Podcast: Transforming Your Relationship With Money

Table of Contents

Understanding Your Money Mindset

Your relationship with money is deeply rooted in your mindset. Negative beliefs can sabotage your financial success, while a positive mindset paves the way for abundance.

Identifying Limiting Beliefs

Many of us carry limiting beliefs about money, often unconsciously. These beliefs, developed over time through various experiences, significantly impact our financial decisions.

- Fear of failure: The fear of making financial mistakes can lead to inaction and missed opportunities.

- Lack of knowledge: Feeling overwhelmed by finances can prevent you from taking control.

- Past negative experiences: Previous financial setbacks can create a sense of hopelessness and prevent future progress.

- Inherited beliefs: Family attitudes towards money can be deeply ingrained and affect our own perspectives.

These beliefs manifest in various ways, such as avoiding investments, overspending, or neglecting budgeting. Cognitive Behavioral Therapy (CBT) techniques can be incredibly helpful in identifying and reframing these negative thoughts. By consciously challenging these beliefs and replacing them with positive affirmations, you can lay the foundation for a healthier financial life.

Cultivating a Positive Money Mindset

Shifting your perspective on money requires conscious effort and consistent practice. Here are some powerful techniques:

- Gratitude practices: Regularly expressing gratitude for your current financial situation, no matter how small, shifts your focus from lack to abundance.

- Affirmations: Repeating positive statements about your financial well-being can reprogram your subconscious mind. Examples include: "I am financially secure," or "I attract abundance effortlessly."

- Visualization: Imagine yourself achieving your financial goals – owning a home, retiring comfortably, or having financial freedom. Visualizing success helps manifest it.

- Positive self-talk: Replace negative self-criticism with encouraging and supportive language. Instead of saying, "I'm so bad with money," try, "I'm learning to manage my finances effectively."

Mastering Your Finances with Practical Tips

Podcasts offer practical, actionable advice to improve your financial literacy and habits.

Budgeting and Tracking Expenses

A budget is your roadmap to financial clarity and control. Understanding where your money goes is the first step to managing it effectively.

- Different budgeting methods:

- 50/30/20 rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- Zero-based budgeting: Assign every dollar a purpose, ensuring your income equals your expenses.

- Expense tracking apps: Utilize apps like Mint, Personal Capital, or YNAB (You Need A Budget) to simplify tracking and analysis.

- Creating a realistic budget: Your budget should be tailored to your specific income and spending habits. Don't aim for perfection; aim for progress.

Building an Emergency Fund and Saving Strategies

Financial security requires a safety net for unexpected expenses. Building an emergency fund provides peace of mind and prevents debt accumulation during crises.

- Defining emergency fund goals: Aim for 3-6 months' worth of living expenses in an easily accessible account.

- Automating savings: Set up automatic transfers from your checking to your savings account to make saving effortless.

- High-yield savings accounts: Maximize your savings growth with accounts offering higher interest rates.

- Investing basics: Once you have an emergency fund, consider investing for long-term growth.

Managing Debt and Improving Credit Score

High debt can severely impact your financial health. Strategic debt management and credit score improvement are crucial for long-term financial well-being.

- Debt snowball/avalanche methods: The snowball method focuses on paying off the smallest debts first for motivation, while the avalanche method targets the debts with the highest interest rates.

- Negotiating with creditors: Contact your creditors to explore options for lower interest rates or payment plans.

- Understanding credit reports: Regularly check your credit reports for errors and monitor your credit score.

- Credit building strategies: Use credit responsibly, pay bills on time, and consider secured credit cards to improve your creditworthiness.

Finding the Right Financial Podcasts

With countless financial podcasts available, choosing the right ones for your needs is key.

Choosing Podcasts Based on Your Needs

Different podcasts cater to specific financial goals.

- Investing podcasts: Learn about stocks, bonds, mutual funds, and other investment strategies.

- Budgeting podcasts: Gain practical tips and techniques for creating and sticking to a budget.

- Debt management podcasts: Discover strategies for tackling debt and improving your credit score.

- Retirement planning podcasts: Plan for a secure and comfortable retirement.

Evaluating Podcast Credibility

It's crucial to choose credible sources of financial information.

- Credentials of the host: Look for hosts with relevant financial expertise and experience.

- Evidence-based advice: The podcast should provide data-driven insights and avoid unsubstantiated claims.

- Avoidance of get-rich-quick schemes: Beware of podcasts promising unrealistic returns or quick fixes.

- Transparency: The podcast should be transparent about any sponsorships or affiliations.

Conclusion

This article has highlighted how listening to podcasts can significantly contribute to transforming your relationship with money. By understanding your money mindset, mastering practical financial skills, and choosing the right podcasts, you can pave the way toward greater financial well-being and security. Start listening to podcasts focused on transforming your relationship with money today and embark on your journey to financial freedom! Remember to actively apply the tips and strategies you learn to maximize your results. Don't delay – begin transforming your relationship with money now!

Featured Posts

-

Thursday Night Diamond Highlights District Champions And Playoff Qualifiers

May 31, 2025

Thursday Night Diamond Highlights District Champions And Playoff Qualifiers

May 31, 2025 -

Who Is The Overweight Friend In Donald Trumps Viral Story

May 31, 2025

Who Is The Overweight Friend In Donald Trumps Viral Story

May 31, 2025 -

End Of The World Music Video Miley Cyrus Latest Visuals

May 31, 2025

End Of The World Music Video Miley Cyrus Latest Visuals

May 31, 2025 -

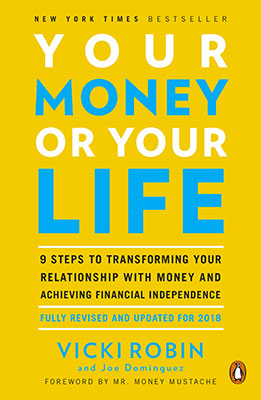

Apples Loss Mobile Game Industrys Gain Financial Implications

May 31, 2025

Apples Loss Mobile Game Industrys Gain Financial Implications

May 31, 2025 -

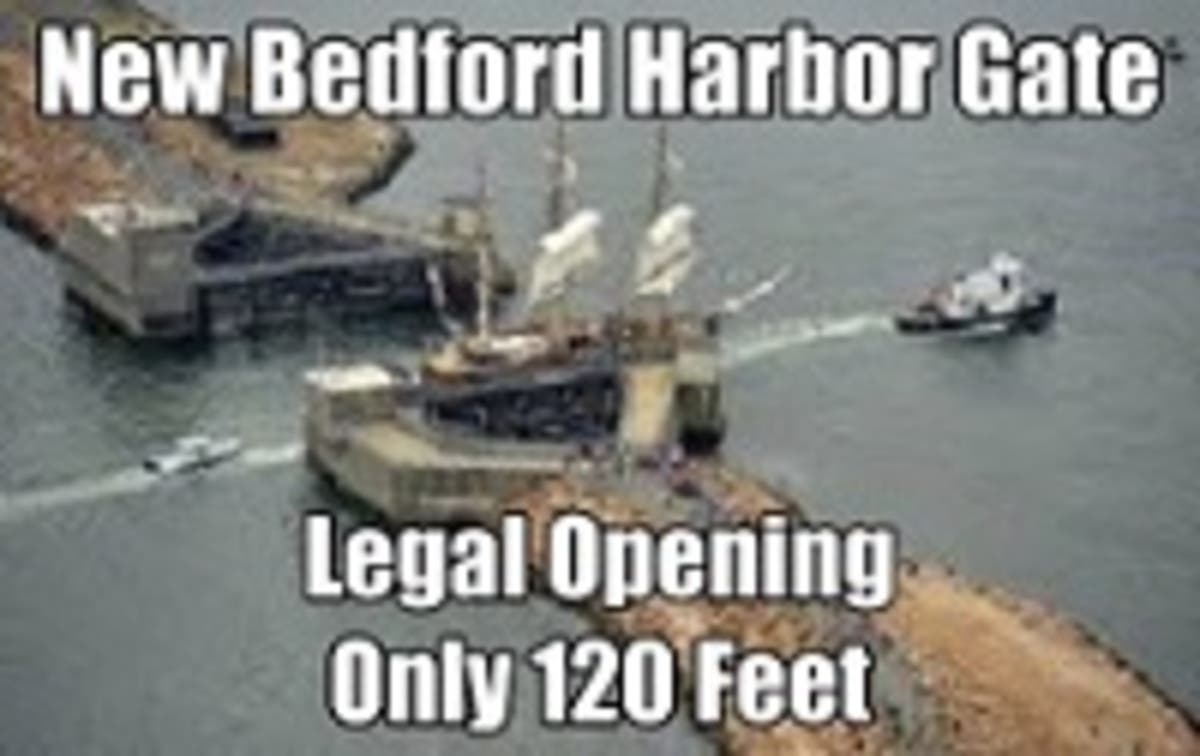

Increased Precipitation In Western Massachusetts A Climate Change Analysis

May 31, 2025

Increased Precipitation In Western Massachusetts A Climate Change Analysis

May 31, 2025