Private Credit Jobs: 5 Key Dos And Don'ts For Landing Your Dream Role

Table of Contents

DO: Network Strategically within the Private Credit Industry

Networking is paramount in securing a private credit job. Building strong relationships within the industry opens doors to unadvertised opportunities and provides invaluable insights.

Leverage LinkedIn Effectively:

- Actively engage with industry professionals by liking, commenting, and sharing relevant content.

- Join relevant groups such as "Private Equity and Venture Capital Professionals" or "Alternative Investments" and actively participate in discussions.

- Follow key players and companies in private credit to stay updated on industry trends and job openings.

- Customize your LinkedIn profile to highlight your skills in areas like financial modeling, credit analysis, and portfolio management, using keywords like "private debt," "direct lending," and "credit underwriting." Include a professional headshot and a compelling summary showcasing your experience and career goals in private credit.

Attend Industry Events:

- Network at conferences, seminars, and workshops focused on private credit, private equity, or alternative investments.

- Prepare insightful questions to engage with speakers and attendees, demonstrating your knowledge and interest. Focus on specific aspects of private credit investments or market trends.

- Follow up with valuable contacts after the event with a personalized email reiterating your interest and expressing gratitude for their time.

Informational Interviews:

- Reach out to professionals working in private credit for informational interviews. These conversations provide invaluable insights into specific roles and the industry.

- Prepare thoughtful questions that demonstrate your genuine interest and understanding of the private credit landscape. Ask about their career path, daily responsibilities, and the challenges and rewards of their role.

- Express gratitude and maintain contact after the interview. This helps build a long-term professional relationship that may lead to future opportunities.

DON'T: Underestimate the Importance of Financial Modeling Skills

Proficiency in financial modeling is non-negotiable for most private credit jobs. Employers seek candidates who can analyze complex financial statements and build robust models to evaluate potential investments.

Master Financial Modeling Software:

- Become proficient in Excel, including advanced functions like VBA, pivot tables, and data visualization tools.

- Learn specialized financial modeling software such as Argus, Bloomberg Terminal, or comparable platforms used in private credit analysis.

- Practice creating detailed financial models for different private credit scenarios, such as leveraged buyouts, debt restructurings, and real estate financing.

Neglect Understanding of Financial Statements:

- Develop a strong understanding of balance sheets, income statements, and cash flow statements. This is the foundation of all financial analysis.

- Learn to interpret and analyze financial data effectively, identifying key performance indicators (KPIs) and potential risks.

- Practice evaluating the financial health and risk assessments of potential investments using various financial ratios and metrics. This includes understanding credit ratings and covenants.

DO: Tailor Your Resume and Cover Letter to Each Application

Generic applications rarely succeed. Each private credit job application requires a customized approach highlighting your relevant skills and experience.

Highlight Relevant Skills and Experience:

- Showcase your experience in areas like credit analysis, financial modeling, portfolio management, due diligence, and legal documentation review.

- Quantify your achievements whenever possible (e.g., "increased portfolio returns by 15% through proactive risk management").

- Use keywords relevant to the specific job description, such as "private debt," "senior secured lending," "mezzanine financing," or "distressed debt."

Research the Company and the Role:

- Demonstrate a deep understanding of the company's investment strategy, target market, and recent transactions.

- Show how your skills and experience align with the specific requirements of the role. Highlight specific examples from your experience that directly relate to the job description.

- Tailor your cover letter to address the specific needs and challenges highlighted in the job description, showing why you're the ideal candidate.

DON'T: Neglect the Importance of Due Diligence

Before applying, research potential employers thoroughly. Understanding the firm's culture and investment strategy will impress recruiters and help you determine if it’s the right fit.

Thoroughly Research Potential Employers:

- Understand the company's culture, investment strategy, and recent transactions by reviewing their website, press releases, and news articles.

- Analyze the firm's reputation and standing within the private credit market. Look for reviews and ratings on sites like Glassdoor.

- Evaluate the team and its experience within the private equity and credit industries. LinkedIn can be a valuable resource for this research.

Skip the Salary Research:

- Research average salaries for similar roles within the private credit sector using resources like Glassdoor, Salary.com, or industry publications.

- Understand the compensation structure, including base salary, bonuses, and benefits.

- Prepare to negotiate your salary confidently during the interview process, having a clear understanding of your worth and the market rate.

DO: Prepare for Behavioral and Technical Interview Questions

Prepare for both technical questions testing your financial knowledge and behavioral questions assessing your personality and work style.

Practice Common Interview Questions:

- Prepare for questions assessing your technical skills in financial modeling, credit analysis, and valuation. Practice walking through model builds and explaining your reasoning.

- Practice your responses to behavioral interview questions, such as the STAR method (Situation, Task, Action, Result), showcasing your skills and experience using concrete examples.

- Prepare insightful questions to ask the interviewer, demonstrating your genuine interest and proactive nature.

Showcase Your Passion for Private Credit:

- Express your enthusiasm for the industry and your understanding of its complexities.

- Highlight your long-term career goals within the private credit sector.

- Demonstrate your commitment to continuous learning and professional development, showcasing your dedication to staying updated on industry trends.

Conclusion:

Securing a coveted private credit job requires a strategic and multifaceted approach. By following these dos and don'ts—mastering financial modeling, networking effectively, tailoring applications, conducting due diligence, and preparing thoroughly for interviews—you significantly increase your chances of landing your dream role in the dynamic world of private credit. Remember, persistence and a genuine passion for the industry are crucial. Start your journey today and begin your search for private credit jobs!

Featured Posts

-

Pattinson Runs Lines With Waterhouse A Look Into His Next Role

May 20, 2025

Pattinson Runs Lines With Waterhouse A Look Into His Next Role

May 20, 2025 -

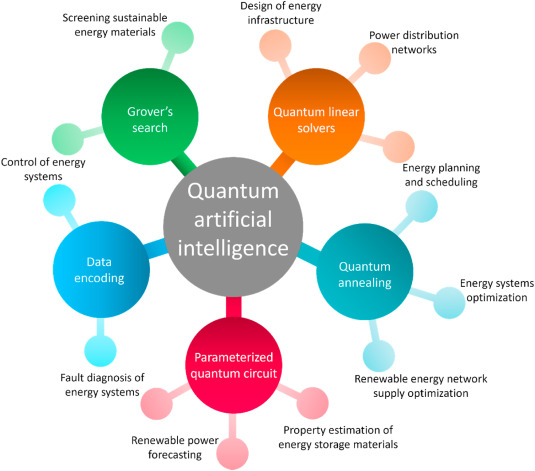

Buy This Ai Quantum Computing Stock The Dips Hidden Advantage

May 20, 2025

Buy This Ai Quantum Computing Stock The Dips Hidden Advantage

May 20, 2025 -

Strike Over Nj Transit Engineers Union Agrees To Contract

May 20, 2025

Strike Over Nj Transit Engineers Union Agrees To Contract

May 20, 2025 -

Complete Guide To The Nyt Mini Crossword March 24 2025

May 20, 2025

Complete Guide To The Nyt Mini Crossword March 24 2025

May 20, 2025 -

Snl Celebrates 50 Years With A Historic Season Finale

May 20, 2025

Snl Celebrates 50 Years With A Historic Season Finale

May 20, 2025

Latest Posts

-

When To Expect Rain Updated Forecasts And Timing

May 20, 2025

When To Expect Rain Updated Forecasts And Timing

May 20, 2025 -

Investing In Ai 12 Top Stocks Based On Reddit Sentiment

May 20, 2025

Investing In Ai 12 Top Stocks Based On Reddit Sentiment

May 20, 2025 -

The 12 Best Ai Stocks According To Reddit A Deep Dive

May 20, 2025

The 12 Best Ai Stocks According To Reddit A Deep Dive

May 20, 2025 -

Ai Stock Investing Reddits 12 Best Bets

May 20, 2025

Ai Stock Investing Reddits 12 Best Bets

May 20, 2025 -

Reddits 12 Most Discussed Ai Stocks Investment Potential

May 20, 2025

Reddits 12 Most Discussed Ai Stocks Investment Potential

May 20, 2025