RBC Reports Lower Than Expected Earnings: Preparing For Increased Loan Defaults

Table of Contents

RBC's recent earnings report revealed lower-than-expected profits, sending ripples through the financial landscape. This surprising news is directly linked to a growing concern: rising loan defaults. The current economic climate, characterized by inflation, rising interest rates, and geopolitical uncertainty, is creating a perfect storm, increasing the financial risk for both individuals and businesses. Understanding this trend and preparing proactively is crucial for navigating the potential challenges ahead.

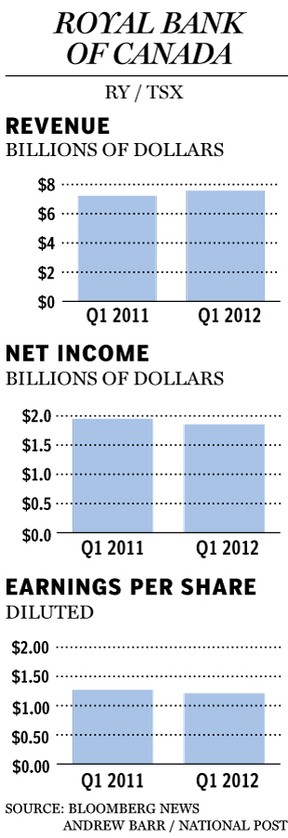

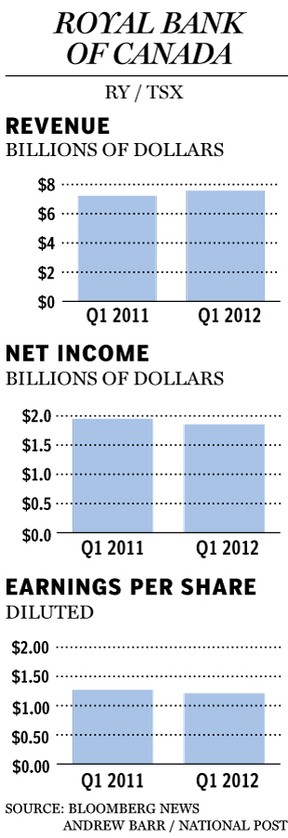

RBC's Q[Quarter] Earnings Report: A Detailed Analysis

Lower-Than-Expected Profit Margins: RBC's Q[Quarter] earnings report showed a significant dip in profitability, falling short of analysts' predictions. Several factors contributed to this decline. The official report, [link to official RBC earnings report], cites increased loan loss provisions as a primary driver.

- Reasons for decreased profit margins:

- Increased loan loss provisions due to anticipated defaults.

- Decreased investment banking revenue reflecting a slowdown in deal-making activity.

- Higher operating expenses due to inflationary pressures.

The report indicates a [Percentage]% decrease in profit margins compared to the same quarter last year, highlighting the seriousness of the situation. This points to a more cautious outlook within the bank regarding the broader economic landscape.

Increased Loan Loss Provisions: The most alarming aspect of RBC's report is the substantial increase in loan loss provisions. This suggests the bank anticipates a significant rise in loan defaults in the coming months.

- Sectors most affected:

- Commercial real estate, facing challenges with rising interest rates and potential oversupply.

- Consumer credit, as borrowers struggle with inflation and reduced purchasing power.

- Energy sector loans, facing volatility due to global events and price fluctuations.

RBC executives have commented on the increased provisions, stating [quote from RBC executives or analysts about rising loan default expectations]. This emphasizes the growing concern within the financial institution about the potential for widespread defaults. The implications for future profitability are substantial, underscoring the need for careful financial management.

Economic Factors Contributing to Rising Loan Defaults

Rising Interest Rates and Inflation: The current inflationary environment and the subsequent increase in interest rates are significantly impacting borrowers' ability to repay loans.

- Impact on different loan types:

- Mortgage payments are increasing, putting pressure on homeowners.

- Auto loan repayments are becoming more burdensome, leading to potential defaults.

- Credit card debt is accumulating faster, with higher interest charges exacerbating the problem.

This combination creates a challenging financial landscape, potentially leading to a broader economic slowdown. Current inflation rates are at [insert current inflation rate], and interest rate predictions suggest further increases are likely [cite relevant economic data and forecasts].

Geopolitical Uncertainty and Supply Chain Disruptions: Global events and ongoing supply chain disruptions are contributing to economic instability and increasing the risk of loan defaults.

- Specific examples of geopolitical events impacting the economy: [Examples: War in Ukraine, political instability in specific regions].

- Supply chain disruptions: These disruptions increase production costs and affect businesses' ability to meet their financial obligations, increasing the likelihood of defaults.

- Knock-on effects: These factors ripple through various sectors, impacting employment, consumer confidence, and overall economic growth, thereby increasing the risk of widespread loan defaults.

Strategies for Preparing for Increased Loan Defaults

Risk Management and Due Diligence: Mitigating the risk of loan defaults requires proactive strategies from both lenders and borrowers.

- Improved risk assessment methodologies: Lenders need to refine their credit scoring models and strengthen due diligence processes.

- Enhanced monitoring of borrower financial health: Regular monitoring of borrowers' financial situations can help identify potential problems early on.

- Diversification of loan portfolio: Diversifying across different loan types and sectors reduces the impact of defaults in a specific area.

Financial Planning and Contingency Measures: Individuals and businesses must implement robust financial plans to prepare for economic uncertainty.

- Budgeting and expense management strategies: Careful budgeting and expense management are crucial to navigate financial challenges.

- Debt consolidation and refinancing options: Exploring options to consolidate or refinance existing debt can help reduce monthly payments.

- Seeking professional financial advice: Consulting a financial advisor can provide personalized guidance and help develop a comprehensive financial plan.

Conclusion:

RBC's lower-than-expected earnings underscore the growing concern about rising loan defaults fueled by inflation, rising interest rates, and geopolitical uncertainty. The increased loan loss provisions highlight the significant risk the bank anticipates. Understanding the implications of RBC's financial outlook and preparing for increased loan defaults is crucial. Implementing proactive risk management strategies and robust financial planning are essential for individuals and businesses to navigate the potential economic challenges ahead. Take control of your financial future by seeking expert advice today! Mitigating the risk of loan defaults requires proactive measures and a thorough understanding of the current economic climate.

Featured Posts

-

Zverevs Upset Griekspoor Triumphs At Indian Wells

May 31, 2025

Zverevs Upset Griekspoor Triumphs At Indian Wells

May 31, 2025 -

The Private Credit Hiring Boom 5 Dos And Don Ts To Get Hired

May 31, 2025

The Private Credit Hiring Boom 5 Dos And Don Ts To Get Hired

May 31, 2025 -

Miley Cyrus Response To Family Tensions With Billy Ray Cyrus

May 31, 2025

Miley Cyrus Response To Family Tensions With Billy Ray Cyrus

May 31, 2025 -

White House Chief Of Staff Impersonation Exclusive Details Of The Federal Investigation

May 31, 2025

White House Chief Of Staff Impersonation Exclusive Details Of The Federal Investigation

May 31, 2025 -

Report Dangerous Climate Whiplash Poses Significant Threat To Urban Populations

May 31, 2025

Report Dangerous Climate Whiplash Poses Significant Threat To Urban Populations

May 31, 2025