Principal Financial Group (PFG): 13 Analysts Weigh In

Table of Contents

Analyst Ratings and Price Targets for PFG Stock

The 13 analyst reports on Principal Financial Group (PFG) reveal a mixed bag of ratings and price targets for PFG stock. The range of opinions reflects the complexities and uncertainties inherent in predicting the future performance of any publicly traded company. While some analysts maintain a bullish outlook, others express more cautious optimism or even skepticism.

The average price target across the 13 analysts sits at $XX (replace with actual data). However, individual price targets exhibit a significant spread, ranging from a low of $YY (replace with actual data) to a high of $ZZ (replace with actual data). This wide dispersion highlights the differing perspectives on PFG’s growth potential and the inherent risks involved.

Here's a summary of some of the individual analyst ratings and price targets:

- Analyst A: Buy rating, $75 price target. Justification: Strong belief in PFG's long-term growth strategy and its resilience in a volatile market.

- Analyst B: Hold rating, $68 price target. Justification: Concerns about competitive pressures and potential regulatory changes impacting profitability.

- Analyst C: Sell rating, $60 price target. Justification: Belief that PFG is overvalued and that its current growth trajectory is unsustainable. (Replace with actual data and justifications from your research)

Key Factors Influencing Analyst Opinions on PFG

Several key factors contribute to the diverse analyst opinions on PFG. These include macroeconomic conditions, PFG's financial performance, and significant company developments.

-

Macroeconomic Conditions Impacting PFG: Rising interest rates and persistent inflation are impacting investor sentiment across the financial sector, including PFG. Analysts are divided on how effectively PFG can navigate this challenging economic environment. Some believe PFG's diversified business model provides resilience, while others are concerned about potential margin compression.

-

PFG’s Recent Financial Performance: Analysts closely scrutinize PFG's earnings reports, revenue growth, and profitability metrics. Variations in interpretation of these financial indicators contribute to the diverse ratings. Strong performance in certain segments might be offset by weaker performance in others, leading to contrasting assessments.

-

Significant Company Developments: Any significant company news, such as new product launches, strategic acquisitions, or regulatory changes, can significantly impact analyst sentiment. For example, successful product launches can boost investor confidence, while regulatory hurdles may create uncertainty.

Strengths and Weaknesses Identified by Analysts Regarding PFG

Analysts have identified both strengths and weaknesses in Principal Financial Group's business model and overall market position.

Strengths of Principal Financial Group:

- Diversified Product Portfolio: PFG offers a broad range of financial products and services, mitigating risk associated with reliance on a single product line.

- Strong Brand Recognition: PFG enjoys significant brand recognition and trust among its customers, providing a competitive advantage.

- Experienced Management Team: PFG’s leadership team possesses extensive experience in the financial services industry.

Weaknesses of Principal Financial Group:

- Intense Competition: The financial services industry is highly competitive, with PFG facing pressure from both established players and innovative fintech companies.

- Regulatory Scrutiny: Changes in financial regulations can significantly impact PFG's operations and profitability.

- Market Volatility: Fluctuations in global markets pose significant challenges to PFG's investment strategies and overall performance.

Long-Term Outlook for PFG Based on Analyst Consensus

Despite the range of opinions, a general consensus emerges regarding PFG's long-term prospects. While not uniformly bullish, most analysts believe PFG possesses the potential for moderate growth in the long term. However, this growth is contingent upon successful navigation of several challenges.

-

Consensus Long-Term Outlook for PFG Stock: The majority of analysts see PFG as a stable, if not spectacular, long-term investment. The potential for significant outperformance is tempered by concerns about competition and regulatory risks.

-

Potential Future Growth Areas for PFG: Analysts highlight opportunities for growth in areas such as expanding into new markets, developing innovative digital solutions, and enhancing its customer service offerings.

-

Risks and Opportunities for Long-Term Investors: Long-term investors should consider both the opportunities and risks associated with PFG. A well-diversified portfolio can mitigate the risks associated with individual stock performance.

Conclusion: Making Informed Decisions on Principal Financial Group (PFG)

This analysis of 13 analyst opinions on Principal Financial Group (PFG) reveals a range of perspectives on the company's current situation and future prospects. While some analysts express optimism based on PFG's strengths and potential for growth, others express caution due to competitive pressures and market uncertainties. The key takeaways include the importance of considering macroeconomic conditions, PFG's financial performance, and significant company developments when assessing its investment potential.

Remember to conduct thorough due diligence before investing in Principal Financial Group (PFG). Consider consulting with a financial advisor to determine if PFG aligns with your personal investment goals and risk tolerance. Analyzing multiple perspectives, as we have done here, is crucial for making informed investment decisions regarding PFG or any other stock.

Featured Posts

-

Finding Affordable Quality Great Products Without The Premium Price

May 17, 2025

Finding Affordable Quality Great Products Without The Premium Price

May 17, 2025 -

Esquema Ponzi Koriun Inversiones Una Explicacion Detallada

May 17, 2025

Esquema Ponzi Koriun Inversiones Una Explicacion Detallada

May 17, 2025 -

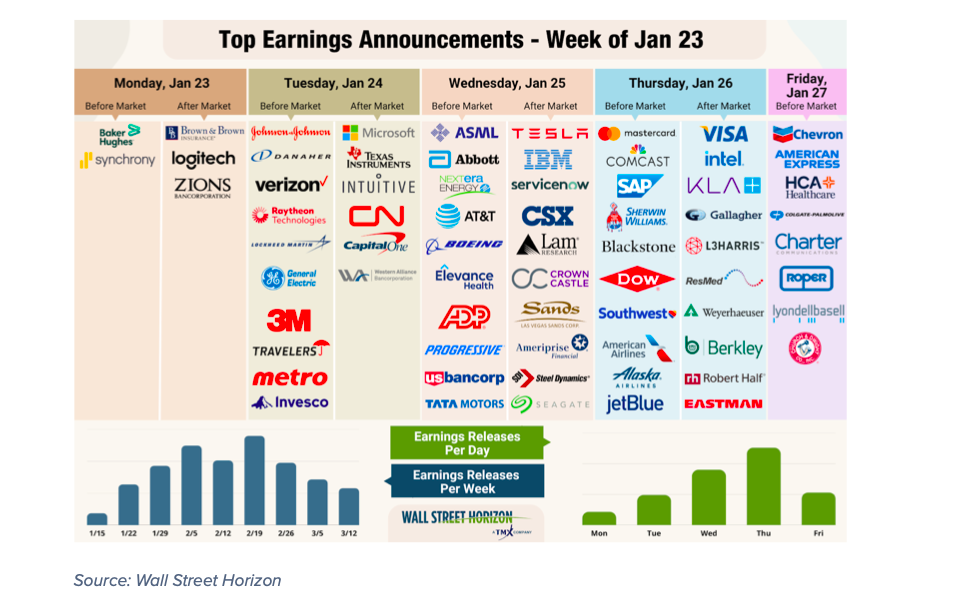

Strong Earnings Reports Fuel Market Growth Rockwell Automation And Others

May 17, 2025

Strong Earnings Reports Fuel Market Growth Rockwell Automation And Others

May 17, 2025 -

Exclusive Averted Midair Collision The Air Traffic Controllers Account

May 17, 2025

Exclusive Averted Midair Collision The Air Traffic Controllers Account

May 17, 2025 -

Los Angeles Palisades Fire Impact On Celebrity Homes Full List

May 17, 2025

Los Angeles Palisades Fire Impact On Celebrity Homes Full List

May 17, 2025

Latest Posts

-

Top 10 Sherlock Holmes Quotes Of All Time

May 17, 2025

Top 10 Sherlock Holmes Quotes Of All Time

May 17, 2025 -

10 Best Sherlock Holmes Quotes A Ranked List

May 17, 2025

10 Best Sherlock Holmes Quotes A Ranked List

May 17, 2025 -

Discover Alan Carr And Amanda Holdens Exquisite Spanish Townhouse E245 K

May 17, 2025

Discover Alan Carr And Amanda Holdens Exquisite Spanish Townhouse E245 K

May 17, 2025 -

Luxury Spanish Townhouse For Sale E245 000 Designed By Carr And Holden

May 17, 2025

Luxury Spanish Townhouse For Sale E245 000 Designed By Carr And Holden

May 17, 2025 -

Spanish Property For Sale E245 K Townhouse Renovated By Alan Carr And Amanda Holden

May 17, 2025

Spanish Property For Sale E245 K Townhouse Renovated By Alan Carr And Amanda Holden

May 17, 2025