RBC Earnings Disappoint: A Look At The Bank's Loan Portfolio And Future Outlook

Table of Contents

Analyzing RBC's Disappointing Loan Portfolio Performance

RBC's loan portfolio, a cornerstone of its profitability, showed signs of weakness in the latest earnings report. This underperformance stems from several interconnected factors, impacting both loan growth and credit quality.

Slowing Loan Growth

The growth in various loan segments fell below projections, signaling a potential slowdown in the Canadian economy.

- Mortgages: Growth in the mortgage portfolio slowed significantly, potentially due to rising interest rates impacting affordability and dampening demand. The earnings report showed a year-over-year growth of only 2%, compared to 5% in the previous quarter (hypothetical figures for illustrative purposes).

- Commercial Loans: Businesses, facing economic uncertainty and higher borrowing costs, appear to be less eager to take on new debt, resulting in slower-than-anticipated growth in commercial lending. The report cited a 3% decline in commercial loan applications compared to the previous quarter.

- Consumer Loans: Reduced consumer spending, influenced by inflation and economic anxieties, further contributed to the slowdown in overall loan growth.

Deteriorating Credit Quality

The report also highlighted a concerning trend: a gradual deterioration in the overall credit quality of RBC's loan portfolio.

- Rising Non-Performing Loans (NPLs): A slight but noticeable increase in NPLs suggests a growing number of borrowers struggling to meet their repayment obligations. While still within manageable levels, this trend warrants close monitoring.

- Increased Provisions for Credit Losses: The bank increased its provisions for credit losses, reflecting a more cautious outlook regarding future loan defaults. This proactive measure signals a potential increase in future loan losses.

Impact of Rising Interest Rates

The Bank of Canada's aggressive interest rate hikes to combat inflation have had a direct impact on RBC's loan portfolio.

- Increased Borrower Costs: Higher interest rates increase the cost of borrowing for consumers and businesses, potentially leading to loan defaults if borrowers cannot manage increased repayments.

- Reduced Demand for Loans: The higher cost of borrowing also reduces the overall demand for new loans, contributing to slower loan growth.

The Impact of Macroeconomic Factors on RBC's Performance

RBC's performance is intrinsically linked to the health of the Canadian economy and global geopolitical events. Several macroeconomic factors played a crucial role in the disappointing earnings.

Inflation and Recessionary Fears

High inflation and the looming threat of a recession are casting a shadow over the Canadian economy and impacting borrower behavior.

- Reduced Consumer Confidence: Rising inflation erodes consumer purchasing power and creates uncertainty, leading to reduced spending and impacting loan demand.

- Business Investment Hesitation: Businesses, facing economic uncertainty and higher borrowing costs, are hesitant to invest and expand, affecting demand for commercial loans. Expert forecasts predict a potential slowdown in GDP growth for the next two quarters.

Geopolitical Risks

Global instability, including the war in Ukraine and persistent supply chain disruptions, creates uncertainty and affects RBC's operations and lending practices.

- Supply Chain Disruptions: Global supply chain issues impact businesses' ability to operate efficiently, potentially increasing the risk of loan defaults.

- Commodity Price Volatility: Fluctuations in commodity prices, influenced by geopolitical events, can impact the financial health of businesses and consumers, impacting loan repayment abilities.

Regulatory Changes

Potential regulatory changes in the Canadian banking sector could also influence RBC's future profitability and operations. While no major changes were announced recently, ongoing discussions regarding stricter lending regulations could impact future lending practices.

RBC's Future Outlook and Investor Implications

The disappointing earnings have significant implications for investors, prompting a reassessment of RBC's future performance and investment strategies.

Revised Earnings Forecasts

Analysts have revised their earnings forecasts for RBC downwards, reflecting concerns about the slowing loan growth and deteriorating credit quality. Several financial institutions have reduced their price targets for RBC stock.

Stock Price Performance and Volatility

The earnings report caused a dip in RBC's stock price, indicating investor concern. The stock's performance will likely remain volatile in the near term, subject to further economic data and developments.

Investment Strategies

Investors should carefully assess their risk tolerance before making any investment decisions concerning RBC stock. The current situation necessitates a cautious approach, possibly diversifying investments across the Canadian banking sector or exploring alternative investment opportunities.

Conclusion

RBC's disappointing earnings highlight a confluence of factors, including a weakening loan portfolio, macroeconomic headwinds, and global geopolitical uncertainties. The slowdown in loan growth, deteriorating credit quality, and increased provisions for credit losses raise concerns about the bank's short-term prospects. Investors need to carefully analyze the situation before making any investment decisions related to RBC stock or other Canadian banking investments. Staying informed about RBC earnings and related financial indicators is crucial for making well-informed choices. To stay updated on RBC earnings and the broader Canadian banking landscape, subscribe to our newsletter or follow reputable financial news sources for comprehensive analysis. Conduct thorough research into RBC earnings and related financial indicators to make informed investment decisions based on RBC earnings and the overall market conditions.

Featured Posts

-

The Good Life Practical Steps For A Fulfilling Life

May 31, 2025

The Good Life Practical Steps For A Fulfilling Life

May 31, 2025 -

Miley Cyrus Plagiaatzaak Rechtszaak Over Hit Gelijkend Op Bruno Mars Hit Gaat Door

May 31, 2025

Miley Cyrus Plagiaatzaak Rechtszaak Over Hit Gelijkend Op Bruno Mars Hit Gaat Door

May 31, 2025 -

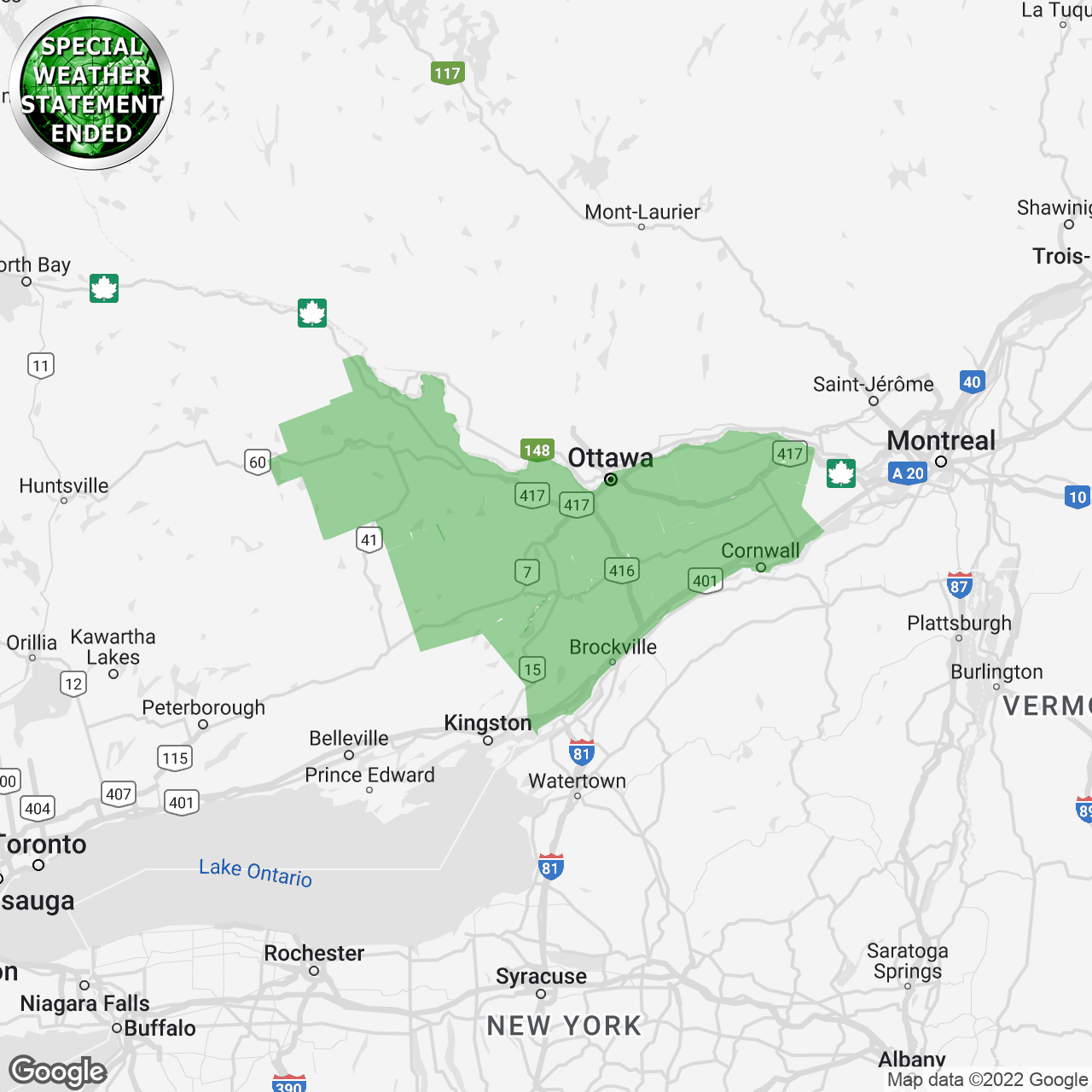

Special Weather Statement Increased Fire Risk In Cleveland And Akron

May 31, 2025

Special Weather Statement Increased Fire Risk In Cleveland And Akron

May 31, 2025 -

Hospitalized Former Nypd Commissioner Keriks Health Update

May 31, 2025

Hospitalized Former Nypd Commissioner Keriks Health Update

May 31, 2025 -

Constance Lloyd Wilde Paying The Price For Oscars Legacy

May 31, 2025

Constance Lloyd Wilde Paying The Price For Oscars Legacy

May 31, 2025