Private Credit Jobs: 5 Do's And Don'ts To Secure Your Position

Table of Contents

5 Do's to Secure Your Private Credit Job

Do 1: Tailor Your Resume and Cover Letter to the Specific Role

Your application materials are your first impression. Generic resumes and cover letters won't cut it in the competitive landscape of private credit jobs. Effective resume optimization and targeted cover letter writing are paramount.

- Quantify your achievements: Instead of simply stating your responsibilities, quantify your accomplishments. For example, instead of "Managed a portfolio of investments," write "Increased portfolio returns by 15% through strategic asset allocation and risk management."

- Highlight relevant skills and experience: Even if a previous role seems unrelated, highlight transferable skills like financial modeling, data analysis, or communication skills applicable to private credit analyst jobs or investment banking jobs.

- Use keywords from the job description: Carefully review the job description and incorporate relevant keywords into your resume and cover letter. This helps Applicant Tracking Systems (ATS) identify your application as a potential match. Consider using private credit resume examples as a guide.

- Showcase your understanding of private credit principles and market trends: Demonstrate your knowledge of private debt, alternative lending, and relevant market dynamics. Show you’ve done your research on private credit investing.

- Proofread meticulously: Typos and grammatical errors are unforgivable. Thoroughly proofread your application materials before submitting them.

Do 2: Network Strategically Within the Private Credit Industry

Networking is crucial for landing a private credit job. Building relationships within the industry can open doors to unadvertised opportunities.

- Attend industry conferences and events: Networking events provide invaluable opportunities to meet professionals and learn about private credit opportunities.

- Leverage LinkedIn: Connect with professionals in private credit, engage in relevant discussions, and follow industry influencers.

- Informational interviews: Reach out to people working in private credit for informational interviews. These conversations can provide valuable insights and potential connections.

- Join relevant professional organizations: Membership in organizations like the CFA Institute or industry-specific groups can expand your network and provide access to resources.

- Build relationships with recruiters specializing in finance: Recruiters often have exclusive access to private equity jobs, private credit jobs, and other financial analyst jobs.

Do 3: Master the Fundamentals of Private Credit Investing

A strong understanding of private credit investing principles is essential. Demonstrate your expertise in relevant areas.

- Credit analysis, financial modeling, and valuation techniques: Develop proficiency in these core skills. Your understanding of leveraged finance will be heavily tested.

- Stay updated on industry trends and regulations: The private credit market is constantly evolving. Stay informed about the latest trends, regulations, and market dynamics.

- Develop expertise in specific areas: Specializing in areas like distressed debt or real estate finance can make you a more attractive candidate.

- Showcase your understanding of different private credit strategies: Be prepared to discuss various investment strategies and their implications.

- Highlight relevant certifications: Certifications such as CFA (Chartered Financial Analyst) or CAIA (Chartered Alternative Investment Analyst) demonstrate your commitment to the field.

Do 4: Prepare Thoroughly for Behavioral and Technical Interviews

Interview preparation is crucial. Practice answering common questions and prepare for technical challenges.

- Practice answering common behavioral interview questions: Prepare examples showcasing your problem-solving skills, teamwork abilities, and handling of challenging situations.

- Prepare for technical questions: Be ready to discuss financial modeling, valuation techniques, credit analysis, and your understanding of private debt.

- Research the firm and interviewer: Demonstrate your genuine interest by researching the firm's investment strategy and the interviewer's background.

- Practice your communication skills: Practice articulating your thoughts clearly and concisely, showcasing your ability to explain complex concepts in a simple manner.

- Prepare insightful questions to ask the interviewer: Asking thoughtful questions demonstrates your engagement and interest in the role and the firm.

Do 5: Follow Up After Each Stage of the Interview Process

Maintaining consistent communication throughout the interview process demonstrates professionalism and enthusiasm.

- Send a thank-you note: After each interview, send a personalized thank-you note reiterating your interest and highlighting key discussion points.

- Follow up on the application status: If you haven't heard back within a reasonable timeframe, politely follow up on the status of your application.

- Maintain professional communication: Respond promptly and professionally to all communication from the firm.

- Show your continued enthusiasm: Reiterate your strong interest in the role and the firm throughout the process.

5 Don'ts When Pursuing Private Credit Jobs

Don't 1: Submit Generic Application Materials

Using generic application materials demonstrates a lack of effort and interest. Tailoring your resume and cover letter to each specific role is crucial.

Don't 2: Neglect Networking Opportunities

Networking is not just about attending events; it's about building genuine relationships. Neglecting networking opportunities limits your access to unadvertised positions and valuable insights.

Don't 3: Underestimate the Importance of Technical Skills

Proficiency in financial modeling, credit analysis, and valuation is non-negotiable. Lacking these technical skills significantly reduces your chances of securing a private credit job.

Don't 4: Go Unprepared for Interviews

Going unprepared to interviews demonstrates a lack of professionalism and interest. Thorough preparation is essential for showcasing your skills and knowledge.

Don't 5: Fail to Follow Up

Failing to follow up after interviews leaves a negative impression. Consistent communication demonstrates your enthusiasm and professionalism.

Conclusion

Securing a coveted position in the competitive world of private credit jobs requires diligent preparation and a strategic approach. By following these five "do's" and avoiding the five "don'ts," you significantly improve your chances of landing your dream role in private debt, alternative lending, or related fields within the exciting private credit sector. Remember, tailoring your application, networking effectively, mastering the fundamentals, preparing thoroughly for interviews, and following up diligently are key to success in your pursuit of private credit jobs. Start refining your approach today and unlock the vast opportunities within the world of private credit!

Featured Posts

-

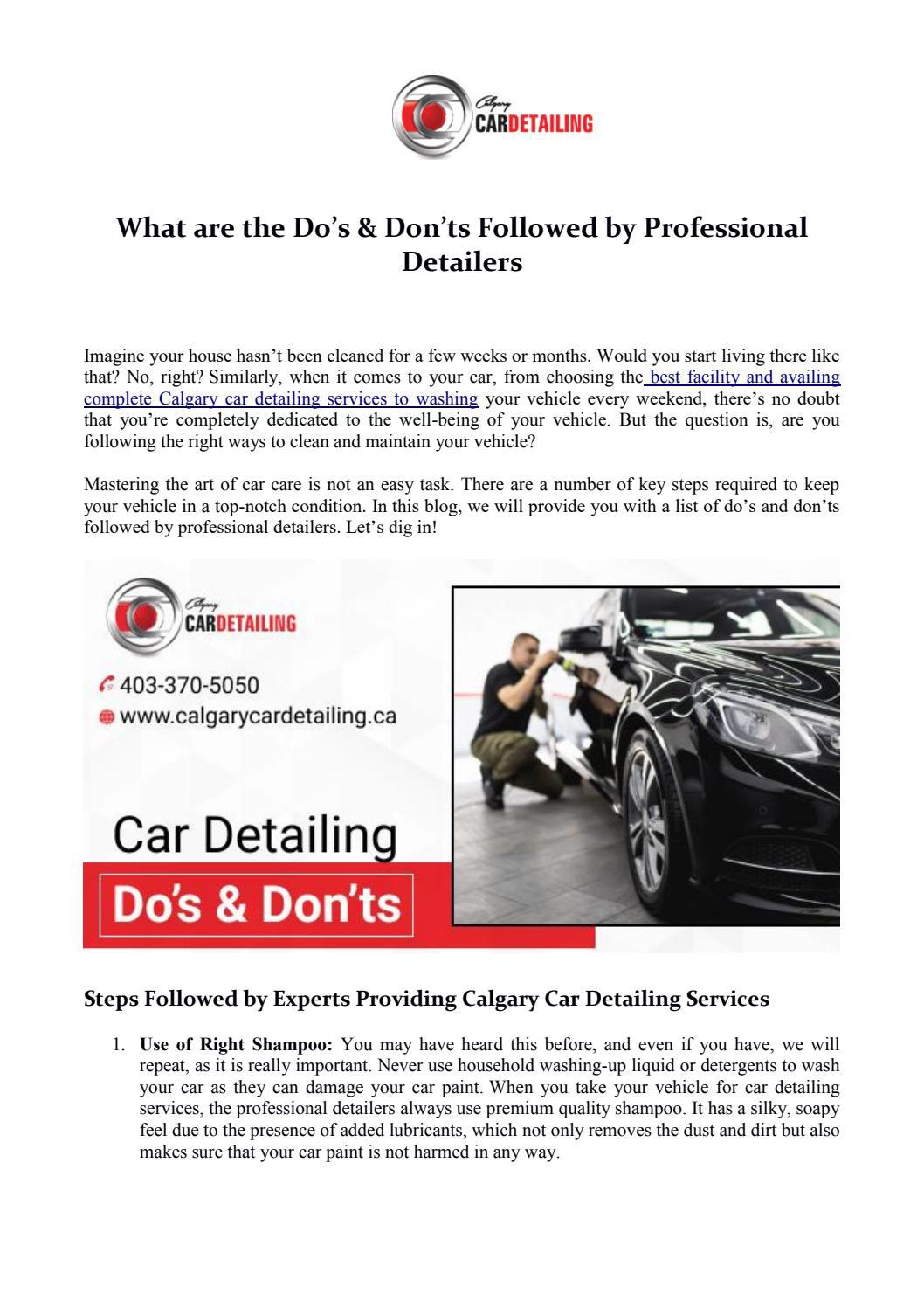

Kazakhstan Triumphs Australias Bjk Cup Run Ends

May 23, 2025

Kazakhstan Triumphs Australias Bjk Cup Run Ends

May 23, 2025 -

Dancehall Artists Trinidad Concert Restrictions And Kartels Backing

May 23, 2025

Dancehall Artists Trinidad Concert Restrictions And Kartels Backing

May 23, 2025 -

Kieran Culkins A Real Pain At Theater Het Kruispunt A Review

May 23, 2025

Kieran Culkins A Real Pain At Theater Het Kruispunt A Review

May 23, 2025 -

Grand Ole Opry Goes Global Historic London Show At Royal Albert Hall

May 23, 2025

Grand Ole Opry Goes Global Historic London Show At Royal Albert Hall

May 23, 2025 -

Airlifting Cows The Unusual Rescue Mission In A Swiss Village

May 23, 2025

Airlifting Cows The Unusual Rescue Mission In A Swiss Village

May 23, 2025

Latest Posts

-

Neal Mc Donoughs Impact On The Last Rodeo

May 23, 2025

Neal Mc Donoughs Impact On The Last Rodeo

May 23, 2025 -

The Last Rodeo Highlights Of Neal Mc Donoughs Acting

May 23, 2025

The Last Rodeo Highlights Of Neal Mc Donoughs Acting

May 23, 2025 -

Dc Legends Of Tomorrow Exploring The Multiverse

May 23, 2025

Dc Legends Of Tomorrow Exploring The Multiverse

May 23, 2025 -

Review Neal Mc Donough In The Last Rodeo

May 23, 2025

Review Neal Mc Donough In The Last Rodeo

May 23, 2025 -

The Last Rodeo Neal Mc Donoughs Standout Performance

May 23, 2025

The Last Rodeo Neal Mc Donoughs Standout Performance

May 23, 2025