Proposed Changes To Bond Forward Regulations For Indian Insurers

Table of Contents

Increased Transparency and Disclosure Requirements

The proposed amendments prioritize increased transparency in bond forward transactions for Indian insurers. This initiative aims to enhance the accuracy and reliability of risk management and reporting, benefiting both insurers and the broader financial system. The implications are far-reaching, demanding a robust overhaul of existing internal processes and reporting mechanisms.

- Enhanced reporting to IRDAI (Insurance Regulatory and Development Authority of India): Insurers can expect more frequent and detailed reports on their bond forward positions, requiring sophisticated data management systems.

- Stricter guidelines on valuation and disclosure of bond forward positions: The new regulations are likely to introduce more stringent valuation methodologies, potentially impacting how insurers report their assets and liabilities. Clearer guidelines on the disclosure of all relevant information related to bond forward contracts are also expected.

- Increased scrutiny of internal controls and risk management frameworks: Insurers will need to demonstrate a robust and compliant internal control environment, including effective risk assessment, mitigation strategies, and regular internal audits to satisfy the enhanced regulatory scrutiny.

These changes emphasize transparency, disclosure, IRDAI, risk management, reporting, and regulatory compliance as cornerstones of the new regime.

Revised Limits and Restrictions on Bond Forward Investments

Proposed changes to the permissible limits for bond forward investments by Indian insurers aim to mitigate risk and maintain systemic stability within the Indian financial ecosystem. The rationale behind these restrictions is to prevent excessive concentration of risk and to ensure that the insurance sector remains resilient to market shocks.

- Changes to the overall exposure limit for bond forwards: The proposed regulations may introduce lower caps on the total exposure insurers can have through bond forwards, limiting their potential losses.

- Potential restrictions on specific types of bond forwards: Certain types of bond forwards, deemed riskier, may face stricter limits or outright prohibitions.

- Impact on insurers' investment strategies and portfolio diversification: Insurers will likely need to reassess their investment strategies, potentially leading to a shift away from bond forwards and towards other asset classes to maintain diversification and achieve their investment objectives.

Keywords like investment limits, restrictions, risk mitigation, systemic stability, and portfolio diversification highlight the core objectives of these regulatory shifts.

Strengthened Supervisory Oversight and Enforcement

The proposed regulations aim to strengthen supervisory oversight of bond forward activities by the IRDAI. This increased supervisory oversight includes more stringent enforcement mechanisms and penalties for non-compliance, fostering a culture of accountability within the insurance sector.

- Increased frequency of audits and inspections by IRDAI: Insurers should anticipate more frequent and rigorous audits and inspections by the IRDAI to ensure compliance with the new regulations.

- Enhanced penalties for violations of bond forward regulations: Non-compliance with the new regulations will likely attract significantly higher penalties than before, creating a strong incentive for compliance.

- Improved data collection and analysis capabilities for regulatory authorities: The IRDAI is likely to enhance its data collection and analysis capabilities to effectively monitor and supervise the bond forward market.

This heightened regulatory scrutiny underscores the importance of enforcement, penalties, compliance, IRDAI, and regulatory scrutiny for Indian insurers.

Impact on the Indian Insurance Market and Investment Strategies

The proposed regulatory changes are expected to significantly affect the Indian insurance market. While aiming to enhance stability, they may also impact competitiveness and necessitate adjustments in insurers' investment strategies.

- Impact on insurers' profitability and investment returns: The revised limits and restrictions could impact insurers’ profitability and investment returns, forcing them to explore alternative investment avenues.

- Changes to risk appetite and investment strategies: Insurers will likely exhibit a more conservative risk appetite and adjust their investment strategies to align with the new regulations.

- Potential for shifts in market share among insurers: Insurers with more sophisticated risk management capabilities and adaptable investment strategies may gain a competitive advantage in this evolving landscape.

Understanding the market impact, investment strategies, competitiveness, profitability, risk appetite, and market share dynamics is crucial for navigating this new era.

Conclusion: Adapting to the Evolving Landscape of Bond Forward Regulations for Indian Insurers

The proposed changes to bond forward regulations represent a significant shift in the regulatory environment for Indian insurers. Increased transparency, revised investment limits, and strengthened supervisory oversight aim to enhance stability and mitigate risks within the sector. However, these changes will require significant adjustments to existing investment strategies, risk management frameworks, and internal processes. Indian insurers must proactively prepare for the implementation of these new Bond Forward Regulations. Thorough understanding and compliance are paramount. Seeking expert consultation and staying informed through relevant publications and regulatory updates is essential for effective adaptation. Preparing for these changes now will ensure your organization remains compliant and competitive in the evolving landscape of bond forward investments in India.

Featured Posts

-

10 Essential Film Noir Movies You Need To See

May 10, 2025

10 Essential Film Noir Movies You Need To See

May 10, 2025 -

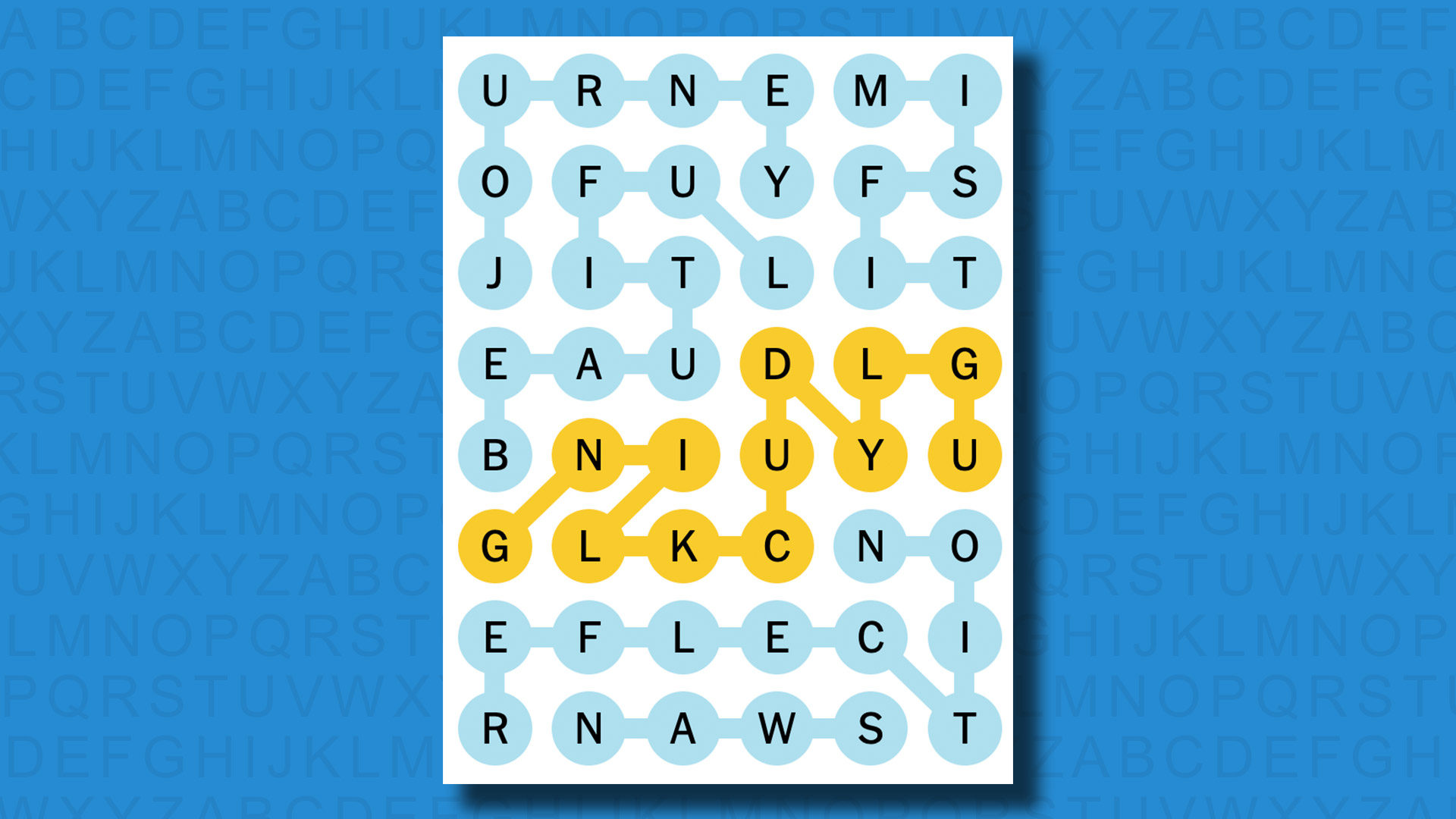

Nyt Strands Answers Game 357 Sunday February 23

May 10, 2025

Nyt Strands Answers Game 357 Sunday February 23

May 10, 2025 -

Trumps Transgender Military Policy An Analysis Of The Controversy

May 10, 2025

Trumps Transgender Military Policy An Analysis Of The Controversy

May 10, 2025 -

Punjab Governments Initiative Technical Training For Transgender Community

May 10, 2025

Punjab Governments Initiative Technical Training For Transgender Community

May 10, 2025 -

Soglashenie Makrona I Tuska 9 Maya Chto Ozhidat Ukraine

May 10, 2025

Soglashenie Makrona I Tuska 9 Maya Chto Ozhidat Ukraine

May 10, 2025