ProShares' XRP ETFs: A Deep Dive Into The No-Spot-Market Launch

Table of Contents

Understanding the "No-Spot-Market" Launch Strategy

The launch of ProShares XRP ETFs without a regulated spot market for XRP represents a significant departure from traditional ETF launches. Understanding this strategy requires clarifying the difference between spot and futures markets.

Defining Spot Markets vs. Futures Markets in the context of cryptocurrencies

- Spot Market: A spot market is where assets are bought and sold for immediate delivery. Traditional ETF launches typically rely on a robust spot market for the underlying asset to ensure accurate price tracking and efficient trading.

- Futures Market: A futures market involves contracts agreeing to buy or sell an asset at a specific price on a future date. ProShares chose a futures-based approach for its XRP ETF due to the absence of a fully regulated XRP spot market.

- Regulatory Implications: The SEC's stance on cryptocurrencies and spot-based ETFs has presented significant hurdles. A futures-based approach may offer a pathway to market access while navigating these regulatory complexities. However, it also introduces potential risks and limitations.

- Advantages and Disadvantages: While a futures-based strategy allows for quicker market entry, it might result in tracking discrepancies compared to a spot-based XRP ETF. The inherent volatility of the cryptocurrency market further amplifies these risks.

The complexity arises from the regulatory uncertainty surrounding XRP itself. The SEC's ongoing legal battle with Ripple has created a significant roadblock for a traditional spot-based XRP ETF. ProShares' innovative approach using futures contracts represents a workaround, attempting to provide exposure to XRP while circumventing the immediate regulatory challenges. This contrasts sharply with traditional ETF launches that rely on a readily available and regulated spot market for the underlying asset.

Analyzing the Potential Benefits and Risks of ProShares' XRP ETFs

Investing in ProShares' XRP ETFs presents a unique opportunity, but it's crucial to carefully weigh the potential benefits against the associated risks.

Potential Benefits:

- Increased Accessibility: The ETF offers easier access to XRP for investors who might not otherwise engage directly with cryptocurrency exchanges.

- Portfolio Diversification: XRP ETFs can contribute to diversification, potentially reducing overall portfolio volatility.

- Indirect Liquidity: The increased demand for XRP futures contracts, indirectly driven by the ETF, could contribute to enhanced liquidity within the XRP market over time.

- Price Discovery: Futures contracts provide a mechanism for price discovery, even without a fully developed spot market.

Potential Risks:

- Tracking Error: The ETF's price might not perfectly mirror the underlying XRP price due to the nature of futures contracts and market conditions.

- Higher Expense Ratios: Futures-based ETFs may have higher expense ratios than their spot-based counterparts.

- Regulatory Uncertainty: The regulatory landscape surrounding XRP and crypto ETFs remains fluid, introducing potential future changes impacting the ETF's performance.

- Market Volatility: The cryptocurrency market is inherently volatile; investing in XRP ETFs carries significant price fluctuation risks.

Risk management is paramount when considering ProShares XRP ETFs. Investors should assess their risk tolerance and diversify their portfolios accordingly. Thorough due diligence and understanding the limitations of a futures-based approach are crucial.

The Regulatory Landscape and Future Outlook for XRP ETFs

The regulatory environment surrounding XRP and ETFs significantly impacts ProShares' strategy and future prospects.

SEC Scrutiny and its Impact:

- SEC Stance: The SEC's historically cautious approach towards cryptocurrencies, particularly regarding their classification as securities, casts a shadow on the XRP ETF landscape.

- Regulatory Challenges: ProShares faces potential regulatory challenges, including scrutiny over the use of futures contracts and the SEC's ongoing investigation into XRP.

- Approval/Disapproval Implications: SEC approval would likely boost the ETF's legitimacy and attract more investors, while disapproval could lead to its delisting.

Future Predictions and Market Trends:

- XRP Price Movements: The future price of XRP is highly speculative and depends on various factors, including regulatory developments and market sentiment.

- Competitor ETFs: The entry of other companies into the XRP ETF market could increase competition and potentially impact prices.

- Cryptocurrency ETF Trend: The overall trend of cryptocurrency ETFs is likely to continue, driven by increasing investor demand for regulated crypto exposure.

The future of XRP ETFs hinges on several factors, including regulatory clarity, market adoption, and the overall trajectory of the cryptocurrency market. Continued monitoring of the SEC's actions and market developments is crucial for assessing the long-term viability of these ETFs.

Investing in ProShares' XRP ETFs: A Practical Guide

Before investing in ProShares XRP ETFs, understanding the various investment strategies and practical aspects is crucial.

Understanding Investment Strategies:

- Investment Approaches: Investors should develop a clear investment strategy considering their risk tolerance and long-term financial goals. This could range from long-term holding to more active trading strategies.

- Risk Tolerance: It is crucial to assess your personal risk tolerance before investing in any cryptocurrency-related asset, given the inherent market volatility.

- Diversification: Diversifying your portfolio to minimize risks associated with investing heavily in a single asset is strongly recommended.

Where to Invest:

- Brokerage Platforms: Once launched, the ProShares XRP ETF will likely be available through various brokerage platforms. (Specific platforms will need to be added here once the ETF is live and trading details are confirmed.)

- Fees and Commissions: Carefully compare trading fees and commissions across different brokerage platforms before selecting one for trading the ETF.

Remember to conduct thorough due diligence before investing and seek professional financial advice if needed.

Conclusion: Making Informed Decisions about ProShares' XRP ETFs

ProShares' XRP ETFs represent a pioneering approach to offering XRP exposure in the absence of a regulated spot market. This strategy, while offering increased accessibility, presents unique risks associated with a futures-based ETF. Understanding the regulatory landscape, the potential benefits and drawbacks, and developing a sound investment strategy are crucial. Learn more about ProShares XRP ETFs, understand the risks associated with XRP ETFs, and explore your investment options in XRP-related assets only after conducting thorough research and considering your personal risk tolerance. Remember to consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Stephen Kings The Long Walk Movie A Terrific Adaptation

May 08, 2025

Stephen Kings The Long Walk Movie A Terrific Adaptation

May 08, 2025 -

Nba Star Jayson Tatum Welcomes Son With Singer Ella Mai New Commercial Fuels Speculation

May 08, 2025

Nba Star Jayson Tatum Welcomes Son With Singer Ella Mai New Commercial Fuels Speculation

May 08, 2025 -

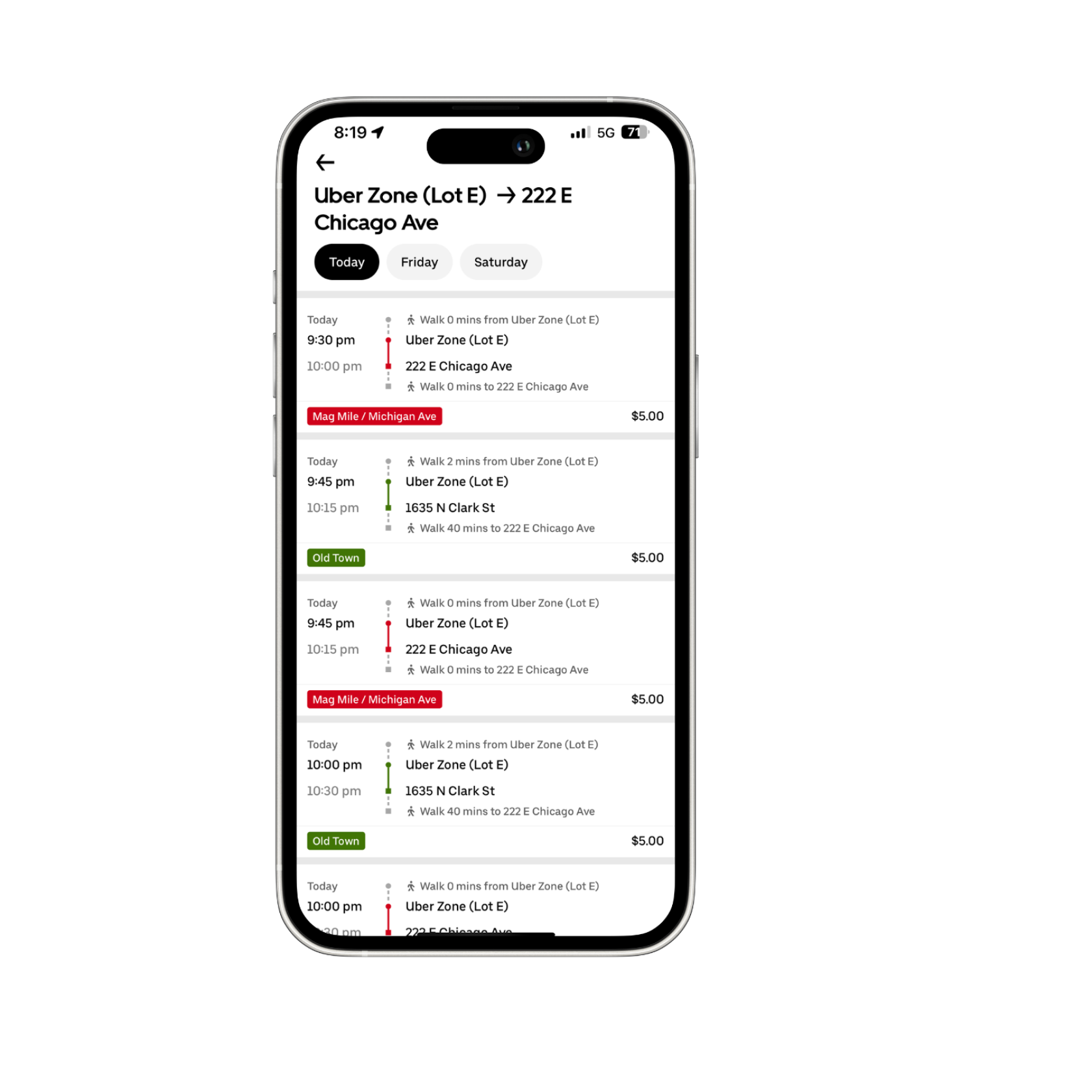

Post Game Transportation Solution 5 Uber Shuttle From United Center

May 08, 2025

Post Game Transportation Solution 5 Uber Shuttle From United Center

May 08, 2025 -

Inter Milans First Leg Triumph Over Bayern Munich In The Champions League

May 08, 2025

Inter Milans First Leg Triumph Over Bayern Munich In The Champions League

May 08, 2025 -

Dwp Scrapping Two Benefits What You Need To Know

May 08, 2025

Dwp Scrapping Two Benefits What You Need To Know

May 08, 2025