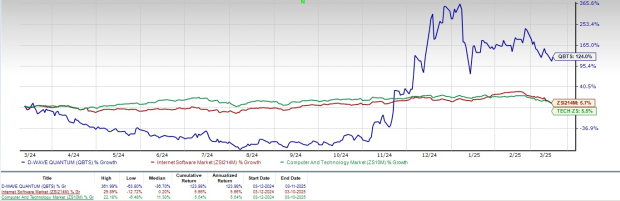

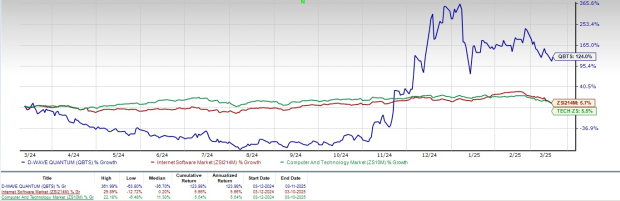

QBTS Stock: Predicting The Earnings Report Reaction

Table of Contents

Analyzing QBTS's Recent Performance and Financial Health

Understanding QBTS's recent financial performance is vital for predicting the market's response to the earnings report. This involves examining several key aspects of its financial health.

QBTS Revenue and Growth Trends

Analyzing QBTS revenue provides a crucial insight into the company's overall performance. Recent revenue figures will be closely scrutinized.

- Key Revenue Streams: Identifying the company's primary revenue sources (e.g., subscriptions, product sales, advertising) helps understand the drivers of growth.

- Year-over-Year Growth Comparisons: Comparing QBTS revenue growth year-over-year reveals trends and highlights areas of strength or weakness. A consistent upward trend indicates positive momentum. A significant deviation from previous quarters needs careful examination.

- Impact of Market Conditions: External factors, such as economic downturns or increased competition, can significantly influence QBTS revenue and need to be considered.

The strength of QBTS revenue growth will be a major factor influencing investor sentiment and the stock's price reaction to the earnings report. Strong QBTS revenue signals robust financial performance.

QBTS Profitability and Margins

Profitability is another critical indicator of QBTS's financial health. Analyzing profit margins reveals the company's efficiency in converting revenue into profit.

- Gross Profit Margin: This ratio shows the profitability of QBTS's core business operations after deducting the cost of goods sold.

- Operating Profit Margin: This indicates QBTS's profitability from its operating activities after considering operating expenses.

- Net Profit Margin: This reveals QBTS's overall profitability after all expenses, including taxes and interest, are accounted for. Trends in these margins—improving or worsening—provide valuable insights.

Analyzing these QBTS profitability metrics allows for a comprehensive assessment of the company's financial health.

Key QBTS Financial Ratios

Examining crucial financial ratios provides a holistic view of QBTS's financial stability.

- Debt-to-Equity Ratio: This indicates QBTS's reliance on debt financing compared to equity. A high ratio suggests higher financial risk.

- Current Ratio: This shows QBTS's ability to meet its short-term obligations using current assets. A ratio below 1 signals potential liquidity problems.

- Other Key Ratios: Other important ratios, depending on the specific industry and business model, might also be relevant in assessing QBTS financial health. Comparing these QBTS financial ratios against industry benchmarks provides context and helps gauge its financial strength relative to its competitors.

Assessing Market Sentiment and Expectations

Understanding market sentiment and expectations surrounding QBTS is as crucial as analyzing its financial health. Investor sentiment can significantly influence the stock's reaction to the earnings report.

QBTS Analyst Ratings and Price Targets

Analyst opinions significantly influence market sentiment.

- Consensus Price Target: The average price target set by analysts indicates the collective market expectation for QBTS stock.

- Range of Predictions: The range of analyst predictions reflects the level of uncertainty surrounding future performance.

- Impact of Recent Upgrades/Downgrades: Recent changes in analyst ratings can significantly influence investor sentiment and stock price movements.

Monitoring analyst activity is crucial for understanding market expectations for QBTS stock.

QBTS News and Media Coverage

News articles and press releases significantly shape investor perception.

- Positive and Negative News: Positive news typically boosts investor confidence, while negative news can lead to selling pressure.

- Impact on Investor Sentiment: The overall tone of media coverage—positive, negative, or neutral—helps gauge prevailing investor sentiment.

Monitoring QBTS news helps understand how the market is perceiving the company.

QBTS Social Media Sentiment

Social media provides a valuable window into public opinion. Analyzing social media conversations surrounding QBTS can offer insights into current investor sentiment.

- Positive vs. Negative Sentiment: Examining the proportion of positive and negative comments can reveal the overall sentiment towards QBTS stock.

- Trends in Social Media Mentions: Tracking mentions over time provides insights into changing investor sentiment. Specific platforms like Twitter, StockTwits, and Reddit can be valuable sources of information.

Potential Factors Influencing the Earnings Report Reaction

Several factors can influence the market’s reaction, beyond the numbers themselves.

Surprise Factor: Beat or Miss Expectations?

Whether QBTS surpasses or falls short of analyst expectations is crucial.

- Impact of Exceeding or Falling Short of Consensus Estimates: A positive surprise (beating expectations) generally leads to a positive stock price reaction, while a negative surprise (missing expectations) often leads to a decline.

The surprise factor plays a significant role in shaping short-term stock price movements.

QBTS Future Guidance

The company's outlook for future performance significantly impacts investor confidence.

- Revenue and Earnings Projections: The guidance provided by QBTS regarding future revenue and earnings growth significantly influences investor sentiment.

- Potential Impact on Stock Price: Positive guidance usually strengthens investor confidence and supports the stock price, while negative guidance might lead to selling pressure.

Future guidance is a key driver of long-term stock price movements.

Market Conditions and Economic Factors

Broader economic conditions influence investor risk appetite.

- Interest Rates: Rising interest rates can negatively affect stock valuations.

- Inflation: High inflation can erode corporate profits and negatively impact investor sentiment.

- Geopolitical Events: Major geopolitical events can significantly impact investor confidence and market volatility.

Macroeconomic factors often play a crucial role in shaping market reactions to earnings reports.

QBTS Stock: Making Informed Investment Decisions

Predicting the market's reaction to the QBTS earnings report requires a comprehensive assessment of its financial health, market sentiment, and potential surprise factors. Careful consideration of these factors is crucial for making informed investment decisions.

Key Takeaways:

- Analyzing QBTS’s financial performance provides a foundation for prediction.

- Understanding market sentiment and analyst expectations is vital.

- The surprise factor—beating or missing expectations—can significantly impact the stock price.

- Broader market conditions and economic factors influence overall investor behavior.

Call to Action: Stay informed on QBTS stock by monitoring the QBTS earnings report closely. Conduct thorough research, and utilize various resources to learn more about QBTS stock prediction strategies. Make informed investment decisions based on a comprehensive understanding of the factors influencing QBTS stock performance.

Featured Posts

-

Investigating The Reasons For D Wave Quantum Qbts Stocks Friday Uptick

May 21, 2025

Investigating The Reasons For D Wave Quantum Qbts Stocks Friday Uptick

May 21, 2025 -

Wwe Raw Recap Rollins And Breakkers Bullying Of Sami Zayn

May 21, 2025

Wwe Raw Recap Rollins And Breakkers Bullying Of Sami Zayn

May 21, 2025 -

Occasionmarkt Bloeit Abn Amro Rapporteert Flinke Verkoopstijging

May 21, 2025

Occasionmarkt Bloeit Abn Amro Rapporteert Flinke Verkoopstijging

May 21, 2025 -

David Walliams And Simon Cowell Alleged Britains Got Talent Rift Deepens

May 21, 2025

David Walliams And Simon Cowell Alleged Britains Got Talent Rift Deepens

May 21, 2025 -

David Walliams And Simon Cowell Britains Got Talent Feud Heats Up

May 21, 2025

David Walliams And Simon Cowell Britains Got Talent Feud Heats Up

May 21, 2025

Latest Posts

-

Warner Bros Plans Film Adaptation Of Viral Reddit Post Casting Sydney Sweeney

May 22, 2025

Warner Bros Plans Film Adaptation Of Viral Reddit Post Casting Sydney Sweeney

May 22, 2025 -

From Reddit To The Big Screen Sydney Sweeneys Potential Role In Warner Bros Film Adaptation

May 22, 2025

From Reddit To The Big Screen Sydney Sweeneys Potential Role In Warner Bros Film Adaptation

May 22, 2025 -

Sydney Sweeney To Star In Film Based On Viral Reddit Post Warner Bros Confirms Interest

May 22, 2025

Sydney Sweeney To Star In Film Based On Viral Reddit Post Warner Bros Confirms Interest

May 22, 2025 -

Nova Filmska Adaptacija Sydney Sweeney U Filmu Temeljenom Na Redditu

May 22, 2025

Nova Filmska Adaptacija Sydney Sweeney U Filmu Temeljenom Na Redditu

May 22, 2025 -

The True Story Behind Sydney Sweeneys Latest Film A Viral Reddit Phenomenon

May 22, 2025

The True Story Behind Sydney Sweeneys Latest Film A Viral Reddit Phenomenon

May 22, 2025