Posthaste: Understanding The Potential For A Canadian Housing Market Correction

Table of Contents

High Housing Prices and Affordability Concerns

The current state of Canadian housing affordability is a major concern. Average house prices in major cities like Toronto and Vancouver have far outpaced income growth, making homeownership increasingly unattainable for many Canadians. This disparity between housing prices and average incomes is a significant driver of the discussion surrounding a potential Canadian housing market correction. The impact of rising interest rates only exacerbates this issue.

- Comparison of house prices to average incomes: In many major cities, the average house price is now multiple times the average annual income, creating significant affordability challenges.

- Impact on first-time homebuyers: The escalating cost of housing is pushing homeownership further out of reach for first-time buyers, a crucial segment of the market.

- Regional variations in affordability: While affordability challenges exist across the country, the severity varies significantly between regions, with some areas experiencing more intense pressure than others. For example, smaller cities often show a less dramatic increase in prices than larger urban centers.

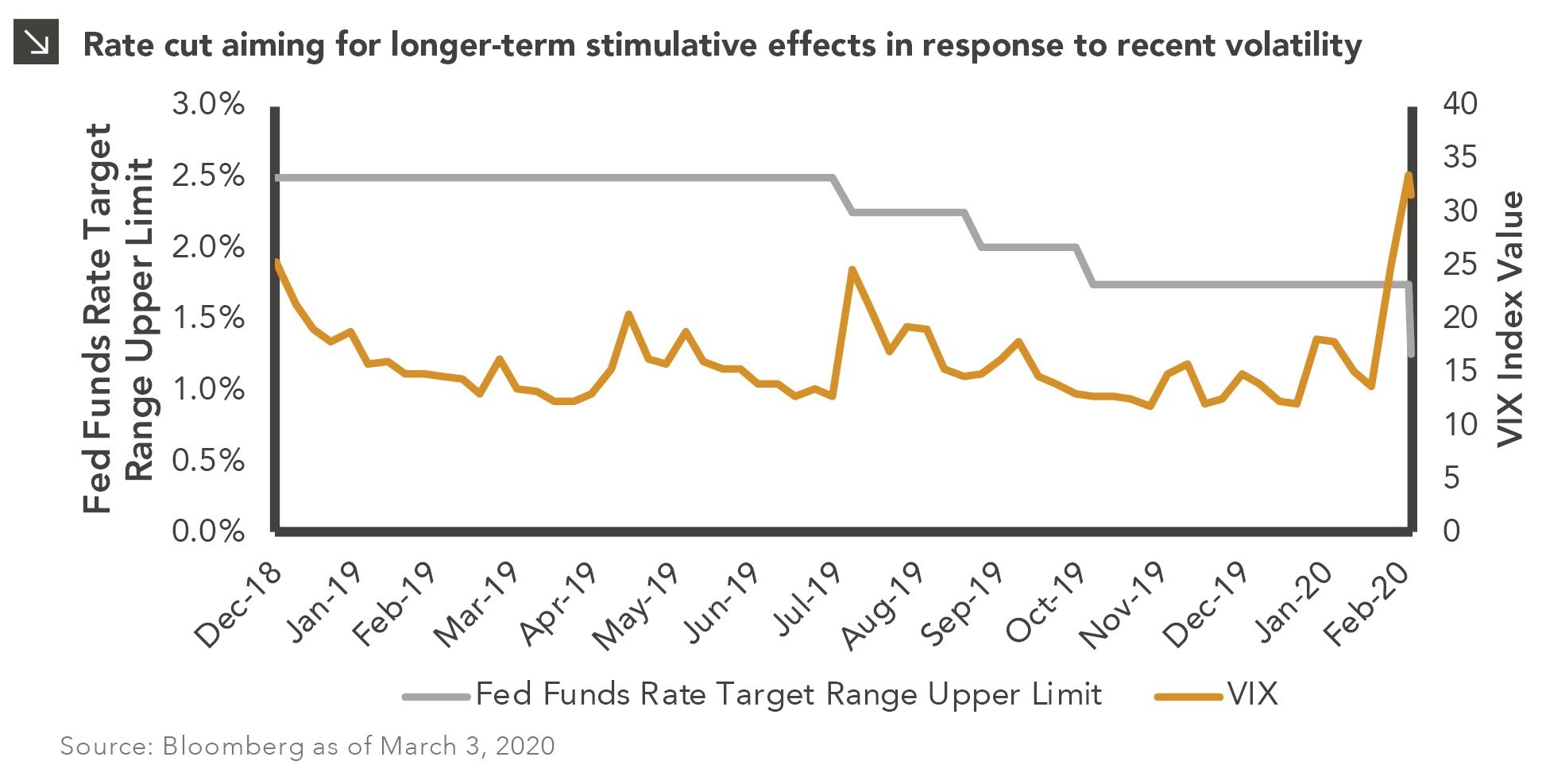

Rising Interest Rates and Their Impact

The Bank of Canada's role in adjusting interest rates is crucial in influencing housing market dynamics. Rising interest rates directly impact the cost of borrowing, making mortgages more expensive. This correlation between interest rates and housing prices is a key factor contributing to concerns about a potential correction.

- Impact on variable-rate mortgages: Borrowers with variable-rate mortgages are immediately affected by interest rate increases, leading to potentially significant jumps in monthly payments.

- Impact on fixed-rate mortgages: While fixed-rate mortgages offer short-term protection, renewals at higher rates can still strain household budgets.

- Potential for increased mortgage defaults: As interest rates rise and affordability diminishes, the risk of increased mortgage defaults becomes a significant concern, potentially impacting the stability of the Canadian housing market.

Overvaluation and Market Volatility

Several indicators suggest potential overvaluation in the Canadian housing market. The current market exhibits a level of volatility that raises concerns about a potential correction.

- Price-to-rent ratios: High price-to-rent ratios in many areas indicate that housing prices may be detached from their fundamental value.

- Sales-to-listing ratios: A declining sales-to-listing ratio, showing a higher number of homes for sale than buyers, suggests weakening demand.

- Comparison to historical market cycles: Analyzing past housing market cycles can provide valuable insights into potential future trends and the likelihood of a correction. Experts often point to historical data to assess the current market's stability.

Potential Signs of a Slowdown

Recent trends in housing sales and construction activity offer insights into the potential for a slowdown or correction. A decrease in buyer activity and increased inventory are some indicators of a cooling market.

- Recent sales data for major cities: Data from major real estate boards across Canada are key indicators of market trends. A consistent decline in sales activity could signal a correction.

- Changes in new housing construction starts: A slowdown in new housing construction starts reflects reduced demand and a potential market correction.

- Shifting buyer sentiment: Surveys and market analyses can reveal changes in buyer sentiment, which are important leading indicators of market trends.

Preparing for a Potential Canadian Housing Market Correction

Several factors – high housing prices, rising interest rates, potential overvaluation, and signs of a slowdown – contribute to the possibility of a Canadian housing market correction. Monitoring key market indicators like sales data, interest rates, and affordability indices is crucial for understanding the current state of the market.

For both buyers and sellers, understanding the implications of a potential correction on financial planning and investment strategies is paramount. Buyers might consider delaying purchases until the market stabilizes, while sellers may need to adjust their pricing strategies.

Stay informed about the evolving situation regarding the Canadian housing market correction and consult with financial professionals for personalized advice. Understanding the potential for a Canadian housing market correction is crucial for making informed decisions in the real estate market, whether you are a buyer, seller, or investor.

Featured Posts

-

Joint Statement Switzerland And China On Tariff Negotiations

May 22, 2025

Joint Statement Switzerland And China On Tariff Negotiations

May 22, 2025 -

Juergen Klopps Liverpool A Detailed Look At The Doubters And The Believers

May 22, 2025

Juergen Klopps Liverpool A Detailed Look At The Doubters And The Believers

May 22, 2025 -

Ukrayina Ta Nato Scho Oznachaye Vidmova Vid Chlenstva Ta Yaki Riziki Chekayut

May 22, 2025

Ukrayina Ta Nato Scho Oznachaye Vidmova Vid Chlenstva Ta Yaki Riziki Chekayut

May 22, 2025 -

Trans Australia Run Record A New World Record In The Making

May 22, 2025

Trans Australia Run Record A New World Record In The Making

May 22, 2025 -

Blake Lively Alleged Controversies And Speculations Explored

May 22, 2025

Blake Lively Alleged Controversies And Speculations Explored

May 22, 2025

Latest Posts

-

Accident Involving Box Truck Shuts Down Part Of Route 581

May 22, 2025

Accident Involving Box Truck Shuts Down Part Of Route 581

May 22, 2025 -

Box Truck Involved In Route 581 Accident Traffic Backed Up

May 22, 2025

Box Truck Involved In Route 581 Accident Traffic Backed Up

May 22, 2025 -

Major Box Truck Crash On Route 581 Leads To Road Closure

May 22, 2025

Major Box Truck Crash On Route 581 Leads To Road Closure

May 22, 2025 -

Route 581 Shutdown Box Truck Accident Causes Delays

May 22, 2025

Route 581 Shutdown Box Truck Accident Causes Delays

May 22, 2025 -

Emergency Responders Tackle Significant Used Car Fire

May 22, 2025

Emergency Responders Tackle Significant Used Car Fire

May 22, 2025