Pre-IPO Challenges: A Forerunner's Guide To Alternative Strategies

Table of Contents

Funding Challenges Before the IPO

Securing sufficient funding is arguably the biggest hurdle for companies preparing for an IPO. The pre-IPO phase often involves multiple funding rounds, each presenting unique challenges.

Securing Pre-IPO Funding

Raising capital before an IPO can be a significant undertaking. Companies typically navigate several funding rounds, such as Series A, B, and C, each requiring a compelling pitch and demonstrating increasing traction.

- Venture Capital: VC firms invest in high-growth potential companies but demand significant equity in return.

- Angel Investors: High-net-worth individuals provide early-stage funding, often offering mentorship alongside capital.

- Private Equity: PE firms invest in established companies, sometimes facilitating the path to an IPO.

- Debt Financing: Borrowing money from banks or other lenders, requiring collateral and a strong financial track record.

- Crowdfunding: Raising funds from a large number of individuals through online platforms, appealing to a wider investor base.

Each funding method presents unique pros and cons. Venture capital provides substantial capital but dilutes ownership. Debt financing avoids equity dilution but adds financial burden. Investors heavily scrutinize factors like market traction, market size, and the strength of the management team before committing funds.

Managing Cash Flow and Burn Rate

Efficient cash management is paramount. Maintaining a healthy cash runway until the IPO is critical, requiring meticulous budgeting and expense control.

- Budgeting: Creating realistic budgets that align with revenue projections and operational needs.

- Expense Control: Identifying and eliminating unnecessary expenses, optimizing resource allocation.

- Revenue Forecasting: Developing accurate revenue projections based on market analysis and sales trends.

- Optimizing Operations: Streamlining processes to improve efficiency and reduce operational costs.

Strategies for extending the runway include exploring alternative funding options, delaying non-essential projects, and negotiating favorable payment terms with suppliers. Running out of cash before the IPO is a major risk that can lead to company failure.

Operational and Scalability Challenges

Scaling operations efficiently while maintaining quality is a significant pre-IPO challenge. Rapid growth can expose vulnerabilities if not properly managed.

Building a Scalable Business Model

A successful IPO requires a business model capable of handling significant growth post-IPO. This necessitates proactive planning and investment in infrastructure.

- Automation: Automating repetitive tasks to increase efficiency and reduce operational costs.

- Efficient Processes: Streamlining workflows and optimizing processes to improve productivity.

- Technology Infrastructure: Investing in robust IT systems to support increased demand and data processing.

- Supply Chain Optimization: Ensuring a reliable and efficient supply chain to meet growing customer demand.

Preparing for increased demand is critical. Identifying potential bottlenecks in the supply chain, production process, or customer service is vital for mitigation strategies.

Managing Growth and Maintaining Quality

Scaling operations while maintaining quality and customer satisfaction is a delicate balance. Rapid expansion without proper infrastructure can lead to decreased quality and customer dissatisfaction.

- Hiring and Training: Recruiting and training skilled employees to handle increased workload.

- Customer Relationship Management (CRM): Implementing robust CRM systems to manage customer interactions effectively.

- Quality Control Measures: Establishing rigorous quality control procedures to ensure consistent product/service quality.

Sustainable growth hinges on effectively managing these aspects. Failing to address these issues can damage the company's reputation and hinder its IPO prospects.

Regulatory and Compliance Hurdles

Navigating the complex regulatory landscape is a critical aspect of pre-IPO preparation. Non-compliance can result in significant penalties and jeopardize the IPO.

Navigating the Regulatory Landscape

Companies must comply with various regulations before and after the IPO, including SEC regulations and corporate governance standards.

- SEC Regulations: Adhering to SEC disclosure requirements and reporting standards.

- Financial Reporting Requirements: Maintaining accurate and transparent financial records.

- Corporate Governance: Implementing robust corporate governance practices to ensure ethical conduct and transparency.

Having legal and compliance expertise is crucial to navigating this complexity. Ignoring these requirements can lead to significant fines and even criminal charges.

Risk Mitigation and Due Diligence

Proactive risk identification and mitigation are essential for a successful IPO. Thorough due diligence and comprehensive risk management plans are crucial.

- Conducting Thorough Due Diligence: Identifying and addressing potential legal, financial, and operational risks.

- Implementing Risk Management Plans: Developing and implementing strategies to mitigate identified risks.

- Developing Contingency Plans: Preparing for unexpected events and developing contingency plans to address potential disruptions.

Transparency and accurate reporting are paramount in addressing potential investor concerns. A well-defined risk management strategy builds investor confidence and increases the chances of a successful IPO.

Conclusion: Overcoming Pre-IPO Challenges Through Strategic Planning

Successfully navigating pre-IPO challenges requires a multifaceted approach. This article highlighted three key areas: securing adequate funding, building a scalable and high-quality operation, and ensuring regulatory compliance. Addressing these pre-IPO challenges effectively requires proactive planning and the implementation of appropriate alternative strategies. By developing a comprehensive strategy, including thorough due diligence, robust risk management, and a clear understanding of various funding options, companies can significantly increase their chances of a successful IPO. Consider consulting with experienced professionals to navigate the complexities of the pre-IPO process and leverage alternative strategies for optimal outcomes. Don't let these challenges derail your dreams; plan strategically and achieve your IPO goals.

Featured Posts

-

Coco Gauff And Peyton Stearns American Duo Dominates In Rome

May 14, 2025

Coco Gauff And Peyton Stearns American Duo Dominates In Rome

May 14, 2025 -

A Critical Look At Sean Diddy Combs Career Examining His Reported Downward Trend

May 14, 2025

A Critical Look At Sean Diddy Combs Career Examining His Reported Downward Trend

May 14, 2025 -

Que Visitar En Sevilla Este Miercoles 7 De Mayo De 2025

May 14, 2025

Que Visitar En Sevilla Este Miercoles 7 De Mayo De 2025

May 14, 2025 -

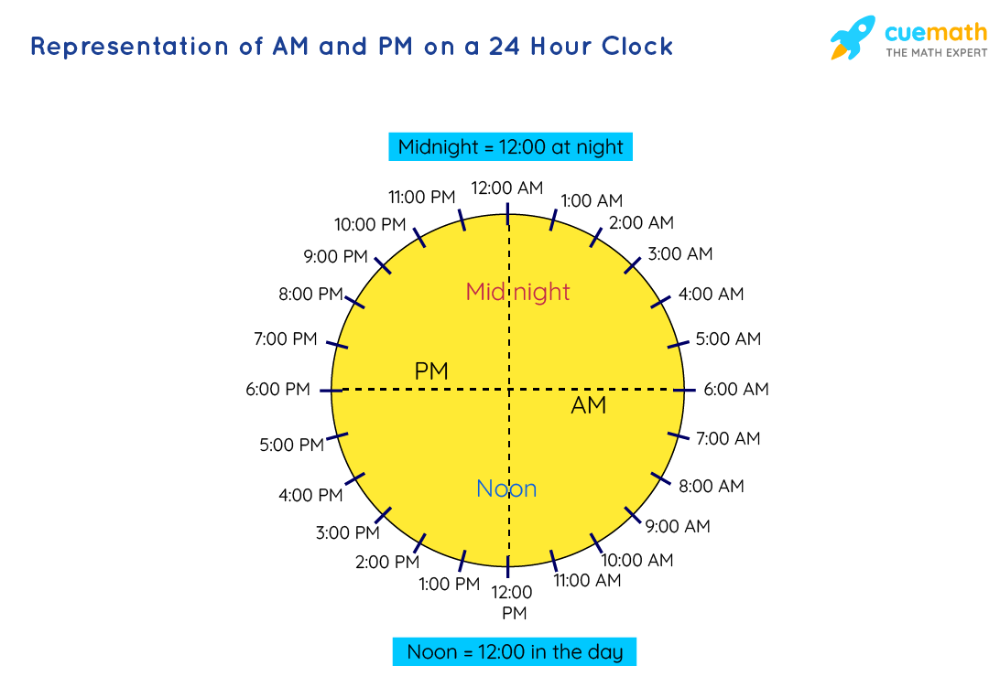

Friday 7 Pm Et Your Daily Dose Of Company News Highlights

May 14, 2025

Friday 7 Pm Et Your Daily Dose Of Company News Highlights

May 14, 2025 -

Jose Mujica El Legado Del Expresidente Uruguayo

May 14, 2025

Jose Mujica El Legado Del Expresidente Uruguayo

May 14, 2025