ProShares XRP ETFs: Analyzing The Price Surge After Launch

Table of Contents

Understanding the ProShares XRP ETF Launch

ProShares XRP ETFs represent a landmark event in the cryptocurrency investment landscape. These exchange-traded funds offer investors a regulated and convenient way to gain exposure to XRP, a leading cryptocurrency known for its use in the Ripple payment system. The significance of their launch lies in overcoming significant regulatory hurdles and catering to a growing demand for regulated crypto investment products.

- Regulatory Hurdles Overcome: The launch signifies a major step forward in the regulatory acceptance of cryptocurrencies, potentially paving the way for more similar products.

- Investor Demand and Market Anticipation: The high level of anticipation preceding the launch suggests strong investor interest and a belief in XRP's future potential. This pent-up demand likely fueled the initial price surge.

- ETF Structure: The specific structure of the ProShares XRP ETF (e.g., physically backed or futures-based) significantly impacts its performance and risk profile. Understanding this structure is crucial for informed investment decisions. (Note: Specific details about the ETF's structure would need to be inserted here once available publicly.)

- Trading Symbol and Exchange Listing: Knowing the trading symbol and the exchange where the ETF is listed is crucial for investors looking to buy and sell shares. (Note: Specific details about the trading symbol and exchange listing would need to be inserted here once available publicly.)

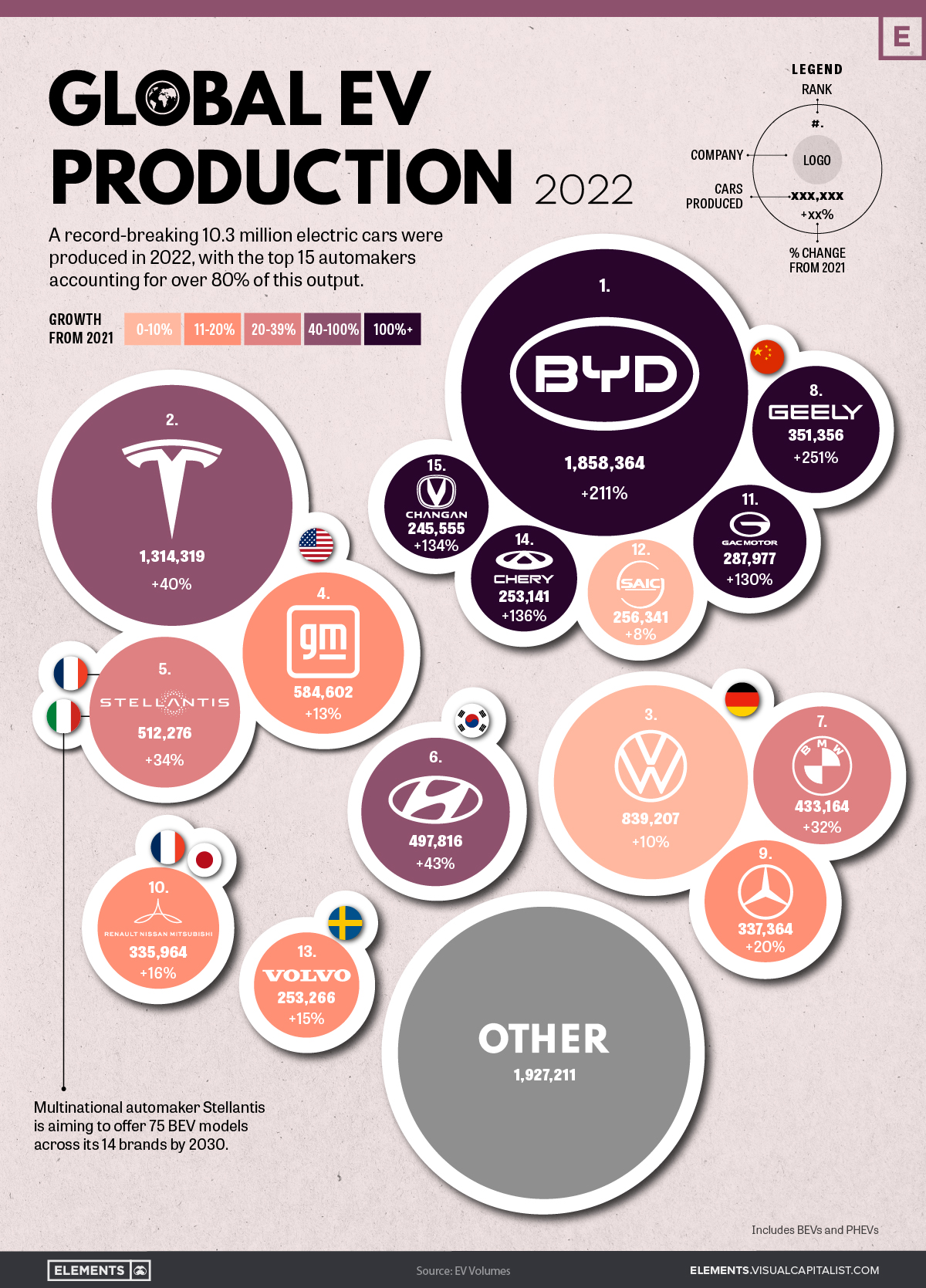

Analyzing the XRP Price Surge Post-Launch

Following the launch of ProShares XRP ETFs, the price of XRP experienced a dramatic increase. (Insert specific data here, e.g., "The price surged by X% within Y days of the launch, reaching a high of Z dollars."). This surge can be visually represented using charts and graphs showcasing the price movement over time. (Insert chart/graph here).

- Short-Term and Long-Term Price Trends: Analyzing both short-term volatility and potential long-term growth trends is essential for understanding the investment landscape.

- Volume Increase During the Surge: A significant increase in trading volume alongside the price surge confirms strong market interest and participation.

- Comparison with Other Cryptocurrencies: Comparing XRP's performance with other cryptocurrencies helps determine whether the surge is unique to XRP or part of a broader market trend.

- Impact on Market Capitalization: The price increase significantly impacted XRP's market capitalization, solidifying its position within the cryptocurrency market.

Factors Contributing to the XRP Price Increase

Several factors contributed to the XRP price increase following the ProShares XRP ETF launch. These factors acted synergistically to create a powerful upward momentum.

- Increased Investor Confidence and Institutional Adoption: The launch of a regulated ETF signals increased confidence in XRP from institutional investors, driving demand.

- Impact of Positive Regulatory News: Any positive regulatory developments surrounding XRP or the broader cryptocurrency market significantly influenced the price increase. (Note: Specific news items would need to be referenced here if applicable.)

- Increased Trading Activity and Liquidity: The ETF launch boosted trading activity and improved liquidity, making it easier for investors to buy and sell XRP.

- Speculation and Market Sentiment: Market sentiment and speculation played a crucial role, potentially amplifying the price increase.

- The Role of Social Media and News Coverage: Positive media coverage and social media discussions can significantly influence investor sentiment and drive price movements.

Potential Risks and Future Outlook for ProShares XRP ETFs

While the launch presents exciting opportunities, investors should carefully consider the potential risks associated with ProShares XRP ETFs.

- Market Volatility and Price Fluctuations: Cryptocurrency markets are inherently volatile, and XRP's price can fluctuate significantly.

- Regulatory Uncertainty and Potential Future Changes: Regulatory changes could impact the ETF's operation and performance.

- Competition from Other XRP Investment Vehicles: The emergence of alternative investment options could affect the demand for ProShares XRP ETFs.

- Potential for Manipulation or Market Bubbles: The cryptocurrency market is susceptible to manipulation and the formation of speculative bubbles.

The future outlook for ProShares XRP ETFs depends on various factors, including regulatory developments, overall market sentiment, and XRP's adoption rate. A balanced perspective incorporates both potential upside and downside scenarios.

Investing Strategies for ProShares XRP ETFs

Investors considering investing in ProShares XRP ETFs should adopt a cautious and strategic approach.

- Risk Tolerance Assessment: Accurately assess your risk tolerance before investing in any cryptocurrency-related products.

- Diversification Strategies: Diversify your investment portfolio to mitigate risk. Don't over-allocate to a single asset.

- Dollar-Cost Averaging: Consider using dollar-cost averaging to reduce the impact of market volatility.

- Setting Realistic Investment Goals: Define your investment goals and timeframe before investing.

- Importance of Thorough Research and Due Diligence: Conduct thorough research and due diligence before making any investment decisions.

Conclusion

The launch of ProShares XRP ETFs has undeniably led to a significant price surge in XRP, driven by increased investor confidence, regulatory progress, and market speculation. However, it's crucial to remember the inherent volatility and risks associated with cryptocurrency investments. Understanding these risks and adopting a sound investment strategy is crucial for navigating this dynamic market. Learn more about ProShares XRP ETFs and make informed investment decisions. Stay updated on the latest developments in ProShares XRP ETFs and the XRP market by following [link to relevant resource]. Consider diversifying your portfolio with ProShares XRP ETFs to potentially capitalize on future growth, but always prioritize risk management.

Featured Posts

-

Breaking Brazil Greenlights First Spot Xrp Etf Trump Weighs In On Ripple

May 08, 2025

Breaking Brazil Greenlights First Spot Xrp Etf Trump Weighs In On Ripple

May 08, 2025 -

Pakistans Global Trade Ahsans Plea For Tech Adoption In Manufacturing

May 08, 2025

Pakistans Global Trade Ahsans Plea For Tech Adoption In Manufacturing

May 08, 2025 -

Gha Voices Concerns Over Proposed Jhl Privatisation

May 08, 2025

Gha Voices Concerns Over Proposed Jhl Privatisation

May 08, 2025 -

Finding A Ps 5 Before The Price Goes Up Your Guide To Retailers

May 08, 2025

Finding A Ps 5 Before The Price Goes Up Your Guide To Retailers

May 08, 2025 -

Bitcoin Rebound Understanding The Factors Driving The Price Increase

May 08, 2025

Bitcoin Rebound Understanding The Factors Driving The Price Increase

May 08, 2025