PwC's Controversial Decision: Shrinking Global Footprint After Multiple Scandals

Table of Contents

The Scandals That Triggered the Restructuring

PwC's decision to restructure wasn't made in a vacuum. A series of high-profile scandals involving audit failures, tax evasion allegations, and regulatory investigations have severely damaged the firm's reputation and led to significant client losses. These events have created a perfect storm of reputational risk, prompting the firm to take drastic measures.

-

NMC Health: The 2020 collapse of NMC Health, a major healthcare provider, exposed serious flaws in PwC's audit work. The scandal resulted in significant fines for PwC and a major blow to its reputation. The firm was accused of failing to identify fraudulent accounting practices, leading to a loss of investor confidence and a substantial financial impact for investors.

-

Wirecard: The 2020 accounting scandal at Wirecard, a German payments processing company, further exacerbated PwC's problems. Similar to the NMC Health case, PwC was accused of overlooking fraudulent activity during its audits. This scandal resulted in substantial regulatory scrutiny and further eroded public trust in the firm's auditing capabilities.

-

Regulatory Investigations & Fines: Multiple regulatory bodies around the globe launched investigations into PwC's auditing practices following these high-profile failures. The resulting fines and penalties added to the financial strain and reputational damage, creating pressure for significant changes within the firm.

-

Client Losses: The lack of trust following these scandals led to a significant exodus of major clients, further impacting PwC’s revenue streams and profitability, fueling the need for a cost-cutting strategy and restructuring.

PwC's Response: Shrinking the Global Footprint – A Strategic Retreat?

In response to the mounting pressure and financial repercussions, PwC announced a strategic restructuring, including a significant reduction in its global footprint. This involves a combination of measures aimed at cost-cutting and risk mitigation.

-

Office Closures: PwC has already announced the closure of several offices across various geographic regions. These closures are strategically targeted, focusing on locations with lower profitability or increased operational risk.

-

Staff Reductions: Alongside office closures, PwC has implemented layoffs, affecting staff across various departments and levels. The scale of these reductions varies by region and reflects a broader effort to streamline operations and reduce costs.

-

Geographic Impact: The restructuring disproportionately affects certain geographic areas, particularly those where the firm experienced the most significant client losses or regulatory challenges. This targeted approach indicates a focus on consolidating resources in more profitable and stable regions.

-

Strategic Retreat or Damage Control? While PwC frames this restructuring as a strategic review and repositioning, many observers see it primarily as a damage-control exercise designed to address the fallout from its scandals and improve its financial health and reduce reputational risk.

Impact on PwC's Services and Client Base

The restructuring will undoubtedly have a significant impact on PwC's service delivery and client relationships.

-

Audit Services: The reduction in staff and resources may affect the quality and timeliness of audit services, potentially leading to delays or increased workload for remaining staff.

-

Consulting and Tax Services: The restructuring will likely impact consulting and tax services as well. Reduced staffing levels could affect project delivery timelines and the firm's ability to compete effectively for new business.

-

Client Relationships: The restructuring will inevitably impact client relationships. Existing clients may face disruption to service delivery, while potential clients may be hesitant to engage with a firm undergoing such significant change.

-

Competitive Landscape: The downsizing could create a competitive disadvantage for PwC, as its rivals may be better positioned to capture new business and expand their market share.

Long-Term Implications for the Accounting Industry

PwC's troubles have broader implications for the accounting industry, particularly the other "Big Four" firms.

-

Increased Regulatory Scrutiny: The scandals have prompted calls for increased regulatory scrutiny and reform within the auditing profession. Expect stricter regulations and more stringent oversight of accounting practices.

-

Ethical Standards: The PwC scandals highlight the need for stronger ethical standards and a greater emphasis on corporate governance within the accounting industry. This may lead to enhanced training and professional development programs.

-

Auditing Reforms: Major changes to auditing practices and procedures are likely to be implemented in the wake of PwC's scandals to prevent similar incidents from occurring in the future.

-

Industry Consolidation: The restructuring may trigger further consolidation or restructuring within the accounting industry as firms respond to increased pressure and evolving market conditions. Mergers and acquisitions may become more common.

Conclusion

PwC's decision to shrink its global footprint is a drastic response to a series of damaging scandals that have severely tarnished its reputation. This strategic retreat, while potentially beneficial for cost-cutting and risk mitigation in the short term, raises significant concerns about the long-term implications for the firm, its clients, and the auditing profession as a whole. The future of PwC and its ability to regain client trust will depend on its capacity to implement effective reforms and demonstrate a genuine commitment to ethical conduct.

Call to Action: Stay informed about the ongoing developments surrounding PwC's restructuring and the broader implications for the accounting industry. Follow our updates on the evolving story of PwC’s controversial decision and the future of its global footprint.

Featured Posts

-

New Music Willie Nelson And Rodney Crowell Duet On Oh What A Beautiful World Album

Apr 29, 2025

New Music Willie Nelson And Rodney Crowell Duet On Oh What A Beautiful World Album

Apr 29, 2025 -

Porsche Macan Fyrsta 100 Rafutgafan Kynnt

Apr 29, 2025

Porsche Macan Fyrsta 100 Rafutgafan Kynnt

Apr 29, 2025 -

The Uks Legal Definition Of Woman Implications For Transgender Rights And Sex Based Laws

Apr 29, 2025

The Uks Legal Definition Of Woman Implications For Transgender Rights And Sex Based Laws

Apr 29, 2025 -

2026 Porsche Cayenne Ev What The Spy Shots Tell Us

Apr 29, 2025

2026 Porsche Cayenne Ev What The Spy Shots Tell Us

Apr 29, 2025 -

Understanding Willie Nelson Fast Facts For Fans

Apr 29, 2025

Understanding Willie Nelson Fast Facts For Fans

Apr 29, 2025

Latest Posts

-

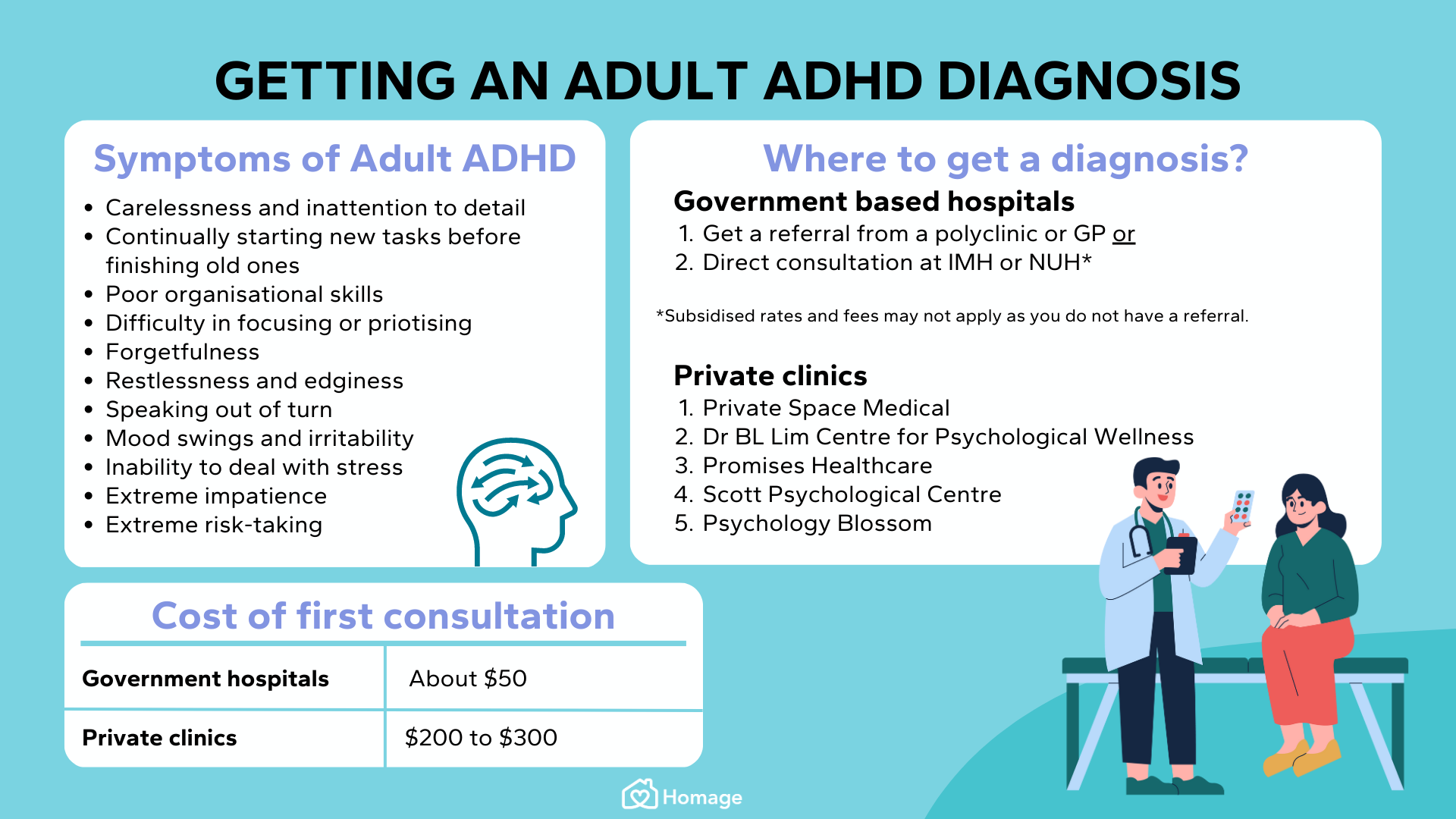

Adult Adhd Next Steps After A Suspected Diagnosis

Apr 29, 2025

Adult Adhd Next Steps After A Suspected Diagnosis

Apr 29, 2025 -

Suspecting Adult Adhd A Practical Guide To Next Steps

Apr 29, 2025

Suspecting Adult Adhd A Practical Guide To Next Steps

Apr 29, 2025 -

Adult Adhd Understanding Your Diagnosis And Moving Forward

Apr 29, 2025

Adult Adhd Understanding Your Diagnosis And Moving Forward

Apr 29, 2025 -

Improve Focus Naturally Effective Natural Approaches To Adhd

Apr 29, 2025

Improve Focus Naturally Effective Natural Approaches To Adhd

Apr 29, 2025 -

Diagnosed With Adult Adhd Your Action Plan Starts Here

Apr 29, 2025

Diagnosed With Adult Adhd Your Action Plan Starts Here

Apr 29, 2025