Private Credit Jobs: 5 Do's And Don'ts For Career Success

Table of Contents

5 DO's for Private Credit Career Success

Do 1: Network Strategically

Building a strong network is paramount in the private credit industry. It's not just about collecting business cards; it's about cultivating meaningful relationships.

- Build relationships with professionals in private credit firms: Attend industry events, connect on LinkedIn, and seek informational interviews. Don't be afraid to reach out to people even if you don't have a direct connection.

- Attend industry conferences and events: SuperReturn, industry-specific conferences, and smaller, more intimate gatherings offer excellent networking opportunities. Actively participate in discussions and workshops.

- Leverage LinkedIn effectively: Optimize your profile to highlight your relevant skills and experience. Engage with content shared by private credit professionals and join relevant groups.

- Participate in relevant online forums and communities: Engage in discussions, share your insights, and build your reputation as a knowledgeable professional.

- Seek informational interviews: These informal conversations are invaluable for gaining insights into the industry, learning about different career paths, and making valuable connections.

Do 2: Master Financial Modeling and Analysis

Proficiency in financial modeling and analysis is non-negotiable for private credit jobs. This requires both technical skills and a deep understanding of financial principles.

- Develop proficiency in Excel and financial modeling software: Master advanced Excel functions, and become comfortable using specialized software like Bloomberg Terminal.

- Gain expertise in financial statement analysis, valuation techniques, and credit analysis: Understand key financial ratios, different valuation methodologies (DCF, precedent transactions), and credit risk assessment tools.

- Pursue relevant certifications: Consider pursuing certifications like the CFA (Chartered Financial Analyst) or CAIA (Chartered Alternative Investment Analyst) to demonstrate your expertise.

- Focus on understanding leveraged finance, debt structuring, and credit risk assessment: A strong grasp of these concepts is essential for success in private credit.

- Practice building detailed financial models for various private credit scenarios: The more you practice, the better you'll become at building accurate and insightful models.

Do 3: Develop Strong Communication and Presentation Skills

In private credit, you'll be communicating complex financial information to various stakeholders. Clear and persuasive communication is crucial.

- Practice concise and persuasive communication, both written and verbal: Learn to articulate your ideas clearly and concisely, both in writing (emails, reports) and verbally (meetings, presentations).

- Master the art of presenting complex financial information clearly and effectively: Practice structuring your presentations logically, using visuals effectively, and answering questions confidently.

- Hone your storytelling skills: Learn to connect with your audience by weaving a compelling narrative around your data and analysis.

- Practice your pitch: Be able to articulate your experience and value proposition succinctly and persuasively. Prepare for behavioral interview questions, focusing on STAR method answers.

- Seek feedback on presentations and adjust accordingly: Don't be afraid to ask for constructive criticism and use it to improve your presentation skills.

Do 4: Understand the Private Credit Landscape

The private credit market is dynamic and constantly evolving. Staying informed is key to career success.

- Stay updated on market trends, regulatory changes, and industry news: Follow reputable financial news sources, industry publications, and blogs.

- Follow key players and influential figures in the private credit space: Understanding the key players and their strategies can provide valuable insights.

- Understand different types of private credit strategies: Familiarize yourself with direct lending, mezzanine financing, distressed debt, and other strategies.

- Research different types of private credit firms: Understand the different structures and investment approaches of various firms, from large banks to boutique fund managers.

- Develop a deep understanding of credit risk management principles: This is fundamental to success in private credit.

Do 5: Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. Make them count.

- Highlight relevant skills and experience that align with specific job descriptions: Use keywords from the job description in your resume and cover letter.

- Quantify achievements whenever possible to demonstrate impact: Use numbers and data to show the results you've achieved in previous roles.

- Tailor your resume and cover letter to each specific job application: Don't send generic applications. Customize your materials to each opportunity.

- Use keywords relevant to private credit job descriptions: Incorporate terms like "leveraged finance," "credit analysis," "debt structuring," "syndicated loans," and "private equity."

- Proofread carefully before submitting your application: Errors can cost you the opportunity.

5 DON'Ts for Private Credit Career Success

Don't 1: Neglect Networking

Networking is crucial in this industry. Don't underestimate its power.

- Don't underestimate the power of networking: Actively build relationships with professionals in the field.

- Don't rely solely on online applications: Attend events, connect with people, and seek opportunities to meet potential employers.

- Don't be afraid to reach out to people you don't know: Many professionals are willing to offer advice and guidance.

- Don't limit your network to one specific area of private credit: Explore different areas to broaden your perspective and opportunities.

Don't 2: Underestimate the Importance of Technical Skills

Technical skills are the foundation of a successful private credit career.

- Don't assume your soft skills are enough: Technical expertise is essential for success.

- Don't neglect continuous learning and development: Stay updated on the latest financial modeling techniques and industry best practices.

- Don't be afraid to seek mentorship: Find experienced professionals who can guide your development.

Don't 3: Overlook Communication Skills

Strong communication is essential for success in any role, especially in private credit.

- Don't underestimate the importance of clear and concise communication: Learn to communicate complex information effectively.

- Don't assume that your technical skills will speak for themselves: Your ability to communicate your findings is just as important.

- Don't shy away from opportunities to present and articulate your ideas: Practice your presentation skills and seek feedback.

Don't 4: Ignore Industry Trends

The private credit market is constantly changing. Stay informed.

- Don't become complacent: The private credit market is dynamic and requires continuous learning.

- Don't fail to stay updated: Keep abreast of market trends, regulatory changes, and emerging investment strategies.

- Don't neglect the importance of continuous professional development: Invest in your education and skills development.

Don't 5: Submit Generic Applications

Take the time to customize your application for each job.

- Don't waste your time sending generic resumes and cover letters: Tailor your application to each specific job description.

- Don't underestimate the importance of tailoring your application: Show the employer that you've taken the time to understand their needs.

- Don't overlook the details: Ensure your application is error-free and well-presented.

Conclusion

Securing a rewarding position in the competitive world of private credit jobs requires a strategic approach. By following these "do's" and "don'ts," you'll significantly improve your chances of success. Remember to network effectively, master crucial skills, and present yourself professionally. Don't delay – start implementing these strategies today to advance your private credit career. Begin your journey to landing your ideal private credit job now!

Featured Posts

-

Significant Weight Gain For Paddy Pimblett After Ufc 314 Bout

May 16, 2025

Significant Weight Gain For Paddy Pimblett After Ufc 314 Bout

May 16, 2025 -

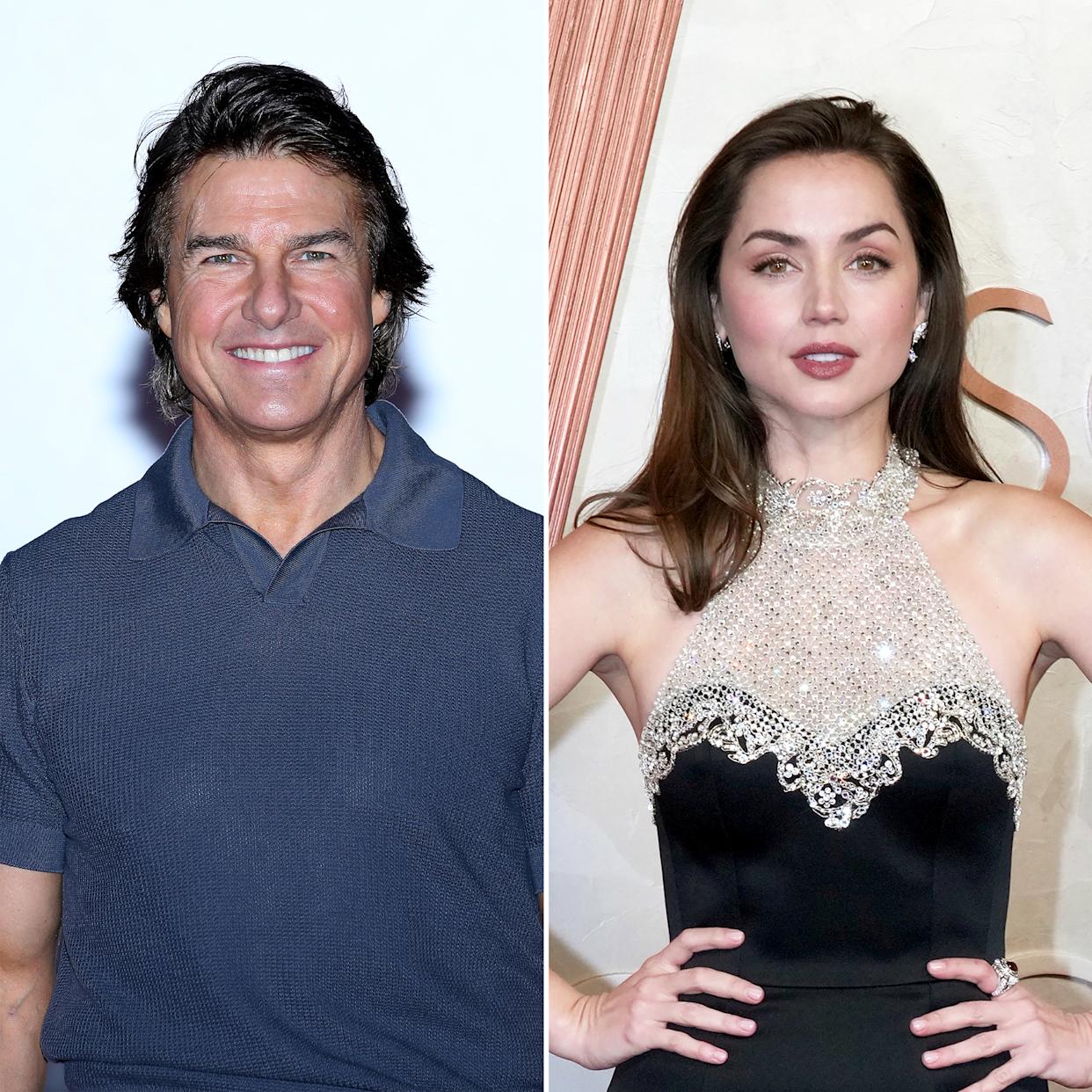

Another Uk Appearance Tom Cruise And Ana De Armas Relationship Rumors Intensify

May 16, 2025

Another Uk Appearance Tom Cruise And Ana De Armas Relationship Rumors Intensify

May 16, 2025 -

Zach Steffens Mistakes Cost Earthquakes In Rapids Defeat

May 16, 2025

Zach Steffens Mistakes Cost Earthquakes In Rapids Defeat

May 16, 2025 -

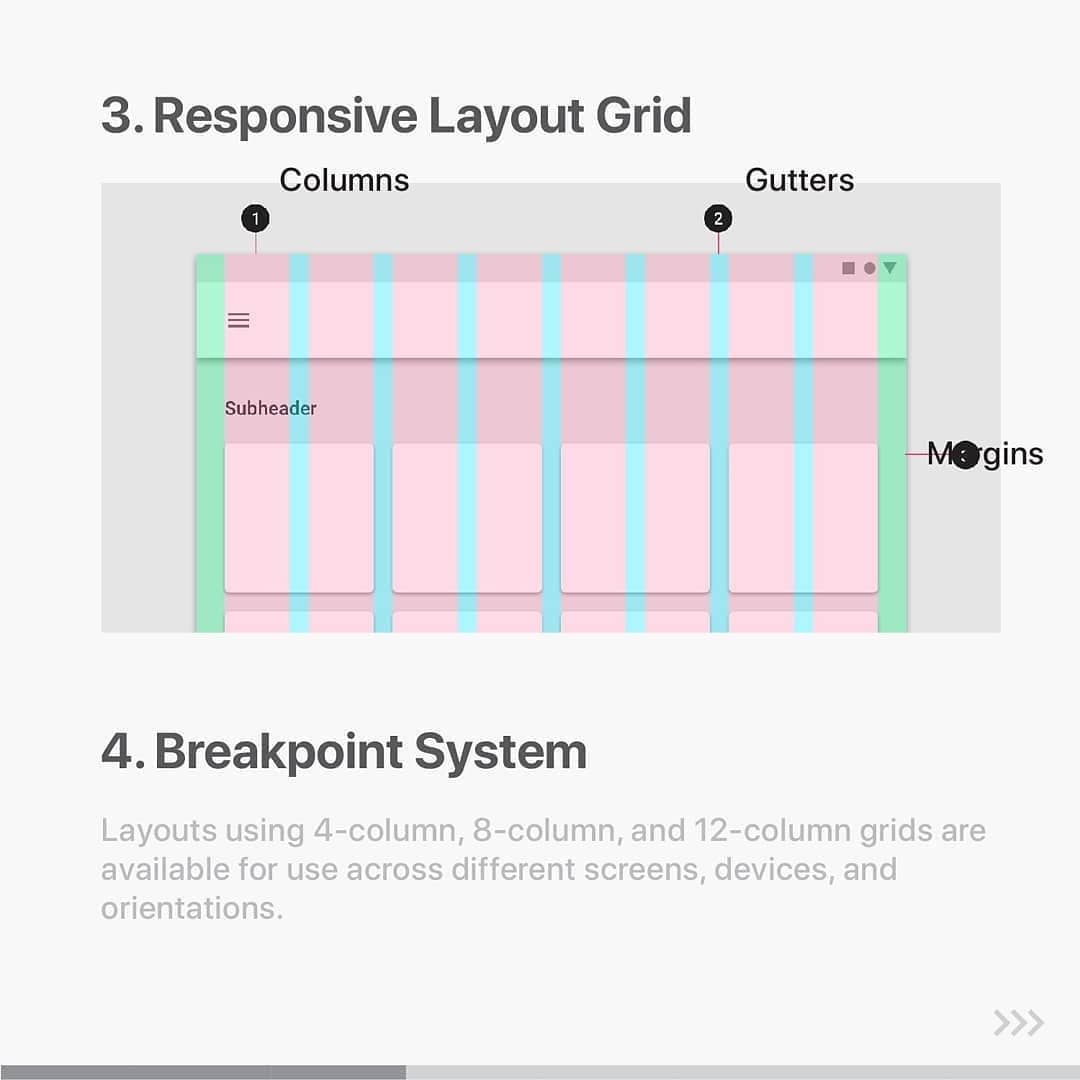

Understanding Androids New Design Language

May 16, 2025

Understanding Androids New Design Language

May 16, 2025 -

Predicting The Giants Padres Game Padres Outright Win Or Narrow Defeat

May 16, 2025

Predicting The Giants Padres Game Padres Outright Win Or Narrow Defeat

May 16, 2025

Latest Posts

-

Nhl Minority Owner Suspended Online Abuse And Condemnation Of Terrorism

May 16, 2025

Nhl Minority Owner Suspended Online Abuse And Condemnation Of Terrorism

May 16, 2025 -

Nhl Referees Embrace Apple Watch Technology Improved Performance

May 16, 2025

Nhl Referees Embrace Apple Watch Technology Improved Performance

May 16, 2025 -

Nhl Playoffs 2024 Where To Watch Every Game

May 16, 2025

Nhl Playoffs 2024 Where To Watch Every Game

May 16, 2025 -

How Apple Watches Are Changing Nhl Refereeing

May 16, 2025

How Apple Watches Are Changing Nhl Refereeing

May 16, 2025 -

Rekordsmen N Kh L Po Khitam Obyavlyaet O Zavershenii Karery Alternative Using A Synonym

May 16, 2025

Rekordsmen N Kh L Po Khitam Obyavlyaet O Zavershenii Karery Alternative Using A Synonym

May 16, 2025