential for further increases in loan losses. The bank has provided revised guidance for [Insert relevant financial metric], reflecting a more conservative forecast. RBC is also reportedly reviewing and potentially adjusting its lending practices and risk management strategies to mitigate future losses. This includes more stringent credit checks and a potentially more cautious approach to lending in vulnerable sectors.

- Revised Guidance: [Summarize RBC's revised financial guidance]

- Changes in Lending Practices: [Mention any changes in lending policies]

- Enhanced Risk Management: [Highlight any improvements in risk management strategies]

Broader Implications for the Banking Industry

RBC's Q3 results and rising loan losses highlight a broader concern within the Canadian banking sector. While RBC remains a financially strong institution, the challenges it faces are indicative of the potential pressures on the entire industry. Other Canadian banks may face similar headwinds, leading to increased provisions for credit losses and potentially impacting their profitability. The overall health of the Canadian banking sector will be closely monitored in the coming quarters.

- Overall Banking Sector Health: [Analyze the overall health of the Canadian Banking Sector]

- Potential Ripple Effects: [Discuss potential consequences of increased loan losses]

- Comparison to Other Banks: [Compare RBC's performance with other Canadian banks]

Conclusion

RBC's Q3 earnings fell short of expectations due to a significant increase in potential loan losses, largely attributed to challenging macroeconomic conditions including high inflation, rising interest rates, and recessionary fears. This has resulted in a considerable drop in net income and EPS, impacting the bank's stock price and prompting revised guidance. The situation highlights a broader concern for the Canadian banking sector and underscores the importance of monitoring economic trends and their impact on loan repayment rates.

Call to Action: Stay informed on the evolving financial landscape and the impact of potential loan losses on RBC and other Canadian banks. Follow [Your Website/Publication] for future updates on RBC earnings and analysis of the banking sector's performance. Continue reading to learn more about the impact of rising interest rates on the financial health of Canadian banks.

![RBC's Q[Quarter] Earnings Fall Short: Impact Of Potential Loan Losses RBC's Q[Quarter] Earnings Fall Short: Impact Of Potential Loan Losses](https://genussprofessional.de/image/rbcs-q-quarter-earnings-fall-short-impact-of-potential-loan-losses.jpeg)

Featured Posts

-

Rosemary And Thyme Essential Oils Benefits And Uses

May 31, 2025

Rosemary And Thyme Essential Oils Benefits And Uses

May 31, 2025 -

Receta Aragonesa De 3 Ingredientes Un Viaje Gastronomico Al Siglo Xix

May 31, 2025

Receta Aragonesa De 3 Ingredientes Un Viaje Gastronomico Al Siglo Xix

May 31, 2025 -

Cnn Data Chief Trumps Shifting Relationship With Elon Musk

May 31, 2025

Cnn Data Chief Trumps Shifting Relationship With Elon Musk

May 31, 2025 -

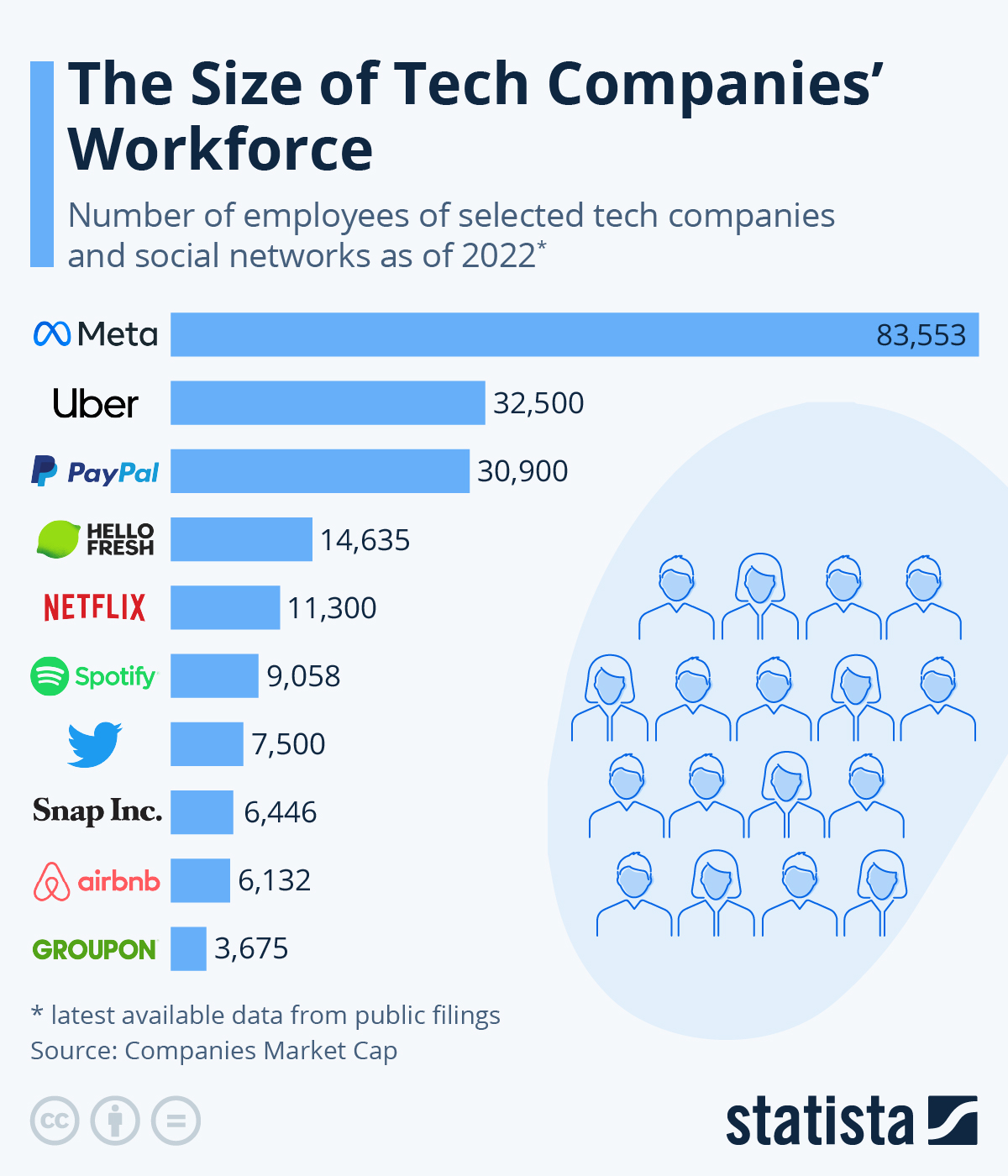

The Zuckerberg Trump Dynamic Implications For Meta And The Tech Industry

May 31, 2025

The Zuckerberg Trump Dynamic Implications For Meta And The Tech Industry

May 31, 2025 -

Cnns Data Chief Exposes The Evolution Of Trump Musk Relations

May 31, 2025

Cnns Data Chief Exposes The Evolution Of Trump Musk Relations

May 31, 2025