Point72 Traders Depart As Emerging Markets Fund Shuts Down

Table of Contents

The Closure of Point72's Emerging Markets Fund

Point72's decision to close its dedicated emerging markets fund marks a significant shift in its investment strategy. While the specific fund name may not be publicly released for confidentiality reasons, it's understood to be a significant vehicle within Point72's portfolio, managing a substantial amount of assets focused on emerging economies. The closure, announced [Insert Date if available, otherwise remove this phrase], followed a period of [positive/negative – choose one based on available information] performance.

- Timeline: The decision to close the fund was reportedly made [Insert timeframe, e.g., "in Q3 2023"] and the official closure took effect [Insert date or timeframe].

- Performance: While exact figures are confidential, reports suggest the fund experienced [Describe performance - e.g., "underperformance relative to benchmarks" or "consistent losses in recent quarters," or "initial strong performance followed by a period of underperformance"]. This underperformance, if true, could be a crucial factor in the decision to shut down the fund.

- Reasons for Closure: Several factors may have contributed to this decision. These include, but are not limited to:

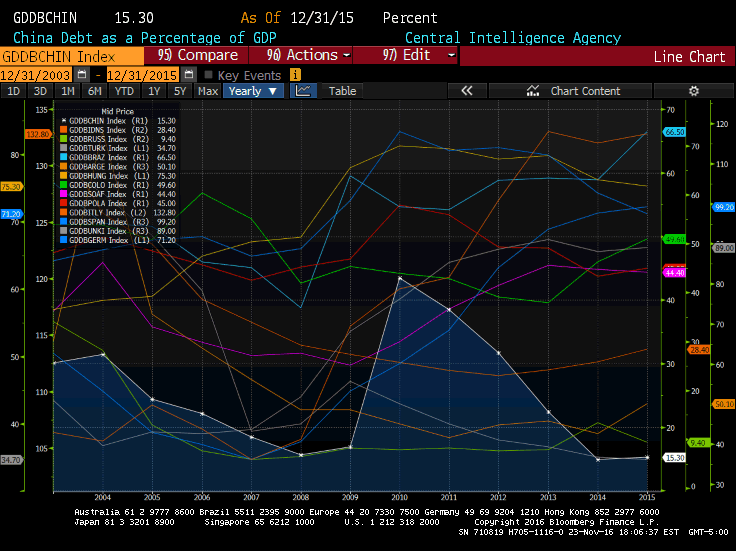

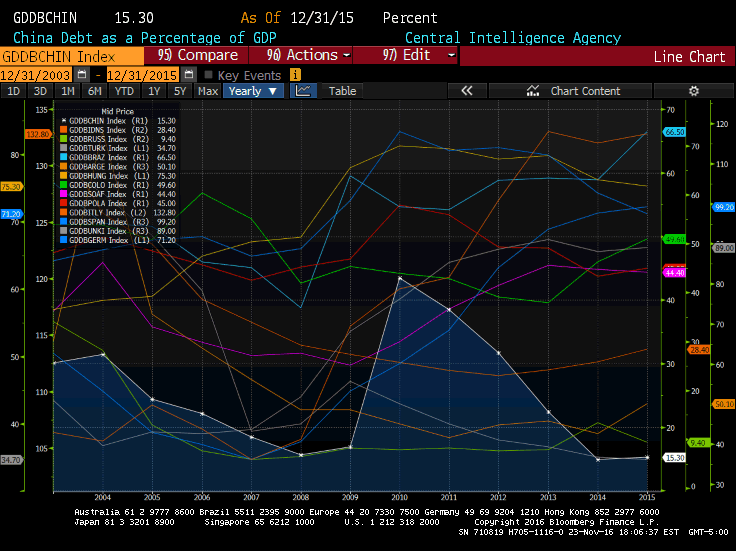

- Market Volatility: Increased volatility in emerging markets, particularly in [mention specific regions if known], might have made maintaining the fund's investment strategy too risky.

- Strategic Realignment: Point72 may be realigning its investment focus towards other asset classes or sectors deemed more profitable.

- Underperformance relative to benchmarks: If the fund consistently failed to meet its performance goals compared to similar investment vehicles, closure becomes a logical step.

- Assets Under Management (AUM): The fund managed [Insert AUM figure if available, otherwise remove this bullet point or replace with "a substantial amount of assets"] before its closure.

Trader Departures and Their Implications

The closure of the emerging markets fund has resulted in the departure of [Insert number if available] traders. These seasoned professionals, experts in navigating the complexities of emerging markets, are now seeking new opportunities elsewhere.

- Reasons for Departures: The job losses are a natural consequence of the fund's closure. Traders are likely seeking positions offering greater stability and opportunities for growth.

- Impact on Remaining Teams: The departures may create a temporary talent gap within Point72, requiring the remaining teams to manage increased workloads and potentially impacting overall efficiency.

- Implications for the Hedge Fund Industry: This event highlights the inherent risks and volatility within the hedge fund industry, particularly concerning emerging markets investments. It also underscores the challenges of talent retention in a competitive landscape.

- Possible Destinations: Departing traders are likely to be sought-after by competing hedge funds and investment firms with similar mandates.

Impact on Investors and the Broader Market

The shutdown of Point72's emerging markets fund has several implications for investors and the broader market.

- Investor Impact: Investors in the fund will likely experience losses depending on the fund's performance at the time of closure. The exact financial implications will vary based on individual investment levels and the timing of their participation.

- Market Reaction: While the immediate market reaction might be limited, the closure could impact investor sentiment towards emerging markets investment in general. This may lead to increased caution or a shift towards other asset classes.

- Shifting Investment Strategies: Other hedge funds may reassess their own strategies for investing in emerging markets, possibly becoming more selective or conservative.

- Risk Assessment: The event serves as a reminder of the inherent risks involved in emerging market investments, highlighting the importance of thorough due diligence and risk assessment for all investors.

Conclusion

The closure of Point72's emerging markets fund and the subsequent trader departures represent a significant event in the financial world. This decision underscores the volatile nature of emerging market investments and the challenges faced by even the most prominent players in the hedge fund industry. The impact on investors, the broader market, and the movement of talent within the industry will continue to unfold. Stay updated on the latest news regarding Point72 and other prominent players in the emerging markets sector to better understand this evolving situation and its potential consequences.

Featured Posts

-

After A Decade Construction Resumes On Worlds Tallest Abandoned Skyscraper

Apr 26, 2025

After A Decade Construction Resumes On Worlds Tallest Abandoned Skyscraper

Apr 26, 2025 -

Exclusive Polygraph Threats Fuel Pentagon Leaks And Internal Conflict Hegseths Response

Apr 26, 2025

Exclusive Polygraph Threats Fuel Pentagon Leaks And Internal Conflict Hegseths Response

Apr 26, 2025 -

Chat Gpt And Open Ai Facing Ftc Investigation

Apr 26, 2025

Chat Gpt And Open Ai Facing Ftc Investigation

Apr 26, 2025 -

Will Chinese Cars Dominate The Global Market

Apr 26, 2025

Will Chinese Cars Dominate The Global Market

Apr 26, 2025 -

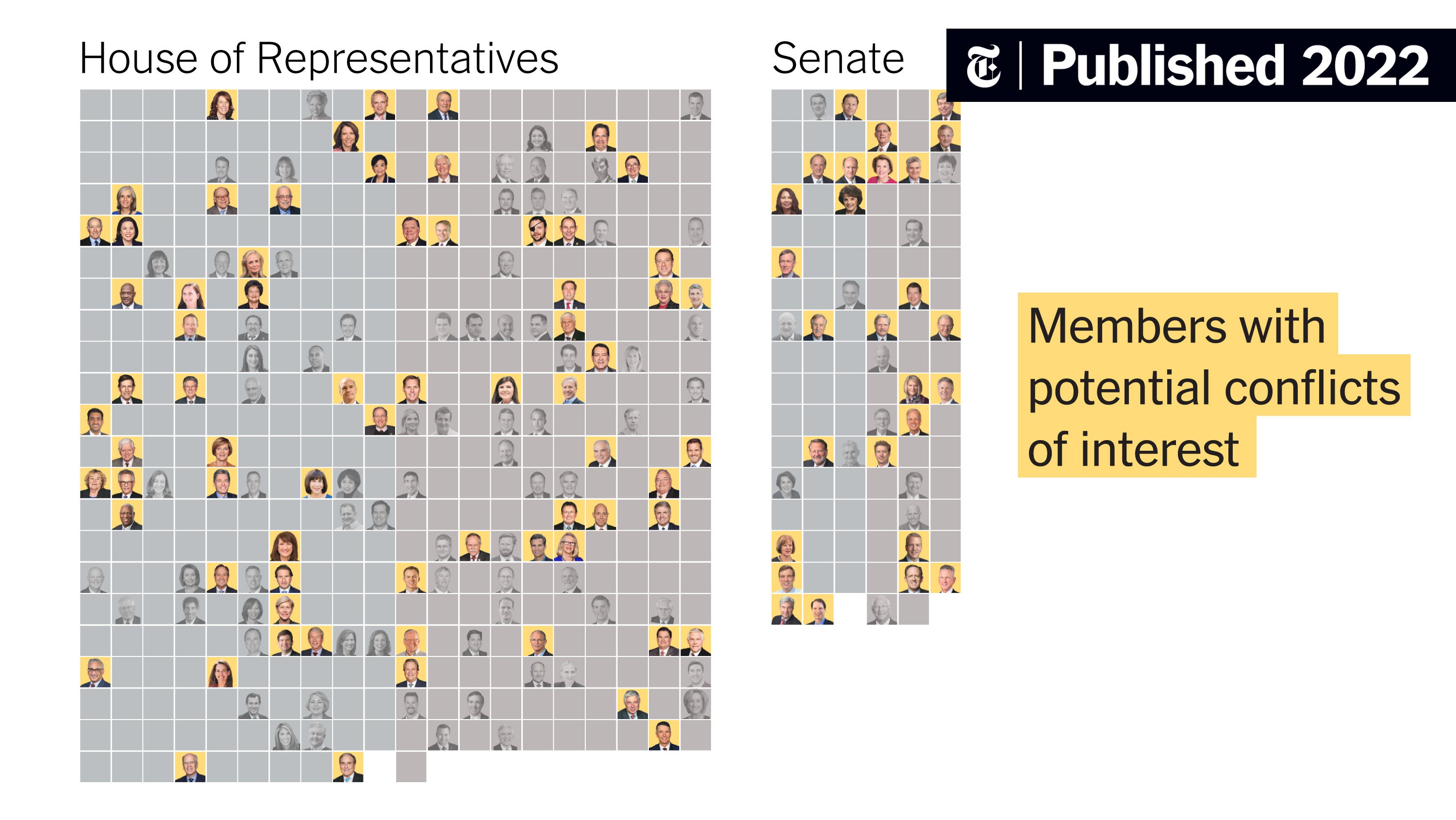

Time Interview Reveals Trumps Position On Banning Congressional Stock Trades

Apr 26, 2025

Time Interview Reveals Trumps Position On Banning Congressional Stock Trades

Apr 26, 2025

Latest Posts

-

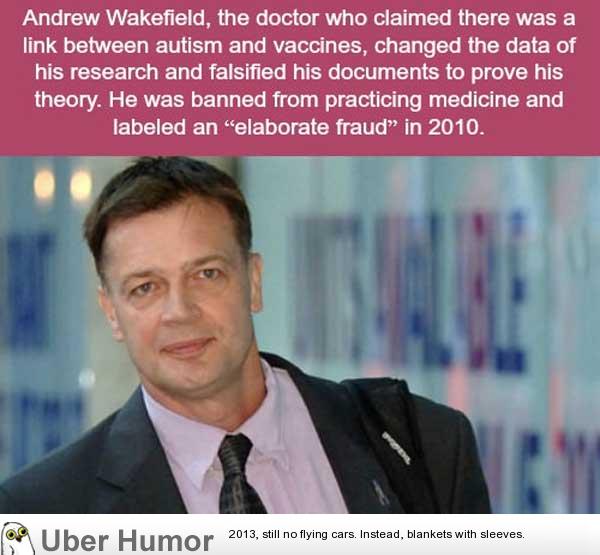

Public Health Concerns Anti Vaxxer Appointed To Head Autism Research

Apr 27, 2025

Public Health Concerns Anti Vaxxer Appointed To Head Autism Research

Apr 27, 2025 -

Autism Study Controversy Anti Vaccination Advocate Takes The Lead

Apr 27, 2025

Autism Study Controversy Anti Vaccination Advocate Takes The Lead

Apr 27, 2025 -

Governments Choice Of Anti Vaxxer For Autism Research Sparks Outrage

Apr 27, 2025

Governments Choice Of Anti Vaxxer For Autism Research Sparks Outrage

Apr 27, 2025 -

Federal Government Appoints Anti Vaxxer To Lead Autism Study

Apr 27, 2025

Federal Government Appoints Anti Vaxxer To Lead Autism Study

Apr 27, 2025 -

Un Ano De Salario Para Madres Tenistas El Nuevo Estandar Wta

Apr 27, 2025

Un Ano De Salario Para Madres Tenistas El Nuevo Estandar Wta

Apr 27, 2025