Podcast: Financial Literacy: Challenging Conventional Wisdom

Table of Contents

Debunking the Myth of "Save Early, Save Often"

The ubiquitous advice "save early, save often" is often presented as a universal truth. However, this mantra overlooks crucial aspects of financial planning, especially for those starting with limited resources or significant debt. While saving is undeniably vital for long-term financial security, prioritizing high-interest debt repayment is frequently more impactful in the short term.

-

The dangers of neglecting high-interest debt: High-interest debt, such as credit card debt, can quickly spiral out of control, negating the benefits of even diligent saving. The interest accrued often outweighs the returns from most savings accounts. Addressing this debt aggressively should be a priority.

-

Strategies for building an emergency fund before aggressive saving: Before aggressively saving for long-term goals, building a solid emergency fund is crucial. This safety net protects against unexpected expenses and prevents you from falling further into debt. Aim for 3-6 months’ worth of living expenses.

-

The benefits of automated savings plans: Automating your savings ensures consistent contributions without requiring constant willpower. Setting up automatic transfers from your checking account to a savings or investment account simplifies the process and builds good financial habits.

Rethinking Investment Strategies: Beyond Diversification

Diversification is often touted as the cornerstone of successful investing. While spreading your investments across various asset classes is generally prudent, it's not a universal panacea. Blindly following diversification can limit potential returns and ignores the importance of conducting thorough research.

-

When diversification might not be optimal: For those with a high risk tolerance and a deep understanding of specific markets, a concentrated investment strategy might yield higher returns.

-

Examples of concentrated investment strategies: Focusing investments on a specific sector you understand well, or even on individual companies you believe in strongly, is a concentrated approach. This necessitates significant research and a higher risk tolerance.

-

Exploring real estate, commodities, or private equity: Diversification doesn't solely mean different stocks and bonds. Alternative investments like real estate, commodities, and private equity can offer diversification benefits and potentially higher returns, though with greater risk.

The Power of Financial Education & Mentorship

Financial literacy isn't a one-time achievement; it's a continuous learning process. The more you understand about personal finance, the better equipped you are to make informed decisions. This learning journey is significantly enhanced through mentorship and guidance.

-

Recommended resources for financial education: Numerous resources are available, including books, online courses, workshops, and, of course, our podcast!

-

The importance of finding a mentor: A mentor with relevant financial experience can provide personalized guidance and insights, accelerating your learning and helping you navigate tricky situations.

-

How to evaluate a financial advisor's credentials: If considering a financial advisor, thoroughly research their credentials, experience, and fee structure before engaging their services.

Addressing the Psychological Barriers to Financial Success

Behavioral biases significantly influence financial decisions. Understanding these biases and developing strategies to overcome them is crucial for achieving financial success.

-

Examples of common behavioral biases in finance: Loss aversion (feeling the pain of a loss more strongly than the pleasure of an equivalent gain), confirmation bias (seeking information confirming pre-existing beliefs), and overconfidence are frequent hurdles.

-

Techniques for improving financial discipline: Mindful spending, budgeting, and tracking expenses are essential for building discipline and avoiding impulsive purchases.

-

Strategies for creating a realistic budget: A realistic budget aligns with your income and expenses, allowing you to save consistently while enjoying life.

Conclusion: Podcast: Financial Literacy: Challenging Conventional Wisdom

This article highlights the importance of questioning conventional financial wisdom and emphasizes the value of continuous financial education and seeking personalized advice. We’ve shown that successful financial management involves more than just "saving early and often," requiring a multifaceted approach encompassing debt management, strategic investing, and overcoming psychological barriers.

Subscribe to our podcast for more insightful discussions on improving your financial literacy. Share this article and our podcast with friends and family interested in building a more secure financial future. You can find us on [Website Address] and [Social Media Links]. Take control of your financial future – start listening today!

Featured Posts

-

Miley Cyrus End Of The World New Music Video Released

May 31, 2025

Miley Cyrus End Of The World New Music Video Released

May 31, 2025 -

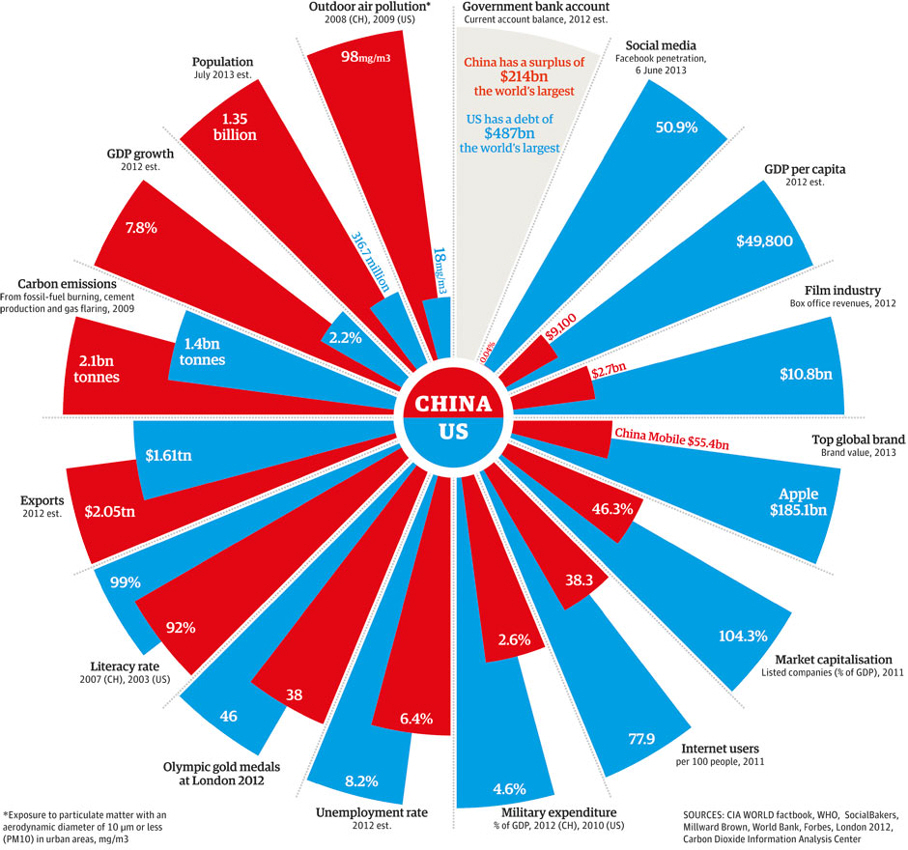

America Vs China A Military Power Comparison And Analysis

May 31, 2025

America Vs China A Military Power Comparison And Analysis

May 31, 2025 -

Rare Sight Elephant Seal In Cape Town Suburb Halts Traffic

May 31, 2025

Rare Sight Elephant Seal In Cape Town Suburb Halts Traffic

May 31, 2025 -

Arese Borromeo Immagini Del Neorealismo Italiano In Ladri Di Biciclette

May 31, 2025

Arese Borromeo Immagini Del Neorealismo Italiano In Ladri Di Biciclette

May 31, 2025 -

Carcamusas Un Plato Toledano Con Alto Valor Proteico Receta Completa

May 31, 2025

Carcamusas Un Plato Toledano Con Alto Valor Proteico Receta Completa

May 31, 2025