Publication AMF Mercialys: 2025E1022016 (25/02/2025)

Table of Contents

Key Financial Highlights of the AMF Mercialys Publication 2025E1022016

The 2025E1022016 AMF Mercialys publication details the company's financial performance for [Specify reporting period, e.g., the fiscal year 2024]. A thorough analysis of the key financial figures is essential for understanding Mercialys' financial health.

-

Revenue Breakdown: The report likely provides a detailed breakdown of revenue streams, differentiating between rental income from various property types, and potentially highlighting the contribution of other revenue sources. Analyzing the growth or decline in each segment reveals underlying market trends and the effectiveness of Mercialys' portfolio strategy.

-

Profitability Analysis: Examining profitability metrics such as net income, earnings per share (EPS), and operating margins provides critical insights into the company's efficiency and earning power. A comparison of these figures with previous years allows for trend identification and evaluation of management performance.

-

Key Financial Ratios: The publication will likely include crucial financial ratios, such as the debt-to-equity ratio, return on equity (ROE), and interest coverage ratio. These ratios offer valuable perspectives on Mercialys' financial leverage, profitability, and ability to meet its debt obligations. Significant changes in these ratios warrant close attention.

-

Significant Changes and Trends: The analysis should note any substantial changes or noteworthy trends observed in the financial data. This could include shifts in revenue streams, changes in profitability, or alterations in the company's capital structure. Understanding these trends is crucial for assessing future prospects. Keywords: Financial performance, revenue, net income, earnings per share, profitability, financial ratios, key performance indicators (KPIs).

Investment Implications of the AMF Mercialys 2025E1022016 Report

The AMF Mercialys 2025E1022016 report has considerable implications for investors considering Mercialys stock or already holding it in their portfolios.

-

Impact on Stock Price: The immediate market reaction to the publication's release, as reflected in Mercialys' stock price, provides valuable insights into investor sentiment. A thorough analysis of the price movement should be conducted, taking into account market conditions and broader economic factors.

-

Future Growth Outlook: The report likely offers projections or management commentary on future growth and profitability. Analyzing this forward-looking information allows for an assessment of the company's potential for long-term value creation and return on investment (ROI).

-

Risk Assessment: Investors should carefully analyze potential risks outlined in the report, such as market fluctuations, interest rate changes, and potential vacancies in the company's property portfolio. Identifying these risks is crucial for formulating an informed investment strategy.

-

Dividend Implications: For income-oriented investors, the report's implications for dividend payments are paramount. Any changes to dividend policies, announced or suggested, significantly impact investment decisions. Keywords: Stock price, investment strategy, risk assessment, dividend yield, return on investment (ROI), market outlook.

Operational Performance and Strategic Initiatives

Beyond the financial statements, the AMF Mercialys 2025E1022016 publication likely details Mercialys' operational performance and strategic initiatives.

-

Key Operational KPIs: Analysis should encompass key performance indicators (KPIs) such as occupancy rates across its property portfolio and tenant satisfaction levels. High occupancy rates and satisfied tenants indicate strong operational efficiency and management.

-

Strategic Initiatives and Partnerships: The report might highlight new strategic initiatives, joint ventures, or partnerships aimed at enhancing profitability, expanding the portfolio, or improving operational efficiency. Analyzing these initiatives reveals management's strategic vision and execution capabilities.

-

Expansion Plans and Development Projects: Mercialys' expansion plans and ongoing development projects, if any, are key elements to assess its future growth potential. Details about new acquisitions, property renovations, or construction projects shed light on management's ambition and capacity for growth.

-

ESG Performance: Increasingly, investors are focusing on Environmental, Social, and Governance (ESG) factors. The report may detail Mercialys' commitment to sustainability, its efforts to reduce its environmental footprint, and its social responsibility initiatives. This information is crucial for ESG-conscious investors. Keywords: Operational efficiency, occupancy rates, tenant satisfaction, strategic partnerships, expansion plans, sustainability, ESG (Environmental, Social, and Governance).

Regulatory Compliance and AMF Reporting Requirements

The AMF Mercialys publication 2025E1022016 is subject to stringent regulatory requirements imposed by the Autorité des Marchés Financiers (AMF).

-

AMF Oversight: The AMF's role is to ensure the accuracy, transparency, and completeness of financial reporting by publicly listed companies in France. Understanding the AMF's regulatory framework is vital for interpreting the publication's contents.

-

Transparency and Accuracy: The publication's adherence to transparency and accuracy principles reflects Mercialys' commitment to good governance and accountability to its investors. Any deviations from these principles could raise concerns.

-

Specific Regulatory Requirements: The report should address specific regulatory requirements concerning financial reporting standards, disclosure practices, and auditing procedures. Understanding these aspects ensures compliance and reinforces investor confidence. Keywords: AMF regulations, financial reporting standards, regulatory compliance, transparency, accountability.

Conclusion: Actionable Insights from the AMF Mercialys Publication 2025E1022016

The AMF Mercialys publication 2025E1022016 offers valuable insights into the financial performance, operational efficiency, and strategic direction of Mercialys. Analyzing the key financial highlights, investment implications, operational performance, and regulatory compliance aspects provides a holistic view of the company's current state and future prospects. It's crucial for investors and stakeholders to carefully review the full AMF Mercialys publication 2025E1022016 and seek professional financial advice if needed to make informed investment decisions. Stay informed about future AMF Mercialys publications and market trends to make well-informed investment decisions.

Featured Posts

-

Downtown Louisville Gas Leak Buildings Evacuated

Apr 30, 2025

Downtown Louisville Gas Leak Buildings Evacuated

Apr 30, 2025 -

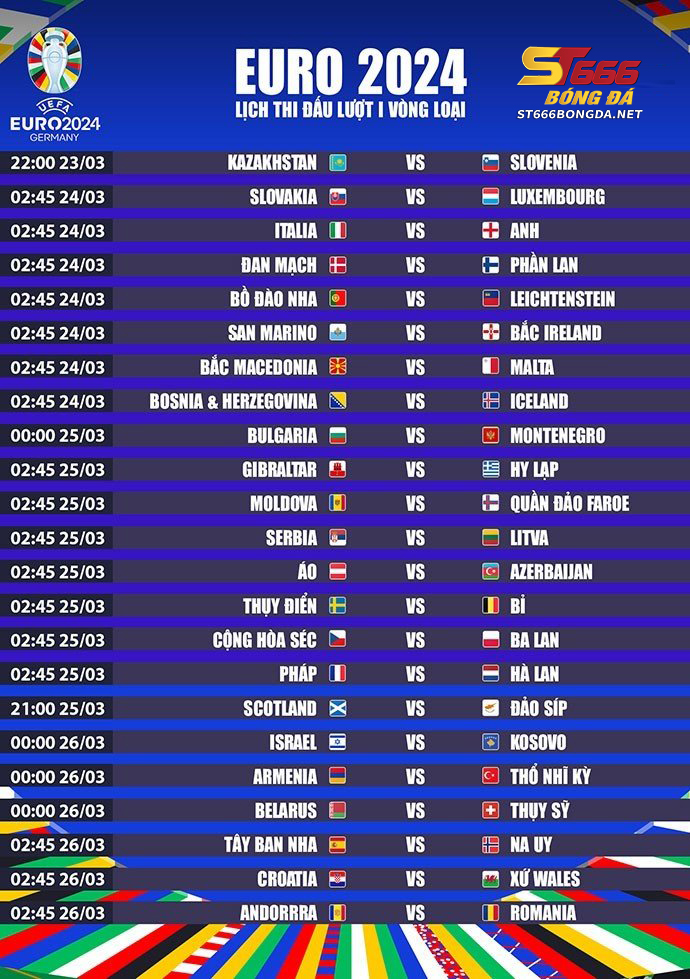

Lich Thi Dau Vong Chung Ket Tnsv Thaco Cup 2025 Thoi Gian And Dia Diem Xem Truc Tiep

Apr 30, 2025

Lich Thi Dau Vong Chung Ket Tnsv Thaco Cup 2025 Thoi Gian And Dia Diem Xem Truc Tiep

Apr 30, 2025 -

Will Tariffs Replace Income Taxes Examining The Economic Realities

Apr 30, 2025

Will Tariffs Replace Income Taxes Examining The Economic Realities

Apr 30, 2025 -

Unian Rezkaya Kritika Trampa V Kanade Zlobniy Samovlyublenniy Sliznyak

Apr 30, 2025

Unian Rezkaya Kritika Trampa V Kanade Zlobniy Samovlyublenniy Sliznyak

Apr 30, 2025 -

69th Eurovision Song Contest Betting Tips And Predictions For 2025

Apr 30, 2025

69th Eurovision Song Contest Betting Tips And Predictions For 2025

Apr 30, 2025