Private Credit Jobs: 5 Crucial Do's And Don'ts For Success

Table of Contents

Do's for Securing Private Credit Jobs

1. Network Strategically

Building a strong network is paramount in the private credit industry. It's not just about who you know, but the quality of those relationships.

- Build relationships within the private credit industry: Attend industry events, conferences, and workshops. Actively engage in conversations, share your knowledge, and show genuine interest in others' work.

- Leverage LinkedIn effectively: Optimize your profile, showcasing your skills and experience relevant to private credit roles. Connect with professionals in the field, engage with their posts, and participate in relevant groups. LinkedIn is a powerful tool for discovering unadvertised private credit jobs.

- Join relevant professional organizations: Membership in organizations like the Association for Corporate Growth (ACG) or the American Investment Council (AIC) can provide valuable networking opportunities and access to industry insights.

- Informational interviews are crucial: Don't be afraid to reach out to people in private credit for informational interviews. This allows you to learn more about their career paths and gain valuable insights into the industry.

2. Highlight Relevant Skills and Experience

Your resume and cover letter are your first impression. Make them count.

- Tailor your resume and cover letter: Don't use a generic template. Carefully read each job description and tailor your application to highlight the specific skills and experience the employer seeks.

- Emphasize key skills: Focus on skills such as financial modeling, credit analysis, due diligence, leveraged buyout (LBO) modeling, distressed debt analysis, and understanding of private equity fund structures.

- Quantify your accomplishments: Use metrics and data to demonstrate the impact you've made in previous roles. Instead of saying "Improved efficiency," say "Improved efficiency by 15% resulting in $X cost savings."

- Showcase experience in relevant areas: Highlight experience in areas such as leveraged buyouts, distressed debt investing, mezzanine financing, or other private credit strategies.

- Demonstrate legal and regulatory knowledge: Show your understanding of relevant regulations and compliance requirements within the private credit space.

3. Master the Art of the Interview

The interview is your chance to shine. Preparation is key.

- Practice common interview questions: Prepare answers to behavioral questions, technical questions related to financial modeling and credit analysis, and questions about your career goals. Practice with a friend or mentor.

- Thorough research is essential: Research the firm, its investment strategy, recent deals, and the interviewer's background. This demonstrates your genuine interest and preparedness.

- Prepare insightful questions: Asking thoughtful questions shows your engagement and intellectual curiosity. Prepare questions about the firm's culture, investment strategy, or current market trends.

- Demonstrate market understanding: Stay current on market trends, economic factors impacting the private credit sector, and relevant news affecting the industry.

- Showcase problem-solving abilities: Highlight your ability to analyze complex situations, identify solutions, and work effectively under pressure.

4. Showcase Your Financial Acumen

A strong understanding of finance is non-negotiable in private credit.

- Demonstrate understanding of financial statements: Be prepared to discuss balance sheets, income statements, and cash flow statements, including key ratios and their implications.

- Master financial modeling and valuation: Proficiency in financial modeling, including discounted cash flow (DCF) analysis and leveraged buyout (LBO) modeling, is crucial.

- Understand different credit instruments: Familiarize yourself with various credit instruments used in private credit, such as senior secured loans, subordinated debt, and mezzanine financing.

- Analyze risk and investment decisions: Be ready to discuss your approach to risk assessment and how you make informed investment decisions.

- Stay updated on market conditions: Keep abreast of current market conditions and economic trends that might affect the private credit sector.

Don'ts for Private Credit Job Seekers

1. Neglect Networking

Networking is not optional; it's vital.

- Don't underestimate the power of networking: Many private credit jobs are never advertised publicly. Networking is crucial for uncovering hidden opportunities.

- Don't rely solely on online applications: While online applications are important, networking significantly increases your chances of securing an interview.

- Don't be afraid to reach out: Proactively reaching out to professionals in the industry, even if you don't have a direct connection, can lead to valuable opportunities.

- Don't miss industry events: Attend conferences, seminars, and other networking events to expand your contacts and gain insights.

2. Submit Generic Applications

Each application should be unique and tailored.

- Don't send generic applications: Customize your resume and cover letter for each job application, highlighting the skills and experience most relevant to the specific role and company.

- Don't ignore job descriptions: Carefully read each job description and address the specific requirements outlined.

- Don't use a generic template: Avoid using a generic resume and cover letter template. Each application should be unique and tailored to the specific job and company.

3. Underprepare for Interviews

Thorough preparation is crucial for success.

- Don't go unprepared: Research the firm and the interviewer extensively before the interview.

- Don't wing it: Practice answering common interview questions to ensure confident and articulate responses.

- Don't underestimate first impressions: Make a strong first impression with professional attire and a positive attitude.

4. Lack Financial Proficiency

A strong financial foundation is essential.

- Don't underestimate financial knowledge: A deep understanding of finance is essential for success in private credit.

- Don't rely solely on academics: While a strong academic background is helpful, practical experience and continuous learning are equally important.

- Don't hesitate to upskill: Brush up on your financial modeling, valuation, and credit analysis skills to stay competitive.

Conclusion

Securing a position in the competitive field of private credit jobs demands a strategic and well-prepared approach. By following these do's and don'ts, you can significantly improve your chances of success. Remember to network strategically, highlight your relevant skills, master the art of the interview, and showcase your financial acumen. Avoid neglecting networking opportunities, submitting generic applications, and underpreparing for interviews, and ensure you demonstrate sufficient financial proficiency. By diligently implementing these strategies, you'll significantly increase your prospects of landing your dream private credit job. Start refining your approach today and begin your journey towards a fulfilling career in private credit jobs.

Featured Posts

-

Serie A En Vivo Atalanta Vs Bologna Fecha 32 Sigue El Partido Aqui

May 13, 2025

Serie A En Vivo Atalanta Vs Bologna Fecha 32 Sigue El Partido Aqui

May 13, 2025 -

Top Filmov S Dzherardom Batlerom Mnenie Eksperta

May 13, 2025

Top Filmov S Dzherardom Batlerom Mnenie Eksperta

May 13, 2025 -

Ball Mark Photo How Sabalenka Won Her Stuttgart Open Match

May 13, 2025

Ball Mark Photo How Sabalenka Won Her Stuttgart Open Match

May 13, 2025 -

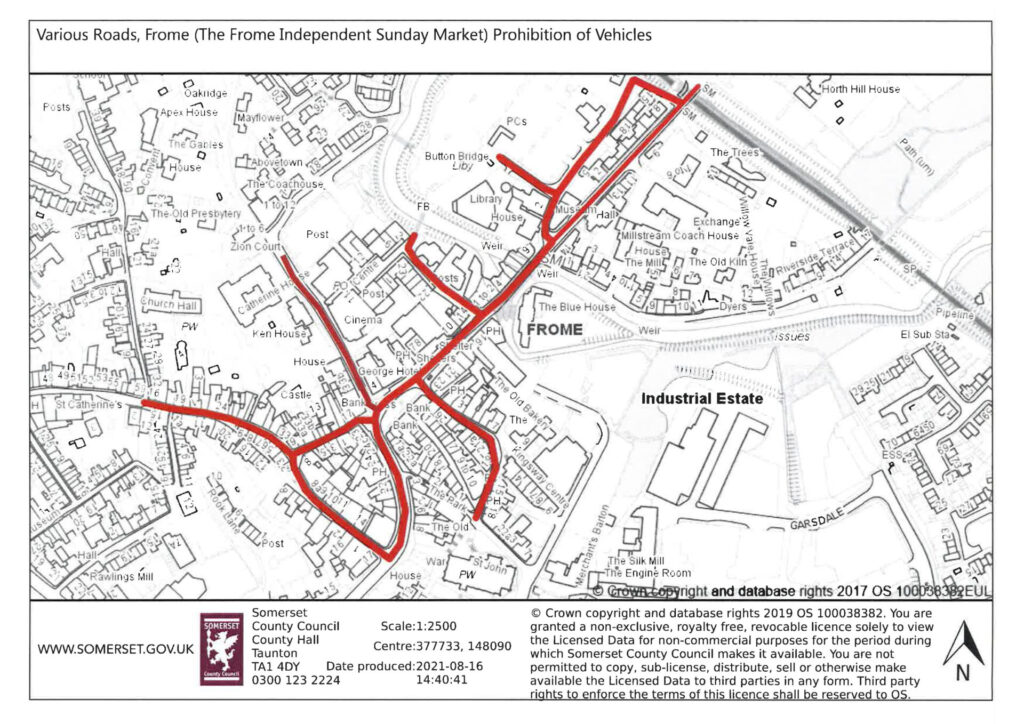

Tasman Council Realistic Assessment Of Key Road Closure

May 13, 2025

Tasman Council Realistic Assessment Of Key Road Closure

May 13, 2025 -

Open Ai And Chat Gpt Facing Ftc Investigation

May 13, 2025

Open Ai And Chat Gpt Facing Ftc Investigation

May 13, 2025