Posthaste: Trouble Brewing In The Global Bond Market

Table of Contents

Rising Interest Rates: A Major Headwind for Bond Prices

The relationship between interest rates and bond prices is inversely proportional. This means that as interest rates rise, bond prices fall, and vice versa. This fundamental principle is at the heart of the current challenges facing the global bond market. Central banks worldwide, in their efforts to combat inflation, have been aggressively raising interest rates. This policy, while aimed at curbing price increases, has significant implications for bondholders.

The impact of central bank policies on bond yields is profound. Higher interest rates make newly issued bonds more attractive, leading to reduced demand for existing bonds with lower yields. This decreased demand directly translates into lower prices for those existing bonds.

- Increased borrowing costs for governments and corporations: Higher interest rates increase the cost of borrowing for governments and corporations, potentially impacting their ability to service their debt.

- Reduced demand for existing bonds: Investors shift their investments towards newly issued bonds offering higher yields, reducing the demand for existing lower-yielding bonds.

- Potential for capital losses for bondholders: As bond prices fall, bondholders face the risk of capital losses if they sell their bonds before maturity.

- The flight to safety and its implications: During periods of uncertainty, investors often seek the safety of government bonds, driving up their prices while potentially exacerbating the decline in other bond sectors.

Inflation's Persistent Grip: Eroding Bond Returns

Inflation significantly impacts the real return on bond investments. Inflation erodes the purchasing power of future interest payments and the principal at maturity. While nominal returns might seem positive, the real return – adjusted for inflation – can be significantly lower or even negative. Predicting and managing inflation risks is a significant challenge for bond investors.

- Impact on purchasing power of bondholders: High inflation diminishes the value of future interest payments and the principal repayment, reducing the real return for bondholders.

- Central bank responses and their effectiveness: Central banks' responses to inflation, including interest rate hikes, can have unintended consequences on bond markets, creating further volatility.

- The search for inflation-protected securities: Investors are increasingly seeking inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), to safeguard their investments against inflation.

- The role of inflation expectations in bond market dynamics: Market participants' expectations about future inflation significantly influence bond yields and prices, creating further uncertainty.

Geopolitical Uncertainty: Adding to Market Volatility

Geopolitical events exert a significant influence on global bond market sentiment. Uncertainty stemming from international conflicts, trade wars, or political instability can trigger significant shifts in investor behavior. This uncertainty translates into increased volatility in bond yields and prices.

- The war in Ukraine and its impact on energy prices and global growth: The ongoing conflict has disrupted global energy markets, fueling inflation and slowing economic growth, impacting bond market performance.

- US-China tensions and their effect on trade and investment: Escalating tensions between the US and China create uncertainty in global trade and investment flows, influencing investor sentiment and bond market dynamics.

- Emerging market debt vulnerabilities: Geopolitical risks disproportionately affect emerging markets, increasing the vulnerability of their debt and potentially leading to defaults.

- Increased risk aversion and capital flight: During periods of geopolitical uncertainty, investors often become more risk-averse, leading to capital flight from riskier assets, including certain types of bonds.

The Credit Crunch: Increased Risk of Defaults

The rising interest rate environment increases the risk of corporate defaults. Companies with high levels of debt might struggle to meet their interest payments, potentially leading to defaults. This is particularly true in the high-yield bond market, which comprises bonds issued by companies with lower credit ratings.

- Stress tests for financial institutions: Regulators are conducting stress tests on financial institutions to assess their resilience to potential defaults and the broader impact on the financial system.

- Increased scrutiny of corporate balance sheets: Investors are scrutinizing corporate balance sheets more closely to assess the creditworthiness of companies and the risk of defaults.

- Potential for contagion effects: A default by a major corporation could trigger a chain reaction, leading to further defaults and increasing the instability of the global bond market.

Conclusion

The global bond market is undeniably facing significant challenges. Rising interest rates, persistent inflation, and geopolitical uncertainty are creating a volatile and unpredictable environment. Investors need to carefully assess their risk tolerance and diversify their portfolios to navigate these turbulent waters. Understanding the complexities of the global bond market and staying informed about these evolving trends is crucial for mitigating risk. Stay informed about the latest developments in the global bond market to make sound investment decisions. Regularly analyze your exposure and consider seeking professional advice for managing your investments in this dynamic landscape. The future of the global bond market depends on effective risk management and a keen awareness of the interconnected factors at play.

Featured Posts

-

Historic Win For Zimbabwe Muzarabanis Bowling Dominates Bangladesh In First Test

May 23, 2025

Historic Win For Zimbabwe Muzarabanis Bowling Dominates Bangladesh In First Test

May 23, 2025 -

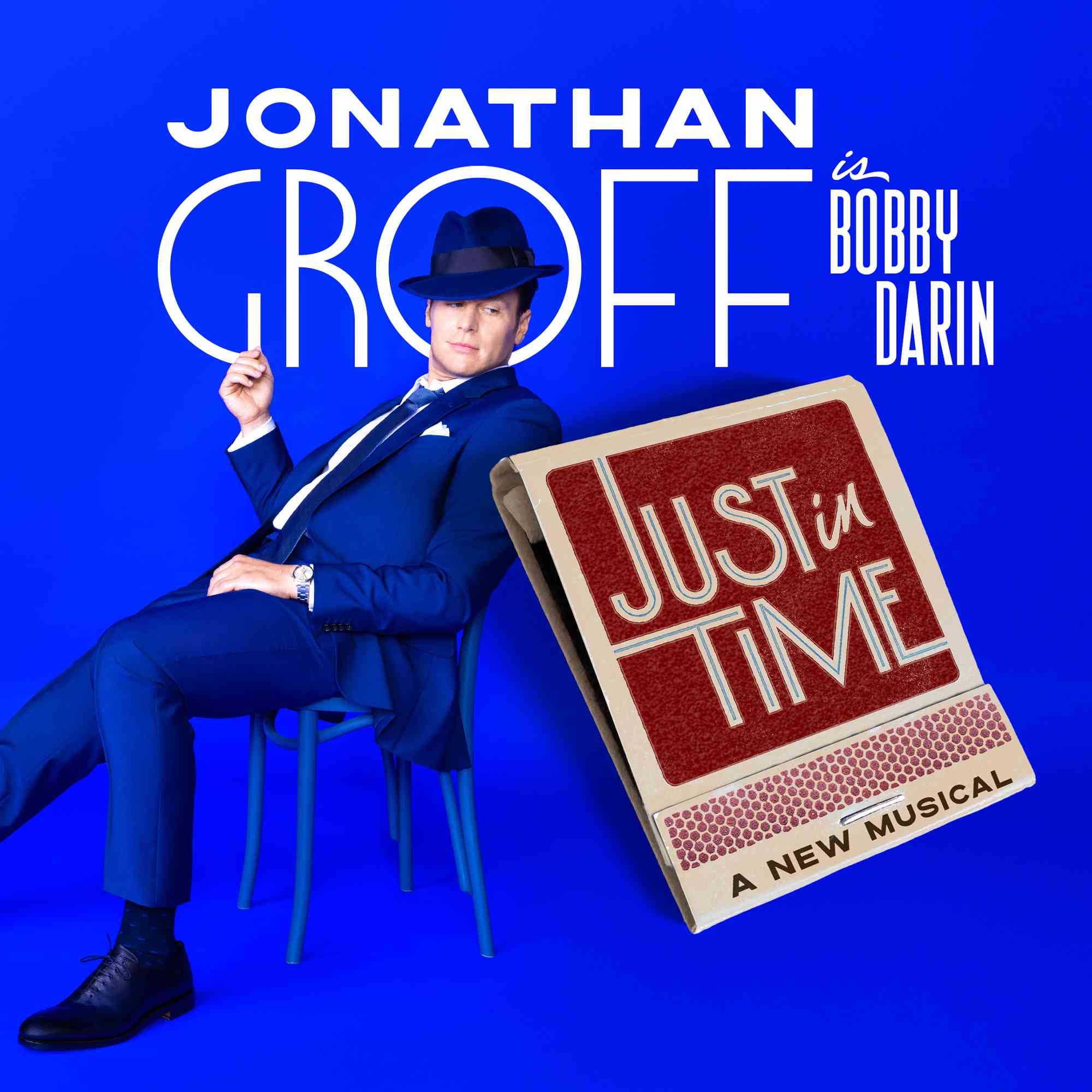

Jonathan Groffs Show Name A Night Of Celebration And Support

May 23, 2025

Jonathan Groffs Show Name A Night Of Celebration And Support

May 23, 2025 -

Dont Miss It Hulu Movies Leaving This Month

May 23, 2025

Dont Miss It Hulu Movies Leaving This Month

May 23, 2025 -

Piastri Secures Pole In Thrilling Bahrain Gp Qualifying

May 23, 2025

Piastri Secures Pole In Thrilling Bahrain Gp Qualifying

May 23, 2025 -

Siren Trailer Julianne Moore Responds To Monster Accusations

May 23, 2025

Siren Trailer Julianne Moore Responds To Monster Accusations

May 23, 2025

Latest Posts

-

Jonathan Groff Channels Bobby Darin In Just In Time A Primal Need To Perform

May 23, 2025

Jonathan Groff Channels Bobby Darin In Just In Time A Primal Need To Perform

May 23, 2025 -

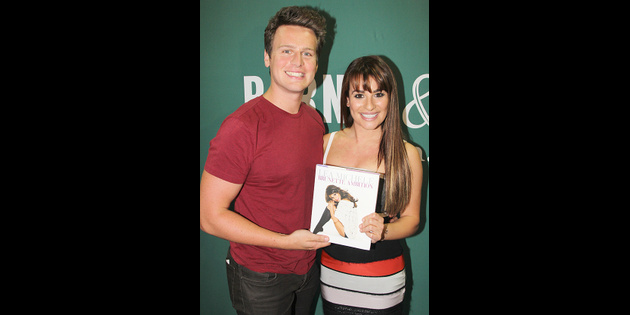

Jonathan Groffs Just In Time Opening Night Lea Michele And Fellow Stars Celebrate

May 23, 2025

Jonathan Groffs Just In Time Opening Night Lea Michele And Fellow Stars Celebrate

May 23, 2025 -

Etoile A Spring Awakening Reunion Brings Laughter With Glick And Groff

May 23, 2025

Etoile A Spring Awakening Reunion Brings Laughter With Glick And Groff

May 23, 2025 -

Jonathan Groffs Broadway Opening Lea Michele And Friends Offer Support

May 23, 2025

Jonathan Groffs Broadway Opening Lea Michele And Friends Offer Support

May 23, 2025 -

Gideon Glick And Jonathan Groffs Etoile Reunion A Hilarious Spring Awakening Callback

May 23, 2025

Gideon Glick And Jonathan Groffs Etoile Reunion A Hilarious Spring Awakening Callback

May 23, 2025