Podcast: Riding The Wave Of Low Inflation

Table of Contents

The current economic climate is characterized by surprisingly low inflation, a phenomenon impacting investment strategies, consumer behavior, and overall economic growth. This article delves into the intricacies of this low inflation environment, exploring both the opportunities and challenges it presents. We'll examine the factors driving low inflation, potential risks, and how to navigate this unique economic landscape effectively. Understanding low inflation is crucial for making informed financial decisions and ensuring long-term financial security.

Understanding the Current Low Inflation Landscape

Defining Low Inflation and Its Measurement

What constitutes "low inflation"? Generally, central banks target a low, positive inflation rate, typically around 2%, aiming for price stability. The most commonly used metric for measuring inflation is the Consumer Price Index (CPI).

- CPI definition: The CPI measures the average change in prices paid by urban consumers for a basket of consumer goods and services.

- Limitations of CPI: The CPI might not perfectly reflect the actual cost of living due to substitution bias (consumers switching to cheaper alternatives) and quality improvements in goods and services.

- Alternative inflation measures: The Personal Consumption Expenditures (PCE) index, preferred by the Federal Reserve, provides a broader measure of inflation, including expenditures by non-profit institutions.

- Historical context of current inflation rates: Comparing current inflation rates to historical data provides valuable context. Understanding the historical trends helps assess whether current low inflation is temporary or a longer-term trend.

Factors Contributing to Low Inflation

Several factors contribute to the current low inflation trend globally:

- Global supply chain dynamics: Improved efficiency and globalization have led to increased competition and lower production costs.

- Technological advancements: Technological innovation often leads to lower production costs and increased productivity, putting downward pressure on prices.

- Subdued consumer demand: In certain economies, sluggish consumer spending can limit inflationary pressure.

- Monetary policy impacts: Central bank policies, such as low interest rates and quantitative easing, can influence inflation rates, although the impact can be complex and debated.

- The role of globalization: Increased international trade and competition can keep prices relatively low.

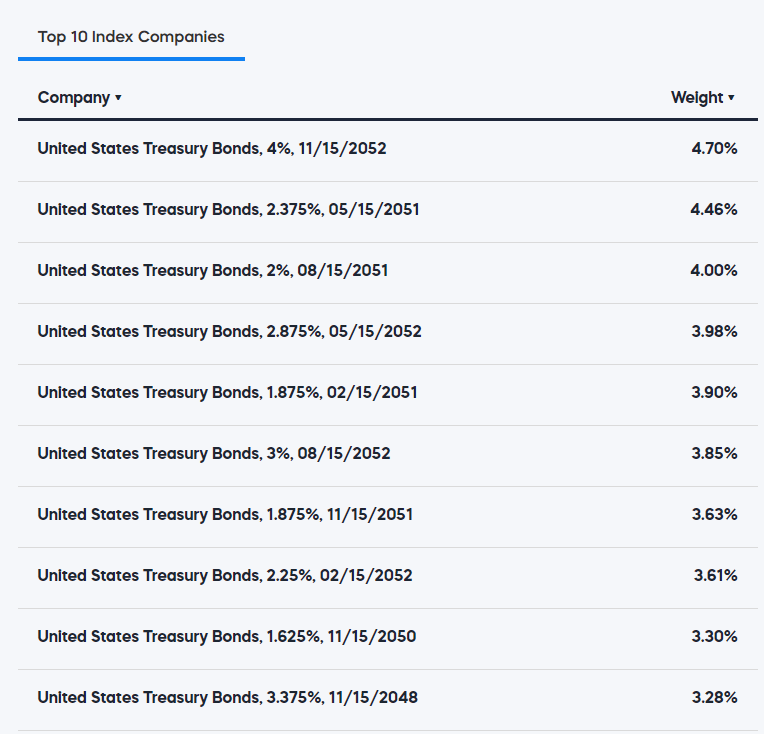

Geographical Variations in Low Inflation

Low inflation's impact varies significantly across geographical regions and economies:

- Examples of countries experiencing different levels of low inflation: Some developed economies might experience near-zero inflation, while emerging economies may face different inflation dynamics.

- Factors causing these variations: Differences in economic growth, monetary policies, and structural factors contribute to regional variations in inflation.

- Impact on international trade: Fluctuations in inflation rates across countries affect exchange rates and international trade balances.

Opportunities Presented by Low Inflation

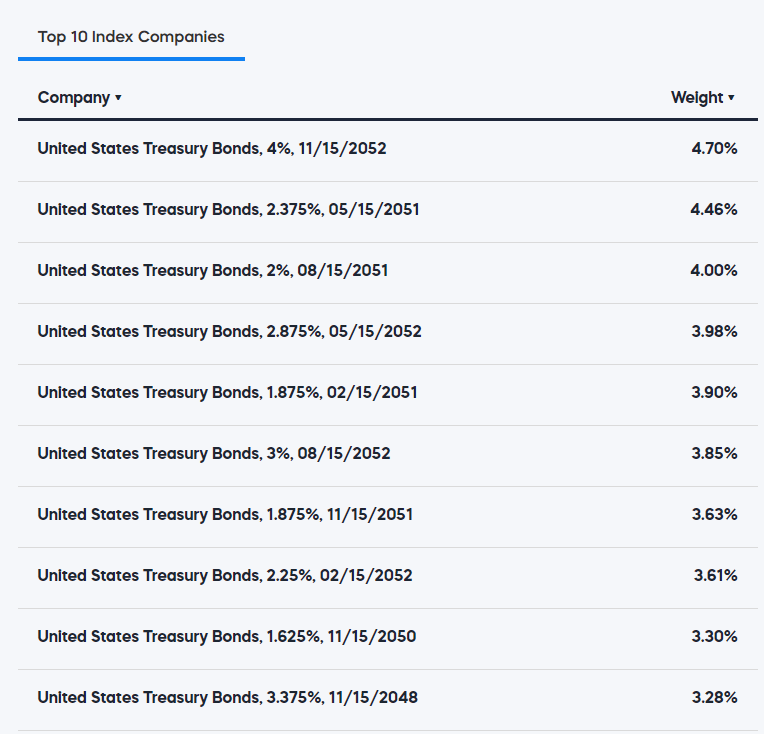

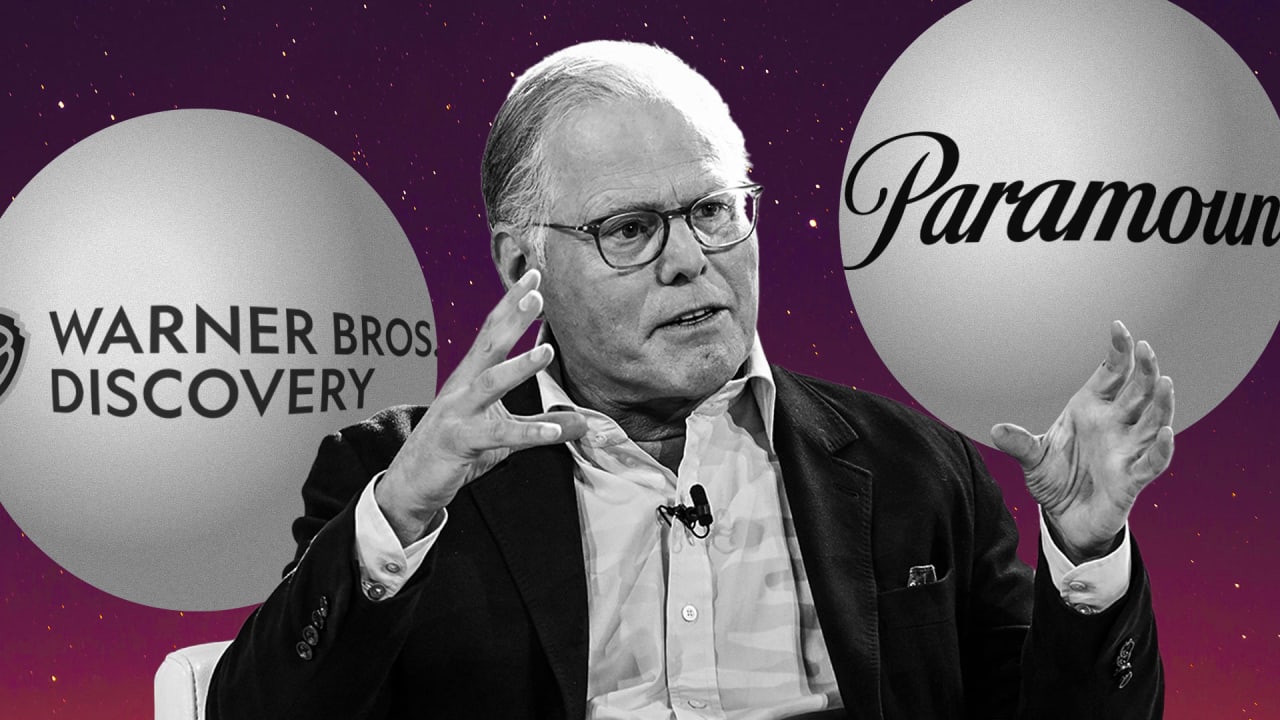

Investment Strategies in a Low Inflation Environment

Low inflation presents both challenges and opportunities for investors.

- Advantages of bonds: In a low-inflation environment, bonds can offer a relatively stable return, preserving capital and providing a safe haven for investments.

- Real estate investment opportunities: Real estate can be a hedge against inflation, particularly if rental income keeps pace with or exceeds inflation.

- Potential for value stocks: Companies with strong fundamentals and undervalued assets may offer attractive investment opportunities during periods of low inflation.

- Importance of diversification: Diversifying investment portfolios across various asset classes remains crucial to manage risk and potentially capture opportunities within different market segments.

Boosting Savings and Debt Management

Low inflation significantly benefits savers and borrowers:

- Increased purchasing power of savings: Low inflation means your savings retain more of their purchasing power over time.

- Reduced real interest payments on debt: The real cost of borrowing decreases, making it more affordable to take on debt for investments or large purchases.

- Strategies for maximizing savings: Explore high-yield savings accounts, certificates of deposit (CDs), and other investment vehicles that can offer better returns than inflation.

Consumer Spending and Economic Growth

Low inflation can stimulate consumer spending and economic growth:

- Increased consumer confidence: When prices remain stable, consumers tend to feel more secure about their purchasing power, leading to increased spending.

- Potential for increased spending: This increased spending can boost economic activity and drive business growth.

- Impact on business investment decisions: Businesses may be more inclined to invest and expand when they anticipate stable prices and sustained consumer demand.

Challenges and Risks Associated with Low Inflation

The Risk of Deflation

While low inflation is generally positive, it carries risks, particularly the risk of deflation:

- Definition of deflation: Deflation is a sustained decrease in the general price level of goods and services, the opposite of inflation.

- Deflationary spiral: Deflation can trigger a negative feedback loop where consumers delay purchases, anticipating further price drops, leading to reduced demand and further price declines.

- Negative impacts on economic growth: Deflation reduces consumer spending, discourages investment, and can lead to economic recession.

- Impact on investment strategies: Traditional investment strategies may need to be adjusted in a deflationary environment.

Monetary Policy Challenges

Central banks face significant challenges managing low inflation:

- Limitations of monetary policy tools: Conventional monetary policy tools, such as lowering interest rates, become less effective when rates are already near zero or negative.

- Potential for negative interest rates: Negative interest rates can have unintended consequences, potentially discouraging lending and investment.

- Challenges in stimulating economic growth: It can be difficult to stimulate economic growth when inflation is low and interest rates are constrained.

Uncertainty and Economic Volatility

Low inflation does not guarantee economic stability:

- Geopolitical risks: Global events can significantly impact economic conditions, irrespective of inflation levels.

- Unexpected economic shocks: Unforeseen events can disrupt economic activity, regardless of the prevailing inflation rate.

- The impact of technological disruption: Rapid technological change can cause both positive and negative economic shocks.

Conclusion

Navigating the current low inflation environment requires careful consideration of the factors contributing to this trend, the opportunities it presents, and the potential risks involved. Understanding the intricacies of low inflation, including its measurement, the driving forces behind it, and its geographical variations, is vital for making informed financial decisions. While low inflation can boost consumer spending and benefit savers, the risk of deflation and challenges for monetary policy necessitate proactive strategies. Effective financial planning, diversification of investment portfolios, and a cautious approach to debt management are essential for riding the wave of low inflation successfully.

Call to Action: Listen to our podcast for in-depth analysis and actionable insights on riding the wave of low inflation and developing effective strategies for navigating this complex economic landscape. Learn how to optimize your financial planning amidst low inflation and secure your future. Subscribe to our podcast now for more insightful discussions on low inflation and related economic topics!

Featured Posts

-

Match Nul Pour L Algerie En Coupe De La Caf Analyse Du Match

May 27, 2025

Match Nul Pour L Algerie En Coupe De La Caf Analyse Du Match

May 27, 2025 -

Gwen Stefani Unexpected Source Of Her Successful Marriage

May 27, 2025

Gwen Stefani Unexpected Source Of Her Successful Marriage

May 27, 2025 -

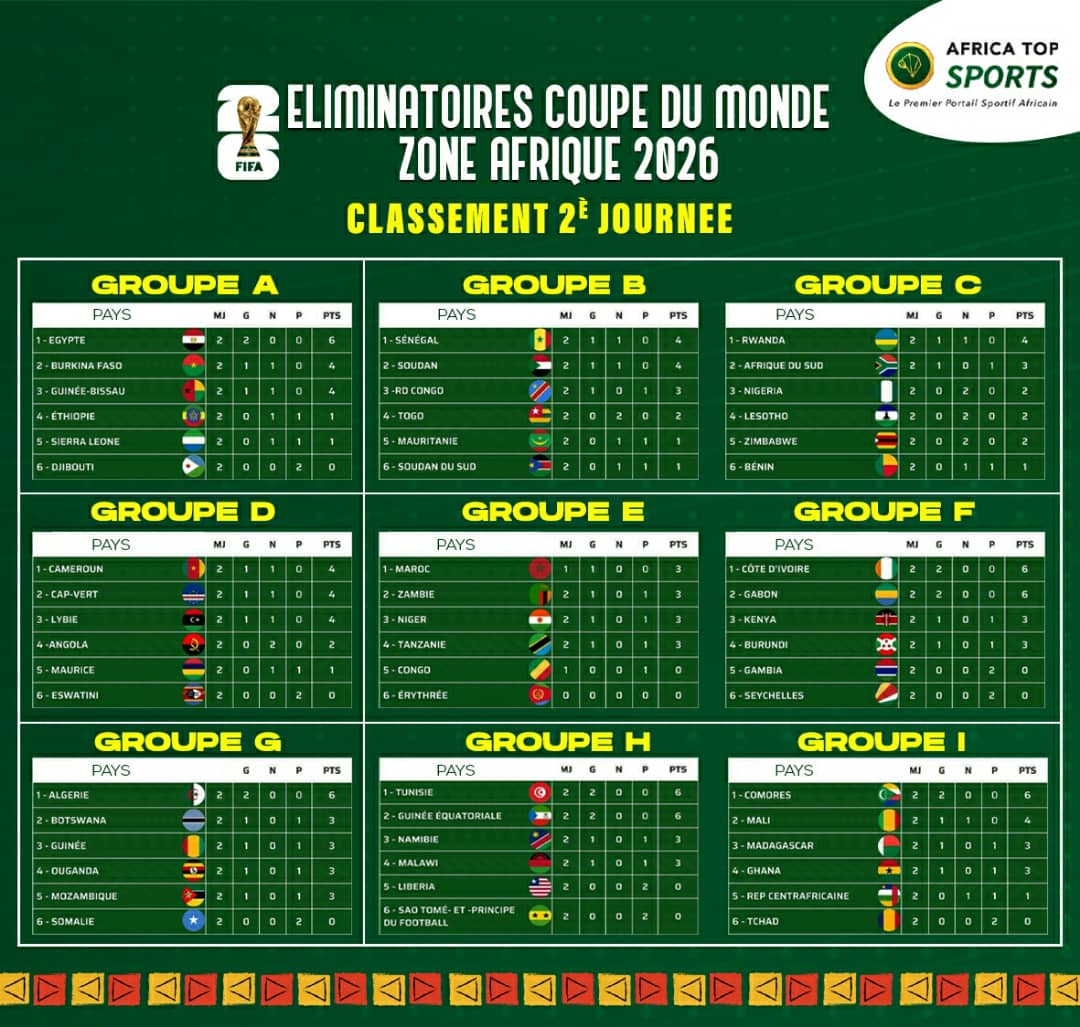

Paramount Investigative Services Inc In Merger And Acquisition Discussions

May 27, 2025

Paramount Investigative Services Inc In Merger And Acquisition Discussions

May 27, 2025 -

Problemes De Securite A Saint Ouen Des Classes Maternelles Demenagent

May 27, 2025

Problemes De Securite A Saint Ouen Des Classes Maternelles Demenagent

May 27, 2025 -

Ashton Kutchers Job Mila Kunis Shocking Account Of Extreme Preparation

May 27, 2025

Ashton Kutchers Job Mila Kunis Shocking Account Of Extreme Preparation

May 27, 2025

Latest Posts

-

Friday Forecast Continued Slide For Live Music Stocks

May 30, 2025

Friday Forecast Continued Slide For Live Music Stocks

May 30, 2025 -

Exploring Dara O Briains Voice Of Reason A Critical Look At His Career

May 30, 2025

Exploring Dara O Briains Voice Of Reason A Critical Look At His Career

May 30, 2025 -

Dara O Briain How His Voice Of Reason Resonates With Audiences

May 30, 2025

Dara O Briain How His Voice Of Reason Resonates With Audiences

May 30, 2025 -

Further Losses Predicted For Live Music Stocks On Friday

May 30, 2025

Further Losses Predicted For Live Music Stocks On Friday

May 30, 2025 -

The Enduring Appeal Of Dara O Briain Why His Voice Of Reason Resonates

May 30, 2025

The Enduring Appeal Of Dara O Briain Why His Voice Of Reason Resonates

May 30, 2025