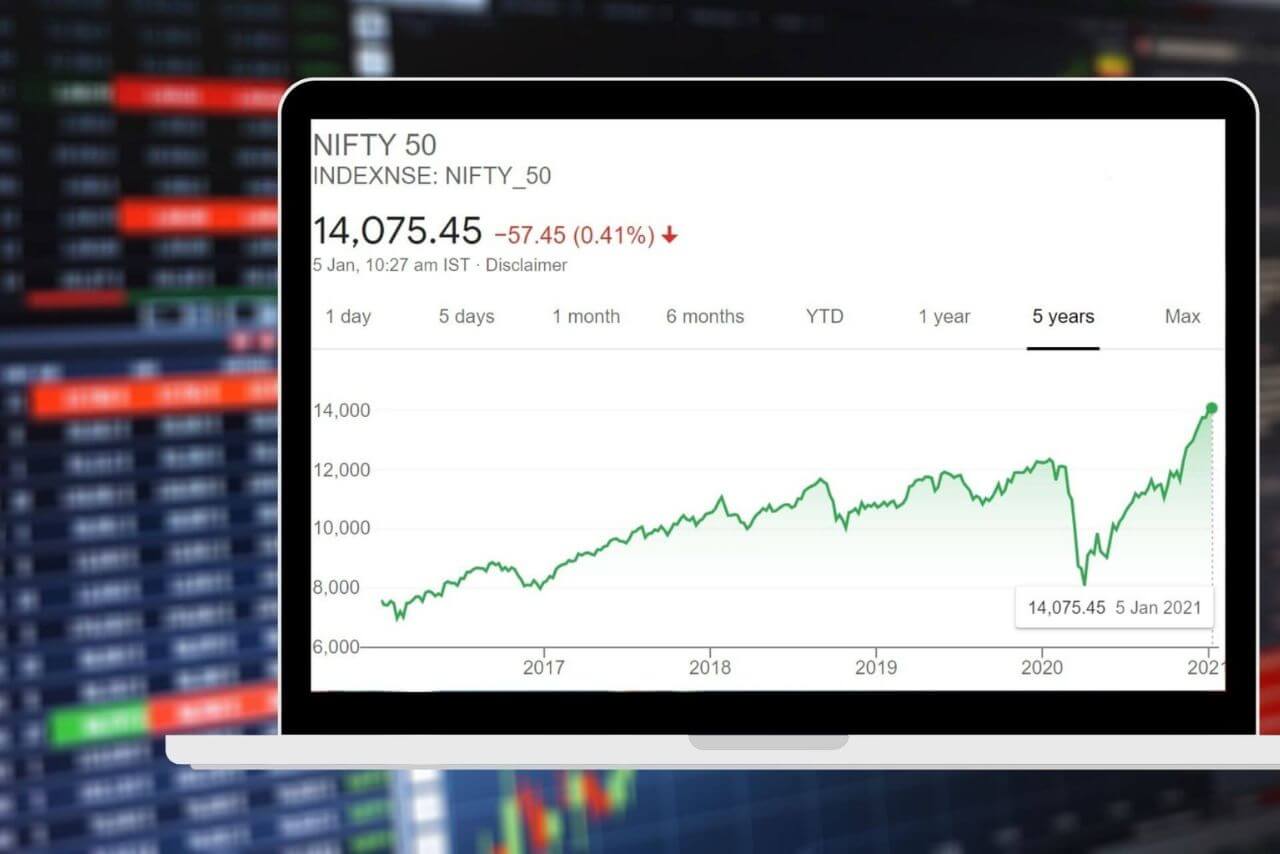

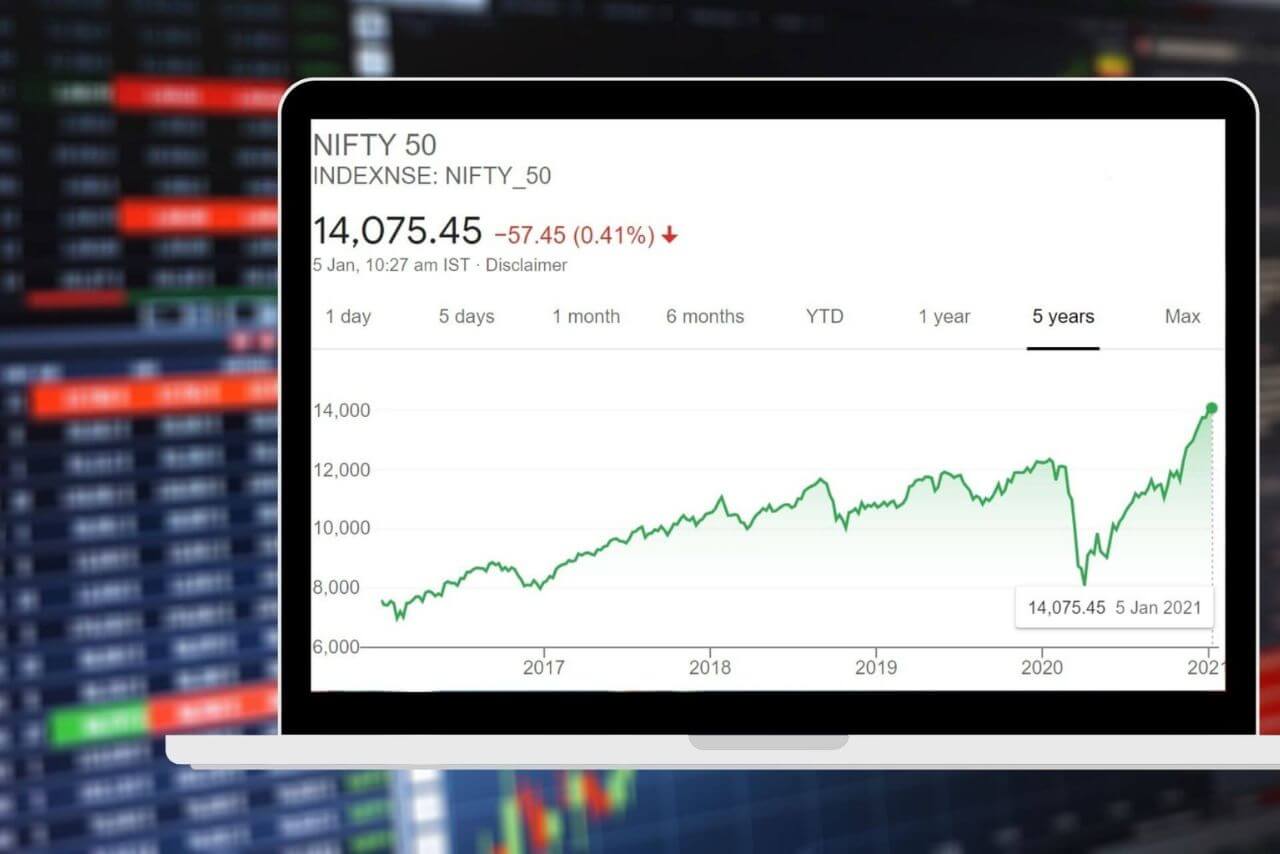

Positive Market Sentiment: India's Nifty Index On An Upward Trajectory

Table of Contents

Driving Forces Behind the Positive Market Sentiment

Several key factors are contributing to the robust positive market sentiment surrounding the Nifty Index and the Indian stock market as a whole.

Strong Economic Fundamentals

India's economy is exhibiting strong fundamentals, bolstering investor confidence and driving the Nifty Index's upward trajectory.

- Robust GDP Growth: Recent quarters have shown consistent and healthy GDP growth, exceeding expectations in several instances. For example, [cite source with specific data on GDP growth]. This robust growth is a significant indicator of a healthy and expanding economy.

- Positive Industrial Production: Industrial production figures consistently show positive growth, indicating increased manufacturing activity and a thriving industrial sector. [cite source with data on industrial production]. This strengthens the overall economic outlook.

- Improving Consumer Confidence: Consumer spending is a key driver of economic growth, and increasing consumer confidence suggests a positive outlook for future economic performance. [cite source showing data on consumer confidence]. Government initiatives aimed at boosting disposable income have also contributed to this improvement.

- Government Initiatives: Pro-growth government policies, such as infrastructure development programs and initiatives to improve the ease of doing business, further enhance the positive market sentiment and contribute to the Nifty Index’s upward movement.

Increased Foreign Institutional Investor (FII) Inflows

Significant inflows of capital from Foreign Institutional Investors (FIIs) are another key driver of the positive market sentiment and the Nifty's rise.

- Attractive Valuations: Compared to other global markets, Indian equities are perceived as attractively valued, making them a compelling investment destination for FIIs.

- Growth Potential: India's long-term growth prospects, driven by a young and expanding population and a burgeoning middle class, attract significant foreign investment.

- Data on FII Inflows: [Cite source providing data on recent FII inflows into the Indian stock market]. This influx of capital directly fuels the upward movement of the Nifty Index.

- Sector-Specific Interest: FIIs are particularly interested in sectors like technology, pharmaceuticals, and financials, which are experiencing strong growth and contributing significantly to the Nifty's performance.

Improved Corporate Earnings

Strong corporate earnings across various sectors are reinforcing the positive market sentiment and supporting the Nifty Index's upward trend.

- Strong Profitability: Leading Indian companies across diverse sectors are reporting improved profitability, indicating robust business performance and healthy financial health. [Cite sources with examples of strong corporate earnings reports].

- Impact on Market Sentiment: These strong earnings reports boost investor confidence, leading to increased investment and driving up the Nifty Index.

- Industry-Specific Trends: Specific industry trends, such as the growth of the digital economy and the expansion of the healthcare sector, are contributing to improved corporate earnings and positive market sentiment.

Analyzing the Nifty Index's Upward Trajectory

The upward trajectory of the Nifty Index is supported by several key technical indicators and sectoral performances.

Key Technical Indicators

Several key technical indicators confirm the strength of the upward trend in the Nifty Index.

- Moving Averages: [Explain the significance of moving averages and their current state for the Nifty Index. Include a chart if possible].

- RSI (Relative Strength Index): [Explain RSI and its implications for the Nifty's upward trend. Include a chart if possible].

- MACD (Moving Average Convergence Divergence): [Explain MACD and its current signals for the Nifty. Include a chart if possible].

Sectoral Performance

The Nifty Index's growth is not uniform across all sectors. Some sectors are significantly outperforming others.

- Leading Sectors: [Identify the leading sectors, such as IT, financials, or pharmaceuticals, and explain the reasons for their strong performance].

- Sector-Specific Factors: [Discuss the factors contributing to the performance of each sector, including specific industry trends and government policies].

Potential Risks and Challenges

While the outlook is positive, it's crucial to acknowledge potential risks and challenges that could impact the positive market sentiment.

- Global Economic Uncertainty: Global economic slowdown or geopolitical events could negatively impact the Indian market.

- Inflation: Persistent high inflation could erode investor confidence and impact market performance.

- Risk Mitigation: Investors should diversify their portfolios and employ risk management strategies to mitigate potential downsides.

Conclusion

The positive market sentiment surrounding India's Nifty Index is driven by strong economic fundamentals, increased FII inflows, and improved corporate earnings. The upward trajectory is further supported by positive technical indicators and strong performance in key sectors. While global uncertainties and inflation pose potential risks, the current outlook remains positive. Monitor the positive market sentiment and Nifty Index trends closely. Stay updated on the factors influencing the upward trajectory of the Nifty and learn more about investing in the Indian stock market and capitalizing on positive market sentiment. While market fluctuations are inevitable, the current positive market sentiment and upward trajectory of India's Nifty Index present promising opportunities for investors.

Featured Posts

-

Teslas Reduced Q1 Profitability Analysis Of The Musk Factor

Apr 24, 2025

Teslas Reduced Q1 Profitability Analysis Of The Musk Factor

Apr 24, 2025 -

Elite Universities And The Trump Administration Navigating Funding Challenges

Apr 24, 2025

Elite Universities And The Trump Administration Navigating Funding Challenges

Apr 24, 2025 -

The Hollywood Strike What It Means For The Film And Television Industry

Apr 24, 2025

The Hollywood Strike What It Means For The Film And Television Industry

Apr 24, 2025 -

Bold And The Beautiful Spoilers Wednesday April 23 Finns Pledge To Liam

Apr 24, 2025

Bold And The Beautiful Spoilers Wednesday April 23 Finns Pledge To Liam

Apr 24, 2025 -

Is Instagrams New Video Editor A Tik Tok Killer

Apr 24, 2025

Is Instagrams New Video Editor A Tik Tok Killer

Apr 24, 2025