Post-Turbulence Rally: Live Music Stocks Up In Pre-Market Trading

Table of Contents

Factors Contributing to the Live Music Stock Rally

Several key factors are driving the current surge in live music stocks, indicating a healthy and robust recovery for the sector.

Rebounding Concert Attendance

The demand for live music experiences has exploded post-lockdown. People are eager to return to concerts, festivals, and tours, leading to a surge in ticket sales across all genres.

- Increased demand for live experiences post-lockdown: Pent-up demand and a desire for social interaction are fueling record-breaking attendance figures.

- Successful return of major festivals and tours: The return of iconic events like Coachella, Glastonbury, and numerous major artist tours has demonstrated the industry's resilience.

- Strong ticket sales across various genres: From pop and rock to country and hip-hop, ticket sales are exceeding expectations, showing broad-based recovery.

For example, Taylor Swift's Eras Tour broke numerous attendance records, demonstrating the incredible appetite for live performances. Similarly, the sold-out shows of Beyoncé and Harry Styles further highlight the massive resurgence of the concert industry. Data from Ticketmaster and other major ticketing platforms show significant increases in ticket sales compared to pre-pandemic levels.

Improved Financial Health of Venues

Live music venues, significantly impacted by the pandemic, are showing signs of improved financial health. This stability contributes to investor confidence in live music stocks.

- Reduced debt from pandemic relief programs: Government assistance programs helped many venues reduce their debt burdens, improving their financial stability.

- Successful cost-cutting measures: Venues implemented efficient cost-cutting measures to navigate the difficult period, improving their operational efficiency.

- Increased sponsorship deals and revenue streams: Venues are exploring diverse revenue streams, including increased sponsorship deals and merchandise sales.

Analysis of financial reports from major venues like Madison Square Garden and The O2 Arena show a clear trend of improving profitability, supported by increased revenue and reduced operational costs. Innovative strategies like enhanced food and beverage offerings and VIP experiences are further contributing to the improved financial picture.

Investor Confidence and Renewed Interest

Positive analyst predictions and increased institutional investment reflect a growing belief in the long-term viability of the live music industry, driving the rally in live music stocks.

- Positive analyst predictions: Numerous financial analysts have issued positive forecasts for live music stocks, highlighting the sector's growth potential.

- Increased institutional investment: Large investment firms are showing renewed interest in the sector, injecting significant capital into live music companies.

- Growing belief in the long-term viability of the live music industry: The resilience demonstrated during the pandemic has strengthened investor confidence in the sector's long-term prospects.

Quotes from leading analysts at firms like Goldman Sachs and Morgan Stanley highlight the bullish sentiment surrounding the live music sector. Significant investment from major players like BlackRock further underscores the growing investor confidence.

Specific Live Music Stocks Performing Well

Several live music stocks are showing impressive performance in the pre-market trading, indicating a positive outlook for the sector.

Top Performers and Their Growth Potential

Several key players are leading the charge in this rally.

- Live Nation Entertainment (LYV): A global leader in live entertainment, Live Nation is experiencing strong growth driven by high concert attendance and diversified revenue streams.

- AEG Presents: A major player in the live music industry, AEG Presents benefits from a strong portfolio of venues and artists, contributing to its positive performance.

These companies are showing significant growth in revenue and earnings, and their future prospects look bright due to the ongoing expansion of their businesses and the growing demand for live music events. Their upcoming projects and strategic partnerships further enhance their growth potential.

Risks and Considerations for Investors

While the outlook is positive, investors should consider potential risks.

- Potential economic downturn: A macroeconomic downturn could impact consumer spending and reduce concert attendance.

- Inflationary pressures: Rising inflation could affect ticket prices and operational costs, impacting profitability.

- Unforeseen global events: Unexpected global events could disrupt concert schedules and impact attendance.

It's crucial to consider these factors and diversify investments to mitigate potential risks associated with the live music stock market.

Long-Term Outlook for the Live Music Industry

The future of the live music industry looks bright, driven by sustained growth and innovation.

Sustained Growth and Innovation

Several factors point to continued growth for the sector.

- Emerging technologies (e.g., virtual concerts, metaverse experiences): Technological advancements are opening new avenues for live entertainment, expanding the reach and potential of the industry.

- Expanding markets in developing countries: Growing middle classes in developing economies are driving increased demand for live music experiences.

- Continued demand for live entertainment: The inherent human desire for live experiences suggests that the demand for live music will continue to be strong.

The integration of technology and expansion into new markets create significant opportunities for growth in the coming years, solidifying the industry's position as a dynamic and resilient sector.

Conclusion

The pre-market surge in live music stocks signifies a strong comeback for the industry after a period of unprecedented turbulence. Factors such as increased concert attendance, improved venue finances, and renewed investor confidence are all contributing to this positive trend. While potential risks remain, the long-term outlook for live music remains bright, fueled by innovation and ongoing global demand. Keep an eye on these live music stocks and consider adding them to your investment portfolio as the industry continues its exciting resurgence. Stay informed about the latest developments in the live music stock market to make informed investment decisions.

Featured Posts

-

Fernando Cabral De Mello Assume Lideranca Na Sony Music Entertainment Brasil

May 30, 2025

Fernando Cabral De Mello Assume Lideranca Na Sony Music Entertainment Brasil

May 30, 2025 -

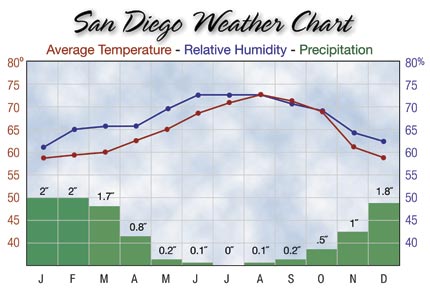

San Diego Weather Forecast Expect Fog Cool Temperatures And Light Showers

May 30, 2025

San Diego Weather Forecast Expect Fog Cool Temperatures And Light Showers

May 30, 2025 -

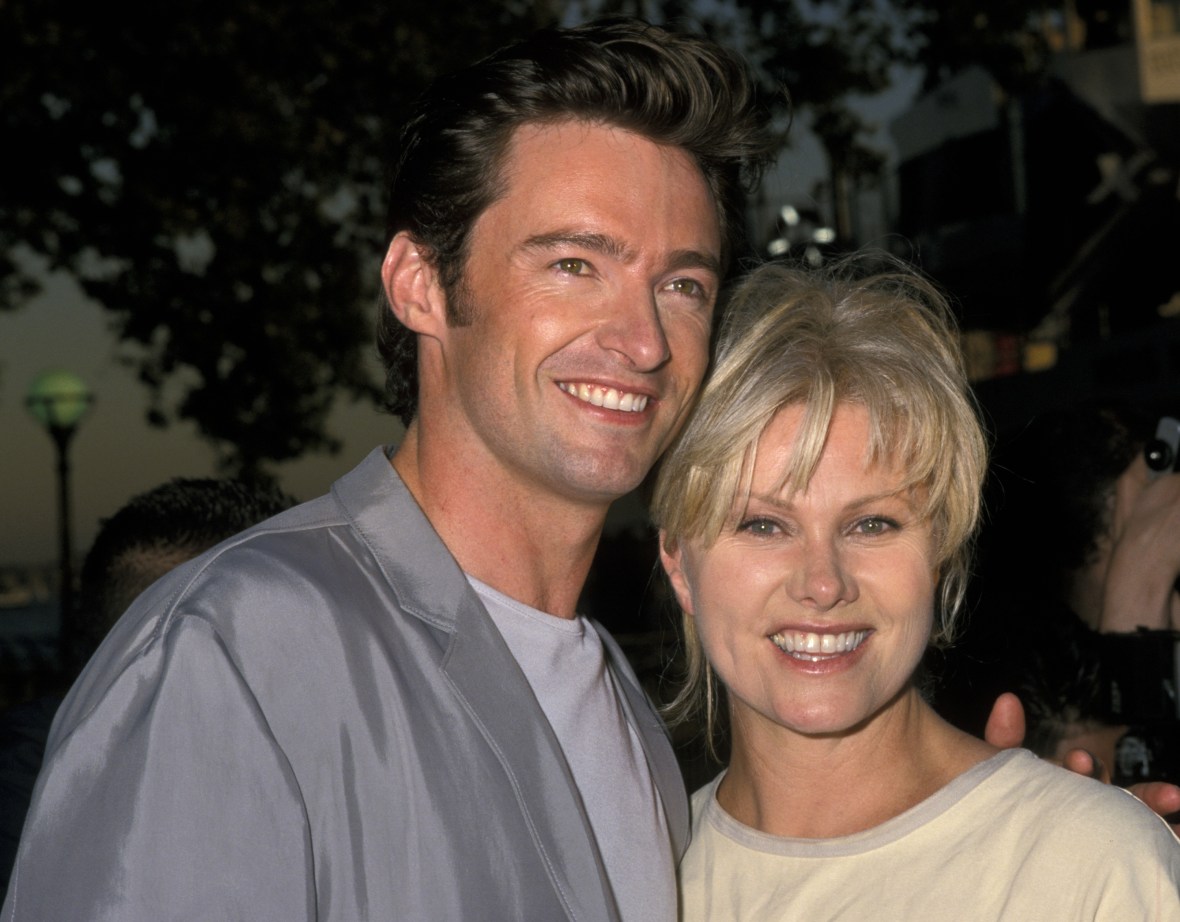

Deborra Lee Furness Reflects On Marriage End With Hugh Jackman A Story Of Gratitude

May 30, 2025

Deborra Lee Furness Reflects On Marriage End With Hugh Jackman A Story Of Gratitude

May 30, 2025 -

Dara O Briain A Voice Of Reason In Modern Comedy

May 30, 2025

Dara O Briain A Voice Of Reason In Modern Comedy

May 30, 2025 -

Angela Del Toro In Daredevil Born Again A Character Deep Dive

May 30, 2025

Angela Del Toro In Daredevil Born Again A Character Deep Dive

May 30, 2025