Podcast: Low Inflation – Opportunities And Challenges

Table of Contents

Opportunities Presented by Low Inflation

Low inflation, characterized by a stable or slowly increasing inflation rate, creates a number of positive economic conditions. This environment, often associated with low interest rates, can unlock significant opportunities for both individuals and businesses.

Increased Consumer Spending Power

Low inflation means prices remain stable or increase slowly. This allows consumers to stretch their budgets further, leading to increased purchasing power and boosted consumer confidence.

- Increased disposable income drives demand for goods and services. With more money available after essential expenses, consumers are more likely to spend on discretionary items, boosting economic activity.

- Stimulates economic growth through higher consumer spending. This increased spending fuels economic growth, creating a positive feedback loop for businesses and the overall economy.

- Creates a positive feedback loop for businesses. Higher consumer demand leads to increased production, job creation, and further investment by businesses. This cycle reinforces economic expansion in a low inflation environment.

Attractive Investment Opportunities

Low interest rates, often a companion of low inflation, create attractive investment opportunities across various asset classes.

- Lower borrowing costs make expansion and investment more feasible for businesses. Businesses can access cheaper loans to fund expansion projects, hire more employees, and increase productivity.

- Bonds may offer lower returns, but provide stability in a low-risk environment. While bond yields might be lower compared to higher inflation periods, they offer a safe haven for investors seeking stability and capital preservation.

- Real estate can be a promising investment, although subject to market fluctuations. Low interest rates can drive down mortgage rates, making real estate more affordable and potentially boosting property values. However, investors should always conduct thorough due diligence.

Sustained Economic Growth Potential

Low and stable inflation can foster a predictable economic environment, which supports sustainable and long-term economic growth.

- Predictable pricing encourages businesses to invest and expand. Businesses can confidently plan for the future, knowing that input costs are unlikely to fluctuate wildly.

- Encourages long-term planning and investment. A stable economic environment reduces uncertainty, allowing businesses and investors to make long-term commitments.

- Creates a more stable job market. Sustainable economic growth leads to greater job security and increased employment opportunities.

Challenges Posed by Low Inflation

While low inflation offers many benefits, it also presents several challenges that require careful consideration. Prolonged periods of very low inflation, or even deflation, can create significant headwinds for the economy.

Deflationary Risks

While low inflation is generally positive, prolonged periods of very low or negative inflation (deflation) can be detrimental.

- Deflation can lead to decreased consumer spending as people delay purchases hoping for lower prices. This creates a dangerous downward spiral, as reduced demand leads to further price decreases.

- This can trigger a downward spiral of reduced economic activity. The expectation of further price drops can dampen consumer and business confidence, leading to reduced investment and spending.

- Businesses may struggle with falling revenues and potential losses. Falling prices can squeeze profit margins, making it difficult for businesses to stay profitable and potentially leading to bankruptcies.

Limited Monetary Policy Effectiveness

Central banks have limited tools to stimulate economic growth when inflation is already low.

- Lowering interest rates further might not be effective and could lead to negative rates, creating financial instability. Negative interest rates can create distortions in the financial system and discourage lending.

- Other unconventional monetary policies may be necessary, with potential unknown consequences. Quantitative easing (QE) and other non-traditional measures have been used, but their long-term effects are still debated.

- The effectiveness of monetary policy in a low-inflation environment is a subject of ongoing debate. Economists continue to research and develop effective strategies for managing monetary policy in a low-inflation world.

Impact on Government Debt

Low inflation can make it more challenging for governments to manage their debt burdens.

- Low inflation can lead to slower growth, reducing tax revenues. Slower economic activity translates to lower tax collections, making it more difficult for governments to repay their debts.

- Increased government borrowing may be necessary to stimulate the economy. Governments might resort to increased borrowing to fund stimulus programs, potentially increasing the national debt.

- Balancing fiscal responsibility with the need for economic stimulus presents a challenge. Governments face the difficult task of balancing the need to stimulate the economy with the need to maintain fiscal discipline.

Conclusion

Low inflation presents a dual-edged sword. While it offers opportunities like increased consumer spending and attractive investment prospects, it also carries risks such as deflation and limits the effectiveness of monetary policy. Understanding these opportunities and challenges is crucial for navigating the current economic landscape. By carefully analyzing the potential benefits and drawbacks of this economic environment and implementing sound financial strategies, businesses and individuals can prepare for and capitalize on the future of low inflation. Listen to our podcast for a deeper dive into the strategies for success in a low inflation economy, and learn how to effectively manage the complexities of this unique economic climate. Learn more about navigating low inflation today!

Featured Posts

-

Delays And Deficiencies Examining The Challenges Facing Trumps Space Force Satellite Program

May 27, 2025

Delays And Deficiencies Examining The Challenges Facing Trumps Space Force Satellite Program

May 27, 2025 -

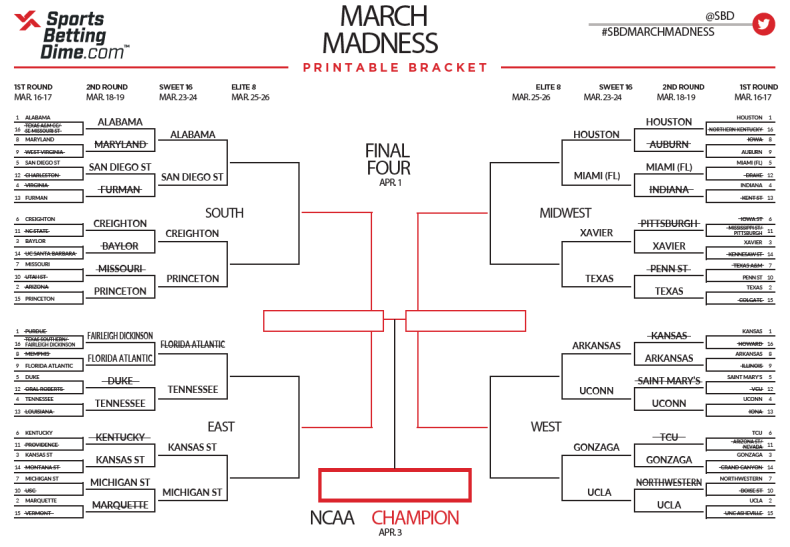

March Madness 2025 Second Round Complete Guide To Games Dates And Tv Listings

May 27, 2025

March Madness 2025 Second Round Complete Guide To Games Dates And Tv Listings

May 27, 2025 -

Newcastle Uniteds Striker Search The Liam Delap Conundrum

May 27, 2025

Newcastle Uniteds Striker Search The Liam Delap Conundrum

May 27, 2025 -

Unforgettable Facial Expressions From Kai Cenat

May 27, 2025

Unforgettable Facial Expressions From Kai Cenat

May 27, 2025 -

Avrupa Merkez Bankasi Trump Korkusu Ve Gelecege Dair Tahminler

May 27, 2025

Avrupa Merkez Bankasi Trump Korkusu Ve Gelecege Dair Tahminler

May 27, 2025

Latest Posts

-

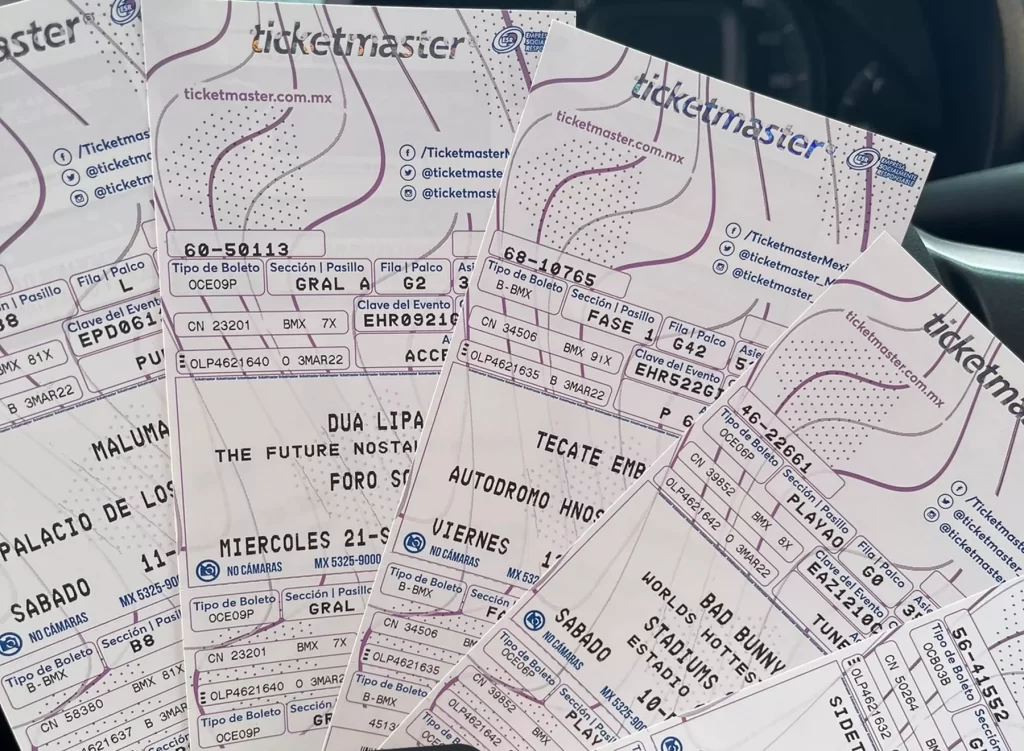

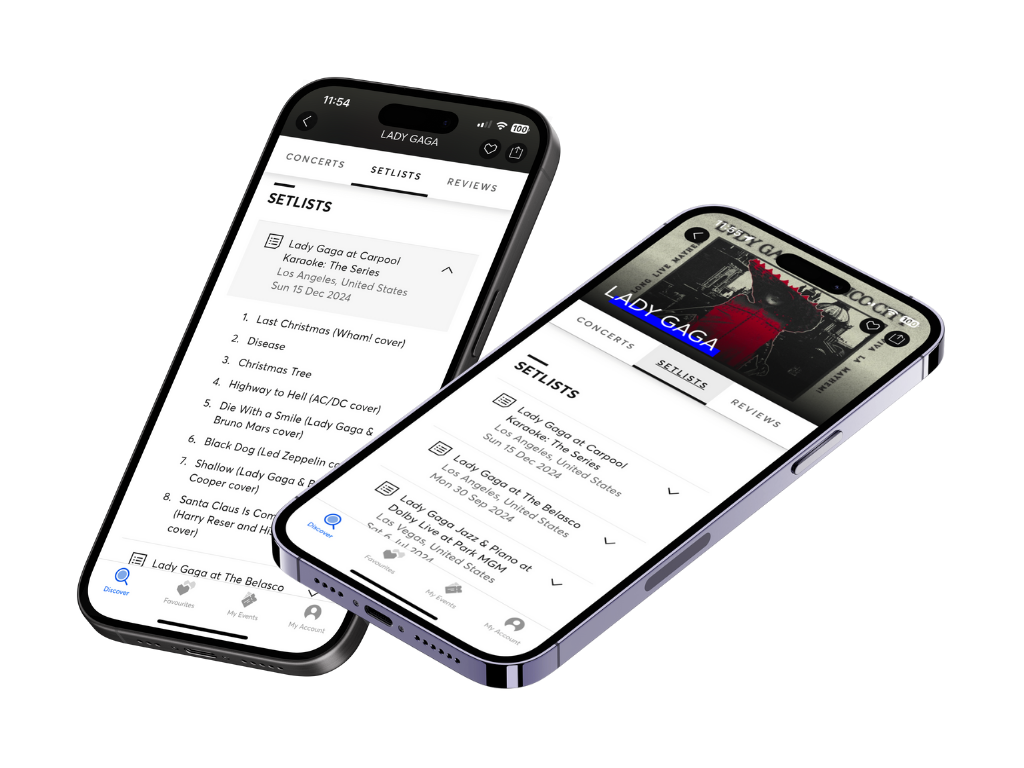

Setlist Fm Y Ticketmaster Una Nueva Era En La Experiencia Del Fan De Musica

May 30, 2025

Setlist Fm Y Ticketmaster Una Nueva Era En La Experiencia Del Fan De Musica

May 30, 2025 -

Mejora Tu Experiencia De Conciertos Con La Alianza Setlist Fm Y Ticketmaster

May 30, 2025

Mejora Tu Experiencia De Conciertos Con La Alianza Setlist Fm Y Ticketmaster

May 30, 2025 -

Integracion Setlist Fm Ticketmaster Una Experiencia De Conciertos Mejorada

May 30, 2025

Integracion Setlist Fm Ticketmaster Una Experiencia De Conciertos Mejorada

May 30, 2025 -

Ticketmaster Y Setlist Fm Integracion Para Una Mejor Gestion De Eventos

May 30, 2025

Ticketmaster Y Setlist Fm Integracion Para Una Mejor Gestion De Eventos

May 30, 2025 -

Setlist Fm Y Ticketmaster Experiencia Mejorada Para Conciertos

May 30, 2025

Setlist Fm Y Ticketmaster Experiencia Mejorada Para Conciertos

May 30, 2025