Posthaste: Is Canada Headed For A Deeper Recession? Analyzing The Impact Of Lower Tariffs.

Table of Contents

Canada's Current Economic Landscape

Canada's economy is facing a complex interplay of factors. While the unemployment rate remains relatively low, inflation is proving persistent, significantly impacting consumer spending and overall economic growth. The Bank of Canada has responded with aggressive interest rate hikes, aiming to curb inflation but risking a potential slowdown in economic activity. Let's examine some key indicators:

- High Inflation: Current inflation levels are squeezing household budgets, reducing discretionary spending and dampening consumer confidence. This impacts demand across various sectors.

- Varying Sectoral Performance: Key economic sectors show mixed performance. While the energy sector benefits from global demand, manufacturing and real estate face headwinds from higher interest rates and reduced consumer spending.

- Interest Rate Hikes: The Bank of Canada's aggressive interest rate hikes, while aiming to control inflation, also increase borrowing costs for businesses and consumers, potentially slowing investment and economic growth.

- Weakening Consumer Confidence and Business Investment: Uncertainty surrounding inflation, interest rates, and global economic conditions has led to decreased consumer confidence and a cautious approach to business investment, further impacting economic growth.

The Impact of Lower Tariffs on the Canadian Economy

Lower tariffs present a double-edged sword for the Canadian economy. While they offer potential benefits like increased imports and lower prices for consumers, they also pose challenges for domestic producers facing increased competition. Let's explore this duality:

- Increased Imports and Lower Prices: Reduced tariffs can lead to an influx of cheaper goods from abroad, potentially benefiting consumers through lower prices and greater product variety. This is particularly relevant for sectors like consumer goods and electronics.

- Increased Competition for Domestic Producers: Lower tariffs make it easier for foreign companies to compete with Canadian businesses, potentially leading to reduced market share and even job losses in certain sectors. This is a significant concern for industries like agriculture and manufacturing.

- Impact on Specific Sectors: The agricultural sector, for instance, might experience both benefits (access to cheaper inputs) and drawbacks (increased competition from subsidized foreign producers). The manufacturing sector could face similar pressures, needing to adapt to increased international competition.

- Increased Trade with Specific Countries: Lower tariffs facilitate increased trade relationships with specific countries, leading to both economic opportunities and potential dependencies. Trade agreements will need to be carefully negotiated to ensure mutual benefits.

Analyzing the Pros and Cons of Lower Tariffs in a Recessionary Environment

The implications of lower tariffs become even more nuanced during a recessionary environment. The potential for increased consumer spending due to lower prices must be weighed against the risk of increased import competition and job losses.

- Stimulating Economic Activity: Lower prices due to lower tariffs could stimulate consumer spending, providing a much-needed boost to a struggling economy. This is a key argument in favor of tariff reductions during a downturn.

- Increased Import Competition: However, increased import competition could exacerbate job losses in already struggling domestic industries, potentially deepening the recession. The need for government support and retraining programs for displaced workers becomes crucial in such scenarios.

- Job Displacement Concerns: Specific sectors heavily reliant on domestic production might experience significant job displacement due to cheaper imports, requiring proactive government interventions to address potential unemployment.

- Short-Term vs. Long-Term Consequences: While lower tariffs might offer a short-term boost to consumer spending, the long-term consequences for domestic industries and employment must be carefully considered.

Predicting the Future: Recession Depth and Tariff Influence

Predicting the future is inherently uncertain, but based on the analysis, several factors will determine the depth of a potential recession and the role of lower tariffs:

- Inflation Control: The Bank of Canada's success in curbing inflation will significantly influence the economic outlook. If inflation remains high, a deeper recession becomes more likely.

- Global Economic Conditions: Global economic uncertainty and potential downturns in major trading partners will impact Canadian exports and economic growth.

- Tariff Impact on Economic Indicators: Lower tariffs could increase consumer spending (GDP growth) but also decrease domestic production and employment (GDP growth, unemployment rate). The net effect is difficult to predict with certainty.

- Potential for Mitigating Factors: Government interventions, such as support for struggling industries and investments in infrastructure, could mitigate the negative impacts of a recession.

Conclusion: Posthaste: Summing Up the Impact of Lower Tariffs on Canada's Recessionary Risk

Lower tariffs present a complex challenge for the Canadian economy, particularly in the context of a potential recession. While they offer the potential for increased consumer spending and lower prices, they also pose risks to domestic producers and employment. The ultimate impact will depend on several factors, including the success of inflation control efforts, global economic conditions, and the extent of government support for affected industries. Stay informed on the evolving Canadian economic landscape and continue to research the impacts of trade policies like lower tariffs on the Canadian economy to better understand the potential for a deeper recession. Understanding the intricacies of "Canadian recession" scenarios, the multifaceted "tariff impacts," and utilizing reliable "economic forecasting" tools are crucial for navigating this complex economic climate.

Featured Posts

-

Milwaukee Sets Record With Nine Stolen Bases In First Four Innings

Apr 23, 2025

Milwaukee Sets Record With Nine Stolen Bases In First Four Innings

Apr 23, 2025 -

Resultats Fdj Du 17 Fevrier Hausse En Bourse

Apr 23, 2025

Resultats Fdj Du 17 Fevrier Hausse En Bourse

Apr 23, 2025 -

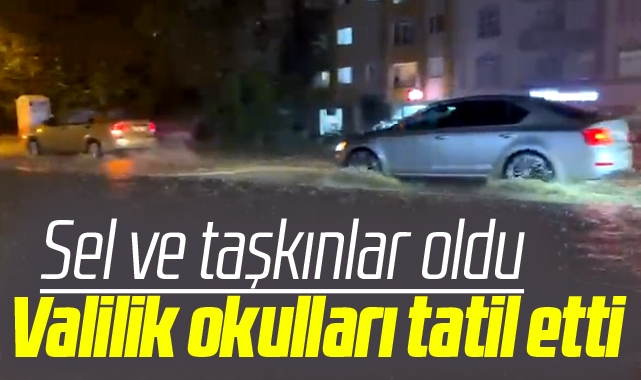

24 Subat Guemueshane Okullar Kapali Mi Son Dakika Haberleri Ve Valilik Duyurusu

Apr 23, 2025

24 Subat Guemueshane Okullar Kapali Mi Son Dakika Haberleri Ve Valilik Duyurusu

Apr 23, 2025 -

Reds Scoring Streak Ends In Loss To Brewers

Apr 23, 2025

Reds Scoring Streak Ends In Loss To Brewers

Apr 23, 2025 -

Pentrich Brewing Company Factory Tour And Tasting Experience

Apr 23, 2025

Pentrich Brewing Company Factory Tour And Tasting Experience

Apr 23, 2025