Pound Strengthens After UK Inflation Report, BOE Rate Cut Expectations Fall

Table of Contents

UK Inflation Report: Key Findings and Market Impact

The latest UK inflation report revealed lower-than-expected inflation figures, triggering a positive response from the markets and bolstering the pound. This surprising data significantly impacted the anticipated actions of the Bank of England.

Lower-Than-Expected Inflation

- Inflation Rate: The Consumer Price Index (CPI) rose by 6.8% in July, lower than the 7.1% predicted by analysts and down from 7.9% in June. The Retail Price Index (RPI) also showed a similar downward trend.

- Market Reaction: The lower-than-anticipated inflation figures calmed market fears about persistent high inflation and reduced the pressure on the BOE to continue aggressively raising interest rates. This unexpected positive economic news contributed directly to the strengthening of the British pound. Investors viewed the lower inflation as a sign of potential economic stability.

Implications for the Bank of England (BOE)

The lower inflation figures significantly reduce the pressure on the BOE to implement further interest rate hikes. The central bank's mandate is to maintain price stability, and the reduced inflation rate suggests that its current monetary policy might be proving effective.

- BOE Response: The market now anticipates a less aggressive approach from the BOE, potentially leading to a pause or even a future reduction in interest rates. The reduced expectation of a rate cut is a major reason behind the pound's strengthening.

- Future Interest Rate Changes: While the BOE's future decisions remain uncertain, the latest inflation data suggests a shift towards a less hawkish stance. The reduced likelihood of further rate hikes significantly boosted investor confidence in the pound.

Pound Strengthens: Analysis of Currency Movements

The pound's strength was evident in its performance against major currencies like the US dollar and the Euro. This strengthening reflects increased confidence in the UK economy following the positive inflation report.

GBP/USD and GBP/EUR Exchange Rates

The pound experienced a noticeable surge against both the US dollar and the Euro.

- GBP/USD: The GBP/USD exchange rate saw a significant increase, reaching its highest point in several months. This represents a strengthening of the pound relative to the dollar.

- GBP/EUR: Similarly, the GBP/EUR exchange rate also showed a positive trend, reflecting the pound’s improved standing against the Euro. The percentage change in both pairs was significant, reflecting strong market sentiment.

Impact on Businesses and Investors

The strengthening pound has a wide-ranging impact on UK businesses and investors.

- Impact on Import/Export Costs: A stronger pound makes imports cheaper for UK businesses but reduces the competitiveness of UK exports. This can have mixed consequences depending on the business model.

- Implications for Investment Returns: Investors holding GBP-denominated assets will see increased value in their holdings, while those invested in other currencies may see reduced returns when converted back to GBP.

- Effects on UK Competitiveness: The stronger pound could negatively affect the competitiveness of UK goods and services in international markets, potentially impacting export-oriented industries.

Future Outlook: Predicting Pound Performance

While the recent strengthening of the pound is encouraging, predicting future performance remains challenging due to various unpredictable factors.

Uncertainty and Volatility

The pound's future trajectory depends on a number of interconnected factors.

- Geopolitical Factors: Global events and geopolitical uncertainties can significantly impact currency markets, potentially increasing volatility and influencing the pound's value.

- Economic Data Releases: Future economic data releases, including employment figures, manufacturing output, and further inflation reports, will continue to influence the pound's performance.

- Potential BOE Policy Shifts: Any changes in BOE monetary policy, even a subtle shift, will have a profound impact on the currency markets.

Expert Opinions and Market Sentiment

Market analysts offer varied perspectives on the pound’s future.

- Positive Outlooks: Some experts suggest that sustained lower inflation could lead to further pound appreciation, citing improved investor confidence and economic stability.

- Cautious Optimism: Others express a more cautious outlook, warning of potential volatility due to global uncertainties and the impact of future economic data releases.

- Overall Market Sentiment: The overall market sentiment currently leans towards a positive outlook for the pound, albeit with acknowledgements of potential risks and uncertainties.

Conclusion

The unexpected drop in UK inflation has resulted in a significant strengthening of the pound, primarily due to reduced expectations of a BOE rate cut. The interplay between inflation data, BOE monetary policy, and the pound's value is a crucial element in understanding currency markets. The positive market reaction reflects a renewed confidence in the UK economy's trajectory. However, future performance remains uncertain, subject to various economic and geopolitical influences.

Stay updated on the latest developments affecting the pound strength and its performance against other major currencies. Monitor the upcoming BOE announcements and economic data releases to make informed decisions regarding your investments and currency trading strategies. Understanding the factors that drive pound strength is essential for navigating the complexities of the foreign exchange market.

Featured Posts

-

Elektrik Kesintileri Rutte Sanchez Goeruesmesi Ve Nato Nun Tepkisi

May 22, 2025

Elektrik Kesintileri Rutte Sanchez Goeruesmesi Ve Nato Nun Tepkisi

May 22, 2025 -

Northcote Gig Vapors Of Morphine Low Rock Show

May 22, 2025

Northcote Gig Vapors Of Morphine Low Rock Show

May 22, 2025 -

Bp Executive Pay 31 Reduction Announced

May 22, 2025

Bp Executive Pay 31 Reduction Announced

May 22, 2025 -

The Impact Of Over The Counter Birth Control In A Post Roe World

May 22, 2025

The Impact Of Over The Counter Birth Control In A Post Roe World

May 22, 2025 -

The Peppa Pig Family Grows Mummy Pig Shares Exciting News

May 22, 2025

The Peppa Pig Family Grows Mummy Pig Shares Exciting News

May 22, 2025

Latest Posts

-

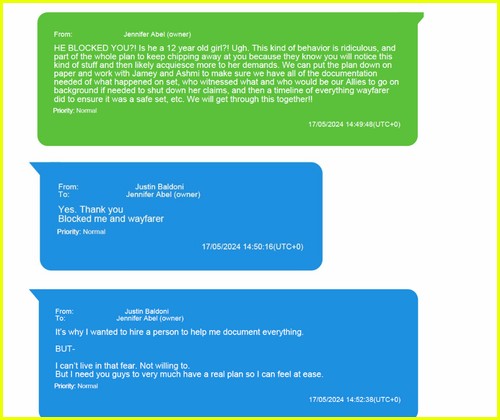

The Blake Lively Allegations Facts Speculation And Public Reaction

May 22, 2025

The Blake Lively Allegations Facts Speculation And Public Reaction

May 22, 2025 -

Understanding The Allegations Surrounding Blake Lively

May 22, 2025

Understanding The Allegations Surrounding Blake Lively

May 22, 2025 -

Taylor Swift Text Leak Allegation Did Blake Livelys Lawyer Make Threats

May 22, 2025

Taylor Swift Text Leak Allegation Did Blake Livelys Lawyer Make Threats

May 22, 2025 -

Blake Lively Lawyers Alleged Threat Taylor Swift Texts At The Center Of Controversy

May 22, 2025

Blake Lively Lawyers Alleged Threat Taylor Swift Texts At The Center Of Controversy

May 22, 2025 -

Blake Lively Alleged Controversies And Speculations Explored

May 22, 2025

Blake Lively Alleged Controversies And Speculations Explored

May 22, 2025